Maintaining Employee Bank Account Data

Information about employee bank accounts tells the system how and where to send expense reimbursements if an employee chooses direct deposit. There must be at least one bank account defined if an employee selects this payment method.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EX_EE_PYMNT_DTL |

View or modify employee bank account information. If you use the Employee Self-Service navigation, you can only view information. If you use the Travel and PeopleSoft Expenses navigation, you can view or modify information. |

|

|

EX_EE_BANK_INT |

Define the intermediary bank routings if funds must pass through several banks before the final bank. |

|

|

EX_EE_BANK_ACCT |

Specify a bank for the deposit of employee expense reimbursement funds. |

|

|

EX_EFT_OPT_SEC |

If the selected payment method for expense reimbursement is EFT, use the Employee EFT Options page to enter additional information for employees who live in certain countries. |

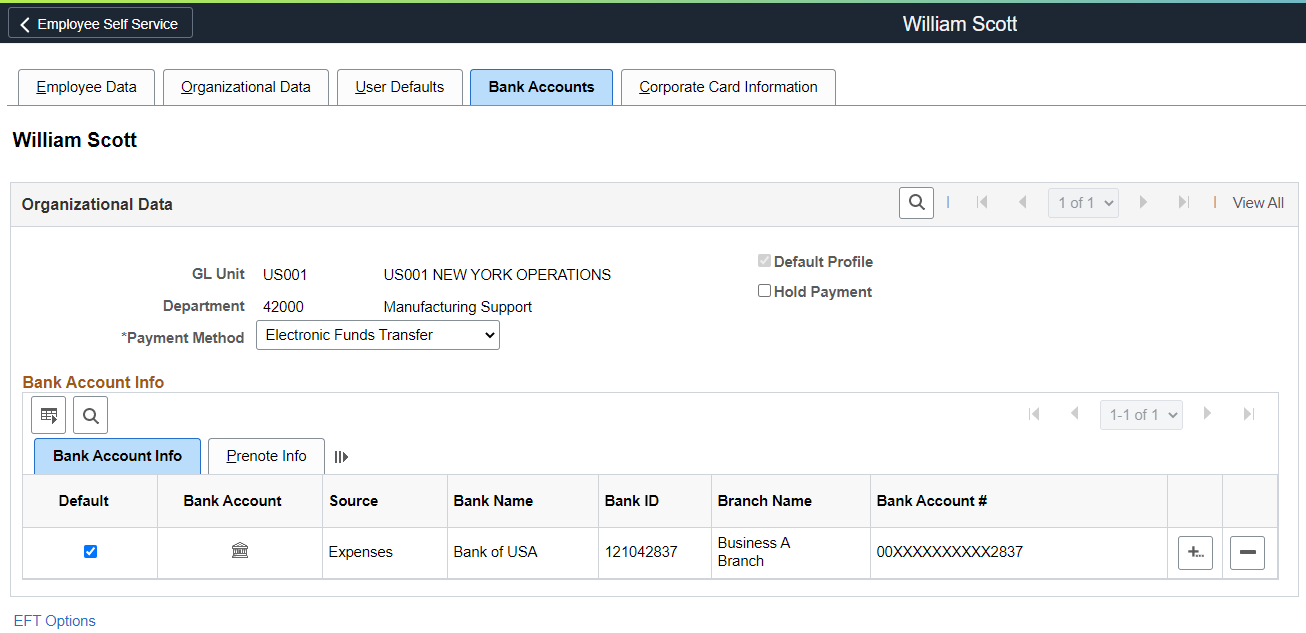

Use the Employee Profile - Bank Accounts page (EX_EE_PYMNT_DTL) to view or modify employee bank account information.

If you use the Employee Self-Service navigation, you can only view information. If you use the Travel and PeopleSoft Expenses navigation, you can view or modify information.

Navigation:

This example illustrates the fields and controls on the Employee Profile - Bank Accounts page.

Organizational Data

Field or Control |

Description |

|---|---|

Default Profile |

When selected, indicates if this profile is the employee's default profile. |

Payment Method |

Select a payment method. Options are:

Note: PeopleSoft Expenses enables the Payment Method field only when you use the Travel and Expenses navigation. |

Hold Payment |

If selected, reimbursement will not occur during a pay cycle until you remove the hold. For example, you can choose to withhold payment until an employee clears outstanding advances. Note: PeopleSoft Expenses enables the Hold Payment field only when you use the Travel and Expenses navigation. |

Bank Account Info (bank account information) Tab

Field or Control |

Description |

|---|---|

Default |

Select to indicate the default bank account for expense reimbursement if more than one bank appears in an employee profile and if the payment method is Automated Clearing House or Electronic Funds. |

|

Click the Bank Account icon to access the Pay to Bank Accounts page, where you can identify a bank for the deposit of expense reimbursement funds. |

Source |

Indicates the source of the bank account information. Options are Expenses or Payroll. |

Bank Name, Bank ID, IBAN, (international bank account number) Branch Name, and Branch ID |

Displays information about the selected bank. |

|

Bank Account # (bank account number) |

Displays the bank account number. If you are using the Bank Account Number Encryption feature, then this value is encrypted and masked. See Understanding Bank Account Encryption. |

Prenote Info (prenote information) Tab

Prenote is a test run performed by an organization to verify payment information, electronic funds transfer (EFT) or automated clearing house (ACH), before sending an actual payment or payment advice. If you select Electronic Funds Transfer as the payment method for an employee, use this tab to change the status of the bank account. ACH prenote is allowed for both expense and cash advance payments. When expenses and cash advance payments are sent to the pay cycle with prenote enabled in PeopleSoft Payables, pay cycle processes the prenote and updates the prenote status in PeopleSoft Expenses.

Field or Control |

Description |

|---|---|

Prenote Status |

Indicates the status of the test:

|

Required |

Select to indicate if a prenote is required. |

Prenotification Date |

Indicates the date that the prenote was sent to the bank. |

Wait Days |

Enter the number of days from the prenotification date to wait before marking the prenote status Confirmed. |

EFT Options |

Click to open the Employee EFT Options page and specify information for employees who live in certain countries. Use only if the payment method for expense reimbursement is Electronic Funds Transfer. |

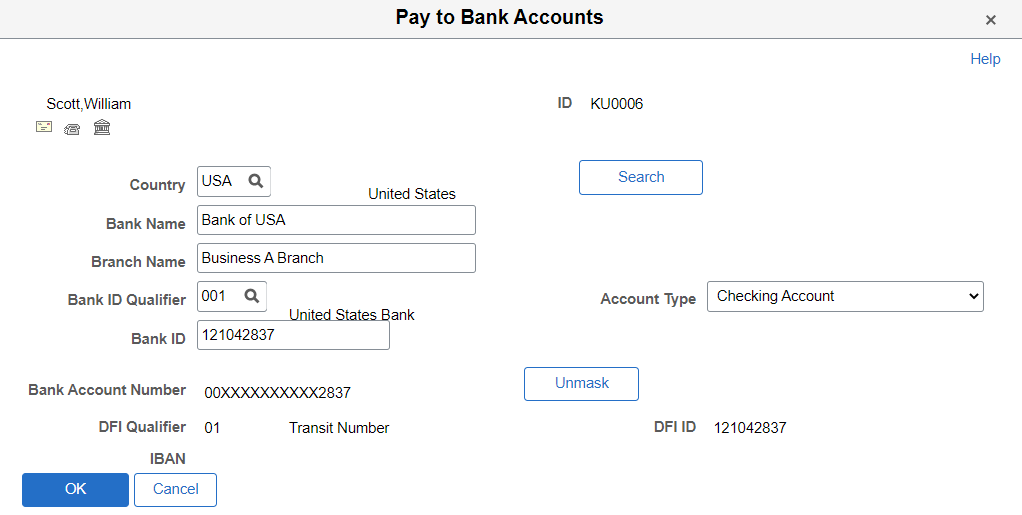

Use the Pay to Bank Accounts page (EX_EE_BANK_ACCT) to specify a bank for the deposit of employee expense reimbursement funds.

Navigation:

. Click the Bank Account icon on the Employee Profile - Bank Accounts page.

. Click the Bank Account icon on the Employee Profile - Bank Accounts page.

This example illustrates the fields and controls on the Pay to Bank Accounts page.

Field or Control |

Description |

|---|---|

|

Click the Go To Address icon to access the Bank Address page. |

|

Click the Phone icon to access the Phone Information page. |

|

Click the Routings icon to access the Intermediary Bank Routing page. |

Country |

Enter the country of the employee's bank. The country code selected dynamically impacts the layout of the Pay to Bank Accounts page IBAN field. |

Bank Name |

Enter the name of the employee's bank. |

Branch Name |

Enter the bank's branch name. |

Bank ID Qualifier |

Determines which edit algorithm to use to check the Bank ID number sequence. |

Account Type |

Indicates the type of account, such as Check Acct (checking account). |

Bank ID |

Enter the routing number of the employee's bank. |

Branch ID |

Enter the bank's branch number. |

Bank Account Number |

Enter the employee's bank account number. If you are using the Bank Account Number Encryption feature and you are viewing this page, then this value is encrypted and masked. See Understanding Bank Account Encryption. |

|

Unmask (button) |

Select to unmask the bank account number and the IBAN number (if entered). This field is visible only when you are using the Bank Account Number Encryption feature. See Setting Up Bank Account Encryption. |

Check Digit |

Enter the two numeral check digit code for the country. |

DFI Qualifier (Depository Financial Institution qualifier) |

Indicates what format (how many characters and numbers) appear in the DFI ID of the bank. Each type has a specific number of characters that you can enter:

|

DFI ID |

If you select a DFI qualifier, then provide an identification that conforms to the banking standards of the DFI qualifier country. |

IBAN or IBAN Digit (international bank account number digit) |

Define the account's IBAN for transmittal with other account information for the bank account. Enter either the IBAN identifier or the two numeral check digit code for the country and click View IBAN. If the system successfully validates check digit, the IBAN for this account displays. Note: The IBAN field displays as either IBAN or IBAN Digit depending on the setting defined on the IBAN Formats page for the country code that is selected. IBAN format options are setup using the Banking menu options. |

BIC (bank identifier code) |

Enter a BIC code for this bank. This code is based on the ISO standard (9362), which is the universal method used to identify the financial institutions that enable automated processing of payments. A BIC code is used to route cross-border and some domestic payments to a bank branch or payments center. SEPA requires the use of BIC and IBAN codes to uniquely identify the creditor's and debtor's banks and bank accounts in all Euro cross-border payments. It is imperative that the IBAN and BIC codes are correct to avoid repair fees that the bank charges due to processing errors, and to avoid delays in processing payments and collections due to the time-consuming correction of these errors. Once you enter a BIC code, the system validates the length and layout of the characters, and validates the BIC country code against the country code set up for the bank branch . |

Use the Intermediary Bank Routings page (EX_EE_BANK_INT) to define the intermediary bank routings if funds must pass through several banks before the final bank.

Navigation:

. Click the Bank Account icon on the Employee Profile - Bank Accounts page. Click the Routings icon on the Pay to Bank Accounts page. (This icon is only accessible through the Travel and Expenses navigation.)

Field or Control |

Description |

|---|---|

Seq (sequence) |

The sequence numbers indicate the relative order in which the funds flow through intermediary banks. |

Field or Control |

Description |

|---|---|

Routing |

Select whether the routing will occur via a bank or DFI ID, and complete the appropriate fields. |

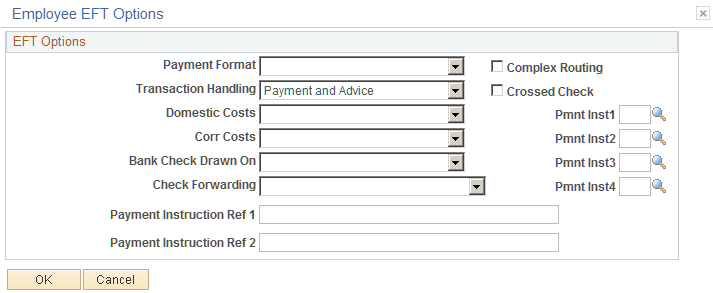

Use the Employee EFT Options page (EX_EFT_OPT_SEC) to if the selected payment method for expense reimbursement is EFT, use the Employee EFT Options page to enter additional information for employees who live in certain countries.

Navigation:

. Click the EFT Options link on the Employee Profile - Bank Accounts page.

. Click the EFT Options link on the Employee Profile - Bank Accounts page.

This example illustrates the fields and controls on the Employee EFT Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Payment Format |

Select a format for the employee's EFT option. PeopleSoft Payables is preloaded with payment formats, such as Check Std, Pay & Dep, or Wire. Create your own payment formats, or modify existing ones with EFT Payment Format Codes. |

Transaction Handling |

Determines which parts of the payment to include in the EFT file that is sent to the employee's bank. Select one:

|

Domestic Costs and Corr Costs (correspondent costs) |

Depending on the country in which an EFT occurs, costs may be involved in executing such transactions, especially with a transfer between two countries. Domestic Costs indicates who pays for the bank costs of the EFT. Banks assess correspondent costs if third parties are involved. When there are domestic costs or correspondent costs with an EFT transaction, select a source of payment. Options are:

|

Bank Check Drawn On |

Specify that a check comes from (none), Payee Bank, or Payer Bank to generate a check for an employee's EFT transactions. |

Check Forwarding |

Indicate that the check goes to (none), Payee, Payee Bank, Payer, or Pyr Bank (payer bank) to forward a check. |

Payment Instruction Ref 1-2 |

Provide any other comments regarding EFT transactions. |

Complex Routing |

Select to indicate that the EFT is routed to the employee's bank through an intermediate party, whose routing information you provide when you define the account. |

Crossed Check |

Select to indicate that the EFT involves a check that cannot be signed over to a third party. |

Pmnt Inst 1-4 (payment instruction 1-4) |

Add further payment instructions for this employee's funds transfers. These fields contain standard EFT instruction codes that come delivered with your system. |