Setting Up Approval Refinement Templates in PeopleSoft Expenses

To set up approval refinement templates, use the Refinement Template (EX_REFINE_TMPL.GBL) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EX_REFINE_TMPL |

Add or modify refinement templates that define, for a transaction type, the approval refinements used to filter transactions for approval. |

Note: The data that is entered using these pages can also be loaded as an Application Data Set (ADS). For more information about ADS, see Migrating Data Using Application Data Sets

Approval refinements are filters for expense transactions that are subject to approval. Filters are used most often for special approvers or auditors who may not review every transaction but only those meeting specific criteria such as expense reports containing charges to projects. You can create your own templates; however, PeopleSoft Expenses delivers refinement templates, which you can modify for your organization's needs and requirements.

Approval refinement templates are effective-dated and you can refine the filters based on values in transaction fields or other criteria. You create refinement templates for active transaction types and approver types.

PeopleSoft Expenses enables or disables fields on the Approval Refinement Template page based on the transaction type that the refinement is associated with. For example, if the transaction type is Expense Report, PeopleSoft Expenses disables the check boxes that relate to time reports, such as the Billable Hours and Non-Billable Hours check boxes.

When you enable multiple refinements, PeopleSoft Expenses evaluates the criteria as an OR condition. For example, if you select Credit Card Feed and Non-Preferred Merchant on the approval refinement template for expense reports to be approved by an expense manager, expense reports with transactions from a credit card feed or transactions where the employee did not use a preferred merchant, PeopleSoft Expenses forwards those expense reports to the expense manager for approval.

In addition to selecting refinements, you can also select to review expense transactions based on business units, departments, employee IDs, expense codes, and time codes. PeopleSoft Expenses evaluates the criteria for these lists as an OR condition. If you select business units or departments, the system routes transactions based on the employee's home business unit and department, not the business unit and department listed in the transaction distributions.

Note: When using Business Unit or Department criteria in the refinement template, routing will be based on the employee's home business unit and department, not the business unit and department contained in the distributions.

Note: If you create a refinement template, PeopleSoft Expenses requires that you select at least one refinement.

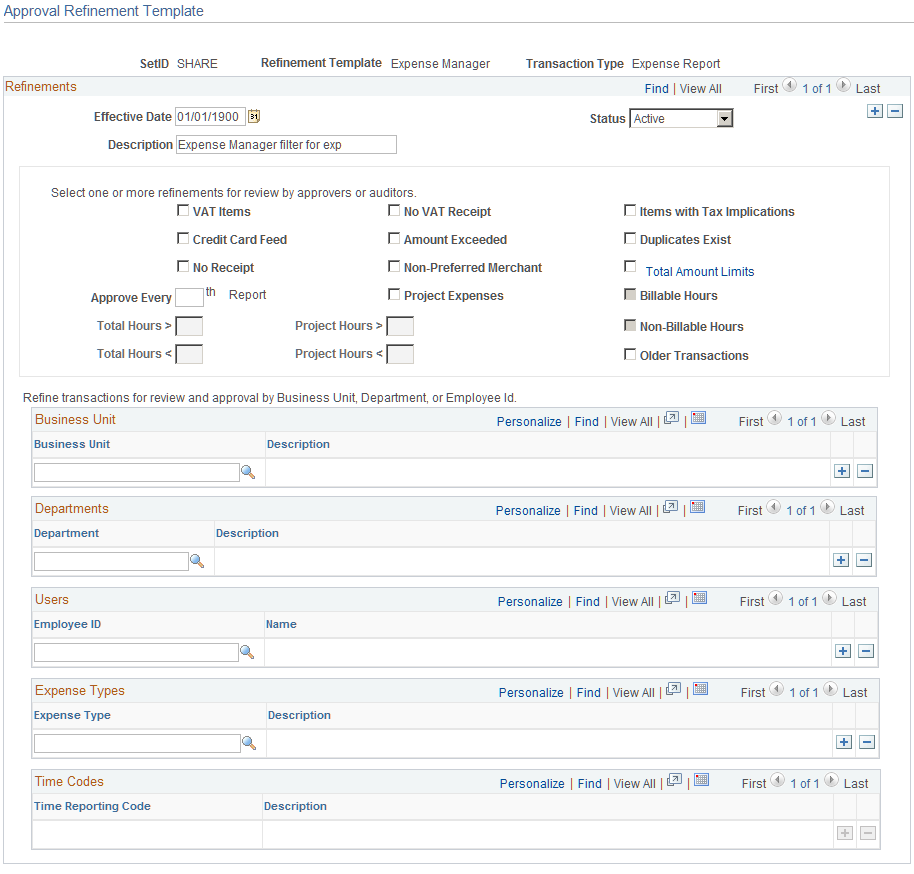

Use the Approval Refinement Template page (EX_REFINE_TMPL) to add or modify refinement templates that define, for a transaction type, the approval refinements used to filter transactions for approval.

Navigation:

This example illustrates the fields and controls on the Approval Refinement Template page.

Field or Control |

Description |

|---|---|

VAT Items |

Select to review expense reports containing expenses that have value added tax. |

No VAT Receipt |

Select to review expense reports for employees who have not provided a receipt for VAT expenses that normally require one. |

Items with Tax Implications |

Select to review an expense report that include reimbursements for which an employee can be taxed. |

Credit Card Feed |

Select to review expense reports containing an expense item that originated from a credit card transaction. |

Amount Exceeded |

Select to review expense transactions containing an expense item that is more than the defined expense location amount or the per diem amount. When this check box is selected, expense reports that are more than the defined location amount or group location limit will be routed to the approver. |

Duplicates Exist |

Select to review expense reports where an expense item appears more than once in the same expense report or the item appears in another expense report for the same employee ID. When employees submit expense reports, the system automatically detects duplicates by checking each line. A program extracts the expense type, transaction date, amount, and currency code fields, then looks for an expense line within the same expense report that has identical values as the extracted line. If the system finds an identical expense line, it flags the line. The program also searches for the same line in all expense reports for the employee and adds a comment to indicate that a duplicate exists. Some duplicates are legitimate; for example, if your organization pays moving expenses for an employee and a spouse, there may be two airline tickets to the same destination on the same day for the same amount. You can still submit an expense report when it has acceptable duplicates. Note: When the expense type has an edit type of per diem, only the expense type and the transaction date is considered when checking for duplicates. |

No Receipt |

Select to review expense reports where the employee has not provided a receipt for an expense that normally requires one. Receipt required rule is setup in Expenses Definition – Business Unit 1 page by defining the Minimum Receipt Amount, or setup in Expenses Definition – Receipts Required page. Only when the transaction is required to provide a receipt, and employee does not provide one, the transaction is flagged and approval is required. If the transaction is not required to provide a receipt according to the setup, then it will not be flagged and no approval is required. |

Non-Preferred Merchant |

Select to review expenses reports that contain an expense item that was purchased from a merchant who is not defined as a preferred merchant for that expense type. |

Total Amount Limits |

Click the link to access the Expenses Definition – Business Unit 1 page and view the pre-payment and post-payment total amount limits that you defined for your business unit. If the total expense amount during Pre-Payment auditing exceeds the limit amount defined on the Expenses Definition – Business Unit 1 page, then the transaction is flagged and approval is required. |

Approve Every [number] Report |

Select this option and enter a number to specify how often to select an expense report or cash advance for approval or audit. PeopleSoft Expenses calculates whether a particular report is subject to the approval or audit process by dividing the number you enter in this field into the report ID or cash advance ID number. If there is a remainder, no action is required. If there is no remainder, the system selects the expense report or cash advance to undergo an approval or an audit. |

Project Expenses |

Select to review expense reports or travel authorizations containing expense transaction lines that are charged to projects. |

Billable Hours |

Select to review time reports or time adjustments that contain billable hours. |

Total Hours > and Total Hours < |

Enter total hours greater than or total hours less than to indicate when you want PeopleSoft Expenses to direct time reports or time adjustments to the approver. |

Project Hours > and Project Hours < |

Enter the total project hours greater than or total project hours less than to indicate when you want PeopleSoft Expenses to direct time reports or time adjustments to the approver. |

Non-Billable Hours |

Select to review time reports or time adjustments that contain non-billable hours. |

Business Unit |

Select an active business unit or a list of active business units. The system routes expense transactions based on the employee's home business unit, not the business unit listed in the transaction distributions. |

Departments |

Select an active department or a list of active departments. The system routes expense transactions based on the employee's home department, not the department listed in the transaction distributions. |

Employees |

Select an active employee or a list of employees. |

Expense Types |

Select an active expense type or a list of active expense types. |

Time Report Codes |

Select an active time report code or a list of active time report codes. |