Setting Up Risk Templates for PeopleSoft Expenses

To set up risk templates use the Risk Template (EX_RISK_TMPL.GBL) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EX_RISK_TMPL |

Set up risk templates. |

Note: The data that is entered using these pages can also be loaded as an Application Data Set (ADS). For more information about ADS, see Migrating Data Using Application Data Sets

Travel and entertainment expenses represent a major source of discretionary spending for organizations. Risk templates are used to control spending and enforce corporate policy for expenditures. Risk templates define risk levels that are associated with an expense transaction. This provides approvers the information they need to make an informed decision during the approval process.

You can define up to five levels of risk for each risk template ID and transaction type. You then select risk criteria for each level of risk. Risk criteria is assigned:

At the header and line levels for expense reports and travel authorizations.

At the header level for time reports, time adjustments, and cash advances.

At the line level for time reports and time adjustments only for billable hours.

When defining risk templates you select the set ID and transaction type, assign a template ID, and then select criteria that tells the system when to display a risk indicator on approval pages.

You also determine how an expense transaction that has risk, is routed to an approver. An expense transaction can be routed to an approver using one of these methods:

Through e-mail, where the approver has access to all of the information that needs to be approved.

Select the Enable Email Approvals option on the risk template to use this method.

Through an e-mail notification, where the approver must log into the Expenses system to approve the transaction.

Deselect the Enable Email Approvals option on the risk template to use this method.

To set up and use the risk templates:

Set up risk templates.

Risk templates are defined by SetID and transaction type, and are assigned a Risk Template ID.

Associate a risk template with an approver profile.

Use the Approval Risk Template page (EX_RISK_TMPL) to set up risk templates.

Navigation:

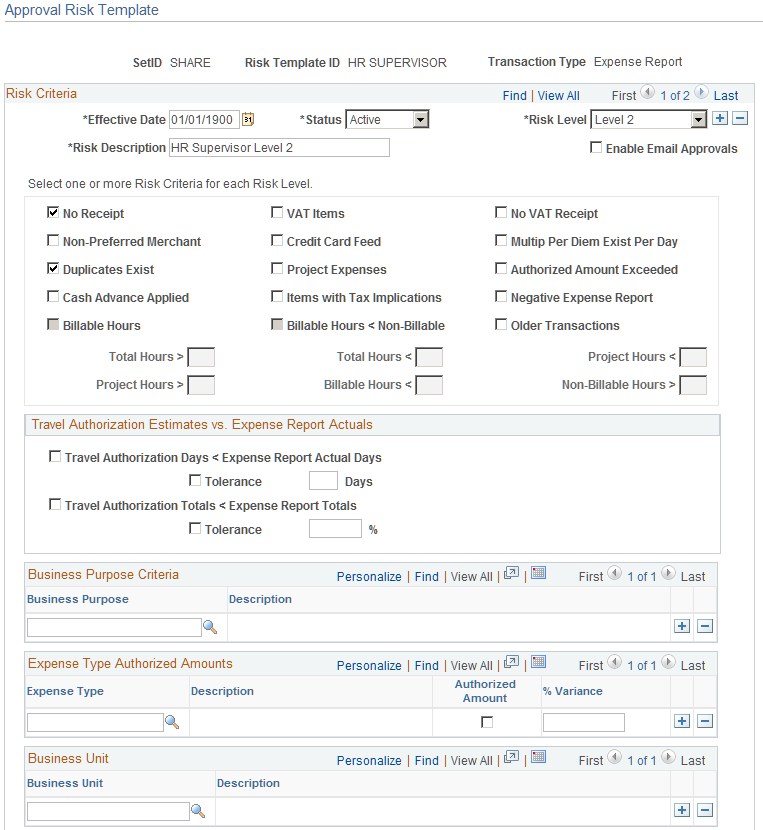

This example illustrates the fields and controls on the Approval Risk Template page (1 of 2). You can find definitions for the fields and controls later on this page.

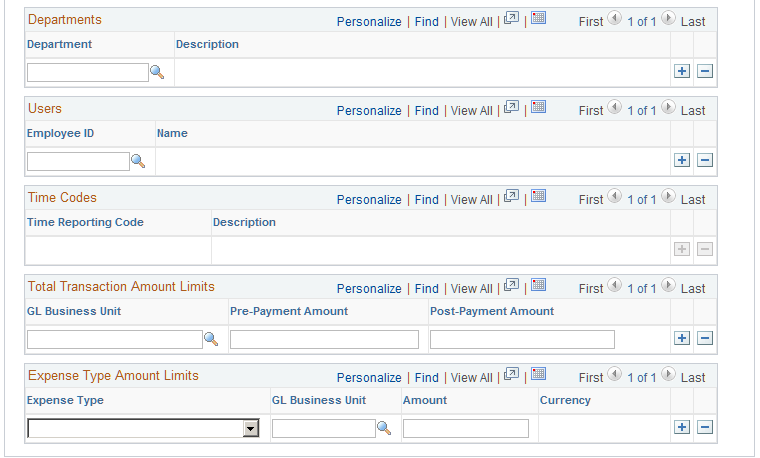

This example illustrates the fields and controls on the Approval Risk Template page (2 of 2). You can find definitions for the fields and controls later on this page.

Use this page to define up to five levels of risk for the transaction type. Risk criteria represent exceptions to company policy that can be assigned to expense transactions. When risk criteria is defined and met for more than two levels, the highest level is shown to the approver. At least one risk criteria must be defined for each risk level. You can also enable e-mail approvals for expense transactions that contain risk.

The transaction type determines the fields that are available on the page.

Risk Criteria

Field or Control |

Description |

|---|---|

Risk Level |

Select the level of risk for the template. Options include Level 1 through Level 5, which indicate the severity of the risk. Level 1 indicates low risk and level 5 indicates high risk. |

Enable Email approvals |

Select to indicate that expense approvals are routed to the approver through an e-mail, if the risk criteria is met. The e-mail includes the transaction details and approval options. Deselect to indicate that expense approvals are routed to the approver through an e-mail notification. The e-mail notification informs the approver that there is a transaction that needs to be reviewed, and provides a link to the Expenses system to approve the transaction. Note: If this option is selected and the risk criteria is not met, then an e-mail notification is sent, regardless of this option. |

VAT Items |

Select to indicate risk when expense reports contain expenses that have value added tax. |

No VAT Receipt |

Select to indicate risk when the employee has not provided a receipt for VAT expenses that requires one. |

No Receipt |

Select to indicate risk when the employee has not provided a receipt for an expense that normally requires one. Receipt required rule is setup in Expenses Definition – Business Unit 1 page by defining the Minimum Receipt Amount, or setup in Expenses Definition – Receipts Required page. Only when the transaction is required to provide a receipt, and employee does not provide one, the transaction is flagged as risk. If the transaction is not required to provide a receipt according to the setup, then it will not be flagged as risk. |

Credit Card Feed |

Select to indicate risk when expense reports contain an expense item that originated from a credit card transaction. |

Multip Per Diem Exist Per Day (multiple per diem exists per day |

Select to indicate risk when expense transactions contain more than one per diem expense type for one day. |

Non-Preferred Merchant |

Select to indicate risk when expenses reports contain an expense item that was purchased from a merchant who is not defined as a preferred merchant for that expense type. |

Project Expenses |

Select to indicate risk when expense reports or travel authorizations contain expense transaction lines that are charged to a project. |

Authorized Amount Exceeded |

Select to indicate risk when expense transactions contain an expense item that is more than the authorized expense amount or the per diem amount. When this check box is selected in risk template, expense report that more than the defined location amount or group location limit will be indicated with risk |

Duplicates Exist |

Select to indicate risk when an expense item appears more than once in the same expense report, or where the item appears in another expense report for the same employee ID. When employees submit expense reports, the system automatically detects duplicates by checking each line. A program extracts the expense type, transaction date, amount, and currency code fields, then looks for an expense line within the same expense report that has identical values as the extracted line. If the system finds an identical expense line, it flags the line. The program also searches for the same line in all expense reports for the employee and adds a comment to indicate that a duplicate exists. Some duplicates are legitimate; for example, if your organization pays moving expenses for an employee and a spouse, there may be two airline tickets to the same destination on the same day for the same amount. You can still submit an expense report when it has acceptable duplicates. Note: When the expense type has an edit type of per diem, only the expense type and the transaction date is considered when checking for duplicates. |

Items with Tax Implications |

Select to indicate risk when an expense report includes reimbursements for which an employee can be taxed. |

Negative Expense Report |

Select to indicate risk when expense reports have a negative amount. |

Cash Advance Applied |

Select to indicate risk when expense reports have a cash advance that has been applied. |

Billable Hours |

Select to indicate risk when time reports or time adjustments contain billable hours. |

Billable Hours < Non-Billable Hours (billable hours are less than non-billable hours) |

Select to indicate risk when billable hours are less than non-billable hours for time reports or time adjustments . |

Total Hours > and Total Hours < |

Enter total hours greater than, or total hours less than, to indicate when time reports or time adjustments have risk to the approver. |

Project Hours > and Project Hours < |

Enter the total project hours greater than, or total project hours less than, to indicate when time reports or time adjustments have risk to the approver. |

Billable Hours < (billable hours less than) |

Enter the total billable hours less than to indicate when time reports or time adjustments have risk to the approver. |

Non-Billable Hours > (billable hours greater than) |

Enter the total billable hours greater than to indicate time reports or time adjustments have risk to the approver. |

Travel Authorization Estimates vs. Expense Report Actuals

Field or Control |

Description |

|---|---|

Travel Authorization Days < Expense Report Actual Days |

Select to indicate risk on expense reports where the travel authorization days is less than the actual days on the expense report. |

Tolerance |

Select to indicate a tolerance for expense reports where the travel authorization days is less than the actual days on the expense report. Indicate the tolerance number of days in the Days field. |

Travel Authorization Totals < Expense Report Totals |

Select to indicate risk on expense reports where the travel authorization total is less than the total on the expense report. |

Tolerance |

Select to indicate a tolerance for expense reports where the travel authorization total is less than the total on the expense report. Indicate the tolerance percent of total in the % field. |

Business Purpose Criteria

Field or Control |

Description |

|---|---|

Business Purpose |

Select the to indicate that expense reports with this business purpose are to be considered for risk. |

Expense Type Authorized Amounts

Expense Type Authorized Amounts details has an Authorized Amount check box that when selected, determines if the system checks for risk against an expense type that has a value over the amount defined in the expense location amount table. The expense location amount table is defined on the Expense Location Amount page. If the Authorized Amount check box is not selected, then the system indicates that the expense type has risk if the expense type appears in the report. There is also a % Variance option that allows a variance before the system indicates risk.

Field or Control |

Description |

|---|---|

Expense Type |

Select an active expense type to indicate the level of risk. |

Authorized Amount |

Select to indicate that the system checks for risk for the expense type if the value is over the amount defined in the expense location amount table. |

% Variance |

Enter a percent of variance that the system allows over the authorized amount. If the amount exceeds this variance, the system considers the report to have risk. |

Business Unit

Field or Control |

Description |

|---|---|

Business Unit |

Select an active business unit to indicate risk. |

Departments

Field or Control |

Description |

|---|---|

Department |

Select an active department to indicate risk. |

Users

Field or Control |

Description |

|---|---|

Employee ID |

Select an active employee to indicate risk. |

Time Codes

Field or Control |

Description |

|---|---|

Time Reporting Code |

Select an active time reporting code to indicate risk. |

Total Transaction Amount Limits

Field or Control |

Description |

|---|---|

GL Business Unit |

Select an active general ledger business unit to indicate risk. |

Pre-Payment Amount |

Enter an amount that indicates a prepayment amount, which indicates a risk for the general ledger business unit. |

Post Payment Amount |

Enter an amount that indicates a post payment, which indicates a risk for the general ledger business unit. Note: Post payment amounts do not apply to travel authorizations. Therefore, if Travel Authorization is selected in the Transaction Type field, an amount is entered into the Post Payment Amount field, and the risk template is associated with an approver profile for a post payment auditor, then you are notified that the total transaction amount limits will be ignored. |

Expense Type Amount Limits

Field or Control |

Description |

|---|---|

Expense Type |

Select an expense type to indicate risk. |

GL Business Unit |

Select the general ledger business unit in which the expense type indicates risk. |

Amount |

Enter an amount that indicates the value of the expense type that indicates risk for the general ledger business unit. |

Header Approvals

If approving at the header level, which is determined on the Setup Process Definitions page (Enterprise Components, Approvals, Approvals, Approval Process Setup), any risk criteria that depends on line level details does not return any risk. This table illustrates the line level risk criteria for the corresponding transaction type that is not recognized for header approvals:

|

Transaction Type |

Risk Criteria |

|---|---|

|

Expense Report |

Project Expense, VAT Items, Expense Type Authorized Amounts, Expense Type Amount Limits |

|

Travel Authorization |

Project Expense, Expense Type Authorized Amounts, Expense Type Amount Limits |

|

Time Report and Time Adjustment |

Billable Hours |

|

Cash Advance |

None |