Setting Up the Treasury Report on Receivables

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Installation Options - Receivables Page |

INSTALLATION_AR |

Enable the fields and buttons that are associated with the Treasury Report on Receivables (TROR) to appear on business unit, pending item entry, and item maintenance pages. See the Installation Options - Receivables Page for more information. |

|

AR_ADD_TEMPLATE |

Define a new TROR report template name and version. |

|

|

AR_UPDATE_TEMPLATE |

Search for an existing template and set up the characteristics of each system-defined line, which is associated with a system-defined part and section. |

|

|

ENTITY_TBL |

Define report entity codes for the government agencies or divisions to which the TROR is submitted. |

|

|

REC_TYPE_TBL |

Define codes that represent the loan types. |

|

|

DELINQ_TBL |

Define delinquency codes. |

To set up the Treasury Report on Receivables (TROR), use the Reporting Entity Code (ENTITY_GRP), Receivable Type (REC_TYPE_GRP), and the Delinquency Code (DELINQ_GRP) components.

The Treasury Report on Receivables (TROR) serves as a management report that informs federal decision makers of the gross book value of the non-tax receivables owed by the public to federal agencies and the status of the federal government’s debt portfolio.

This overview discusses the setup needed to generate the TROR:

TROR templates.

Entity codes and receivables types.

Entry types.

Delinquency codes.

Customer types.

TROR Templates

The TROR Template provides you with the flexibility to set up one or more effective-dated report templates.

Use the TROR template to select data that you want to appear on the TROR report. The template enables the inclusion and exclusion of receivables based on the setup. This means that item entry use IDs can be included or excluded from certain lines in the report, as well as item delinquency codes.

The report version system data controls the output and template structure. Lines cannot be added to or deleted from a template by the end user. The end user can set up a new template for a report using the system-defined version of the report. The system-defined version of the report cannot be modified. This ensures that the generated report is current and complies with the output specifications of the U.S. Treasury.

The TROR template consists of these categories.

Report Template

The report template is created by the end user to select and report on receivables within their system.

Report Part

The number of Report Parts in the template is defined in the report version control record. Report parts cannot be added to or deleted from a template. This ensures that the report output is consistent with the U.S. Treasury's version of the report.

Report Section

The number of Report Sections in the template is defined in the report version control record. Report sections cannot be added to or deleted from a template. This ensures the report output is consistent with the U.S. Treasury's version of the report.

Report Line

The number of Report Lines in the template is defined in the report version control record. Report lines cannot be added to or deleted from a template. This ensures the report output is consistent with the U.S. Treasury's version of the report.

The lines in the report display as one line or many sub-lines. The report template component will treat each line line/sub line combination as one line. Each line has its own select statement where you define the receivable select criteria as well as delinquency code selection criteria.

Because the TROR uses setup data defined specific to your implementation of Receivables, the process of establishing a new template with selection and exclusion criteria can be an involved process. To expedite the setup process, a sample template is delivered as demo data. The sample template can be copied and used as a starting point to create a template for your implementation.

Entity Codes and Receivable Types

When you enter pending items, you assign reporting entity codes and receivable types. The entity codes and receivable types are used to identify the items for which you are including data in the report.

You set up reporting entity codes to represent the government agencies and divisions for which the Treasury Report on Receivables is submitted.

Setting up an entity code enables you to set up report behavior and map Receivable business units to the entity code. You select a TROR reporting template for an entity code. When you run the report, this template is applied based on the SetID and entity code that you select on the Preparer run control page. You select the receivable types that can be applied to a report, and select only one of these receivable type options to apply to the specific report you are running.

You select business units for the entity code. When you select a SetID on the Preparer run control page, it determines which entity codes are available for selection, which in turn determines the business units and associated data that are selected to the Treasury Report on Receivables that you generate. There is an edit on the Reporting Entity Code page that verifies that the business units you select on the Reporting Entity Code page have the same SetID as the SetID the entity code that you are setting up.

Entry Types

Many of the lines in the report include only amounts for items with specific entry types. To populate these lines, you must set up entry types for the codes in the following table and create an automatic entry type for each entry type:

|

Entry Type Code |

Description |

|---|---|

|

ADMIN |

Administrative Charge |

|

FC |

Finance Charge |

|

OC |

Overdue Charge |

|

PY |

Payment |

|

WO |

Write-off |

|

TAXES |

Tax Receipts |

|

AD |

Adjust Write-off |

|

ADR |

Adjustments Reclassified |

|

ADS |

Adjustments to Sale of Assets |

|

ADC |

Adjustments - Consolidations |

|

RD |

Rescheduled Debt |

Delinquency Codes

You assign delinquency codes to items on the Item Delinquency page. The system uses these codes to determine which items' amounts to include in various lines of the report. You must set up the delinquency codes in the following table for the report and the codes in the report must exactly match the codes in this list to update the various line amounts correctly:

|

Delinquency Code |

Description |

|---|---|

|

AGN |

By Agency |

|

OTP |

Other Third Party |

|

AST |

Asset Sales |

|

PCA |

Private Collection Agency |

|

TOP |

At Treasury for Offset |

|

WGR |

Wage Garnishment |

|

CLO |

Closed Out |

|

NA |

Non-Delinquent |

|

BKR |

In Bankruptcy |

|

FRB |

Forbearance/Formal Appeals |

|

FRC |

In Foreclosure |

|

LIT |

In Litigation |

|

IOS |

Eligible for Internal Offset |

|

TXS |

At Treasury Cross Servicing |

|

OF% |

Exempt from Treasury Referral |

|

DET |

Debt Exempted by Treasury |

|

DC% |

Debt Collection |

Customer Types

The report also includes item amounts for only specific customer types in various lines on the report. You assign the customer type to the customer on the General Info page for the customer. Also, the report includes item amounts for customers in various lines only if you selected the Federal Customer check box on the General Info page.

The system-delivered translate values for the Customer Type field (CUSTOMER_TYPE) are 1, 2, 3, and 4. For the report to update the report lines correctly, you must change these translate values to the following values:

F: Foreign

M: Commercial

N: Consumer

S: State Local

X: Excluded Foreign Customers

Note: You can also set up user-defined customer types.

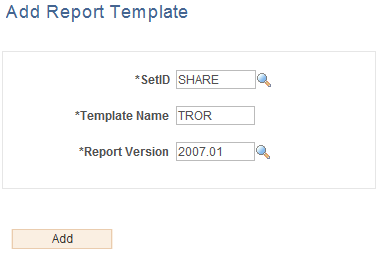

Use the Add Report Template page (AR_ADD_TEMPLATE) to define a new TROR report template name and version.

Navigation:

This example illustrates the fields and controls on the Add Report Template page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

SetID |

Select the SetID that applies to your organization. |

Template Name |

Assign an identifiable name for this TROR template. |

Report Version |

Select the version of this report. This number represents the most current report version and is derived from the version control record (AR_RPT_VERSION), which is delivered as system data. |

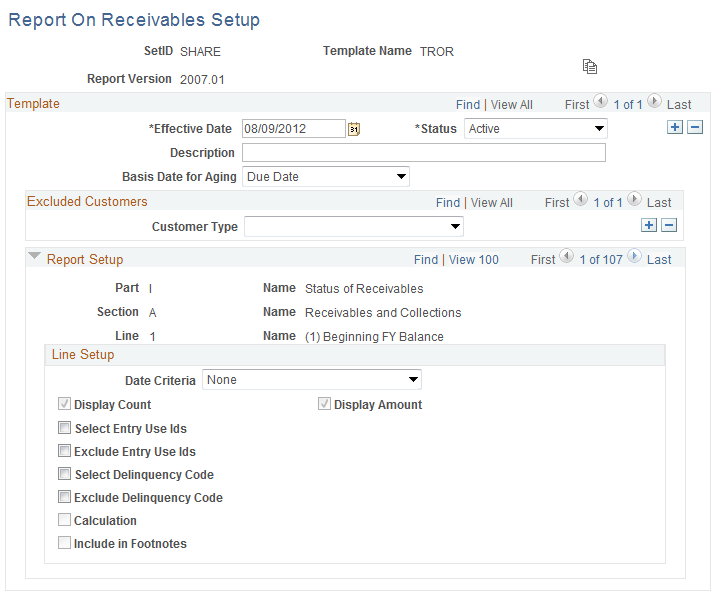

Use the Report On Receivables Setup page (AR_UPDATE_TEMPLATE) to search for an existing template and set up the characteristics of each system-defined line, which is associated with a system-defined part and section.

Navigation:

This example illustrates the fields and controls on the Report on Receivables Setup page. You can find definitions for the fields and controls later on this page.

Click the Copy Template icon to display the Report on Receivables Template Copy page. You can select a new SetID and enter a new template name on this page. The version is display only and is controlled by the system defined version control table. For example, user can create a new template using sample template TRORV1 under SetID SHARE, report version 2007.01, if wish to reuse the set up data for the sample template.

Once the new template has been copied, you can return to the Update Report Template search page and search for the new template that you just created. You can modify the characteristics of this template as needed.

Field or Control |

Description |

|---|---|

Effective Date |

Select the date from which this report template setup is applicable. |

Status |

Select whether the data on this report template is an Active or Inactive. Note: You can modify the information on this template as of a selected effective date by clicking the Add (+) icon, changing the effective data and making that date active. |

Description |

Enter a description of this template. |

Basis Date for Aging |

Select either the Due Date, which is the due date assigned to an item, or the As of Date of an item. |

Customer Type |

Select a specific type of customer to exclude from this report or you can leave the field blank to include all customer types in the report. Customer types are defined based on your implementation setup. If you want to exclude more than one customer type, you can click the Add (+) icon to the right of the Customer Type field and select another customer type to exclude from the report. You can continue to add the customer types that you want to exclude using the Add (+) icon. |

Report Setup |

Expand the section to display the Report Setup and Line Setup group boxes. The Report Setup group box consists of a consecutive series of Parts, Sections, and Lines along with their descriptions. When you click View All on the right side of the Report Setup header row, you can display all of the Report Setup and Line Setup for each part, section, and line of the report. Name indicates the name of the part, section, and line that will be printed on the report. |

Line Setup |

Select from these options (some of which are active or inactive due to your selection) to define the Line Setup:

|

For example, to define the line setup for:

Part I Name: Status of Receivables

Section A Name: Receivables and Collections

Line 4A Name: (A) At Agency (-)

You can select from these options:

Date Criteria

Same choices as Line 4.

Display Count check box

Display Amount check box

Select Entry Use IDs check box selected

System Function ID – WS-01 –

Description – Pay an Item

Entry Type –PY – A payment would be considered a collection.

Entry Reason - The entry reason can be left blank which allows all payments to be selected.

Exclude Entry Use ID check box will be unavailable since the option to select entry use IDs is already selected.

Select the Delinquency Code check box.

Delinquency Code – AGN (At Agency) will select receivables that have a delinquency code of AGN.

Exclude Delinquency Code check box not be enabled since the option to select Agency Codes is enabled.

Calculation check box will not be enabled based on report version control data.

Include in Footnotes check box not be enabled based on report version control data.

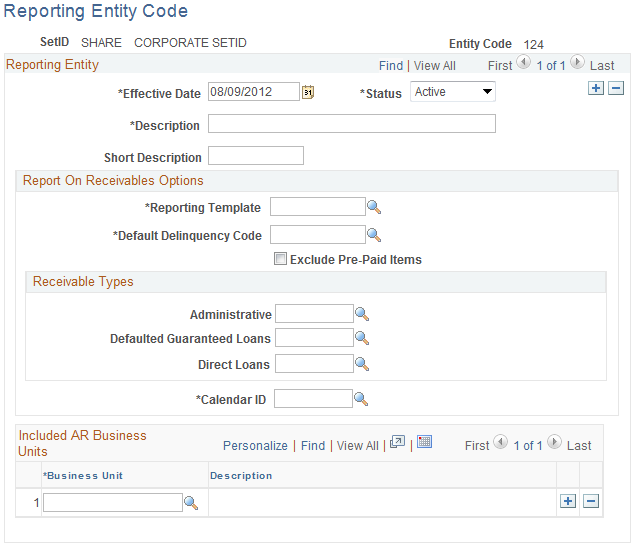

Use the Reporting Entity Code page (ENTITY_TBL) to define report entity codes for the government agencies or divisions to which the TROR is submitted.

The entity code component includes TROR reporting options. These reporting options enable users to set up and report behavior and map Receivable business units to the entity code.

Navigation:

This example illustrates the fields and controls on the Reporting Entity Code page. You can find definitions for the fields and controls later on this page.

The report entity code is unique for each reporting entity. The first two digits identify the agency, the next two digits identify the bureau, and the remaining digits identify the entity.

Field or Control |

Description |

|---|---|

Entity Code |

Enter the entity code for the reporting entity that you want to define. The first two digits identify the agency, the next two digits identify the bureau, and the remaining digits identify the entity. |

Reporting Template |

Select the TROR reporting template to use when generating the Treasury Report On Receivables based on the selection of this reporting entity code. |

Default Delinquency Code |

Select the delinquency code that you prefer as the default value for new receivables. |

Exclude Prepaid Items |

Select this check box if you want to exclude prepaid items on the Treasury Report on Receivables for this reporting entity code. |

Receivable Types |

Select the Receivable Types that identify a receivable as Administrative, Default Guaranteed Loans, and Direct Loans. The receivable type can be defined as any value in the system and is mapped from this entity code to the receivable type on the TROR. Note: Only one Receivable Type appears on a given report. |

Calendar ID |

Select the calendar that you want to apply to the generation of data for the Treasury Report on Receivables. The calendar ID that you select for the entity code determines the fiscal year and accounting periods that appear on the report. |

Included AR Business Units |

Select any business units that you want to include in the processing of the data for the Treasury Report on Receivables. An error message will display If the calendar ID for the selected business unit does not match the calendar ID selected for this reporting entity code. |

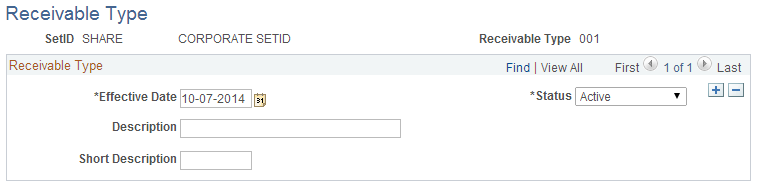

Use the Receivable Type page (REC_TYPE_TBL) to define codes that represent the loan types.

Navigation:

This example illustrates the fields and controls on the Receivable Type page.

The Receivable Type code identifies the loan as a direct loan, defaulted guaranteed loan, or noncredit receivable. This code appears at the top of the Treasury Report on Receivables report to identify the types of items for which amounts are included in the various report lines.

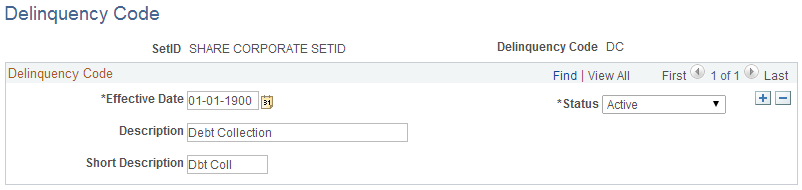

Use the Delinquency Code page (DELINQ_TBL) to define delinquency codes.

Navigation:

This example illustrates the fields and controls on the Delinquency Code page.

Be sure that the code values exactly match those in the list described earlier in this section.