Setting Up Payment Processing

This topic discusses the pages and functionality that are involved in Financial Gateway electronic banking payment processing.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PMT_CHUNK_DEFN |

Define fields to include for a specified payment grouping rule. |

|

|

BANK_INTEGRATION |

Define layouts and transformation programs for a specific bank. |

|

|

External Accounts - Payment Methods |

PYMNT_BANK |

Define the payment methods that are supported for an account, payment processing options, and EFT file attributes. For each account, you can enter multiple payment methods. See the External Accounts - Payment Methods Page for more information. |

|

PMT_EXT_COMM_PG |

Optional if output type is File. Define command line information to carry out an external toolkit. |

To define external commands, use the External Command component (PMT_EXT_COMM_CMP_GBL).

This list describes the pages and functionality that are involved in Financial Gateway electronic banking payment processing:

Payment Grouping Rules

Definitions of rules that determine what payments can be grouped together in the same file.

Layout Catalog

See Layout Catalog Page.

Code Mappings

See Code Mappings Page.

(Optional) Event Code Definition

Node Definition (required only if you are using Integration Broker to transmit payment files)

See Setting Up PeopleSoft Integration Broker for Bank Statements, Payments, and Payment Acknowledgements.

(Optional) Encryption Profile

(Optional) External Commands

Captures the setup information that is needed to call third-party toolkits to provide encryption and communication of payment files. External commands can be used when you are transmitting payment files using FTP.

Bank Integration Layouts

This component is the main setup component where file layouts, output type, and integration options are associated with a bank.

External Accounts - Payment Methods - Electronic Layouts

The Payment Methods page () captures how each account's payment method is settled and in what layout. Payments can be settled through the Financial Gateway Dispatch Payments or the Payables Pay Cycle Manager.

See External Accounts - Payment Methods Page.

How you set up the payment processing functionality depends on the implementation. Because each organization or bank has differing payment layout requirements, delivering all possible layout variations to suit all needs would be exceedingly difficult. If you use the delivered functionality and do not need to make any modifications or changes, you have fewer setup tasks.

If you are creating new layouts or editing existing layouts for an organization's payment processing requirements, you need to first create the payment layout and all its supporting functionality. Specifically, you need to define payment grouping rules and code mappings, and you must also create the file layout objects and formatting logic for new (or modified) payment layouts.

Note: If you create new layouts or modify existing ones for an organization's payment processing requirements, you must add them to the Layout Catalog.

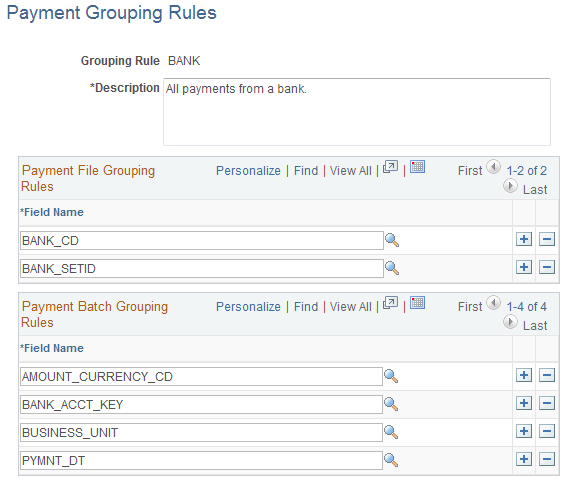

Use the Payment Grouping Rules page (PMT_CHUNK_DEFN) to define fields to include for a specified payment grouping rule.

Navigation:

This example illustrates the fields and controls on the Payment Grouping Rules page.

Each payment layout specification defines rules for grouping payments into the file. Grouping rules determine how payments are grouped together into payment files. Certain layouts require a different file for every payment, and other layouts require a separate file for each different business date in a file. For example, the SWIFT MT103 payment layout requires that only one payment exist in a file; therefore, the associated grouping rule is SINGLEPAYMENT.

Other layouts have different rules. For example, CCD+ files can contain payments from multiple accounts and multiple processing dates, so the grouping rule is BANK, and payments for this bank can be included in the same file. For layouts requiring payments to be processed on the same day, you can use the BANKDATE file grouping rule. You can change file grouping rules to accommodate a layout with a specific bank's requirement. To define a file grouping rule, enter the fields to group for a payment type.

There are essentially three layers of filtering that determines how payments are grouped together:

Initially the system groups all payments by bank code, SetID, payment layout, and payment method.

This level of filtering is hard coded in the system and cannot be changed or overwritten.

Next, the payment file grouping rules, entered in the top grid, further define how the payments are grouped together, thus determining how many payment files are ultimately created during the payment load process.

Finally, the payment batch grouping rules define how payments within a file are grouped together.

PeopleSoft delivers the following grouping rules:

|

Payment File Grouping Rule |

Description |

|---|---|

|

BANK |

All payments from a bank. |

|

BANKACCOUNT |

All payments from a specified bank account. |

|

BANKACCOUNTDATE |

All payments from a bank account and on a payment date. |

|

BANKDATE |

All payments from a bank and on a payment date. |

|

SINGLEPAYMENT |

One payment per file. |

Payment Batch Grouping Rules

This set of fields adds an additional level of filtering that further defines how payment lines and payments are grouped together in a file. Because some payment layouts have additional requirements, this feature allows users to further define the logic for grouping payments. An example is the payment layout using ISO 20022 XML messages (credit transfer initiation and STP credit transfer). After the payments have been grouped together in a file based on the file grouping rules, they can be further grouped by fields such as business unit, source system, currency code, payment date, and payment ID. The maximum number of additional grouping fields is ten.

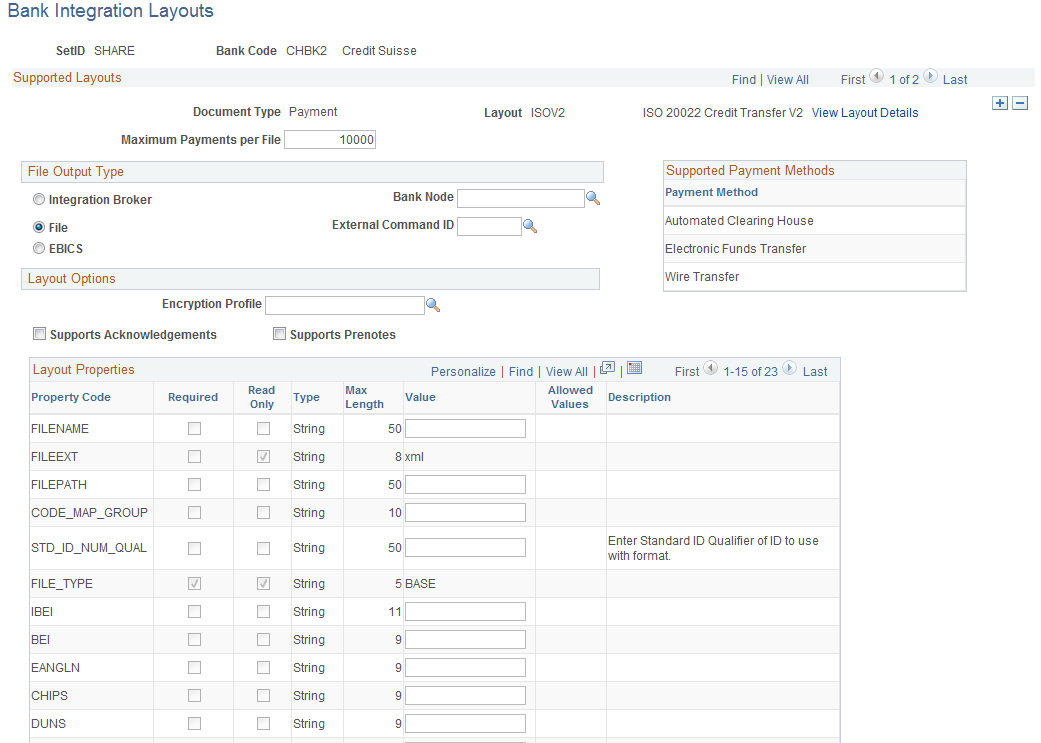

Use the Bank Integration Layouts page (BANK_INTEGRATION) to define layouts and transformation programs for a specific bank.

Navigation:

This example illustrates the fields and controls on the Bank Integration Layouts page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Layout |

Select a layout from the Layout Catalog to enable for this bank. Values that are defined for the layout automatically populate the Layout Properties region. |

View Layout Details |

Click to access the Layout Catalog page and view details of the payment layout. |

File Output Type

Field or Control |

Description |

|---|---|

Integration Broker |

Select to publish the layout as an IP message to the Integration Broker. |

File |

Select to send the layout to a file. Requires that the FILENAME, FILEEXT, and FILEPATH layout properties be defined. |

EBICS |

Select to indicate this layout follows EBICS protocol requirements. For more information about using the EBICS protocol for SEPA payments, see Understanding SEPA. |

Bank Node |

The node to which the Integration Broker Node message will be published. Required if Message output type is selected. |

External Command ID (optional) |

An option that is active only if the output layout type is File. This is the external command to carry out after the file is sent. External commands are a way to carry out a third-party communication or security toolkit. They enable the output FILEPATH and FILENAME to be passed to a third-party application to initiate additional processing. |

Layout Options

Field or Control |

Description |

|---|---|

Encryption Profile (optional) |

Select an encryption profile to apply to this payment layout's data before sending to a message or file. The profile must be one that was designed to encrypt or digitally sign files. Use the Encryption Profile page (ENCRYPTION_PRFL) () to define encryption standards to be used to protect data when communicating with banks and determine algorithms and store public and private keys that are used in encryption. See the product documentation for PeopleTools: Security Administration. |

Supports Acknowledgments |

Select to enable functionality for receiving files containing payment acknowledgment messages from the specified bank. When payments are dispatched for this bank and layout, they will be set to a status of "Dispatched to Bank." Once a payment acknowledgement is received from the bank, the status to set to "Paid." Note: Because no successful payment acknowledgments are sent for ACH payments, the Supports Acknowledgments functionality is never enabled for them. Therefore, when ACH payments are dispatched, the status of the payment changes to Paid, not to Dispatched to Bank. The only types of acknowledgments for ACH payments are ACH Returns and ACH Notifications of Change (NOC), which are the results of payment errors. In the case of ACH Returns, once they are imported into Financial Gateway, the payment status is reset from Paid to Error. ACH NOCs are statements of payment errors that are minor in nature and did not prevent the payment from being processed. Hence, the payment status does not change in Financial Gateway for and ACH NOC. The details of the error for ACH Returns and NOCs can be viewed from the Acknowledgment Files page. |

Supports Prenotes |

Select to enable the functionality for creating and processing zero-dollar, prenotification payment files using this layout. |

Supported Payment Methods

This group box displays payment methods that are supported by this layout.

Layout Properties

A payment layout can have a number of layout properties. Three layout properties are available, however, that all payment layouts contain. This table provides examples of how to set up each of them.

|

Field |

Description |

|---|---|

|

FILENAME |

Determines the filename when data are sent to a file or published into the Integration Broker. You can leave this property blank and the default will be BANKNAME + FILEID, or you can override and create your own naming convention. For example: At runtime the FILEID

( The date bind value

is flexible and can be altered to change the date format. Refer to

the PeopleTools PeopleCode documentation on the For another example: At runtime equals: |

|

FILEEXT |

File extension to add to the filename. Do not include a dot (.) in this field; the system will automatically add one between FILENAME and FILEEXT. |

|

FILEPATH |

The output directory to which the files are written. If this field is left blank, the system will send it to the default Process Scheduler file output location. Use this option only when layouts have an output type of File. The value must end in a back slash or forward slash (\ or /), depending on your operating system. For example, using Windows, "c:\temp" is invalid; it must be "c:\temp\". |

To create a new payment layout:

Work with the organization or financial institution and develop the requirements for the payment layout.

If a usable file layout object is delivered by PeopleSoft, analyze the gap between the delivered file layout object and the layout requirements.

Define a new file layout object.

You can save a delivered file layout object with another file name and then edit it, or you can create a new file layout object.

Implement the formatting logic.

PeopleSoft delivers the formatting logic in application classes that are included in the TR_FORMAT Payment package. Use the delivered application classes, extending the logic of an existing class (or extend from the BaseFormatter application class) so as to take advantage of the delivered logic.

For example, suppose that you want to create a new CDDFormatter file layout object that includes PeopleSoft-delivered logic and also enters a value in an optional field, Individual ID, in the entry detail record for tracing purposes. To do this, use the following code for the application class NewCCDFormatter:

import TR_FORMAT:Payment:CCDFormatter; class NewCCDFormatter extends CCDFormatter method populateEntryDetail (&rec as Record); end-class /* constructor */ method NewCCDFormatter %Super = create CCDFormatter (); end-method /* override parent method here */ method populateEntryDetail /+ &rec as Record +/ %Super.populateEntryDetail (&rec); Local &myIndividualIDVal; /* add logic to get your &myIndividualIDVal here */ &rec.ACH_INDIVIDUAL_ID.Value = &myIndividualIDVal; end-method;You can either create an Application Engine to call the new formatter class or specify in the layout to use the new formatter class. If choosing the Application Engine approach, write a wrapper Application Engine to invoke the new formatter class and pass in your File Layout object name.

To do this, you can copy an application class invoker Application Engine, changing the payment formatter name (such as CCDFormatter) to the new payment layout name, and changing the file layout object name to the new file layout object name.

Define a new Layout Catalog entry.

In addition to any parameters that you must define for this new Layout Catalog entry, define a transformation program name to the wrapper Application Engine or the new formatter class that you created in step 4.

To use the new layout, set up a bank account payment method (on the Banking, Administer Bank Integration, External Accounts, Payment Method page).

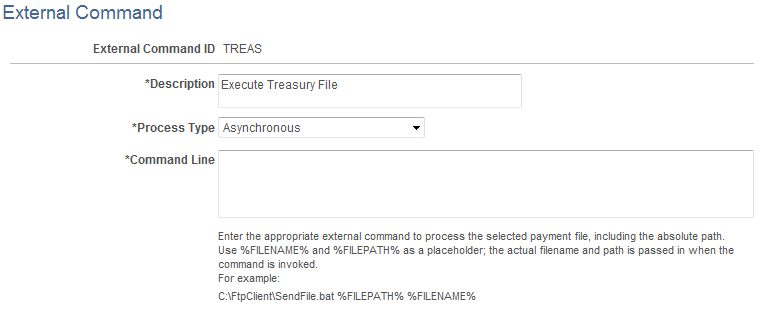

Use the External Command page (PMT_EXT_COMM_PG) to define command line information to carry out an external toolkit.

Optional if output type is File. This is the external command to carry out after the file is output. This enables you to integrate with third-party toolkits (such as security and communications toolkits) and define command parameters that call executable files, batch files, and command-line functions.

Navigation:

This example illustrates the fields and controls on the External Command page. You can find definitions for the fields and controls later on this page.

Optional if output type is file. This is the external command to execute after the file is created. External commands are a way to execute a third-party communication or security toolkit. They allow the output Filepath and Filename to be passed to a third party to initiate additional processing.

Field or Control |

Description |

|---|---|

Process Type |

Select a value:

|

Command Line |

Enter the actual command line code for the system to perform at runtime. External commands can contain two bind variables, %FILENAME% and %FILEPATH%. At system runtime, these bind variables are bonded with the location of the output file for the external command to process. |