Creating Credit Card Payments Using Item Inquiries

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AR_CRCARD_DETAILS |

View or modify the customer's credit card details, and authorize and settle a credit card transaction. |

You can create credit card payments on any of the following PeopleSoft Receivables inquiry pages:

Account Overview - Balances page

Item List page

View/Update Item Details - Detail 1 page

Use any of these inquiry pages to access the Credit Card Details page. The system obtains the value in the Deposit Unit field on the Credit Card Details page from the business unit specified in the inquiry search criteria. If no business unit is entered, then the system obtains the value from the Define User Preferences - Overall Preferences page.

The system automatically builds a credit card worksheet that contains any items you selected on the inquiry page. The items you select are stored in the Payment ID Item table (PS_PAYMENT_ID_ITEM) so that the system correctly selects or creates the credit card worksheet.

When you choose to pay for items by credit card on the Account Overview - Balances page or the Item List page, the system populates the Customer ID and Business Unit fields in the Customer Reference region of the Credit Card Worksheet Selection page from the information you entered on the inquiry page. If you do not specify a customer on the Item List page, the system prompts you to enter bill-to customer information.

When you choose to pay for an item by credit card from the View/Update Item Details page, the system uses the customer ID on the selected item as the bill-to customer for the credit card worksheet. The currency of the item is the credit card currency.

Use the Credit Card Workbench to review credit card transaction history for a customer.

Use the Credit Card Details page (AR_CRCARD_DETAILS) to view or modify the customer's credit card details, and authorize and settle a credit card transaction.

Navigation:

Select Accounts Receivable, and click the Pay Balance by Credit Card link on the Account Overview - Balances page.

Select Pay by Credit Card in the Item Action field on the Item List page and click the Go button.

Click the Pay By Credit Card link on the View/Update Item Details - Detail 1 page.

, and then click the Credit Card Details link.

, and then click the Credit Card Details link.

, and then click the Pay by Credit Card link.

, and then click the Credit Card Details icon in the Credit Card Payment List grid.

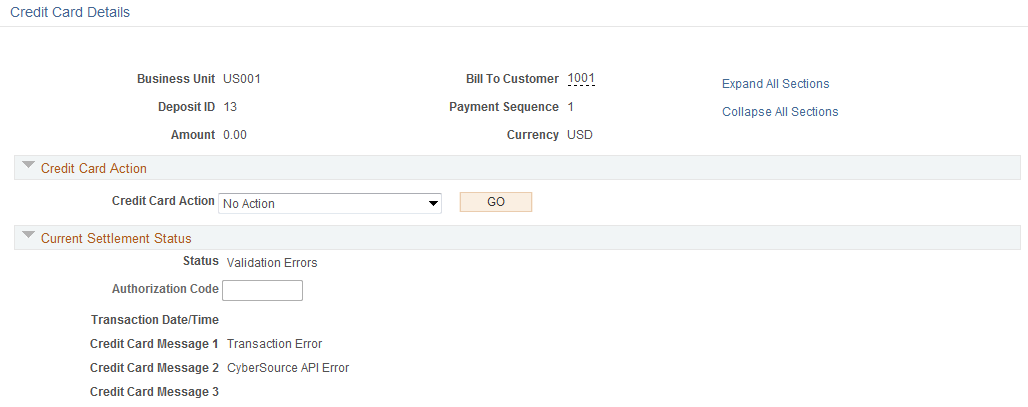

This example illustrates the fields and controls on the Credit Card Details page (1 of 3).

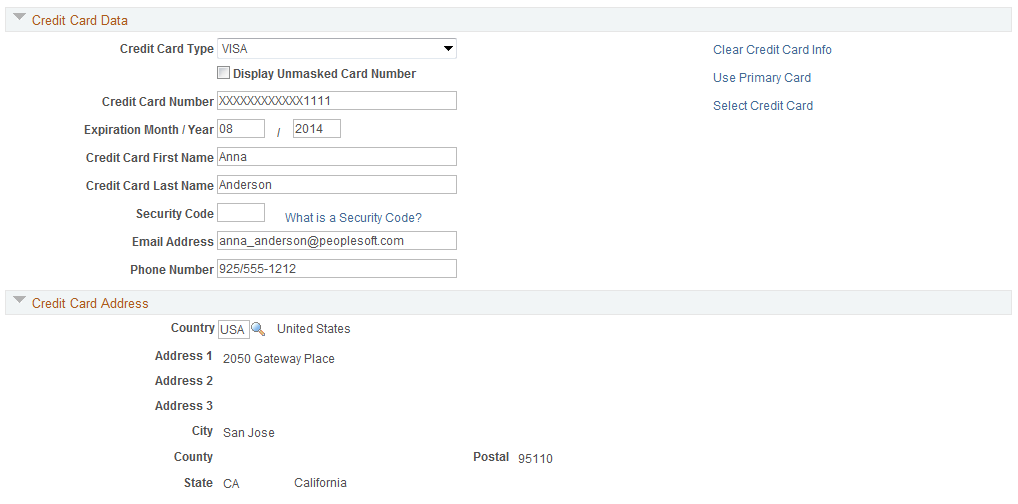

This example illustrates the fields and controls on the Credit Card Details page (2 of 3).

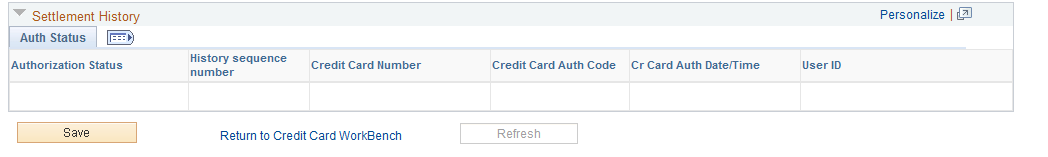

This example illustrates the fields and controls on the Credit Card Details page (3 of 3).

You can maintain credit card information on the Credit Card Details page. From this page, you can settle the payment immediately or settle the payment in a batch process.

For the credit card data to be authorized and settled, you must enter data in all the fields required by the third-party authorizing authority.

If you access this page from a PeopleSoft Receivables inquiry page, the system displays a warning at the top of the page. If you want to leave the Credit Card Detail page without saving or processing the credit card transaction, you must click the indicated link to cancel the transaction. Leaving the page using another method, such as clicking the back button on your browser, creates a credit card worksheet based on the items you selected on the inquiry page.

Credit Card Action

Field or Control |

Description |

|---|---|

Credit Card Action |

Select the settlement action for this credit card transaction. The values are: No Action: The system does not perform any settlement action on this transaction. Authorize and Settle Now:The system obtains an approval for the credit card transaction from the third-party authorizing authority and charges the amount of this transaction to the specified credit card. Authorize and Settle Later: The system processes the credit card transaction the next time the Credit Card Processor multiprocess job (ARCRCARD) is run. Manually Approved/Settled: The credit card payment was processed outside of the PeopleSoft system. Optionally, you can enter the authorization code. This option is called a Manual Charge in PeopleSoft Billing. Cancel Settlement Request: The settlement request is canceled. The history is retained for this transaction, but the status of the transaction is set to No Action. |

Current Settlement Status

The system populates all but the Authorization Codefield in this region.

This information is also written to the Credit Card History table.

Field or Control |

Description |

|---|---|

Status |

Displays the current status of the authorization and settlement request. |

Authorization Code |

Displays the authorization code for the transaction. You can enter an authorization code if the value in the Credit Card Action field is Manually Approved and Settled. If the transaction was settled through a third-party authorizing authority, the system populates the Authorization Code field. |

Transaction Date/Time |

Displays the date and time of a transaction request. |

Credit Card Message 1, Credit Card Message 2, and Credit Card Message 3 |

Displays processing messages. A message with a prefix of ICS indicates that the message is from a third-party authorizing authority. |

Credit Card Data

In this region, enter credit card information to pay for outstanding items. You must enter data in all the fields required by a third-party authorizing authority for the credit card data to be authorized and settled. The system retrieves default values for all credit card information from the primary credit card that is defined on the Contact Addl Info (contact additional information) page for the customer's primary contact. If the system does not find default credit card information, you must supply values for the required fields.

Field or Control |

Description |

|---|---|

Credit Card Type |

Select the type of credit card. These values must first be set up on the Credit Card Type page. |

Credit Card Number |

Enter the credit card number. The system performs a number of validations that are specified by the parameters you set up on the Credit Card Type page. If you enter a value that does not match the parameters set up for the card type on the Credit Card Type page, an error message appears. |

No Mask |

Select this check box to display the complete credit card number without any mask. Values are:

Important! The No Mask check box is only accessible to users with the role of SUPERVISOR. |

Email ID and Telephone |

Enter the e-mail address and telephone number for the person named on the credit card. |

Clear Credit Card Data |

Click to clear the credit card information on the page. |

Credit Card Address

Enter address information for the transaction.

Settlement History

Use this region to review the credit card payment history.

Field or Control |

Description |

|---|---|

Auth Status (authorization status) |

Displays the authorization status of the authorization and settlement attempt. |

History Sequence Number |

Displays a unique sequence number for all historical transactions. |

Credit Card Auth Code (credit card authorization code) |

Displays the approval code that the third-party authorizing authority assigned to the transaction. |

Cr Card Auth Date/Time (credit card authorization date and time) |

Displays the date and time that the transaction was attempted. |

User ID |

Displays the user ID that was used to submit the transaction. |