Setting Up Credit Card Profiles

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AR_CRCARD_PRFL |

Create credit card profiles. |

To set up credit card profiles, use the Credit Card Profile component (AR_CRCARD_PROFILE).

Credit card profiles enable you to control the selection of open items for credit card processing and the processing of credit card worksheets that have been created. The Credit Card Scheduler process (ARCRCARD) uses credit card profiles to control the batch creation of credit card worksheets. When you create credit card worksheets online, the system does not use any of created profiles. Credit card profiles enable you to set limits on the amount of each credit card payment within worksheets that are created in batch. You can also determine the actions that the system takes to manage low values.

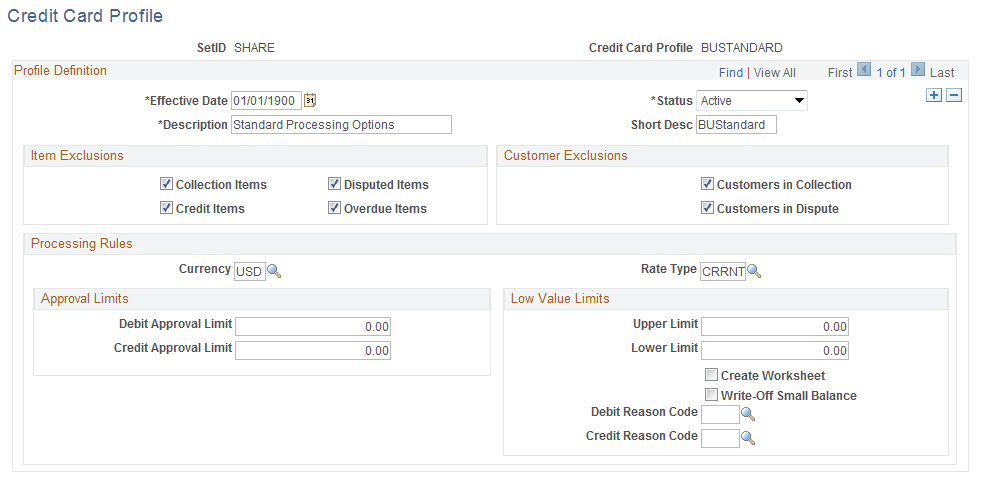

Use the Credit Card Profile page (AR_CRCARD_PRFL) to create credit card profiles, select item and customer exclusions, and define processing rules.

Navigation:

This example illustrates the fields and controls on the Credit Card Profile page. You can find definitions for the fields and controls later on this page.

Item Exclusions

Use the check boxes in the Item Exclusions group box to prevent the Credit Card Scheduler process (ARCRCARD) from selecting certain types of items when it creates credit card payments and builds the worksheet.

Customer Exclusions

Use the check boxes in the Customer Exclusions group box to prevent the credit card process from selecting items for customers who are in collection or dispute.

Approval Limits

The values that you enter in the Approval Limits group box determine whether the credit card process automatically approves a credit card payment. If the worksheet amount is within the approval limits, then the system approves the payment. An approved credit card payment is available for authorization and settlement with a third-party credit-card transaction provider. If the worksheet amount is outside the specified limits, the system creates the credit card worksheet, but marks the worksheet as an exception to show that it needs manual review. You can find the exceptions using the Credit Card Workbench. So approval really means that the process attempts to settle the transaction. Failure to approve means that the credit card payment requires manual intervention.

Field or Control |

Description |

|---|---|

Debit Approval Limit |

Enter the maximum amount that a credit card debit can be for the Credit Card Scheduler process to approve it. |

Credit Approval Limits |

Enter the maximum amount that a credit card credit can be for the Credit Card Scheduler process to approve it. |

Low Value Limits

Enter the values for the range of credit-card payment amounts that are too low to warrant processing the amount by credit card that is due because the administrative cost of collecting the money is more than the amount to be collected.

Field or Control |

Description |

|---|---|

Upper Limit and Lower Limit |

Enter a value other than 0 to enable low value processing. Otherwise, the low value processing rules are not applied. |

Create Worksheet |

Select to create an unapproved credit card worksheet when the credit card payment is within the specified low value limits. This enables you to decide whether you should authorize and settle this amount, manually modify the worksheet, or delete the worksheet. |

Write Off Small Balance |

Select to write off a small balance. The Create Worksheet check box must be selected to enable this option. The system creates a credit card worksheet for the low balance with either a write-off an overpayment (WS-10) line or a write-off an underpayment (WS-11) line on the worksheet and sets the worksheet to post. This marks the selected open items as paid, and the remaining item amount is written off. You must specify the Debit Reason Code and the Credit Reason Code for this option. |