Processing Accruals for PeopleSoft Payables

This section lists prerequisites and discusses how to process accruals for PeopleSoft Payables.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PE_ACCRL_RQST |

Process period end accruals for specific business units or all business units. |

|

|

PE_ACCRL_RQST1 |

Review accrual information prior to running the create period end accrual process. |

|

|

PE_ACCRL_DELETE |

To deleting accruals for PeopleSoft Payables. |

Before processing period end accruals you must:

Define accrual information for each business unit.

Define accounting entry templates.

Define Journal Generator templates.

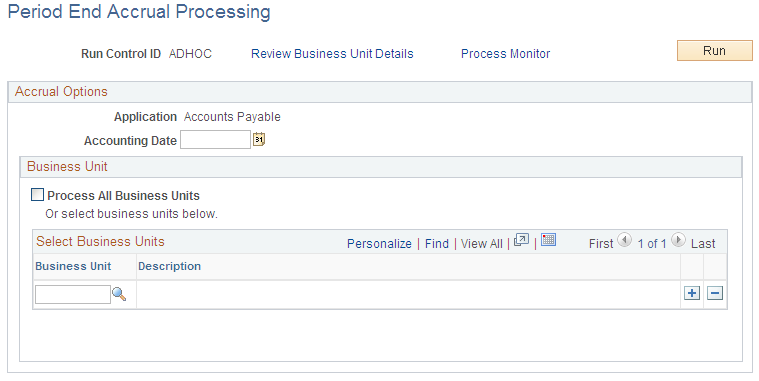

Use the Period End Accrual Processing page (PE_ACCRL_RQST) to process period end accruals for specific business units or all business units.

Navigation:

Accounts Payable, Batch Processes, Vouchers, Period End Accrual, Create Period End Accruals

This example illustrates the fields and controls on the Period End Accrual Processing page. You can find definitions for the fields and controls later on this page.

Accrual and Expense entries will be created along with the accompanying reversal entries in the next period.

Field or Control |

Description |

|---|---|

Review Business Unit Details |

After selecting the business units to process, click this link to access the Review Business Unit Details page to review the period end accrual information prior to running the process. |

Accounting Date |

Select the accounting date to be used for creating accruals. If you select an accounting date that has already been processed, the system will warn you that the accrual entries have already been processed. |

All Business Units |

Select this check box to process period end accruals for all business units. Business units without period end accrual options set up will be skipped by the process. |

Business Unit |

Select the General Ledger business unit you want to use to process period end accruals. Business units without period end accrual options set up will be skipped by the process. |

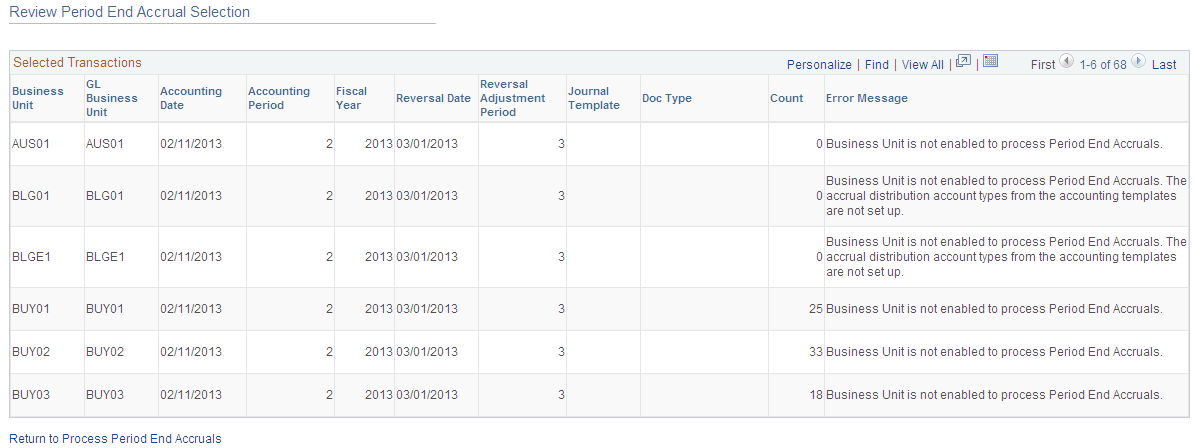

Use the Review Period End Accrual Selection page (PE_ACCRL_RQST1) to review accrual information prior to running the create period end accrual process.

Navigation:

Accounts Payable, Batch Processes, Vouchers, Period End Accrual, Create Period End Accruals

Click the Review Business Unit Details link on the Period End Accrual Processing page.

This example illustrates the fields and controls on the Review Period End Accrual Selection page.

The accrual reversal accounting date will be derived by selecting the first day of the next accounting period from the date provided in the run control. The system will create the accrual reversals by reversing the amounts found on the accrual entry and set the accounting date to reversal date. The system will create the expense reversal by reversing the amounts found on the expense entry.

The Review Period End Accrual selection allows users to review accrual information as well as any known errors that may be encountered will be listed such as:

No journal generator template setup in the business unit setup.

Control check box at the BU level has not been checked and does not allow period end accruals.

Periods for the applications are still open.

Business unit is not enabled to process period end accruals.

Note: The system displays an estimate of the number of vouchers that are eligible to be processed by Period End Accrual process. During the process, the number of vouchers processed may be different, depending on the detail rules when accounts are excluded, Control Group rules, if applicable, etc.

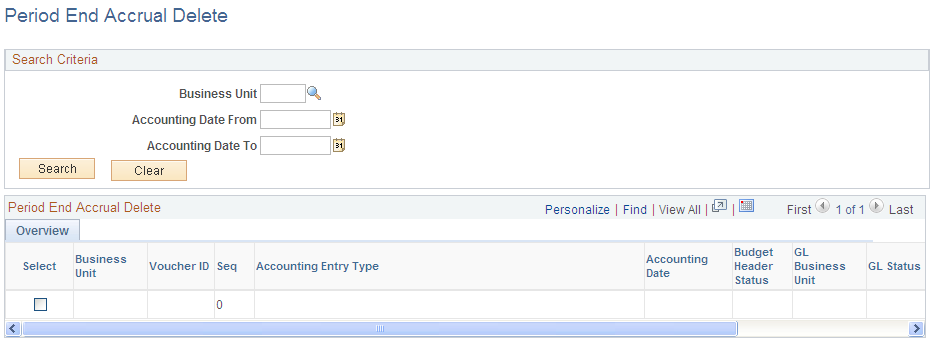

Use the Period End Accrual Delete page (PE_ACCRL_DELETE) to delete accruals for PeopleSoft Payables.

Navigation:

Accounts Payable, Batch Processes, Vouchers, Period End Accrual, Delete Period End Accruals

This example illustrates the fields and controls on the Period End Accrual Delete page.

There may be instances where the accounting entries have been created erroneously. If the accounting entries have not been journal generated, you can reverse the entries. If the accounting entries have been journal generated, any erroneous transactions will need to be reversed in General Ledger through a reversing journal transaction. If transactions have been budget checked by commitment control, these transactions will have to be zeroed out and budget checked after they have been reversed.

When the transactions are populated into the grid, users have the option to select the transactions they want to delete. The check box will be unavailable for selection if the accounting transaction has been journal generated. If you select transactions for deletion and they have been budget checked, the transactions will be updated to zero out the amounts and the system will set the budget checking status to not budget checked.

The delete selected rows button will delete all selected rows and their associated reversal row. If budget checking has been run on any transactions selected for deletion, users will receive a message that the budget checked transactions will need to be budget checked again to reverse any activity. If the rows have been budget checked, they will be updated to be budget checked again. The distribution status will be set to Ignore for all lines so they will not be selected by the Journal Generator program.