Canceling Individual Payments

This section provides an overview of payment cancellation with associated liabilities and discusses how to cancel a payment.

This section discusses canceling individual payments. PeopleSoft Payables also provides the ability to cancel multiple payments using the Mass Payment Cancellation component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PYMNT_CANCEL |

Cancel payments, reverse a cancellation, or view previously canceled payments. |

|

|

PO Associated with a Voucher Page |

AP_PO_VCH_PYMT_DT |

View purchase orders associated with the selected payment. This link is conditional, and the page appears only when the following three conditions exist:

|

|

PO Schedules tied to the Voucher Page |

AP_PYMTCL_PO_DET1 |

View purchase order schedules associated with the selected payment. This link is conditional, and the page appears only when the following three conditions exist:

|

This section discusses how to:

Cancel payments with associated liabilities.

Cancel payment schedules with associated liabilities.

Payment cancellation with no Commitment Control integration

Payment cancellation and Commitment Control integration.

Payment cancellation processing sequence.

Cancel Payments With Associated Liabilities

To cancel payments and close any associated liabilities, select the Do Not Reissue/Close Liability option. The system determines if vouchers associated with the payment are direct vouchers or PO vouchers. If you are cancelling the payment with the close liabilities option, the associated voucher is a PO voucher, and:

Commitment Control is not enabled, the system provides you with the option to unmatch vouchers.

Commitment Control is enabled, the system provides you with the option to restore encumbrances.

If all the system checks pass, the system displays the PO Associated with the Voucher page.

Cancel Payment Schedules With Associated Liabilities

For payments defined with payment schedules, select the Do Not Reissue/Close Liability option. The system functions like it does when canceling a payment using the close option, except that it cancels a payment schedule and closes any liabilities associated with that payment schedule. The other difference between canceling a payment schedule and canceling a payment is that the pages list the schedule ID number instead of the reference number, and the PO Associated with the Voucher page displays all the vouchers associated with the payment schedule.

Payment Cancellation With No Commitment Control Integration

When the payment cancellation and closure includes purchase orders associated with vouchers, but Commitment Control is not enabled, the system provides you with the option of unmatching the voucher, in addition to closing the liability. The system:

Determines if the payment being cancelled has at least one matched voucher.

If so, the system provides you with the option to unmatch the voucher, in addition to closing the liability.

Determines if the matched voucher is associated to a closed receiver line.

Provides you with the option for unmatching the voucher if there is no association to a closed receiver line.

The system generates a new message asking if you wish to unmatch the voucher. Select Yes to unmatch the voucher and close the liability. Select No to only close the liability.

Provides you with the option for unmatching the voucher if there is an association to a closed receiver line.

The system generates a new message asking if you wish to unmatch the voucher. Select Yes to unmatch the voucher and close the liability. Note that the system unmatches the closed receiver line as well. Select No to only close the liability.

Determines if the voucher is partially paid.

If so, the system displays a warning message that the voucher cannot be unmatched because it has been partially paid. You can continue with closing the voucher, however, the system does not unmatch the voucher.

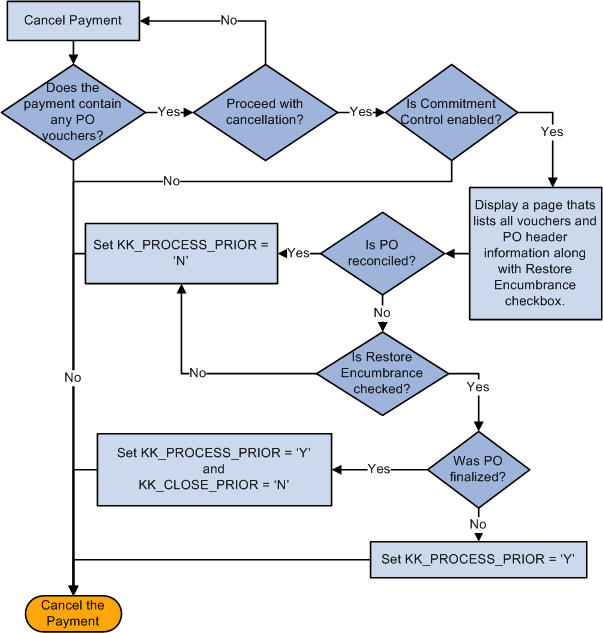

Payment Cancellation and Commitment Control Integration

If the payment to be cancelled contains vouchers tied to purchase orders, the system gives the option of restoring encumbrance to the purchase order. If you choose to restore the encumbrance, the system automatically unmatches the voucher. If you choose not to restore the encumbrance, the system does not unmatch the voucher.

When the voucher is associated with purchase orders, and Commitment Control is enabled, the system:

Determines if the encumbrance can be restored to the purchase order.

The system generates a message asking if you wish to restore the encumbrance and reopen the purchase order. Select Yes to restore the encumbrance and reopen the purchase order. Select No and the system only liquidates the liability.

If you use matching and you opted to restore the encumbrance and reopen the purchase order, the system automatically unmatches the voucher after the Voucher Posting process, which updates the purchase order and the receiver match statuses to Partial.

Determines if the purchase order has been reconciled and finalized, and if encumbrances are established.

If all purchase orders have been reconciled, then the system prevents you from reopening the purchase orders and restoring the encumbrances and the system advises you that only the remaining liability can be restored.

Determines if the PO voucher has no associated partial payments.

The system determines if the unreconciled PO vouchers have multiple payment schedules and if two or more payment schedules have been paid. The system does not restore the encumbrance when there is an active payment schedule. For the system to restore encumbrances, the following conditions must be met: associated payment schedules must either be not paid or paid and cancelled, and the entire voucher amount must be available.

The system uses these results to ensure field value synchronization between source transactions and referenced transactions, which are used in the Budget Processor process.

The following diagram illustrates the PeopleSoft Payables payment cancellation processing logic for scenarios involving purchase orders and Commitment Control integration.

Payment Cancellation Processing Sequence

The following is the sequence of processes you perform to successfully close a PO voucher that has not been paid:

Create a PO voucher.

Run the Matching Application Engine process (AP_MATCH).

Run the Commitment Control's Budget Processor process.

Run the Voucher Posting process.

Pay the voucher.

Run the Payment Posting process.

Cancel and close the payment.

Run the Payment Posting process again.

Run the Voucher Posting process again to unmatch any matched items.

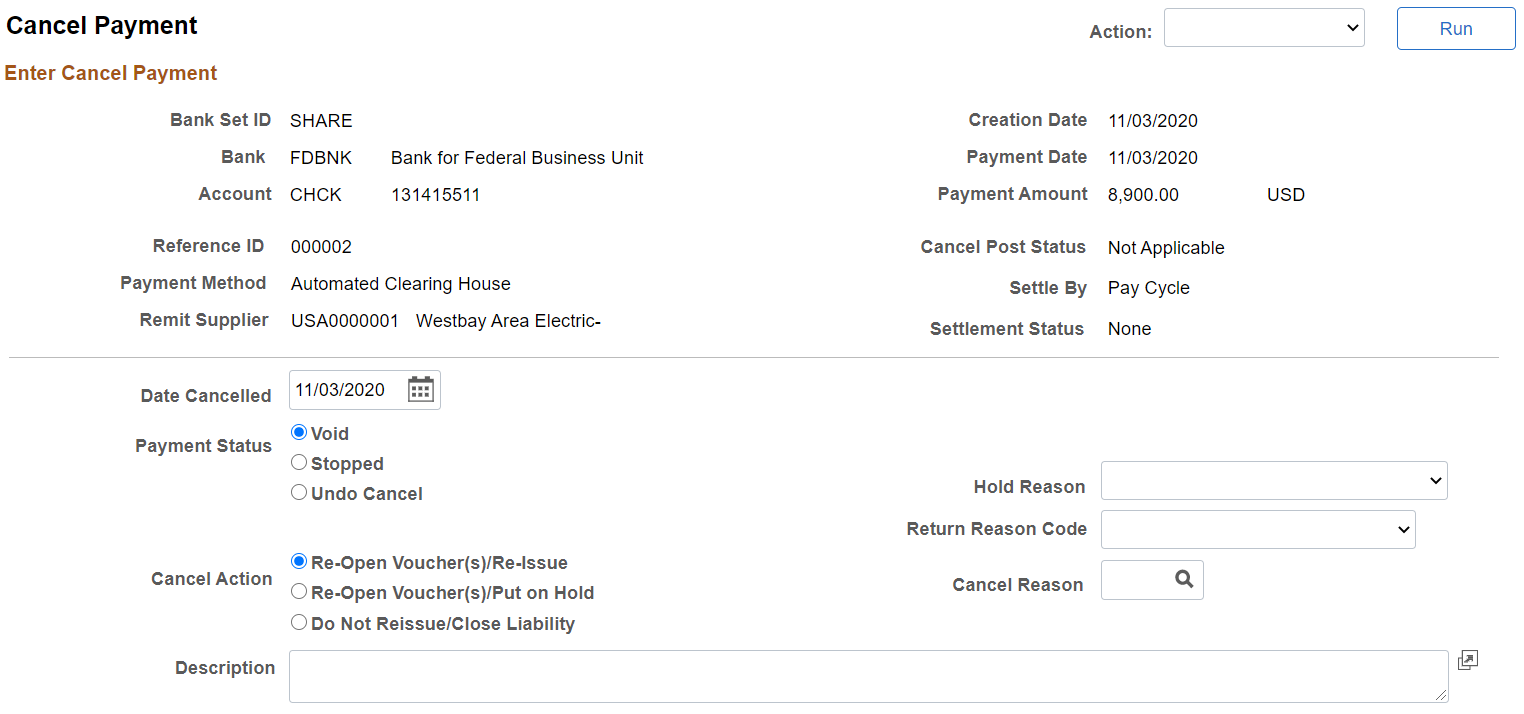

Use the Cancel Payment page (PYMNT_CANCEL) to cancel payments, reverse a cancellation, or view previously canceled payments.

Navigation:

This example illustrates the fields and controls on the Cancel Payment page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Action |

Select to run one of the following on-demand processes after you have marked and saved the cancellation. This creates the necessary accounting entries. Displayed on-demand processes depend on the selected Payment Status and Cancel Action values. For example, if you select Void and Re-Open Voucher(s)/Re-Issue, the 1. Payment Post and 2. Journal Generate values appear. Processes are numbered to indicate the order of how the processes are run. For example, if you select 2. Journal Generate, the system automatically initiates the number 1 process (in this example, 1. Payment Post), and then the number 2 process (in this example, 2. Journal Generate).

See Payment Cancellation. |

Bank SetID |

Displays your bank SetID, bank code, and account number and descriptions. |

Remit Supplier |

Displays remit supplier number and description. |

Reference ID |

Displays payment reference ID. |

Creation Date |

Displays the date the payment was created. |

Payment Date |

Displays the date the payment was issued. |

IBAN |

Displays the international bank account number (IBAN) in addition to the local, domestic bank account number when the country has been set up to display the IBAN on the IBAN Formats page. |

Settle by |

Displays whether the payment was settled through Financial Gateway or Pay Cycle functionality. |

Settlement Status |

Displays the settlement status of Error, Hold, Loaded, Paid, Canceled, or None. |

Date Cancelled |

Enter the date that you want to cancel the payment. |

Payment Status |

Select a payment action. Options include: Void: Select to void the payment. You void a payment when it has not been released. Stop: Select to stop the payment. You stop a payment when it has been released. Undo Cancel: You can undo any cancellation until you post the canceled payment. Warning! After posting, you cannot undo the cancellation. |

Cancel Action |

Select a cancel action. Options include: Re-Open Voucher(s)/Re-Issue: Use to reselect the scheduled payments and reissue them the next time that you run a pay cycle, assuming that the vouchers meet the selection criteria for that pay cycle. Important! If you reopen and reissue the voucher, the existing schedule payment will be cancelled in the Payment Posting process and a new schedule is added. Note: If you decide to reopen vouchers and reissue, remember that you must run the Payment Posting process twice to record the reversal before those vouchers are available for a new payment selection. You can undo your cancellation, as long as the canceled payment is not posted. Re-Open Voucher(s)/Put on Hold: Use to reopen the scheduled payments, but places the reopened scheduled payments on hold for your review. Select this option if you need to perform additional investigation or revise voucher information before proceeding with payment. A pay cycle process does not select the scheduled payments until the hold is removed on the Payments page of the Voucher component. If you select this value, you must also select a reason code in the Hold Reason field. Do Not Reissue/Close Liability: Use to cancel the payment and close any liabilities associated with it. The amount of the liability to close is calculated as the amount of unpaid liability remaining. The system takes into account whether the business unit is accounting at gross or net. The Payment Posting process identifies the voucher as process manual close, and the amount of the outstanding liability is reversed the next time the Voucher Posting process runs. See Understanding Payment Cancellation With Associated Liabilities. |

Cancel Reason |

Specify a cancel reason for payment cancellations. |

Hold Reason |

Specify a hold reason for payment cancellations placed on hold. The system defaults this hold reason onto the cancelled payment's new payment schedule. Select from the following: Accounting, Amount, Cntrct Ret (contract return), Goods, IPAC (Intra-Governmental Payment and Collection System), Other, Quantity, and Wthd hold (withholding hold). |

Return Reason Code |

Select a return reason code. This field is available only if the bank account is listed on the PIR Definition page. |

Description |

Enter comments or an explanation for the cancellation. |

Document Sequencing |

If you have document sequencing enabled, click the Document Sequence link to access the Document Sequence page, where you can change the payment document type. |