Defining Agency Location Codes

To set up agency location codes, use the Agency Location component (AGENCY_LOC_CD).

This section provides an overview of agency location codes and discusses how to define agency location codes and specify government-wide accounting (GWA) reporting options.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AGENCY_LOC_CD |

Create agency location codes for federal payment schedules. |

|

|

AGENCY_LOC_CD2 |

Specify the business activity and reporter category combination for the agency location code to be used for federal reporting. |

|

|

ALC_IPAC_FLDS |

Define the IPAC fields |

If you represent a U.S. Federal agency, you probably pay your suppliers through a Treasury Disbursing Office (TDO). You identify your TDOs with Agency Location Codes (ALC). Define an eight-digit ALC for each TDO you set up and assign it to the TDO on the Bank Information page. If you represent a U.S. Federal agency that does not disburse through a TDO, you can set up ALCs that bypass the voucher save edit that enforces eight-digit ALCs.

If you represent a U.S. Federal agency that uses the Intra-Governmental Payment and Collection System (IPAC), then you must also define an ALC for each of the suppliers you pay through IPAC.

The business activity you define for your ALCs on the GWA Reporting Options page determines what type of cash transaction activity you report on the SF224 Statement of Cash Transactions report. The business activity and reporter category combination you define for your ALCs determines what cash reclassification transactions you report on the Partial 224 report. The Partial 224 report is an effort by the U.S. Treasury to ultimately phase out the SF224 Statement of Cash Transactions report over the next several years by having agencies report collection and disbursement activity with a new Business Event Type Code (BETC). Once the cash activity includes the BETC you only need to report cash reclassifications via the Partial 224 report. The U.S. Treasury is taking a phased approach to modify financial systems that agencies interface with today to include the BETC code. These systems include IPAC for collections and payments, CashLink for collections, and Secure Payment System (SPS) for payments. The U.S. Treasury requires systems to accommodate future implementation of BETC and therefore, exclude activity from the Partial 224 report that includes the BETC code.

Warning! The reporting of cash reclassifications for the new Partial 224 report is not applicable until the U.S. Treasury completes their requirements for Business Event Type Codes (BETC). The U.S. Treasury plans on phasing the BETC requirements towards the end of 2006. Please contact the U.S. Treasury for more information.

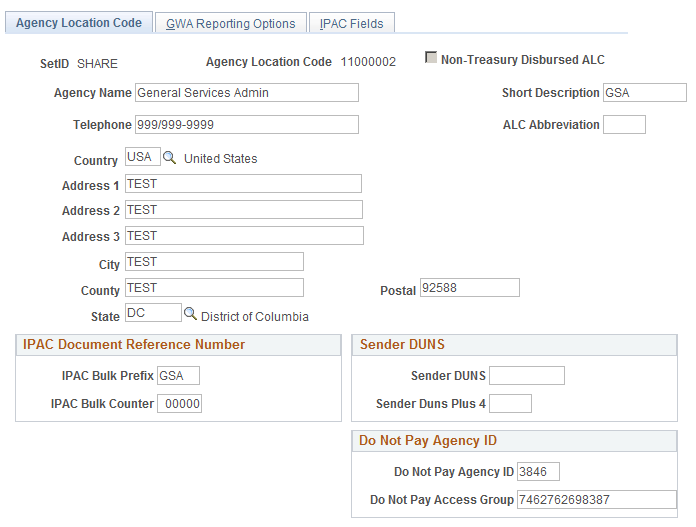

Use the Agency Location Code page (AGENCY_LOC_CD) to create agency location codes for federal payment schedules.

Navigation:

This example illustrates the fields and controls on the Agency Location Code page. You can find definitions for the fields and controls later on this page.

Enter agency name and address information for the ALC.

Field or Control |

Description |

|---|---|

Non-Treasury Disbursed ALC |

Select if this ALC does not disburse payments through a U.S. Federal TDO. This enables the vouchers paid from this ALC to bypass the edit for an eight-digit numeric ALC, which means that you can enter an ALC of one to eight alphanumeric values. |

ALC Abbreviation |

Enter an abbreviation value for the ALC code. |

IPAC Bulk Prefix |

Enter a 3-digit alphanumeric prefix to be used by PeopleSoft in creating unique document reference numbers (to differentiate from the Department of Treasury document reference numbers) for those Agency Location Codes that are used to send payments and collections. |

IPAC Bulk Counter |

Enter the beginning number from which to increment the sequential counter for the document reference number. |

Sender DUNS and Sender Duns Plus 4 |

Enter Sender DUNS and Sender Duns Plus 4 values for your specific ALC. These fields can be made required or optional on the IPAC Fields page. The Receiver DUNS and DUNS Plus 4 values are stored on the Supplier - Identifying Information page. Note: If Sender DUNS and/or Sender DUNS Plus 4 is/are entered on the ALC page and if they are marked as Required on IPAC Fields page, then these value(s) are used as default value(s) for IPAC payments. |

Do Not Pay Agency ID |

Enter a 2-4 digit value, which is registered in the U.S. Federal Government Do Not Pay application. |

Do Not Pay Access Group |

Enter the access group value that is assigned to your agency. |

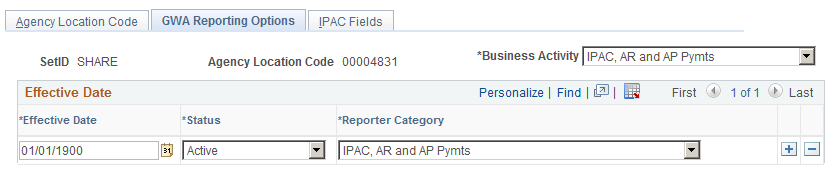

Use the GWA Reporting Options page (AGENCY_LOC_CD2) to specify the business activity and reporter category combination for the agency location code to be used for federal reporting.

Navigation:

This example illustrates the fields and controls on the GWA Reporting Options page. You can find definitions for the fields and controls later on this page.

The business activity you define for your ALCs on this page determines what type of cash transaction activity you report on the SF224 Statement of Cash Transactions report. The business activity and reporter category combination you define determines what cash reclassification transactions you report on the Partial 224 report.

Field or Control |

Description |

|---|---|

Business Activity |

Enter the business activity type for the agency location code. The business activity type identifies the types of transactions an ALC reports on the SF224/CTA Statement of Cash Transactions report. The business activity type specifies which systems the ALC utilizes at the U.S. Treasury to process cash transactions. It drives the Business Exception Activity report so actual data that is not applicable for a particular ALC is presented on the exception report to be identified and corrected by the Agency. Options include: AP Payments Only. AP Payments and AR. AR Only. IPAC Only. IPAC and AP Pymts. IPAC and AR. IPAC, AR and AP Pymts. No Business Activity Type. |

Status |

Select Active or Inactive. Enter an effective date for the status and reporter category. |

Reporter Category |

Enter a GWA reporter category code. The reporter category code identifies which systems are supporting the BETC code for detailed transactions. This also drives whether an ALC is ready to use the Partial 224 reporting capabilities. Select a GWA reporter category code for this agency location code. The reporter category can be equivalent to the business activity type, a subset of the business activity type, or a non-reporter. For example, if you select the IPAC and AP Pymts business activity type, the valid selections are IPAC Only, AP Payments Only, IPAC and AP Pymts, or Non Reporter. If either the Sender or Receiver ALC has one of the following four Reporter Category values, then that ALC agency is a GWA reporter for PIR: AP Payments Only. AP Payments and AR. AR Only. IPAC Only. IPAC and AP Pymts. IPAC and AR. IPAC, AR and AP Pymts. Non Reporter. Note: If you select IPAC reporter category, TAS/BETC information is required for IPAC payments. This information appears when you save the GWA Reporting Options page. Note: To be a full GWA Reporter “IPAC, AR and AP Pymts” should be selected. |

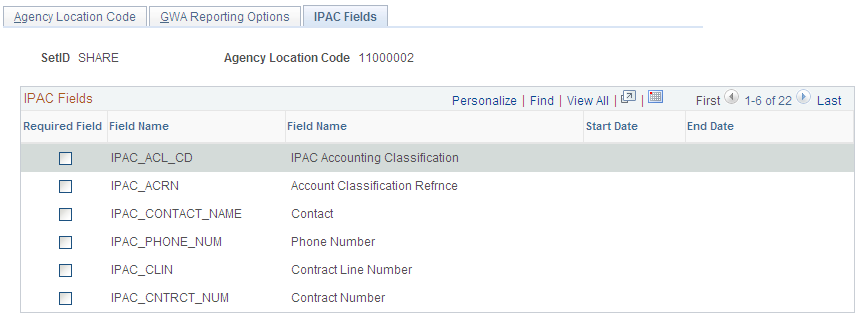

Use the IPAC Fields page (ALC_IPAC_FLDS) to allow federal customers, who utilize the IPAC functionality, to define the IPAC fields as required or optional. IPAC fields on this page can be set to required or optional for both Sender and Receiver agencies.

Navigation:

This example illustrates the fields and controls on the IPAC Fields page.

Field or Control |

Description |

|---|---|

Required Field |

Select the Required Field check box to define the selected field as required for this ALC. |

Start Date and End Date |

The date fields will be active only when you select the Required field. Start Date must be the current date or greater and the End Date must be at least one day greater than the start date. |