Adjusting Withholding Manually

Once you have posted the withholding data, you may need to make adjustments to the withholding transactions. You can either run the Withholding Update process to make adjustments automatically, or you can enter adjustments manually using the Withhold Adjustments page.

This section discusses how to manually adjust posted withholding transactions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

WTHD_ADJUSTMENT |

Manually adjust posted withholding transactions by supplier or add withholding entries from a legacy or third-party system. |

Use the Withhold Adjustments page (WTHD_ADJUSTMENT) to manually adjust posted withholding transactions by supplier or add withholding entries from a legacy or third-party system.

Navigation:

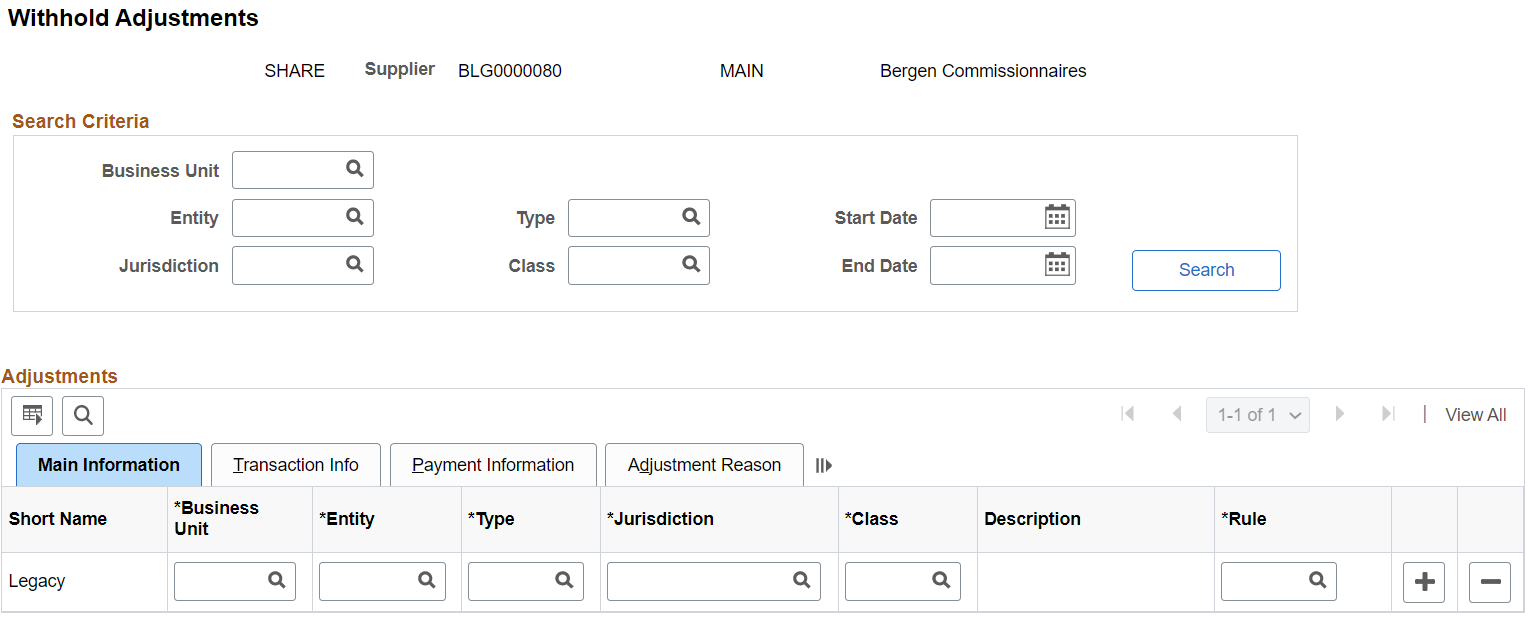

This example illustrates the fields and controls on the Withhold Adjustments page. You can find definitions for the fields and controls later on this page.

You can either modify existing posted withholding entries or add withholding entries from a legacy or third-party system.

To modify an existing withholding entry:

Enter your search criteria in the Search Criteria group box and click the Search button.

The Adjustments grid displays all posted withholding transactions that meet your criteria.

Modify data for each withholding transaction in the Adjustments grid that requires it.

You can also add and delete transaction rows as needed.

Save.

Saving the page updates the withholding transaction table, but does not update the underlying voucher tables. To have the system update the underlying voucher tables, use the Withholding Update process.

To add legacy or third-party data:

Add a withholding transaction row in the Adjustments grid.

Enter the following information, at minimum: business unit, entity, type, jurisdiction, class, rule, basis amount, liability amount, paid amount, payment date, declaration date, and adjustment reason.

Save.

Each transaction row you enter is added to the withholding transaction table, and is added to or subtracted from the totals already in the withholding transaction table.

Adjustments

This grid shows business unit and withholding class combination data on the Main Information tab, withholding transaction details on the Transaction Info tab, and bank account and payment information on the Payment Information tab. The Adjustment Reason tab displays the creation date and the user ID of the user who created the transaction adjustment row, along with a field for entering adjustment reasons.

Field or Control |

Description |

|---|---|

Basis Amt (basis amount) |

Displays the amount on which the withholding is calculated. This is the basis amount that is reported to the withholding entity for this payment. It includes the liability amount and is typically the gross amount of the voucher. |

Liability Amt (liability amount) |

Displays the amount of back up withholding that is retained to remit to the withholding entity. This amount may also be remitted to the original supplier depending on your business processes. |

Paid Amount |

Displays the amount of the withholding liability amount that has been paid to the withholding entity or original supplier. This value appears after you pay the liability to the entity or original supplier and post the payment. An amount of 0.00 means that no withholding has been paid. |

Payment Date |

Displays the date on which the payment was made. Some entities, including the IRS in the United States, require that you report withholding based on payment date. In this case the payment date needs to be in the year that you are reporting in. For example, let's say that you need to do an adjustment for a supplier for 2005 but the current year is 2006. When you add a row, the payment date defaults to today's date, which you must override with a 2005 date. |

Declaration Date |

Displays the date on which the withholding is declared. Declaration date is used for withholding entities who use a date other than payment date—accounting date, for example—to report withholding transactions. |

Posted Date |

Displays the date the payment was posted. |

Adjustment Reason |

Enter an adjustment reason for the listed transaction. |