Setting Up and Configuring PeopleSoft Expenses for DCAA Compliance

This topic discusses Enabling and Disabling DCAA Compliance Functionality.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INSTALLATION_EX |

Enable DCAA compliance requirements and overage accounting. |

|

|

BUS_UNIT_TBL_EX1 |

Disable DCAA compliance requirements at the general ledger business unit level for business units that are not required to be compliant. |

|

|

Expenses Definition – Business Unit 2 Page (DCAA Compliance) |

BUS_UNIT_TBL_EX2 |

Set up DCAA compliance rules, such as time report submission requirements and disabling future project time reporting. |

|

EX_EE_ORG_DTA2 |

Disable DCAA compliance requirements for the employee. |

|

|

EX_TRC_EX |

Enable and disable future entry time reporting. See also, Time Reporting Code (EX_TRC_EX) Page and Time Reporting Code (EX_TRC_MAP_TBL) Page |

There are three levels in which you can enable or override DCAA compliance functionality:

Use the Installation Options - Expenses page (INSTALLATION_EX) to enable DCAA compliance requirements and overage accounting.

Navigation

In the Expenses Options group box, select the DCAA Enabled check box to indicate that you want PeopleSoft Expenses to enforce DCAA audit requirements.

Use the Expenses Definition – Business Unit 1 page (BUS_UNIT_TBL_EX1) to disable DCAA compliance requirements at the general ledger business unit level for business units that are not required to be compliant.

Navigation

PeopleSoft Expenses provides an override at the general ledger business unit level and displays the Disable DCAA check box only if you selected the DCAA Enabled check box on the Installation Options - Expenses page.

When you add a new general ledger business unit, PeopleSoft Expenses defaults to what you have set up at the Installation Options - Expenses page. If DCAA is enabled, the Disable DCAA check box is enabled.

Use the Employee Profile - Organizational Data page (EX_EE_ORG_DTA2) to disable DCAA compliance requirements for the employee.

Navigation

PeopleSoft Expenses displays the Disable DCAA check box only if DCAA is enabled on the Installation Options - Expenses page and is not disabled for the employee's general ledger business unit. An administrator may override DCAA for an employee by selecting this check box, meaning that the employee will be exempt from meeting DCAA requirements.

When processing time reports, PeopleSoft Expenses references the values set at the installation, general ledger business unit, and employee profile levels. This table summarizes when PeopleSoft Expenses displays or hides the DCAA check boxes:

|

Level |

Flag |

Selected |

Selected |

Selected |

Selected |

|---|---|---|---|---|---|

|

Installation |

Enable DCAA |

Yes |

Yes |

Yes |

No |

|

GL Business Unit |

Disable DCAA |

No |

No |

Yes |

Does not Display |

|

Employee Profile |

Disable DCAA |

No |

Yes |

Does not Display |

Does not Display |

|

DCAA Compliance Required |

Yes |

No |

No |

No |

|

See Installation Options - Expenses Page.

Use the Expenses Definition – Business Unit 2 page (BUS_UNIT_TBL_EX2) to set up DCAA compliance rules, such as time report submission requirements and disabling future project time reporting.

Navigation:

Employees who work on government projects are required to report their time by a threshold set by their organization. This threshold is negotiated as part of the government contract and applies to all employees assigned to work on projects for that government agency. You can define the cutoff time differently for each general ledger business unit.

If employees report their time late or makes changes after the cutoff date, you can require them to enter a comment to explain their tardiness or the reason for the change. You also control whether employees can enter future time or restrict them to enter only time that they have worked.

The Expenses Definition – Business Unit 2 page enables you to apply DCAA compliance rules to general ledger business units. These fields on the PeopleSoft Expenses Definition – Business Unit 2 page are specific to DCAA compliance rules:

Project Time Options

Field or Control |

Description |

|---|---|

Disable Entry of Future Project Hours |

Select to prevent employees in the business unit from entering future project time on their time reports. |

DCAA Compliance Rules

Field or Control |

Description |

|---|---|

Submission Cutoff days |

Enter how many calendar days employees have to report their time for a particular date. A zero in this field means that time must be reported the same day the employee worked it. |

Time |

Enter the time by which reporting should be completed and saved or submitted. |

Time Zone |

If not populated, PeopleSoft Expenses uses the application server time as the clock to determine the cutoff time for saving or submitting time reports. If populated, employees are required to save or submit their time reports by the time indicated for the given time zone. For example, if you set up the submission time and time zone for 6:00 p.m. Eastern Time (U.S.), employees in California are required to save or submit their time reports by 3:00 p.m. Pacific Time. |

Require Comments for Changes |

Select to require comments when employees report their time late or make changes after the cutoff date. |

Note: You must enter information in the fields listed above if PeopleSoft Expenses displays the Disable DCAA check box and it is not selected for the general ledger business unit.

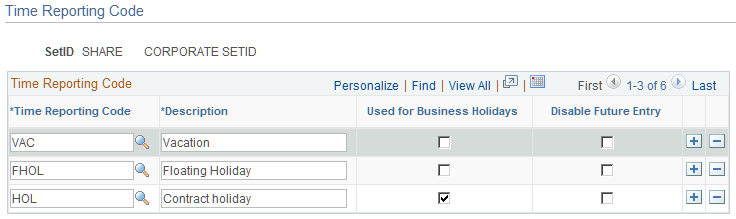

Use the Time Reporting Code page (EX_TRC_MAP_TBL) to enable and disable future entry time reporting.

Navigation:

This example illustrates the fields and controls on the Time Reporting Code (EX_TRC_MAP_TBL) page. You can find definitions for the fields and controls later on this page.

The Time Reporting Code (EX_TRC_EX and EX_TRC_MAP_TBL) pages enable you to prohibit reporting future personal time on time reports. Select the Disable Future Entry check box for a time reporting code to prohibit employees from entering personal hours on a time report if the date entered on the report is after the current date.