Understanding How PeopleSoft Asset Management Calculates Depreciation

PeopleSoft Asset Management determines depreciation amounts using either tables or formulas. If you have a large number of assets, you will probably want to use formula-based depreciation, because this is considerably faster and uses less storage space. To help you more fully understand how PeopleSoft Asset Management calculates depreciation, this topic includes a discussion of how formulas are used.

When you add an asset to PeopleSoft Asset Management, you decide the cost basis that you want to depreciate—you can include the basic cost of the asset as well as any freight and taxes that were paid. If you do not want to include freight and tax charges in the depreciable cost basis, you can still track these charges in the Acquisition Detail page.

If allowed by the depreciation method, the cost basis is reduced by either salvage value or tax credits.

You can enter the salvage value as a percentage of the cost or the actual amount. Typically, you specify salvage value when you add the asset in PeopleSoft Asset Management. If allowed, salvage value is deducted from the cost basis for depreciation calculations. When the salvage value changes after depreciation begins, PeopleSoft Asset Management automatically adjusts the cost basis and depreciation from that time forward to reflect the change.

See Calculating Depreciation When Salvage Value Exceeds Net Book Value (NBV).

Tax methods such as ACRS and MACRS determine which tax credits are available in PeopleSoft Asset Management. When you specify a Qualified Investment Code, PeopleSoft Asset Management uses this code to determine which tax credits apply to your assets. If you fail to specify a Qualified Investment Code for any reason, PeopleSoft Asset Management deduces the applicable code from the tax method that you elect.

If you do not specify a tax system, PeopleSoft Asset Management considers the date that the assets were placed in service to determine which method applies. Based on the tax method that you select and the recovery life, PeopleSoft Asset Management derives the corresponding qualified investment code and the tax credits that available under that code, and elects the applicable tax credits for you.

If a Basis Reduction Percentage applies, the depreciable basis of the asset is reduced. The calculation is based on the Qualified Investment Code, the Tax Credit, and the Basis Reduction Percentage.

Calculating Tax Credits

PeopleSoft Asset Management uses the Qualified Investment Code, together with the Recovery Life and in-service date, to determine the Qualified Investment Percentage—the rate that is applied to the book cost— to determine the amount that qualifies for tax credits.

The Tax Credit Percentage is derived from the Tax Credit Type, Tax Credit Code, Recovery Life, and in-service date.

The amount of the tax credit is based on the following calculations:

Cost Basis Reduction

After the amount of the tax credit is calculated, a corresponding reduction in the basis is calculated as required:

If you dispose of the asset before it has completely depreciated, PeopleSoft Asset Management calculates the recapture of the credit and adds it to the depreciable cost basis.

Section 179 Expense

If you elect to expense all or a portion of the cost, you should select the Section 179 Expense Taken check box on the Asset Book Definition - Tax page. Investment credits are automatically calculated based on the criteria that you enter in the Asset Book Definition - Tax Credit page.

If an asset is considered a listed property asset for tax purposes, then the allowable depreciable basis is reduced by the percentage of business use. For example:

Listed property is certain kinds of assets that are conducive to mixed business and personal use such as:

Passenger automobiles under a certain weight.

Any other property that is used for transportation such as trucks, buses, boats, airplanes, motorcycles, and any other vehicles for transporting persons or goods.

Any property of a type that is generally used for entertainment, recreation, or amusement such as photographic, phonographic, communication, and video recording equipment.

Any computer and related peripheral equipment unless it is used only at a regular business establishment and owned or leased by the person operating the establishment.

Any cellular telephone (or similar telecommunications equipment) placed in service or leased in a tax year beginning after 1989.

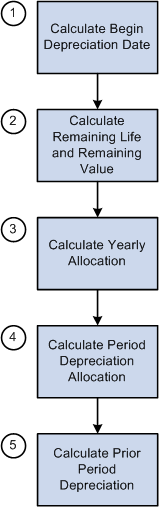

PeopleSoft Asset Management performs five basic steps to calculate depreciation for an asset. It calculates:

The asset's beginning depreciation date.

The asset's remaining life and remaining value.

The asset's yearly depreciation.

The asset's period depreciation allocation.

The asset's prior period depreciation.

PeopleSoft Asset Management depreciation calculation process flow.

The following sections provide illustrative examples of how PeopleSoft Asset Management handles all of these calculations in a variety of different scenarios.

Note: PeopleSoft Asset Management calculates depreciation yearly, not by month or by period. It then allocates yearly depreciation among the year's periods, except when you select the Declining Balance depreciation method or the Declining Balance method with a switch to the Straight Line method and the monthly depreciation option is selected.