Understanding Pay Cycle Manager

This section discusses:

Pay Cycle process flow.

Pay Cycle statuses.

Pay Cycle exceptions.

Draft payments.

Payment formatting.

Separate payments.

Payment sorting.

Check payments that never reach the banking system.

Pay Cycle processing using the PeopleSoft Payables Payment Interface.

Pay Cycle processing using the PeopleSoft Financial Gateway.

Pay Cycle Manager is the focal point for managing payments in PeopleSoft Payables. From the Pay Cycle Manager page, you process each of the Pay Cycle Application Engine process (AP_APY2015) steps necessary to turn bank account, supplier, voucher, and business unit information into actual payments. Use Pay Cycle Manager to initiate the Pay Cycle process, view and send payments to a printer or a file, and create automated clearing house (ACH) files, drafts, electronic funds transfer (EFT) files, wire transfer reports, and positive payment files.

The Pay Cycle Manager integrates much of the data entered into PeopleSoft Payables and uses this payment data not only to create the negotiable documents but also to provide information for reports. Many of the activities of PeopleSoft Payables lead to or come from the Pay Cycle Manager.

The individual processes—such as payment selection, payment creation, EFT formatting, printing checks, and creating positive payment files—that turn vouchers into payments are referred to collectively as the pay cycle and are all processed by the Pay Cycle process.

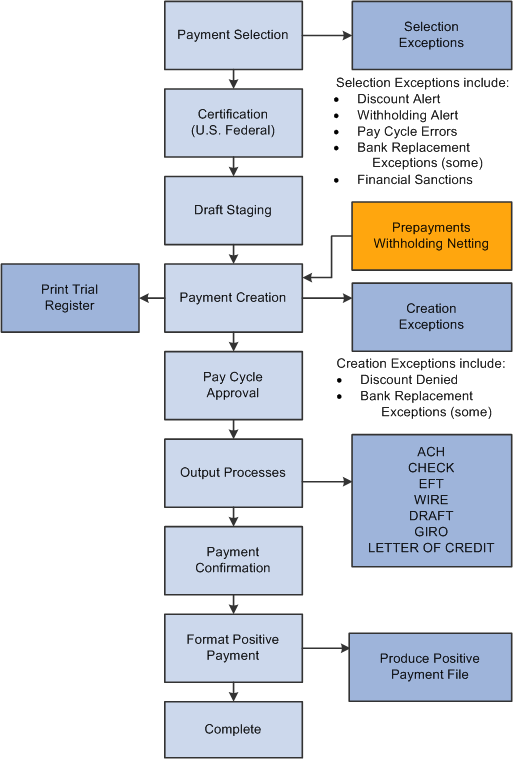

Diagram of the process flow for the Pay Cycle process (not all of the processes indicated would necessarily be included in a single pay cycle).

The Pay Cycle Manager is the place to go any time during this process of creating payments. It tells you exactly where your payments are in the payment process and keeps you informed of the current status of a pay cycle.

|

Status |

Meaning |

|---|---|

|

Approved |

Pay cycle has been approved. |

|

Certified |

(USF) Pay cycle has been approved by an authorized certifier. For U.S. Federal agencies only. |

|

Completed |

The Pay cycle is finished. You can start payment selection again using the next payment dates. |

|

Confirmed |

You have successfully confirmed that the payment references are correct on the Confirm Payment Reference page. |

|

Created |

Payments are ready to print. If EFT payments are being processed, the files are ready to format or be sent through the approval process. |

|

Exceptions |

Pay cycle exceptions have been found. |

|

Formatted |

The formatting process for the positive payment file has finished successfully. |

|

New |

When you create a pay cycle, its status is New. |

|

No work |

No payments have been selected or created for processing. |

|

Printed |

Payments are printed or data has been written to a file. |

|

Rejected |

Pay cycle has been rejected. |

|

Reset |

Pay cycle has been reset. Payment Selection can be run again. |

|

Restarted |

Pay cycle has been restarted and is ready for Payment Creation. |

|

Running |

One of the Pay Cycle processes is currently running. |

|

Selected |

Payment selection has finished successfully. |

|

Staged |

Payment selection has finished successfully and Draft payments have been successfully staged. |

|

To Be Certified |

(USF) Pay cycle is awaiting approval by authorized certifier. U.S. Federal agencies only. |

The Pay Cycle Manager page notifies you of any exceptions that might occur during processing and transfers you to the appropriate page so that you can decide how best to handle these conditions. These exceptions pages include:

Pay Cycle Errors page.

Lost Discount Alert page.

Discounts Denied page.

Withholding exception page.

Bank Replacement Exceptions page.

Pay Cycle Financial Sanction Warnings page.

During the Pay Cycle process, draft payments go through three steps:

Term |

Definition |

|---|---|

Payment Selection |

You select draft payments when you define your payment selection criteria. The batch process sequentially evaluates the vouchers and selects the payment schedules to be processed using the criteria that you established. |

Draft Staging |

The Draft Staging Application Engine process (AP_DFT_PROC) is called by the Pay Cycle process and creates a temporary or virtual view of split draft payments. After payment selection, drafts are created and grouped by draft ID. If you select draft optimization or draft rounding, the system creates a Draft Master ID for all split payments. The system assigns sibling Draft Create keys and groups all split payments under the draft master ID. You approve or reject scheduled draft payments in Draft Staging Approval before they are created on the Draft Staging Approval page at the draft maser ID level. |

Payment Creation |

After you approve the drafts, the Payment Creation process creates draft payments. You can then print draft payments or generate EFT drafts before the draft due date. Drafts contain the draft identification number, the draft amount, and the draft maturity date. |

PeopleSoft Payables provides powerful payment formatting capabilities that let you build a variety of payment forms to meet your business needs. The following table lists the standard payment forms that PeopleSoft Payables provides, along with the output processes called by the Pay Cycle process to produce the payment file:

|

Description |

Output Process Name |

Type of Process |

|---|---|---|

|

Draft EFT file |

FIN2025 |

SQR |

|

Draft EFT file with advice |

APX2027 |

BI Publisher |

|

Stub over check with advice |

APY2021X1 |

BI Publisher |

|

Check with separate advice |

APY2021X1 |

BI Publisher |

|

Check over stub with overflow |

APY2021X1 |

BI Publisher |

|

File copy |

APX2021 |

BI Publisher |

|

Stub over draft with advice |

APX2021 |

BI Publisher |

|

EFT file |

FIN2025 |

SQR (Structured Query Report) |

|

EFT file with advice |

APX2027 |

BI Publisher |

|

Check file layout |

APX2021 |

BI Publisher |

|

Giro-EFT file |

APX2021 |

BI Publisher |

|

Giro-EFT file with advice |

APX2027 |

BI Publisher |

|

Letter of credit advice |

APY2028X |

BI Publisher |

|

Positive payment form |

APY2055 |

|

|

Wire report |

APX2027 |

BI Publisher |

Typically, multiple scheduled payments to one supplier in a pay cycle are bundled into one payment. This is not the case when the supplier payment options specify separate payments for each scheduled payment,

You can specify:

Separate payments for a scheduled payment upon voucher entry.

Separate payments for a scheduled payment on the Pay Cycle Data Details page after Payment Selection processing.

That the scheduled payments have different payment handling codes. In this scenario, the system produces one payment for each handling code.

PeopleSoft Payables sorts payments at two hierarchical levels, payment handling code sequence and sort field sequence.

The first in priority is the payment handling code sequence, which you set up on the Payment Handling Codes page. If you give a high sequence number (the delivered number is 99) to the payment handling code HD or High Dollar Payment (which is applicable not just to dollars, but to any large amount payment), then any payment that is assigned a payment handling code of HD will be among the last to be produced by your output process (that is, printed last), and will therefore be at the top of your pile of checks, ready for any special handling, such as special signatures. This functionality works in conjunction with your bank account setup; when you set up bank accounts, you can select to override the payment handling code on a voucher with the High Dollar Payment code for any voucher that exceeds a specified amount.

The second in priority is the sort sequence by payment field that you define for each form ID on the Sort Fields page. You can define check sorting sequence by any of the following payment fields:

Remit Zip Code

Payment Handling

Bank SetID

Bank Code

Bank Account

Payment Method

Remit SetID

Remit Supplier

Name 1

Note: To print payments in dollar amount order, you must first run a script and configure fields on the Sort Fields page. This is fully discussed in the documentation for Specifying Payment Form Attributes.

After the system creates payments, it automatically marks as reconciled those check payments that never reach the banking system, such as:

Voided checks.

Alignment checks.

Overflow checks.

When you process pay cycles that include payments imported through the PeopleSoft Payables Payment Interface, such as payments sourced from PeopleSoft Expenses and PeopleSoft Treasury, you must process the pay cycles serially, one pay cycle at a time. If multiple pay cycles that include imported payments from the same source are run at the same time, payments may be generated more than once for the same source document.

If you are using PeopleSoft Expenses to generate cash advance and expense report payments, after Pay Cycle Manager has finished, you can also perform the PeopleSoft Expenses' Consolidate Supplier Payment process. This process include the following tool that enable you to review and manage the supplier consolidated payment reconciliation process: Supplier Payments Export to File Application Engine process (EX_VNDPT_EXP) that creates a flat file of corporate card suppliers payments, which can be saved as a spreadsheet.

This section discusses:

Pay Cycle processing through PeopleSoft Financial Gateway.

Payment cancellation.

Payments in error.

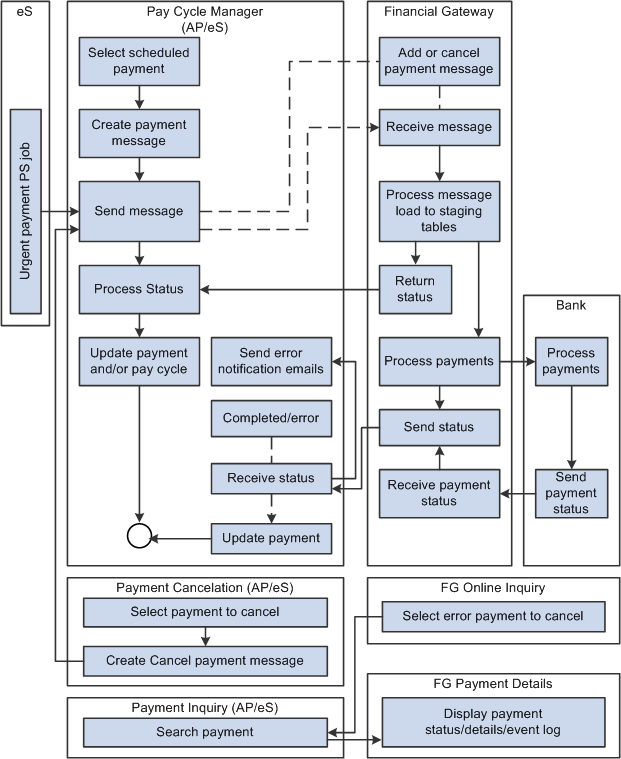

Pay Cycle Processing Through PeopleSoft Financial Gateway

You can submit approved payments electronically through the PeopleSoft Financial Gateway, using Pay Cycle Manager. The PeopleSoft Financial Gateway can be considered a web service agent or service oriented architecture (SOA). It provides certain PeopleSoft financial applications with payment processing capabilities, such as formatting payments, message acknowledgement, security features, and direct communication to financial institutions.

The Pay Cycle Manager settles only payments of EFT, ACH, and WIR payment methods through PeopleSoft Financial Gateway.

For wires, how you settle wires causes different results. When the system settles wires through Pay Cycle Manager, it results in the Pay Cycle process producing just an advice. If the system settles wires through PeopleSoft Financial Gateway, the system uses the defined form ID and layout for the electronic settlement. In addition, the system changes the wire label from wire report to wire because it is no longer simply producing a hard-copy report.

Note: You control whether an approved payment is processed through the PeopleSoft Financial Gateway by selecting a check box on the External Accounts - Payment Methods page. If you do not want a payment settled through PeopleSoft Financial Gateway, you should deselect this check box prior to scheduling payments on the voucher.

Certain PeopleSoft Payables processes help create the PeopleSoft Financial Gateway specific payments:

During the Pay Cycle payment selection and creation processes, the system flags all payments marked for Financial Gateway settlement. This process also:

Groups payments based on certain criteria, which includes layout code and settle through field information.

Validates that the correct payment layout code is used if the bank replacement functionality is used.

During the Voucher Build Application Engine process (AP_VCHRBLD), the system validates the correct layout code.

If the layout code is undefined on the Supplier Pay table (VENDOR_PAY), the process retrieves the default value from the Bank Payment Layout table (BANK_PYMNT_LYT).

If the layout code is defined on the Supplier Pay table, the process validates this value against values stored in the Bank Payment Layout table and ensures that the layout can be settled by PeopleSoft Financial Gateway.

After payment selection and creation, the system inserts these Financial Gateway specific payments into a new pay cycle process row in the pay cycle result grid (PYCYCL_STATRPT) in Pay Cycle Manager. Clicking the Process button causes the system to:

Invoke the Payables Financial Gateway Application Engine process (AP_FG_PROC), which creates payment messages. Payment messages hold both the general settlement information (such as bank, routing, supplier bank, and payment advice information) and payment information. In addition to exchanging messages with the PeopleSoft Financial Gateway, the Payables Financial Gateway process and the AP Payment online Application Class handle various background processing tasks for payments; for example, they populate temporary and staging tables with payment data and update payment statuses.

Assign a unique Financial Gateway payment ID number.

Based on the number defined in maximum transactions per message in the Financial Gateway Installation table (INSTALLATION_FG), the system limits the number of payments held in each payment message. Exceeding this limit triggers the creation of the next payment ID.

You set the payment ID on the Source Registration page in the PeopleSoft Financial Gateway functionality. The batch name is an identification number to represent all the payments for a pay cycle, consisting of a concatenated string of the pay cycle ID number and the pay cycle sequence number.

Load payments to PeopleSoft Financial Gateway tables for further processing and transmittal to the bank after PeopleSoft Financial Gateway receives the payment message from PeopleSoft Payables.

Send acknowledgement messages to PeopleSoft Payables indicating whether the payment dispatch process is successful.

If successful, PeopleSoft Payables updates the payments' status to Loaded. When requested by the PeopleSoft Financial Gateway, the status is then updated.

If unsuccessful, PeopleSoft Financial Gateway sends error messages to PeopleSoft Payables. PeopleSoft Payables consolidates the messages before sending error notification to the user through email (you enable the error notification function by entering a user ID on the Payment Selection Criteria page).

Schedule and transmit the payments to the bank, sending asynchronous acknowledgement messages back to PeopleSoft Payables containing payment information. PeopleSoft Payables uses this information to update the payments' status to Paid, Error, or other statuses. During this part of the process, the Financial Gateway payment information appears on various PeopleSoft Financial Gateway and PeopleSoft Payables inquiry pages.

This diagram shows the integrations between PeopleSoft Payables and PeopleSoft Financial Gateway.

Note: If the Financial Gateway Application Engine process ends abnormally during processing, you can restart the process using the Process Monitor in the Process Scheduler. The process begins again from where it ended.

When the payment processing is complete, you can use the following pages to review information:

PeopleSoft Payables pages:

Pay Cycle Details (PYCYCL_DATA_INQ).

Pay Cycle Approval (PYCYCL_APPROVAL).

Payment Inquiry (PYMNT_INQ_SRCH).

PeopleSoft Financial Gateway pages:

Review Payments (PMT_INQUIRY).

Review Payment Details (PMT_LIFE_CYCLE_INQ).

Review Payment Files (PMT_FILE_DEFN).

Review Acknowledgement Files (PMT_FILE_ACK_DEFN).

Payment Cancellation

You can cancel payments that display a settlement status of Loaded, Hold, or Error. Canceling a Financial Gateway payment triggers the following system actions:

The system sends a cancel message to PeopleSoft Financial Gateway.

When you use the Mass Payment Cancellation component (AP_PMT_MASS_CNL) to cancel multiple payments, the system sends multiple cancel payments in a message to PeopleSoft Financial Gateway.

PeopleSoft Financial Gateway receives the message, and manages the cancel request depending on the settlement status.

Loaded: Payments with a loaded status may be on the staging table and pending transmission to the bank, or they may be in active transmission to the bank.

If the payment is still pending transmission, PeopleSoft Financial Gateway removes the payment from the staging tables and sends an acknowledgement message back to PeopleSoft Payables. PeopleSoft Payables then updates the payment's status to Canceled.

If the payment is in active transmission, PeopleSoft Financial Gateway prohibits the cancellation and sends an error message to PeopleSoft Payables. For these situations, you must wait for PeopleSoft Payables to display a payment status of Paid, and then cancel the payment.

Hold: For held payments, PeopleSoft Financial Gateway removes the payment from the staging tables and sends an acknowledgement message to PeopleSoft Payables. PeopleSoft Payables then updates the payment's status to Canceled.

Error: PeopleSoft Financial Gateway holds payments on the staging tables due to errors encountered during PeopleSoft Financial Gateway or bank processing. To cancel payments in error, PeopleSoft Financial Gateway updates the staging and update error tables and sends an acknowledgement message to PeopleSoft Payables. PeopleSoft Payables then updates the payment's status to Canceled.

When you cancel multiple payments, use the Mass Cancellation Job page to view errors encountered through the PeopleSoft Financial Gateway.

In some cases, payment statuses may be out of synchronicity between PeopleSoft Payables and PeopleSoft Financial Gateway. When a payment has a Canceled status in PeopleSoft Payables, no messages are transmitted between PeopleSoft Payables and PeopleSoft Financial Gateway. "Out of sync" payment statuses generally occur when users reverse and save a canceled payment. At Save, the system displays a warning message stating that saving the reverse canceled payment may disrupt the synchronization between the two systems.

Payments in Error

During processing through the PeopleSoft Financial Gateway functionality, the system marks payments that have processing errors, and sends individual or batch messages to PeopleSoft Payables that the payments cannot be settled. The system then sends payment error notification emails to specified user IDs if you define the required notification parameters, such as user's email address in user preference and user ID in the payment selection criteria. This payment error notification email contains payment error summary information and a link to the Pay Cycle Error page for error correction.

As error payments can be related to different pay cycles, the system first determines if the payment requires email notification, then bundles those errors requiring notification together into a single email.

See Setting Up the PeopleSoft Financial Gateway Integration.

Field or Control |

Description |

|---|---|

Pay Cycle |

Displays the ID and description of the pay cycle that is being processed. |

Remit Supplier |

Displays the remit supplier number. |

Total |

Displays the total dollar amount of the selected payments. |

Voucher |

Displays the voucher ID. |

Sched Pymnts (scheduled payments) |

Displays the total number of scheduled payments. |

Seq Number (sequence number) |

Displays the pay cycle sequence number. Each time you process a pay cycle, it is assigned the next sequence number. |

Status |

Displays the status of the pay cycle. |