Accounting for Asset Retirement Obligations

This topic provides an overview of accounting for asset retirement obligations (ARO).

PeopleSoft Asset Management facilitates compliance with U.S. Generally Accepted Accounting Principles (GAAP) by automating the recognition of asset retirement obligations and the corresponding accretion and depreciation expense. When configured, PeopleSoft Asset Management:

Flags assets with legal obligations that are associated with retirement to facilitate proper reporting and processing of the retirement obligations in accordance with GAAP.

Captures the initial measurement of an asset retirement obligation.

Calculates depreciation of the Asset Retirement Cost.

Recognizes and measures the asset retirement obligation.

Provides online schedule of expenses for asset retirement obligation for review.

Provides accounting and settlement of asset retirement obligation.

Compliance for leased assets, group assets, and asset impairment.

Provides GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards) processing options.

Provides reports for asset retirement obligation.

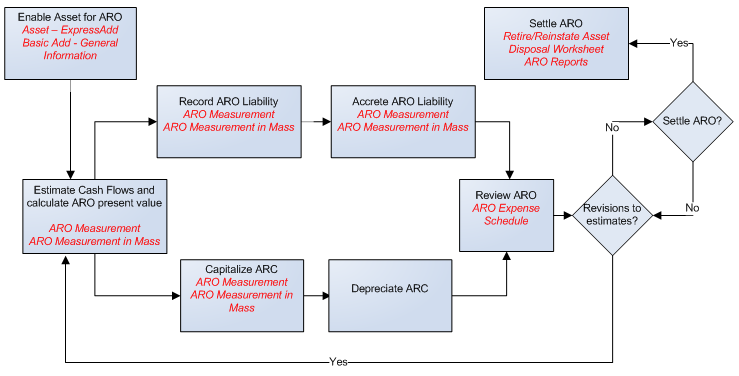

This diagram presents the Asset Retirement Obligation process flow within Asset Management:

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) Processing Options

Asset Management enables you to process ARO using Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). You specify which ARO processing option to use with the AM Business Unit Definition Page.

If you use the GAAP option to process ARO, no adjustments are made to the risk-adjusted rate over the life of the ARO asset; the obligation is adjusted only for changes in the amount or timing of cash flows (the obligation continues to be measured using the rate when the decommissioning obligation was incurred).

If you use the IFRS option to process ARO, the risk-adjusted rate is used at the outset, but the rate is adjusted at each reporting date thereafter (the decommissioning obligation is re-measured each reporting period giving consideration to changes in the amount or timing of cash flows and changes in the discount rate).

You can use GAAP option or the IFRS option, but not both—all ARO assets within the business unit must adhere to the same processing method.

The ARO Measurement and ARO Measurement en Masse - Process Parameters pages display different characteristics depending on whether you are processing ARO using GAAP or IFRS.

Common Terminology

The following table includes common terms used in Asset Retirement Obligation functionality:

Term |

Definition |

|---|---|

Asset Retirement Cost (ARC) |

Amount capitalized that increases the carrying amount of the long-lived asset when a liability for an asset retirement obligation is recognized. The ARC is depreciated over the life of the lease as it is part of the asset cost basis and tracked by ARO sequence number. |

Asset Retirement Obligation (ARO) Liability |

Liability for the obligation associated with the retirement of a tangible long-lived asset. The associated liability is recognized upon capitalization of the related ARC. |

Asset Retirement Obligation (ARO) |

ARO is the obligation associated with the retirement of a tangible long-lived asset as defined by financial accounting standards. |

Accretion Expense |

Period-to-period changes in the ARO liability resulting from the passage of time, recognized as an increase in the carrying amount of the liability and an expense charged as an operating item on the income statement. |

ARO Settlement |

When the ARO-enabled asset is retired, the associated asset retirement obligation is settled (reduce the remaining ARO liability and record an ARO Settlement for the amount actually incurred. The difference between the asset retirement obligation liability and the amount actually incurred is to be recognized as either a gain or loss. |

ARO Gain or Loss |

Upon ARO Settlement, if the actual cost incurred for the expected liability is greater than the ARO liability recorded, a loss is recognized, and if the actual cost is less than the asset retirement obligation liability, a gain is recognized. |

The accounting entry templates that correspond to an asset that is flagged as eligible for asset retirement obligations include the distribution types required for ARO processing. Configuration of the ARO distribution types is available from the Accounting Entry Templates and the Accounting Templates en Masse components.

|

Transaction Types |

Distribution Type |

|---|---|

|

ADJ; RET |

ARO Liability |

|

ADJ |

Accretion Expense |

|

RET |

ARO Settlement |

|

RET |

ARO Gain |

|

RET |

ARO Loss |

For more information, see Understanding Accounting Entry and Financial Processing.

Note: The ARO distribution types are included in the Accounting Template Book Code Update process (AM_BKCD_TMPL) and the Book Code Discrepancy Report (AMAE1100).

The ARO distribution types are used to record the following ARO accounting events:

|

Event Description |

Account |

Account |

Debit |

Credit |

|---|---|---|---|---|

|

1) Record initial fair value of the ARO liability: |

||||

|

Long-lived asset (ARC) |

XX |

|||

|

ARO Liability |

XX |

|||

|

2) Record accretion expense: |

||||

|

Accretion Expense |

XX |

|||

|

ARO Liability |

XX |

|||

|

3) Record revision in estimated ARO Liability (increase): |

||||

|

Long-lived Asset (ARC) |

XX |

|||

|

ARO Liability |

XX |

|||

|

4) Record revision in estimated ARO Liability (decrease): |

||||

|

ARO Liability |

XX |

|||

|

Long-lived Asset (ARC) |

XX |

|||

|

5) Record ARO settlement. See Settling the Asset Retirement Obligation |

The following ARO accounting entries do not require ARO-specific distribution types.

Record depreciation expense.

Record removal after settlement.

ARO Processing for Asset Impairment

PeopleSoft asset impairment functionality satisfies asset retirement obligation requirements. When asset retirement obligations are recorded in PeopleSoft, an asset cost adjustment recognizes the increase in the carrying value of the related long-lived asset. The carrying amount of the asset being tested for impairment should include amounts of capitalized asset retirement costs.

Note: In the event of a ChartField transfer for an ARO-enabled asset, all accounting entries associated with that asset reflect the new ChartField(s) as of the transaction date of the transfer with an accounting date in the current open period as specified on the transaction.

ARO Processing for Leased Assets

PeopleSoft supports the recording of asset retirement obligations in accordance with GAAP for leased assets. Leased assets are available for ARO selection and processing.

ARO Processing for Group Assets

PeopleSoft Asset Management provides the ability to record asset retirement obligations against group member assets. The asset search criteria on the Asset Retirement Obligations components recognize a business unit this is enabled for group asset processing and displays Group Asset ID as an additional search field.

ARO Processing and Document Sequencing

Asset Retirement Obligations should be recorded using a separate document type. All documents entered will be numbered sequentially.

The Generate ARC button creates the entry to record the ARC and the corresponding ARO Liability:

|

Removal of Capitalized ARC |

Debit |

Credit |

|---|---|---|

|

Long-lived Asset (ARC) |

XXXX |

|

|

ARO Liability |

XXXX |

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ARO_CFLOW_DEFN |

Set up expected cash flow definitions to be used in the ARO measurement and describe the specific purpose for the ARO. |

|

|

ARO_MEASUREMENT |

Define the parameters to be used in the ARO calculations for an individual asset. |

|

|

ARO_ACCR_SCHED |

Review the scheduled accretion expense as calculated by month over the life of the asset. |

|

|

ARO_MASS_SEL |

Retrieve a list of eligible ARO-enabled assets for which to define ARO measurement information. |

|

|

ARO_MASS_PAR |

Define ARO measurement parameters for multiple assets at once. |

|

|

ARO_ACCR_MAS |

Review the scheduled accretion expense as calculated by month over the life of the assets that were selected for ARO processing. |

|

|

ARO_EXP_SCHED_YR |

View the ARO-related accretion and depreciation expense for an asset by year to verify results. |

|

|

ARO_EXP_SCHED_PD |

View the ARO-related accretion and depreciation expense for an asset by period to verify results. |

|

|

AM_ARO_RPT_RQST |

Run ARO reports that provide information for FAS-compliant disclosures. |

In order to facilitate reporting and processing of asset retirement obligations in PeopleSoft, assets with legal obligations associated with their retirement should be flagged as such. To enable assets for ARO processing:

Enable ARO processing at the system level (Installation Options – Asset Management page).

Enable ARO processing at the business unit level and define ARO processing parameters, such as GAAP or IFRS processing and inclusion of asset retirement cost in the impairment calculation (AM Business Unit Definition Page).

Use the delivered Cost Type for ARO (value = O) or establish your own to be used for identifying assets that require ARO processing.

See Cost Types Page.

Create an ARO asset profile (or profiles) to be used in assigning defaults for assets that you designate as subject to ARO processing.

Enable ARO for each business unit that has assets requiring ARO processing.

When adding an asset using the Basic Add component, you can either select an ARO profile to designate the asset as one that requires ARO treatment, or if the profile defaults do not apply to the asset, you can identify the asset eligible for ARO processing by selecting the Asset Retirement Obligations check box.

When adding an asset using Express Add, you can select the Asset Retirement Obligations checkbox to designate assets eligible for ARO processing.

The initial measurement of an asset retirement obligation represents the amount by which the obligation could be settled in a current transaction between willing parties. An organization assesses whether an obligating event has occurred and an asset retirement obligation should be recognized. Use the following components for measuring Asset Retirement Obligations (ARO):

ARO Measurement (ARO_MEASUREMENT)

ARO Measurement en Masse (ARO_MASS_RQST)

ARO Expense Schedule (ARO_EXP_SCHED)

This section discusses how to

Establish the ARO cash flow definition.

Set up ARO Measurement

Set up ARO Measurement en Masse

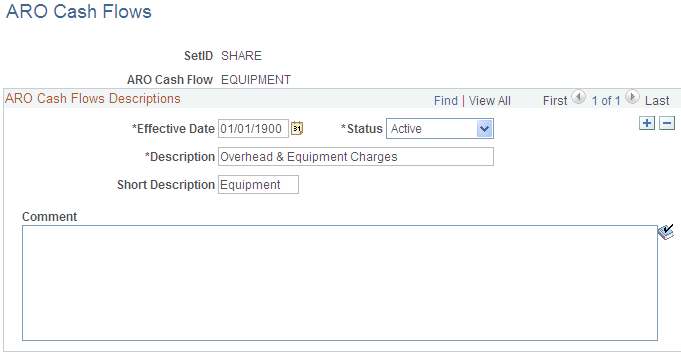

Use the ARO Cash Flows page (ARO_CFLOW_DEFN) to set up expected cash flow definitions to be used in the ARO measurement and describe the specific purpose for the ARO.

.

This example illustrates the fields and controls on the ARO Cash Flows Page. You can find definitions for the fields and controls later on this page.

Establish effective-dated ARO Cash Flow definitions by SetID to enable consistent data entry of estimated cash flow categories and descriptions.

Field or Control |

Description |

|---|---|

Status |

Select to make the ARO cash flow definition Active or Inactive. This is a required field. |

Description |

Enter a long description that is to be available for selection from ARO Measurement and ARO Measurement en Masse components. This is a required field. |

Short Description |

Enter a short description. If blank, this field adopts the truncated long description to fit this field. |

Comment |

Enter detailed information related to this definition. This field is optional and used for information purposes only. |

This section discusses how to:

Define ARO Measurement by asset.

Review the Accretion Schedule.

Define ARO Measurement for multiple assets.

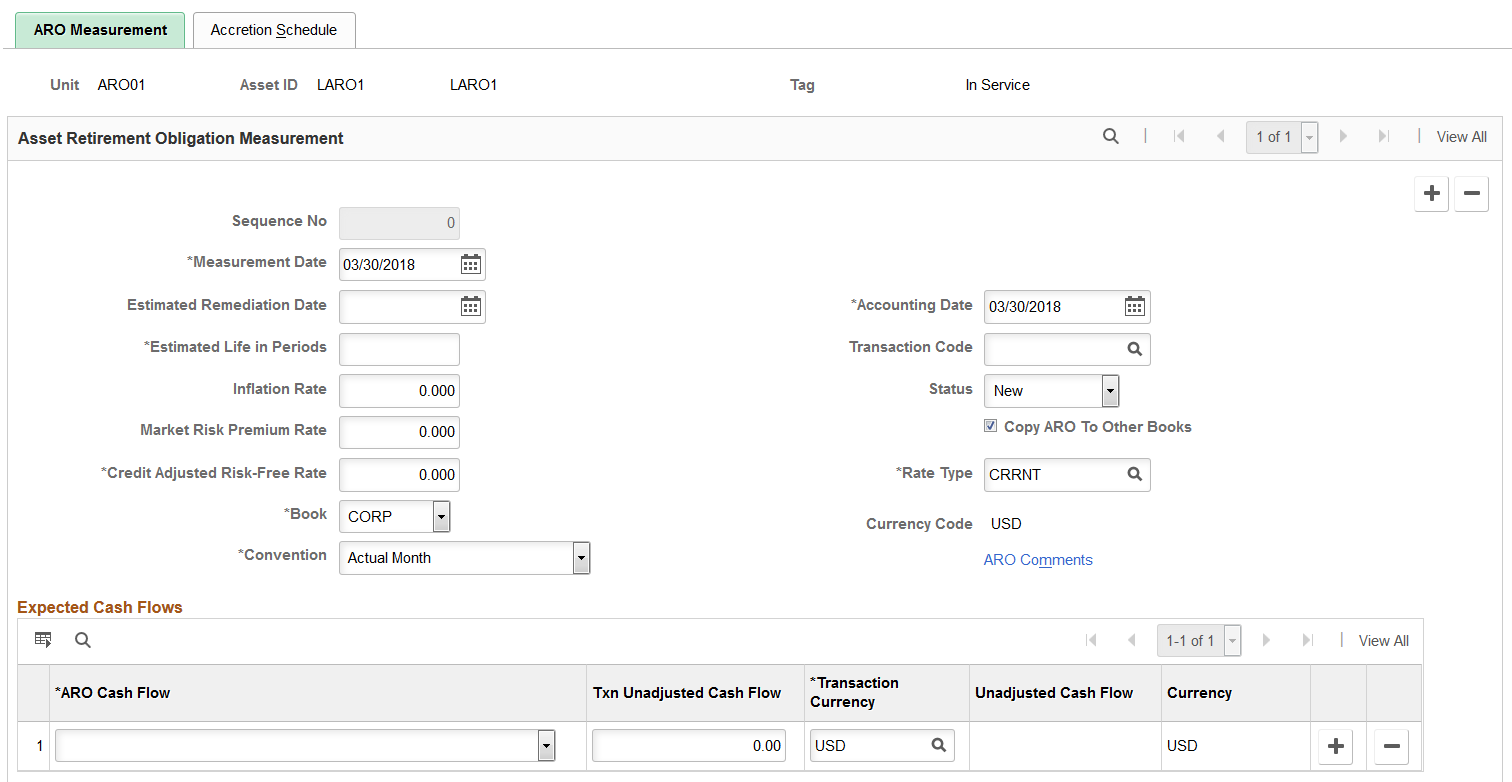

Use the ARO Measurement page (ARO_MEASUREMENT) to define the parameters to be used in the ARO calculations for an individual asset.

The ARO Measurement page displays slightly different characteristics depending on whether you are processing ARO using GAAP or IFRS.

Navigation:

This example illustrates the fields and controls on the ARO Measurement Page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the ARO Measurement Page. You can find definitions for the fields and controls later on this page.

Asset Retirement Obligations can only be measured for assets that have a status other than Disposed or Transferred. You can search for assets that are eligible for asset retirement obligation treatment (see Enabling Assets for ARO Processing and establish the ARO measurement by asset.

Field or Control |

Description |

|---|---|

Sequence No (sequence number) |

Displays the ARO sequence number that is used to track incremental liability measurements, which are adjustments recorded in a period subsequent to the original measurement. The sequence number is generated upon saving the page. |

Adjusted Sequence Number |

Displays the ARO adjusted sequence number when you create an ARO adjustment. This field appears only when the selected business unit uses IFRS processing and you create a new ARO adjustment. |

Measurement Date |

Enter the date that the asset retirement obligation is initially recognized. This is the transaction date. The default value is the system date or the transaction date from the AM User Preferences page. |

Adjusted Measurement Date |

Displays the ARO adjusted measurement date when you create an ARO adjustment. This field appears only when the selected business unit uses IFRS processing and you create a new ARO adjustment. |

Estimated Remediation Date |

Enter an estimated remediation date for informational purposes only. |

Estimated Life in Periods |

Enter the period (months) to be used in calculating the ARO liability. |

Status |

Select a status for the ARO measurement. Values are:

The ARO measurement information can be updated for Adjustment, New, Error, or On Hold statuses. |

Inflation Rate |

Enter the percentage rate to be used to adjust expected cash flows for the ARO. |

Market-Risk Premium Rate |

Enter a market risk factor percentage to be used to adjust expected cash flows for the ARO. As this is usually difficult to assess, this field is not required. |

Credit-Adjusted Risk-Free Rate |

Enter the percentage to be used in calculating the accretion expense and the present value of the expected cash flows for the ARO. |

Book |

Displays the asset book information will be registered for only one Book since the measurement will be the same for all books. |

Convention |

Select the depreciation convention to be assigned to the resulting asset cost adjustment. The default value is the Actual Month convention. |

Accounting Date |

Enter the accounting date for the measurement of ARO. The default value is the system date or the accounting date from the AM User Preferences page. |

Transaction Code |

Select the value that identifies which accounting entry template to use for the transaction. This field is optional. |

Rate Type |

Enter the currency exchange rate type for the ARO if using multiple currencies. |

Copy ARO to Other Books |

Select this option to copy the asset retirement obligation to all other required books for the asset. If you selected the Keep All Books in Sync option at the business unit level, the system automatically selects this option. |

ARO Comments |

Click this link to access the ARO Comments modal page to optionally include additional information about assumptions used in estimating cash flows, for example. |

Expected Cash Flows

Field or Control |

Description |

|---|---|

ARO Cash Flow |

Select the ARO Cash Flow definitions that apply to this asset for calculation. |

Txn Unadjusted Cash Flow (transaction unadjusted cash flow) |

Enter the initial expected cash flow (in the transaction currency), which is an estimate of the amount for which an obligation could be settled in a current transaction between willing parties. |

Transaction Currency |

Select the transaction currency for the expected cash flows. The default value is the base currency of the asset book. |

Unadjusted Cash Flows |

Displays the expected cash flow in the base currency. |

Currency |

Displays the base currency of the asset book. |

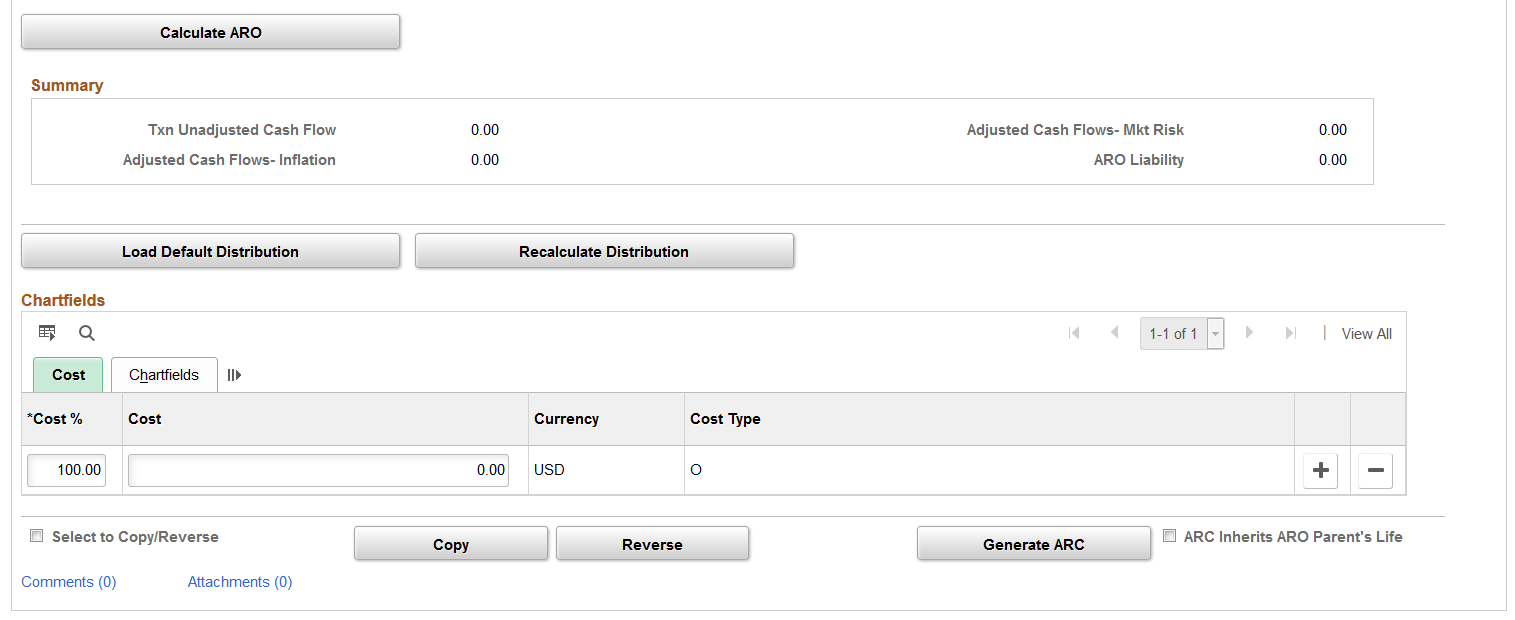

Calculate ARO |

Click this button to initiate the calculation of the ARO liability. |

Summary

Field or Control |

Description |

|---|---|

Txn Unadjusted Cash Flow (transaction unadjusted cash flow) |

Displays the sum of amounts entered in the Txn Unadjusted Cash Flow column. |

Adjusted Cash Flows - Inflation |

Displays the (sum of Txn Unadjusted Cash Flow) x ((1+Inflation rate) ^ estimated life)). |

Adjusted Cash Flows - Market Risk |

Displays the (sum of expected cash flows as adjusted for inflation) x (market risk premium). |

ARO Liability |

Displays the (sum of expected cash flows as adjusted for inflation) + (sum of expected cash flows as adjusted for market risk premium) x (1/(1+credit adjusted risk free rate) ^ estimated life). |

Load Default Distribution |

Click this button to load the default ChartFields for the accounting entries for ARO processing. |

Recalculate Distribution |

When making changes to the information, click this button to revise the distribution. |

ChartFields

Field or Control |

Description |

|---|---|

Select to Copy, Reverse, or Adjust |

Select this option to copy, reverse, or adjust the ARO measurement data. When you select this check box, click the corresponding button (Copy, Reverse, Adjustment). |

Copy |

Click to copy ARO measurements for another asset. |

Reverse |

For assets whose ARO measurement status is Processed, you can select the Copy or Reverse option and click this button to revert any measurements already processed. This action marks the row as reverted and it creates a new sequence number with a status of Reversed. The reversed row is the same as the original, display only, and creates a negative ARC request. |

Adjust |

Click to create a new ARO measurement row that you can use to input new measurement values. This button is available only when the selected business unit uses IFRS processing. |

Generate ARC |

Click to insert the information into the INTFC_FIN and INTFC_PHY_A tables, which is then processed by the Transaction Loader to create the ARO asset. When the process is run to generate the Asset Retirement Cost (ARC) entries, the ARC amount is capitalized and increases the carrying amount of the long-lived asset when the ARO liability for an asset is recognized. This process records the initial fair value (or estimated future cash flow) of the ARO liability. |

ARC Inherits ARO Parent’s Life |

Select this option for ARC to inherit ARO Parents life. When an Asset Retirement Cost (ARC) measurement asset is added to the original asset, the measurement asset will use the remaining life of the original asset. |

Click the Comments link to access the ARO Measurement - Comments page and view or add relevant supporting comments to an asset transaction.

Click the Attachments link to access the ARO Measurement - Attachments page and view or add relevant supporting documents to an asset transaction.

ARO Measurement - Comments Page

Use the ARO Measurement - Comments page (AM_COMMENTS_SEC) and view or add relevant supporting comments to an asset transaction.

Field or Control |

Description |

|---|---|

Comment |

Enter comments for an asset. |

User ID, Name and Date/Time Stamp |

Displays the user ID, name, and date/time stamp related to the user who added the comment. You can edit the date/time stamp after saving the comment. |

Source |

Displays the transaction source for the asset, such as adjustment, transfer, and so forth. |

ARO Measurement - Attachments Page

Use the ARO Measurement - Attachments page (AM_ADD_ATTACH_SEC) to view or add relevant supporting documents to an asset transaction.

Field or Control |

Description |

|---|---|

Add Attachment |

Click this button to attach files as supporting documentation for an asset. Supply a description of the file or files that you attach. |

File Name |

Displays the attached file. Click the file-link to access the file. |

Description |

Displays a description of the file attachment when one was provided by the user. |

User, Name, and Date/Time Stamp |

Displays the user ID, name, and date/time stamp related to the user who added the attachment. |

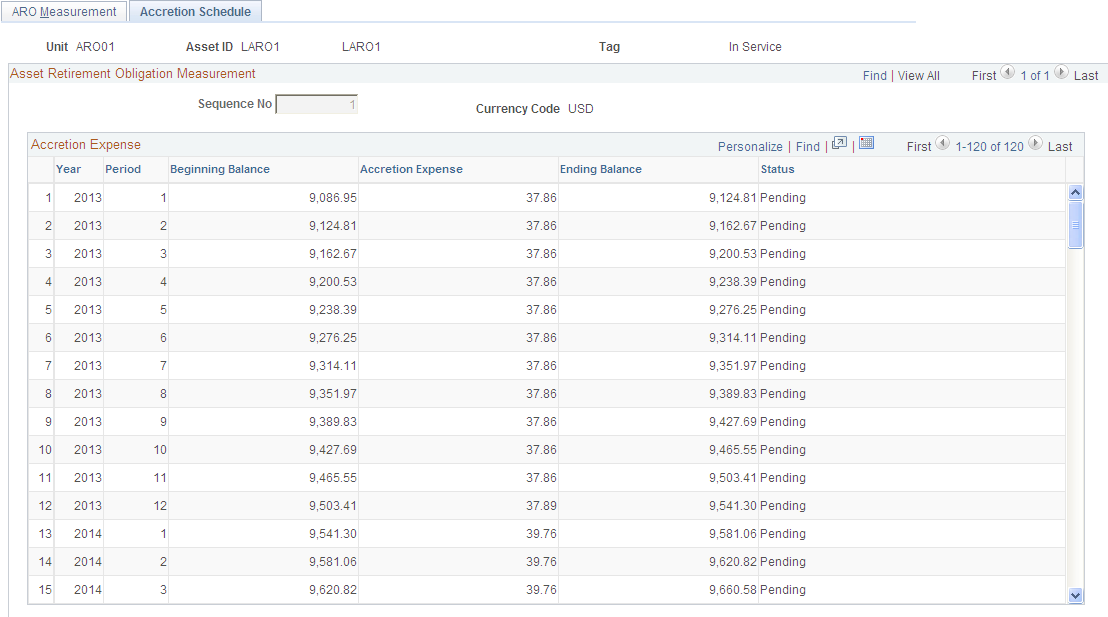

Use the Accretion Schedule page (ARO_ACCR_SCHED) to review the scheduled accretion expense as calculated by month over the life of the asset. (Asset Management, Asset Transactions, Asset Disposal, ARO Measurement, Accretion Schedule):

Navigation:

This example illustrates the fields and controls on the Accretion Schedule Page. You can find definitions for the fields and controls later on this page.

The Accretion Schedule page displays the scheduled accretion expense, by period, over the asset life using the parameters from the ARO Measurement page. This page also displays the beginning balance of the ARO liability, increased by the accretion expense for each period, the ending balance of the ARO liability, and the ARO status.

See Accreting the Asset Retirement Obligation.

When a correction is performed to the ARO Measurement and you create a reversal, the posted Accretion Expense rows are reversed and those rows not yet posted are deleted. Accretion Expense entries should use the same ChartField combinations that are entered for the ARO measurement.

When an asset retirement obligation is measured, an asset retirement cost is capitalized by increasing the carrying amount of the long-lived asset by the same amount as the liability. Since the asset retirement cost is included in the cost basis of the asset, it is subject to the regular depreciation process. Depreciation that corresponds to asset retirement cost is identified by ARO sequence number.

Each ARO sequence number represents each incremental liability measured.

Note: Bonus depreciation does not apply to asset retirement cost.

|

Record depreciation expense |

Debit |

Credit |

||

|---|---|---|---|---|

|

Depreciation Expense (ARC) |

XX |

|||

|

Accumulated Depreciation |

XX |

Organizations are to recognize period-to-period changes in the liability for the asset retirement obligation resulting from the passage of time, and revisions to either the timing or amount of the original estimated future cash flows.

The Accretion Expense is processed through the Depreciation Close program (AM_DPCLOSE).

|

Record accretion expense |

Debit |

Credit |

||

|---|---|---|---|---|

|

Accretion Expense |

XX |

|||

|

ARO Liability |

XX |

Changes due to the passage of time are measured by recognizing accretion expense. The method commonly used to calculate accretion expense is the interest method of allocation. Using the interest method of allocation, accretion expense is determined by multiplying the carrying value of the liability at the beginning of each period by a constant effective interest rate. The interest rate used should be the credit-adjusted risk-free rate applied when the liability was measured initially. The rate should not change subsequent to the initial measurement.

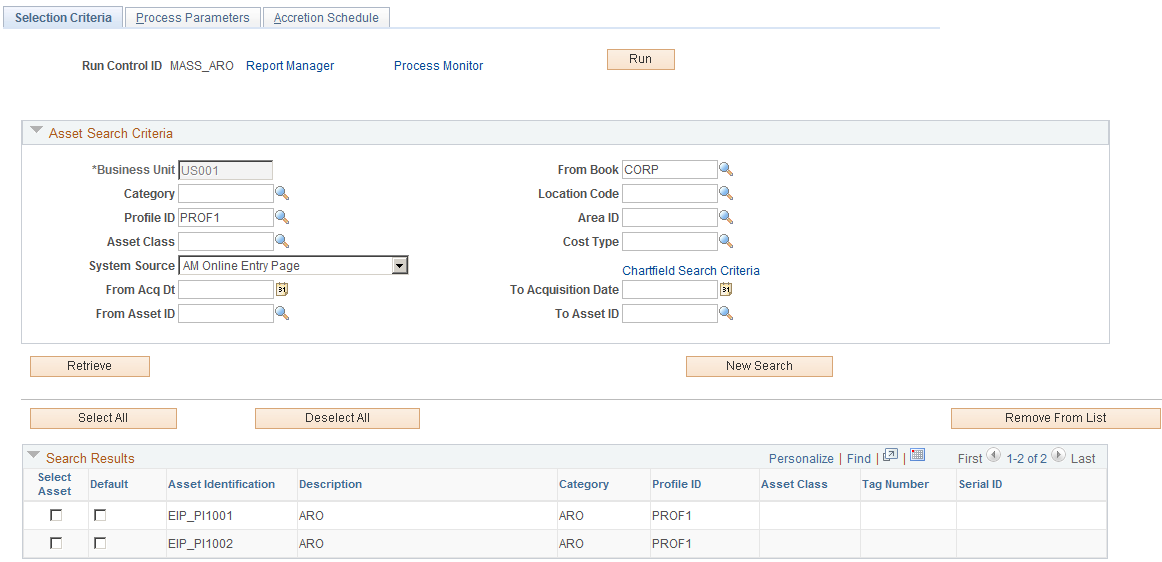

Use the ARO Measurement en Masse – Selection Criteria page (ARO_MASS_SEL) to retrieve a list of eligible ARO- enabled assets for which to define ARO measurement information. (Asset Management, Asset Transactions, Asset Disposal, ARO Measurement en Masse, Selection Criteria):

Navigation:

This example illustrates the fields and controls on the ARO Measurement en Masse - Selection Criteria Page. You can find definitions for the fields and controls later on this page.

Asset Search Criteria

Enter your selection criteria to retrieve a list of ARO-enabled assets that are eligible for ARO accounting treatment and click the Retrieve button. Once you have selected the assets to process from the search results, defined the process parameters, and reviewed the accretion expense schedule, click the Run button to process the selected assets for ARO. The search criteria fields on this page are the same as those on the ARO Measurement page. See ARO Measurement Page.

Search Results

Field or Control |

Description |

|---|---|

Select Asset |

Select the assets that you want to include in the mass ARO process. You could also click the Select All button, the Deselect All button. |

Default |

Select this check box for the asset whose ChartField combinations are to be used as the default ChartField distribution on the Process Parameters page. |

Remove From List |

Select the Select Asset check box adjacent to the assets that you would like to remove from the search results grid for processing and click the Remove From List button. |

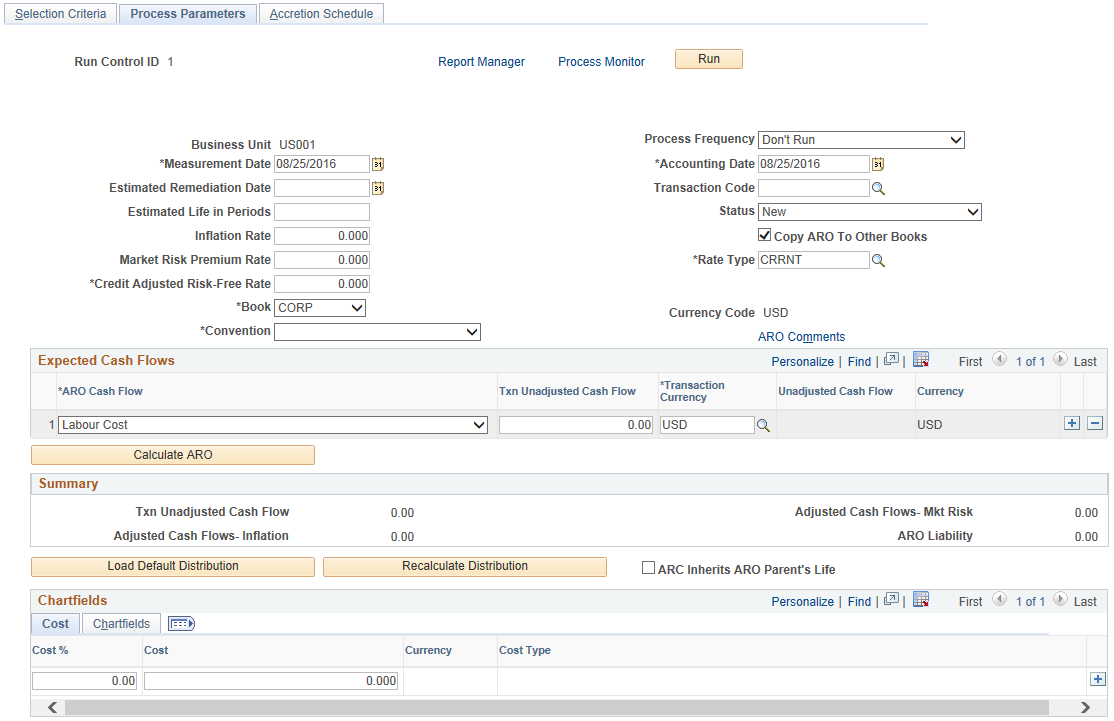

Use the ARO Measurement en Masse – Process Parameters page to define ARO measurement parameters for multiple assets at once.

Navigation:

This example illustrates the fields and controls on the ARO Measurement en Masse - Process Parameters Page. You can find definitions for the fields and controls later on this page.

After selecting the assets to be processed for ARO accounting treatment from the Selection Criteria page, you can set your process parameters on this page for processing those assets at once.

The fields on the Process Parameters page are the same as to those on the ARO Measurement page. The ARO Measurement page, however, is used for processing individual assets as opposed to processing a group set of assets.

See ARO Measurement Page.

When you have entered the process parameters on this page, click the Run button to process the selected assets. The AM_ARO_MASS Application Engine process then populates the tables that are defined in ARO Measurement component. You can review the output of this process from the inquiries and reports that are provided for meeting ARO reporting requirements. See Reviewing ARO Processing Results and Reporting for Asset Retirement Obligations.

Use the ARO Measurement en Masse – Accretion Schedule page (ARO_ACCR_MAS) to review the scheduled accretion expense as calculated by month over the life of the assets that were selected for processing. (Asset Management, Asset Transactions, Asset Disposal, ARO Measurement en Masse, Accretion Schedule):

This page is identical to the ARO Measurement - Accretion Schedule page.