Understanding Composite Asset Processing

Composite Asset Processing, frequently used by utility companies, is a way of grouping many assets so that their total cost is carried by, and depreciated as, one asset. This single asset is termed a composite asset, and associated assets are known as composite members.

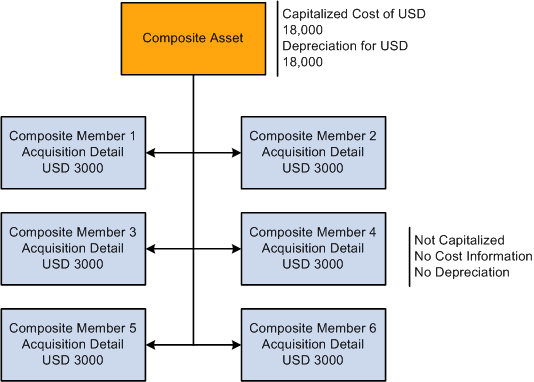

In composite processing, no transaction detail is carried by individual composite members. All transaction detail, including any gain or loss accrued upon retirement, is rolled up to the composite asset level. Once this rollup occurs, no transaction detail is retained by composite members. Because depreciation occurs at the composite asset level, only the composite asset carries any information—such as book, depreciation method, prorate convention, or life—that relates to depreciation.

This graphic illustrates a composite asset.

Because the composite asset carries all the cost for its associated composite members, it is a financial, or capitalized, asset. The composite asset can also carry its own cost information or not, as required, although no individual detail is retained once the total cost has been rolled up. Composite member assets, on the other hand, are nonfinancial assets, or not capitalized, and carry no cost information. Instead, they carry acquisition detail, which is summed up and capitalized at the composite asset level.

All transactions are performed at the composite asset level except for adjustments to acquisition detail. Adjustments are made at the composite member level and then rolled up to the composite level.

Note: The fair value (FV) of the asset does not roll up from the composite member to the composite level.

Summing up and adjusting cost information for composite assets is accomplished through a mass change that:

Sums the acquisition detail for each ChartField combination contained in the affected Composite Member assets.

Inserts one cost row into the Composite Asset for the total of each ChartField combination.

Note: Composite members are not considered in the Capitalization Threshold evaluation.