Setting Up Risk Scoring Rules

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AR_RISKSCR_TBL |

Define risk scoring rules. |

|

|

AR_RISK_SEC |

Enter risk scoring range values. |

You can set up one or more risk scoring rules for selected setid, customer, or customer group. These risk score rules are used by the Risk Scoring program (RUN_AR_RISK) to compute a risk score for a customer. The range value is used in conjunction with the risk scoring weight to compute the risk score. The system computes the Range Value * Risk Scoring Weight = Risk Score.

You can define a risk score rule using one or more risk scoring elements selected from a risk scoring group. You assign a risk scoring weight, a low and high range, and range value for each risk scoring element. The high and low ranges are determined by the type of scoring element you select, which can be Amount, Char (character), percent, days, date or numeric.

For example, when the risk scoring element is BALDUE and the type is Amount, you can enter the low and high range values and the range value on the Risk Range Details grid of the Risk Range Details page. For example, if the risk scoring element is BALDUE, the type is Amount, and the length is 23, you could enter these multiple rows of values:

|

Range Low |

Range High |

Range Value |

|---|---|---|

|

1 |

1,999 |

10 |

|

2.000 |

2,999 |

20 |

|

3.000 |

3,999 |

30 |

|

4.000 |

9,999,999,999.99 |

40 |

When the risk scoring element is CRHOLD and the type is Char and has a yes/no value (such as: Is the customer on credit hold?) the system automatically populates the Risk Range Details grid with Y for Range High and Range Low values in one row and N for Range High and Range Low values in the next row. You can enter the range value. For example if CRHOLD is the risk scoring element:

|

Range Low (system generated) |

Range High (system generated) |

Range Value |

|---|---|---|

|

Y |

Y |

5 |

|

N |

N |

10 |

When the risk scoring element is CUSTOMER_TYPE, the type is Char, and CUSTOMER_TYPE does not have a yes/no value, then you could enter these values:

|

Range Low |

Range High |

Range Value |

|---|---|---|

|

A |

L |

10 |

|

M |

Z |

20 |

You can set up multiple risk rules for a customer or customer group. However, the Risk Scoring Application Engine program only applies one rule per customer or customer group per run.

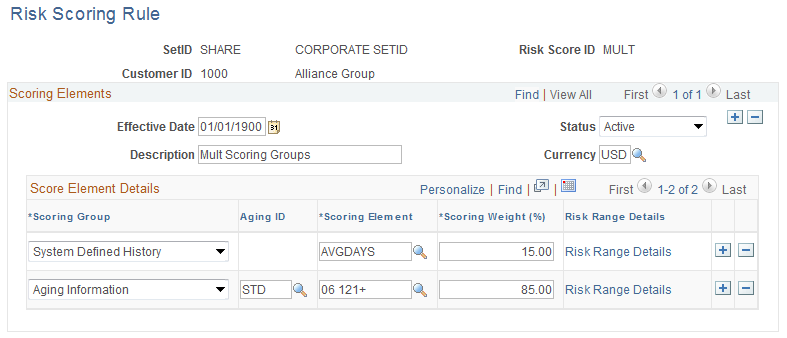

Use the Risk Scoring Rule page (AR_RISKSCR_TBL) to define risk scoring rules.

Navigation:

This example illustrates the fields and controls on the Risk Scoring Rules page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

Select the date that this risk score element will become effective. You can add risk scoring elements, as well as assign a new effective date if you modify an existing risk scoring element. |

Currency |

Enter an anchor currency to apply to this risk score ID. Note: This field is required when you select a Scoring Element that is amount-based, such as SALES. |

Scoring Group |

Select one of these values:

|

Aging ID |

Select an aging ID value, which is used to populate the scoring element with the correct aging categories. Note: This field only appears when you select Aging as the Scoring Group. |

Amount |

Enter a threshold amount in order to select the oldest item greater than this amount. Note: This field only appears when you select Item Information as the Scoring Group and DTOLDIT (data of the oldest item) as the Scoring Element. |

Scoring Element |

Select the scoring element that you want to apply to the selected scoring group. This value describes the type of scoring data used to make up a scoring rule based on the Scoring Group you select. For example, you can select Customer Activity as the Scoring Group and BALDUE as the Scoring Element, or System Defined History as the Scoring Group and DSO30 as the Scoring Element. |

Scoring Weight (%) scoring weight (percentage) |

Enter the percentage of weight that you want to apply to this scoring element which is multiplied by the Range Value that you enter on the Risk Range Details page to obtain a Risk Score for that element row. When the Risk Scoring program runs, it sums up the individual element scores for the overall customer score and updates the PS_CUST_CREDIT table with the customer risk score. Default value is 100.00 percent. Important! The total scoring weight percentages for all of the scoring elements must equal 100.00 percent. |

Risk Range Details |

Click this link to access the Risk Range Details page. |

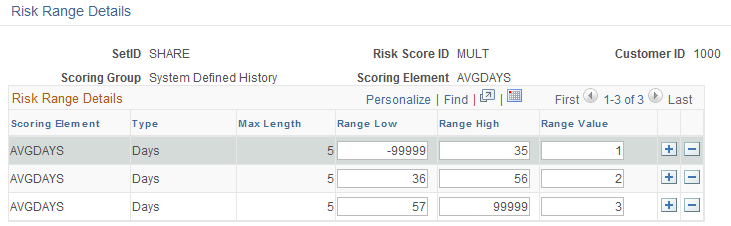

Use the Risk Range Details page (AR_RISK_SEC) to enter risk scoring range values.

Navigation:

Click the Risk Range Details link on the Risk Scoring Rule page.

This example illustrates the fields and controls on the Risk Range Details page. You can find definitions for the fields and controls later on this page.

This page displays the risk range details for each scoring group and scoring element.

Field or Control |

Description |

|---|---|

Type |

Indicates the type of field that appears based on the selected scoring element on the Risk Scoring Rule page, such as Char, Amount, percent, days, date or numeric. |

Max Length (maximum length) |

Displays the maximum length of the data the user can enter in the range low and range high value columns. The length along with the type is displayed to aid users in entering the range values. If the type is days and the length is 5 you can enter whole number range values up to 5 positions in length such as .99999, 40000, and more. |

Range Low and Range Highand Range Value |

These fields depend on your selection of the type of scoring element, as well as Scoring Group and Scoring Element values on the Risk Scoring Rule page. For example, if you select the scoring group (Customer Activity) and the scoring element (BALDUE), which is based on an amount, then you enter a low range (-99,999) and high range (5,000). If you select a Scoring Element value on the Risk Scoring Rule page that has a Yes/No value, such as CRHOLD (the customer on credit hold), then these Range Low and Range High fields are automatically populated with a row for Yes (Y) and a row for No (N). Range Value: Enter a value for each range between 1 and 100. |