Adding Capital and Operating Leases

This topic discusses how to add and update Capital and Operating Leases.

Note: Financial transactions cannot be performed on the Lease Administration Lease Assets through Asset Management.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Express Add – Definition and Update Lease Information – Definition Pages |

ASSET_LEASE_01 |

Create a capital lease or an operating lease. |

|

Express Add – Definition and Update Lease Information – Definition Pages |

ASSET_LEASE_01 |

Update a capital lease or an operating lease. |

|

ASSET_LEASE_02 |

Enter cost, ChartField, and depreciation data for a leased asset. |

|

|

ASSET_LEASE_02 |

Update cost, ChartField, and depreciation data for a leased asset. |

|

|

Express Add – Step Lease Payment and Update Lease Information – Step Lease Payment Pages |

ASSET_LEASE_05 |

Enter a step-lease payment schedule. |

|

Express Add – Step Lease Payment and Update Lease Information – Step Lease Payment Pages |

ASSET_LEASE_05 |

Update a step-lease payment schedule. |

|

Express Add – Payment Schedule and Update Lease Information – Payment Schedule Pages |

ASSET_LEASE_03 |

Create or view lease payment schedules. |

|

Express Add – Payment Schedule and Update Lease Information – Payment Schedule Pages |

ASSET_LEASE_03 |

Update lease payment schedules. |

|

Update Lease Information - Operating ChartFields |

ASSET_LEASE_06U |

Update operating lease ChartField information. ASSET_LEASE_06 and ASSET_LEASE_06U are used to allocate operating lease payments to a particular set of ChartFields. |

Use the Express Add - Definition page (ASSET_LEASE_01) to create a capital lease or an operating lease.

Navigation:

Use the Update Lease Information - Definition page (ASSET_LEASE_01) to update a capital lease or an operating lease.

Navigation:

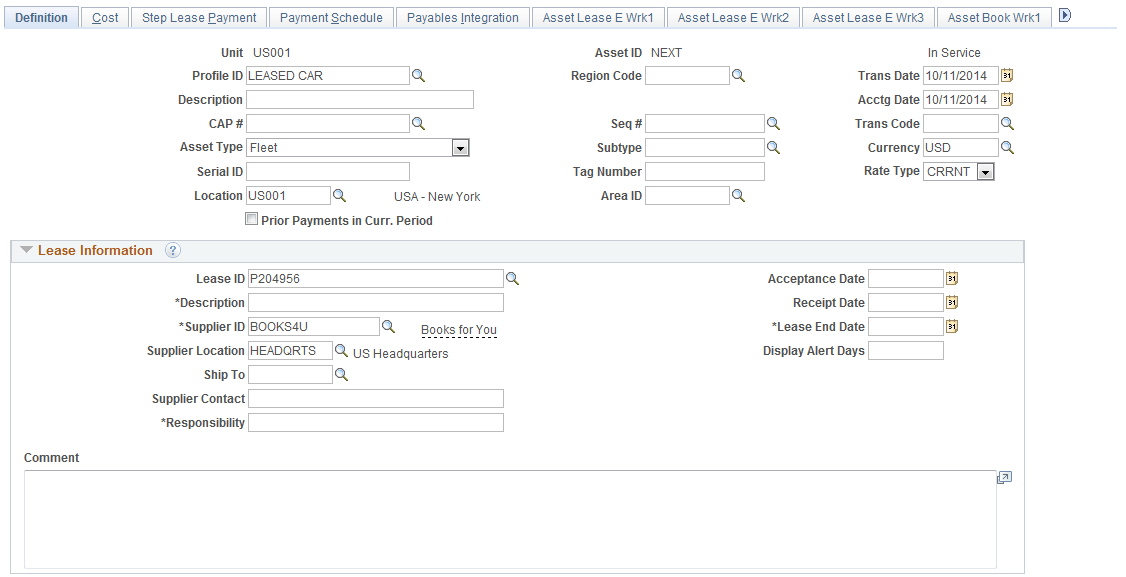

This example illustrates the fields and controls on the Leased Assets - Express Add - Definition page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Leased Assets - Express Add - Definition page (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Profile ID |

Enter an ID if you want to use the default information from an asset profile to define this asset. You must enter a profile ID for a capital lease because all depreciation information is stored in the profile ID. A profile ID is not required for an operating lease. |

Region Code |

Select a region code from the available options. |

Trans Date (transaction date) and Acctg Date (accounting date) |

Enter a transaction date and accounting date for the lease. For leases, the payment date is based on the transaction date. For example, if a lease begins in October and you need to start the payments in the same month, enter a transaction date of October 1. The accounting date has no bearing on the payment date. |

CAP # (capital acquisition planning number) and Seq # (sequence number) |

Select the associated Capital Acquisition Plan number for this leased asset or look up the associated Asset ID Sequence number if one has been assigned. |

Trans Code (transaction code) |

Select the accounting entry template that is used for transactions relating to this asset. |

Asset Type |

Select the asset type from the available established values. You must enter Asset Type for operating leases if you do not enter a profile. |

Subtype |

Select the asset subtype from the available defined values for the selected Asset Type. |

Currency |

Select the currency for the transactions that are processed with this asset. |

Serial ID |

Enter the Serial ID that is associated with this asset. Serial IDs track physical inventory, especially for IT assets. |

Tag Number |

Enter the tag number that is associated with this asset. Tag numbers track physical inventory. Note: To perform a physical inventory with PeopleSoft Asset Management, your assets must use tag numbers. |

Rate Type |

The exchange rate that is defined for the default book for the business unit appears by default in this field. You can select a different rate type. |

Location |

Select the location code from the available values. |

Area ID |

Select the area ID from the available values. |

Asset Operational Information |

Click this link to display the Define Asset Operational Information page. The link is visible only after saving the lease component. |

Lease Information

Field or Control |

Description |

|---|---|

Lease ID and Description |

Select from the available lease IDs assign a new ID for this business unit and add a description of the lease. Description is required only if a Lease ID has been assigned. |

Supplier ID and Supplier Contact |

Select the Supplier ID from the list of available suppliers for this asset and enter contact information. Supplier ID is required if Lease ID is assigned. |

Supplier Location and Ship To |

Enter the supplier location and ship to location from the available values. These fields are enabled only when a supplier ID is entered. |

Responsibility |

Enter the name of the person who is responsible for this leased asset. Required if Lease ID is entered. |

Acceptance Date |

Indicates the date that the lease contract is accepted (signed and returned to the lessor). If you complete the Interim Rent (Monthly) field in the Lease Term group box, you must enter an acceptance date that is earlier than the commencement date of the lease. Interim rent starts on the acceptance date and ends on the commencement date. You enter the amount of the interim rent in the Interim Rent (Monthly) field. |

Receipt Date |

Enter the date the leased asset is received. This is an information-only date field for reporting purposes. |

Lease End Date |

Enter the date the leased asset is received. Lease End Date becomes required when a Lease ID is entered. This date is used for the Lease End Date report. |

Display Alert Days |

Enter the number of days in advance to receive the Lease End Date pagelet based on the Lease End Date. This field appears only if PeopleSoft IT Asset Management (ITAM) is installed. |

Commence Date and Expiration Date |

These fields represent the first and last lease payment date (regardless of interim rent), and appear only after you save the page. |

Inception Date |

This field appears when viewing this page in Update/Display mode. The date that is displayed is the date of the original transaction. |

Additional Lease Information |

Click this link to access the Lease administration component. Note: If Lease Administration is installed, users can see Clauses, Options and Critical dates, Contacts along with Notes and Attachments and Supplemental Data pages on the lease component. Else, only the Notes and Attachments, and Supplemental Data pages are displayed on the lease component. |

Comment |

Enter any comments to be noted for this leased asset. |

Note: If LEASE is entered and PeopleSoft ITAM is installed then Description, Lease End Date, Vendor Id and Responsibility are required fields.

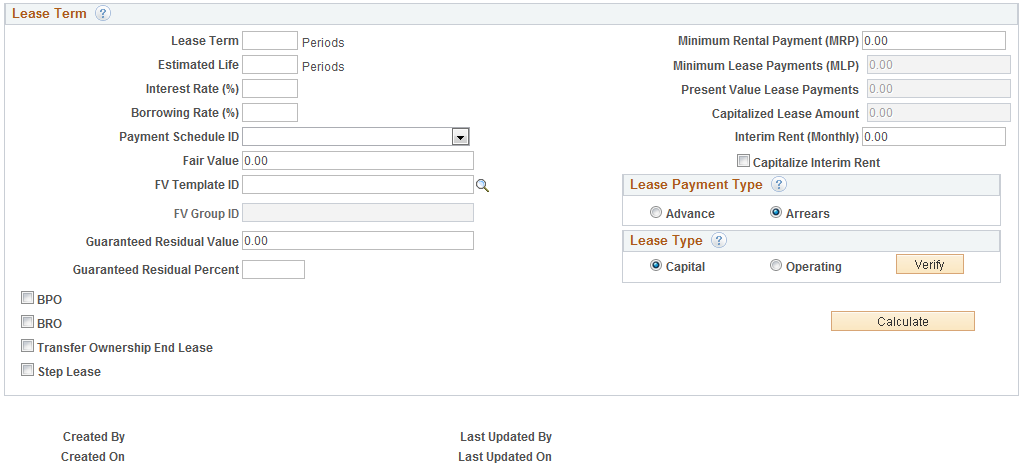

Lease Term

Field or Control |

Description |

|---|---|

Lease Term |

Enter the number of periods in this lease. |

Estimated Life |

The number of periods that you entered in Lease Term field appears by default. You can change this value. |

Interest Rate (%) (interest rate percentage) |

Enter the approximate percentage of profit the lessor gains by leasing the asset to you. This number must be an annual interest rate percentage in whole numbers. |

Borrowing Rate (%) |

Enter the interest rate that you would have incurred at the inception of the lease if you had borrowed the necessary funds to purchase the leased asset. This number must be an annual interest rate percentage in whole numbers. |

Payment Schedule ID |

If you want the system to define a lease payment schedule, enter a payment schedule ID. Capital leases must have a payment schedule ID. The values that you can select are set up on the Payment Schedule page when you specify the payment frequency and number of periods. |

Fair Value |

Enter the fair value. The system uses the fair value to verify the lease type. It also records this value on the AM_FMV table to use in the asset revaluation process. The system calculates the capitalized lease amount using the lesser of the Present Value Lease Payments and Fair Value field values. If the present value of the lease payments is less than the fair value, the capitalized lease amount equals the present value of the minimum lease payment (MLP). If the fair value is less than the present value of lease payments, the capitalized lease amount equals the fair value. You might want to change the interest rate so that the net present value equals the fair value. If you do not enter a fair value, the capitalized lease amount equals the present value of the MLP. |

FV Template ID (fair value template ID) |

Select a fair value template, which includes the valuation method, level and premise. If left blank, the fair value is created but the additional valuation information is not provided. |

FV Group ID (fair value group ID) |

This field is active only when the selected FV Template ID has a valuation premise of In Use. The default value is supplied from the selected FV Template ID; however, you can override it and select another FV Group ID. |

Guar. Residual Value (guaranteed residual value) |

Calculates depreciation based on the amount of the residual value of the leased asset that is guaranteed by the lessee to the lessor and considered as part of the minimum lease payments. |

Guaranteed Residual Percent |

Calculates depreciation based on the percent of the residual value of the leased asset that is guaranteed by the lessee to the lessor and considered as part of the minimum lease payments. |

Field or Control |

Description |

|---|---|

BPO (bargain purchase option) |

Select if this lease includes a bargain purchase option, which represents a payment by the lessee to the lessor at the end of the lease term, allowing the lessee to obtain title to the leased property. |

BRO (bargain renewal option) |

Select if this lease includes a bargain renewal option, which requires a payment if the lease agreement grants the lessee the right to renew or extend the lease. If the agreement specifies that the lease must be renewed or extended, a penalty might be required for failure to renew. |

Transfer Ownership end lease |

Check if there is an ownership transfer of the asset at the end of the lease period. |

Step lease |

Select if the lease is a step lease. A step lease features variable payment amounts and/or variable timing over the term of the lease. |

Field or Control |

Description |

|---|---|

Minimum Rental Payment (MRP) |

Enter the minimum rental payment. This field is not required for step leases. Note: You must either enter a minimum rental payment here or complete the cost information on the Cost page. Otherwise, the system cannot calculate the lease payment schedule. |

Minimum Lease Payments (MLP) |

Display a minimum lease payment.

|

Present Value Lease Payments |

Displays the present value of the lease payments for a step lease. The system uses two formulas to determine the present value of the total payment for a step lease.

|

The example illustrates the calculations using an interest rate of 7.2 percent.

|

Number of Terms |

Frequency |

Payment Amount |

|---|---|---|

|

6 |

Monthly |

400 USD |

|

18 |

Monthly |

350 USD |

PV1 equals Present value of the first payment in the schedule:

400 USD × ([ 1 - (1 + 0.01) ^ -6 ] ÷ (0.01) ) = 2,350.40 USD

PV2 equals Present value of the second payment in the schedule:

[350 USD × ([ 1 - (1 + 0.01) ^ -18 ] / (0.01) )] × (1 ÷ 1.01 ^ 6) = 5,744.88 USD

Present value of the total cash flow equals: 2,350.40 + 5,744.88 = 8,095.28 USD

Note: The lease term during the renewal period is considered part of the overall lease term.

Field or Control |

Description |

|---|---|

Capitalized Lease Amount |

Enter the cost. The system uses the following method to calculate lease payments: Capitalized Lease Amount - Prior Obligation Reduction = Residual Capitalized Lease Amount Residual Lease Amount × (Annual Implicit Interest Rate / Number of Periods per Year) = Interest Expense per Period Interest Expense per Payment + Obligation Reduction = MRP |

For example, this table illustrates a full payment schedule for a simple capital leased asset with a capitalized amount of 10,500 USD, an interest rate of 7 percent, a monthly payment of 908.53 USD, and 12 periods per year:

|

Period |

Residual Capitalized Lease Amount in USD |

Obligation Reduction |

Interest Expense |

Payment in USD |

|---|---|---|---|---|

|

1 |

10,500.00 |

847.2800562 |

61.24994377 |

908.53 |

|

2 |

9,652.71 |

852.2225232 |

56.30747678 |

908.53 |

|

3 |

8,800.49 |

857.1938213 |

51.33617873 |

908.53 |

|

4 |

7,943.29 |

862.1941186 |

46.33588144 |

908.53 |

|

5 |

7,081.10 |

867.2235843 |

41.30641574 |

908.53 |

|

6 |

6,213.88 |

872.2823885 |

36.2476115 |

908.53 |

|

7 |

5,341.59 |

877.3707024 |

31.15929757 |

908.53 |

|

8 |

4,464.22 |

882.4886982 |

26.0413018 |

908.53 |

|

9 |

3,581.73 |

887.6365489 |

20.89345107 |

908.53 |

|

10 |

2,694.10 |

892.8144288 |

15.7155712 |

908.53 |

|

11 |

1,801.28 |

898.022513 |

10.50748703 |

908.53 |

|

12 |

903.26 |

903.2609776 |

5.26902237 |

908.53 |

Field or Control |

Description |

|---|---|

Interim Rent (Monthly) |

Enter the amount of monthly interim rent for a capital or operating lease. Interim rent is common for quarterly leases. Interim rent starts on the acceptance date and ends on the commencement date of the lease. Once the lease officially begins, the normal rental payment amount is tracked by the lease payment schedule. PeopleSoft Asset Management prorates the first month of interim rent. You can see interim rent payments on the Express Add - Payment Schedule page (ASSET_LEASE_03). Select Capitalize Interim Rent if you want to include these interim payments as part of your asset cost. Note: You must post journal entries for interim rent each month by running the Depreciation Close process (AM_DPCLOSE). |

Capitalize Interim Rent |

Select this check box to capitalize. When selected, the interim rent is added to the cost of the leased asset. |

Calculate |

Click to have the system calculate the lease payment schedule. Before the system can calculate the lease payment schedule, you must have:

|

Lease Payment Type

Select a payment type: Advance or Arrears. You can use either type for both capital leases and operating leases. More details on these two payment types are provided in this table:

|

Calculation |

Advance Payment Type |

Arrears Payment Type |

|---|---|---|

|

Present Value Factor |

Total payment terms for present value factor excludes the term of the advance (or first) payment. |

Total payment terms for present value factor equal the total terms of the lease. |

|

Present Value of Minimum Lease Payments |

Equals: (Present Value Factor × Periodic Payment Amount) + Advance payment. |

Equals: Present Value Factor × Periodic Payment Amount. |

|

Amortization Schedule |

Period interest expense equals: Capitalized Amount × the period interest rate. The Capitalized Amount used for the first period of the payment excludes the advance payment amount. |

Period interest expense equals: Capitalized Amount × the period interest rate. |

Field or Control |

Description |

|---|---|

Advance |

Select if an asset is leased with the first payment that is due before the lease begins. For advance payments, the interest expense is not calculated. If the present value is calculated on a lease with 12 monthly payments of 100.00 USD and an interest rate of seven percent, then the calculated present value factor is 10.6254. Calculated present value = 100 USD + 10.6254 × 100 = 1,162.54 USD |

Arrears |

An arrears payment type means that an asset is leased with the payment due at the end of the period. This is the lease payment type by default. If the present value is calculated on a lease with 12 monthly payments of 100.00 USD and an interest rate of seven percent, then the calculated present value factor is 11.5571. Calculated present value = 11.5571 × 100 = 1,155.71 USD |

Lease Type

When you select the lease type, you can verify that you have selected the correct lease type for a country. If you do not select either the Capital or the Operating options, the system selects the lease type for you. The system can verify the lease types for the U.S., Canada, Germany, and Australia. Canada uses the same criteria as the U.S. for classifying capital and operating leases. Germany uses a higher threshold for the lease term (90 percent instead of 75 percent).

Note: You cannot change a lease type from capital to operating or from operating to capital. If you must change the lease type, you must first retire the leased asset and then reenter the lease with the appropriate lease type.

Field or Control |

Description |

|---|---|

Capital |

Select if the lease is a capital lease. According to FAS13, a capital lease must meet one of the following criteria:

|

Field or Control |

Description |

|---|---|

Operating |

Select if the lease is an operating lease. |

Verify |

Click this button to verify if the lease meets the criteria for a capital lease or an operating lease. If the lease type meets the criteria, the system displays a message confirming that the criteria for FAS13 has been met. If you do not select the Capital or Operating option before clicking the Verify button, the system looks at the information that you have entered on this page about the lease, including the country code, and selects the lease type for that country. Note: This verification test is disabled for leased assets that use an Indian business unit; designation of capital or operating leases is manual for assets in India. See (IND) Using PeopleSoft Asset Management Options to Meet Indian Requirements. |

Use the Express Add - Cost page (ASSET_LEASE_02) to enter cost, ChartField, and depreciation data for a leased asset.

Navigation:

Use the Update Lease Information - Cost page (ASSET_LEASE_02) to update cost, ChartField, and depreciation data for a leased asset.

Navigation:

This example illustrates the fields and controls on the Cost page. You can find definitions for the fields and controls later on this page.

If you did not enter a minimum rental payment (MRP) on the Definition (ASSET_LEASE-01) page, you must complete the cost information on this page.

The system uses the cost information on this page to calculate the lease payment schedule. Use the Cost, Chartfields, and Depreciation tabs to enter more details. Because the ChartFields are effective-dated, you can use them to track transfers.

Note: If you are working with a step lease, you do not have to enter any information on this page.

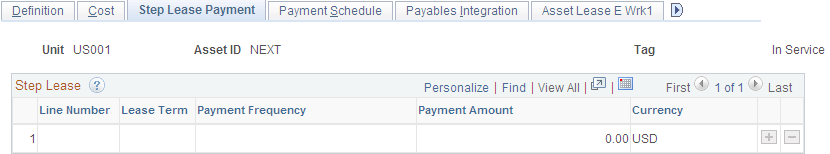

Use the Express Add - Step Lease Payment page (ASSET_LEASE_05) to enter a step-lease payment schedule.

Navigation:

Use the Update Lease Information - Step Lease Payment page (ASSET_LEASE_05) to update a step-lease payment schedule.

Navigation:

This example illustrates the fields and controls on the Step Lease Payment page. You can find definitions for the fields and controls later on this page.

If you checked the Step lease check box on the Definition (ASSET_LEASE-01) page, you can use this page to change payment information.

Enter a line number, enter the lease term (number of periods), select a payment frequency, and enter a payment amount. For example, you could define a step lease that consists of six monthly payments of 400.00 JPY followed by 18 monthly payments of 350 JPY.

If you are defining a skip payment, enter a payment frequency, the number of lease terms, and a payment amount of zero (0.00).

Note: The line numbers must be in sequential order. For example, if you update a lease schedule and need to insert a row between lines 1 and 2, you can use a line number such as 1.2.

After you are done working with this page, you must return to the Definition (ASSET_LEASE-01) page and click the Calculate button to generate the lease payment schedule.

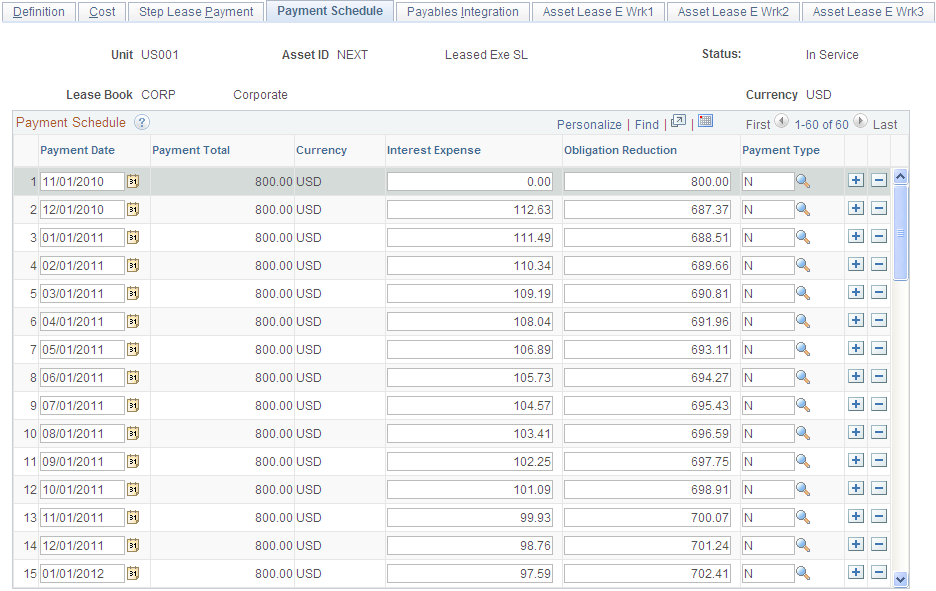

Use the Express Add - Payment Schedule page (ASSET_LEASE_03) to create or view lease payment schedules.

Navigation:

Use the Update Lease Information - Payment Schedule page (ASSET_LEASE_03) to update lease payment schedules.

Navigation:

This example illustrates the fields and controls on the Payment Schedule. You can find definitions for the fields and controls later on this page.

The system calculates the payment schedule on this page when you click the Calculate button on the Express Add - Definition page.

You can update the information on this page as needed.

Note: In case of capitalizing the interim rent, payments are noted with a C rather than I next to the payment line. You can change this designation by modifying message number 8015,37, using the PeopleTools Message Catalog.

If you elect to process periodic depreciation accounting entries, the system creates the journal entries that are shown in the following table:

|

Action |

Debits |

Credits |

|---|---|---|

|

Add |

|

|

|

Adjust |

|

|

|

Transfer In |

|

AD Accumulated Depreciation |

|

Transfer Out |

AD Accumulated Depreciation |

|

|

Retire |

|

|