Defining Cost-Plus Contract Lines

This section provides an overview of defining cost-plus contract lines, lists common elements and discusses how to define cost-plus contract line terms and amounts for fixed fees, define cost-plus contract line terms and amounts for award fees, define cost-plus contract line terms and amounts for incentive fees, and define cost-plus contract line terms and amounts for other fees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CA_AMT_TERMS |

Define contract terms and conditions and set up limit processing parameters for rate-based contract lines associated with fee types of Fixed, Award, Incentive and Other. |

Cost-plus contract lines are rate-based contract lines associated with a fee type. To track, calculate, and report on fees associated with a government contract, you must define a contract with a contract classification of Government and add rate-based contract lines to it that have been assigned a fee type of Fixed, Award, Incentive or Other. A government contract can contain any combination of rate-based contract lines associated with various fee types, but only one fee type can be assigned to a rate-based contract line. After you add the contract lines to the contract and save the contract, the system can create fee-specific pages to process and manage cost-plus attributes, such as funded amount, revenue and fee limits, period of performance billing controls, fee worksheets, and so on.

After a fee type is assigned to a rate-based contract line, and that contract line is added to the contract and saved, the system generates a fee-specific Contract Amounts page, and Billing and Revenue Fee Worksheet pages, that once complete, enables the system to calculate fees. The data entered on the Contract Amounts page enables the system to calculate the funded and revenue fee amounts as well as capture base fee calculation data used by the billing and revenue fee worksheets. Because the attributes used for cost-plus contract processing are controlled at the contract line level, if a contract line is added with an incorrect fee type, you must delete that contract line and unassign any billing and revenue plans associated with it. You can then add a new contract line assigned to the correct fee type.

Field or Control |

Description |

|---|---|

Awarded Cost |

Enter the awarded amount for the contract line. This amount is used as a control amount and cannot be exceeded by the entered funded amount. |

Awarded Fee |

Enter the awarded fee amount for the contract line. This amount is used as a control amount and cannot be exceeded by the entered funded fee amount. |

Awarded Total |

Displays the calculated total of the awarded costs and awarded fee amounts for the contract line. |

Funded Cost |

Enter the funded costs amount for the contract line. This amount is used for limit processing for transactions occurring against this contract line. The amount that you enter here cannot exceed the awarded amount. |

Funded Fee |

Enter the funded fee amount for this contract line. Government contracts generally contain limits on the amount of fees that can be billed. The amount entered here is used to limit the amount of fees that can be billed for this contract line. For fixed, award, and incentive fees, this field is populated by the system based on calculations using the funded cost amount; however, the value can be overridden. For a fee type of Other, you must enter the funded fee amount. |

Funded Total |

Displays the calculated total of funded cost and funded fee amounts for the contract line. |

Revenue Cost |

Enter the revenue costs for the contract line. This field will only appears for contract lines associated with a fee type (cost-plus) and you must have selected the Separate Billing and Revenue option on the Install Options-Contracts page. Enter a revenue cost amount when you need to set a separate revenue recognition limit amount for this contract line. |

Revenue Fee Worksheet |

Click to access the revenue fee worksheet. This link will only appears for contract lines associated with a fee type (cost-plus) and you must have selected the Separate Billing and Revenue option on the Install Options-Contracts page. |

Transaction Limits |

Click to access the Transaction Limits page and enter transaction limit criteria and amounts for this contract line. |

Review Limits |

Click to access the Review Limits component. The Review Limits component enables you to review overall limit amounts, amounts remaining, and any amounts in excess for the contract line. For excess limit amounts, you can also view the details of the last processed transaction. |

Perform Limit Checking |

Click this button to perform limit checking for this contract line on an ad hoc basis. Clicking this button will launch the Limits (CA_LIMIT) process and run limit checking for the contract line's billing and revenue limit amounts if changes were made using amendment processing. |

Start Date |

Enter the start date for the contract line. Government Contracts enables you to control billing and limit processing within a specified date range per contract line. After the contract is set to an active processing status, this date is no longer editable if the Control Limits and Billing option is selected. |

End Date |

Enter the end date for the contracts line. After the contract is set to an active processing status, this date can be changed throughout the life of the contract, using amendment processing, but cannot be set to a date prior to the entered start date. |

Control Limits and Billing |

Select the check box to control billing and limit processing for rate-based and rate-based contract lines associated with a fee type (cost-plus). When this option is selected, the Contracts/Billing Interface (CA_BI_INTFC) process and the Limits (CA_LIMIT) process will only select transactions for processing if the transaction date falls within the period of performance date. All other transactions are not processed. Note: If you have not selected the option to separate billing and revenue on the Installation Options-Contracts page, the period of performance settings also apply to revenue, as the billing transaction rows (BIL) are used for both billing and revenue recognition purposes. |

Use the Contract Amounts page (CA_AMT_TERMS) to define contract terms and conditions and set up limit processing parameters for rate-based contract lines associated with fee types of Fixed, Award, Incentive and Other.

Navigation:

Click the Contract Terms link on the Detail tab of the Contract – Lines page.

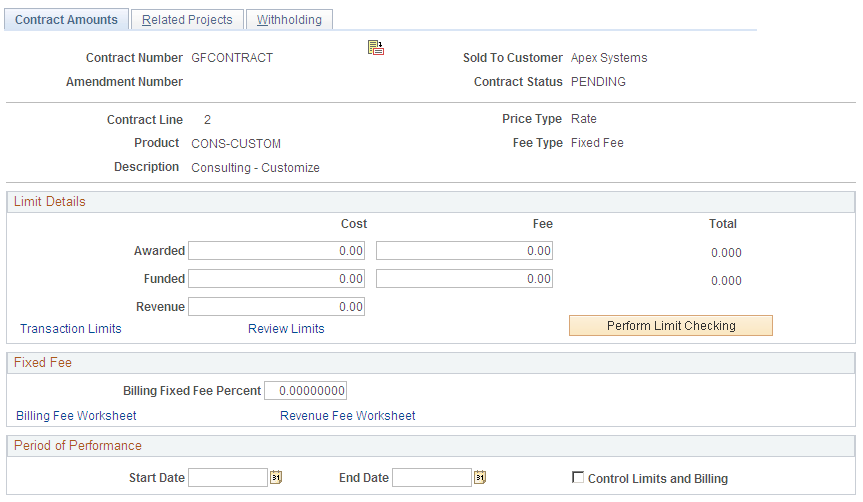

This example illustrates the fields and controls on the Contract Amounts page (fixed fee type). You can find definitions for the fields and controls later on this page.

Fixed Fee

Field or Control |

Description |

|---|---|

Billing Fixed Fee Percent |

Enter the fixed fee percent amount for the contract line. The fixed fee percent is multiplied by the total funded costs to determine the total funded fee amount. The fixed fee amount represent the profit earned on top of total costs for performing the service or creating the product defined on the contract, but is subject to a limit. |

Revenue Fee Worksheet |

Click to access the revenue fee worksheet and define, calculate and manage fixed fee percentages, limit amounts and fee amounts for revenue. This link only appears if you have selected the Separate Billing and Revenue check box on the Installation Options-Contracts page, and after the revenue plan is defined for the contract line. |

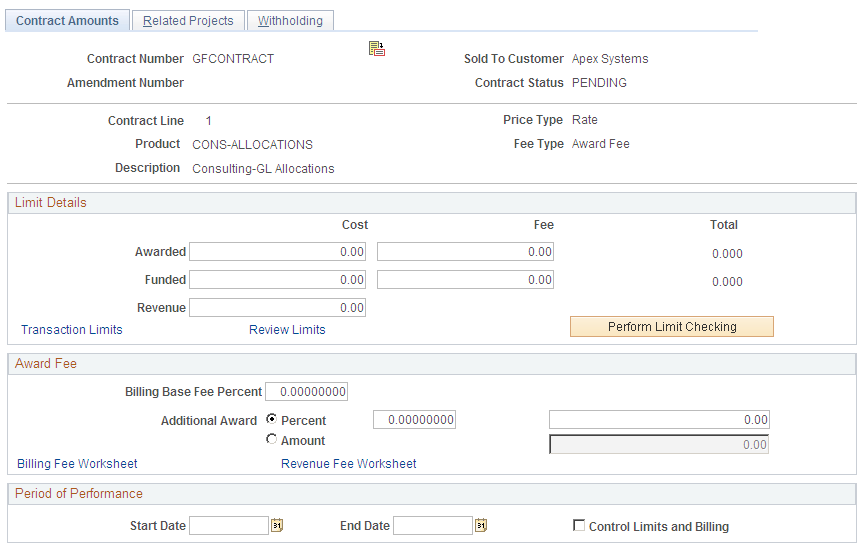

Access the Contract Amounts award fees.

This example illustrates the fields and controls on the Contract Amounts page (award fee type). You can find definitions for the fields and controls later on this page.

Award Fee

Field or Control |

Description |

|---|---|

Billing Base Fee Percent |

Enter the billing base fee percent amount for the contract line. The billing base fee percent is multiplied by the total funded costs to determine the total funded fee amount. The billing base fee amount represent the agreed upon profit percentage earned on top of total costs for performing the service or creating the product defined on the contract, but is subject to a limit. Note: If no base fee percentage is provided by the government, you can enter zero in this field, and the system will not calculate a base fee amount. |

Additional Award |

Enter the additional award amount or percent available for work completed for this contract line. If you select the Percent option, and enter a percentage, the system multiplies the percentage by the funded cost amount and displays the result in the corresponding field. You can manually override the calculated amount if needed, or select the Amount option and enter the amount in the corresponding field. |

Revenue Fee Worksheet |

Click to access the revenue fee worksheet and define, calculate, and manage award fee percentages, limit amounts and fee amounts for revenue. This link only appears if you have selected the Separate Billing and Revenue check box on the Installation Options-Contracts page, and after the revenue plan is defined for the contract line. |

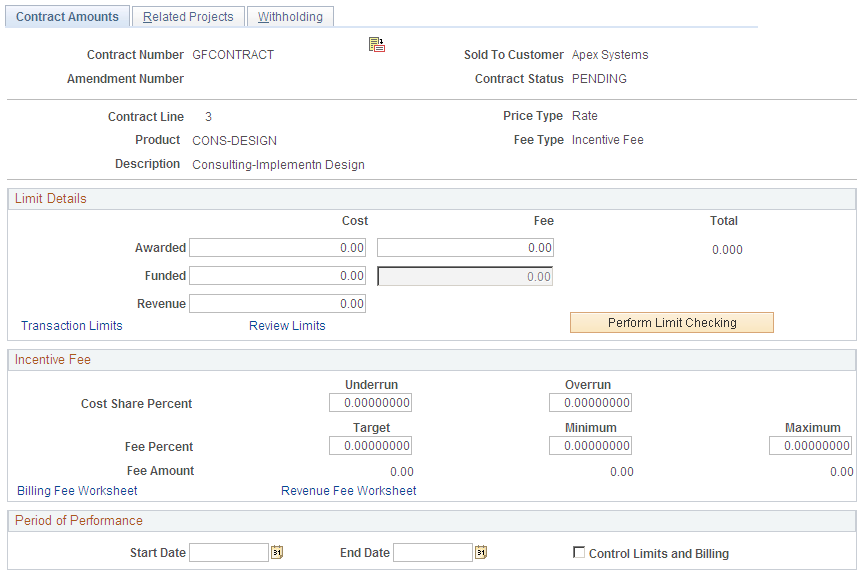

Access the Contract Amounts page for incentive fees.

This example illustrates the fields and controls on the Contract Amounts page (incentive fee type). You can find definitions for the fields and controls later on this page.

Incentive Fee

Incentive fee calculations are based on the funded and revenue limit amounts that you enter on this page. If you leave these fields blank, then the system cannot properly calculate the fee amounts for billing and revenue. Revenue fee limit amounts are only required if you have selected the Separate Billing and Revenue option on the Installation Options-Contracts page.

Field or Control |

Description |

|---|---|

Cost Share Percent: Underrun |

Enter the cost share underrun percentage that the system uses to adjust the target fee percentage that can be billed. Fee calculations are based on the funded cost amount. |

Cost Share Percent: Overrun |

Enter the cost share overrun percentage that the system uses to adjust the target fee percentage that can be billed. Fee calculations are based on the funded cost amount. |

Fee Percent: Target |

Enter the target fee percent that the system uses to calculate the target fee amount. Fee calculations are based on the funded cost amount. |

Fee Percent: Minimum |

Enter the minimum billable fee percentage for the contract line. Fee calculations are based on the funded cost amount. |

Fee Percent: Maximum |

Enter the maximum billable fee percentage for the contract line. This fee percent is used to calculate the funded fee limit amount by multiplying the maximum fee percent by the funded cost amount. |

Fee Amount: Target |

Displays the calculated result of the target fee percentage multiplied by the funded cost amount. |

Fee Amount: Minimum |

Displays the calculated result of the minimum fee percentage multiplied by the funded cost amount. |

Fee Amount: Maximum |

Displays the calculated result of the maximum fee percentage multiplied by the funded cost amount. |

Revenue Fee Worksheet |

Click to access the revenue fee worksheet and define, calculate, and manage incentive fee percentages, limit amounts, and fee amounts for revenue. This link only appears if you have selected the Separate Billing and Revenue check box on the Installation Options-Contracts page, and after the revenue plan is defined for the contract line. |

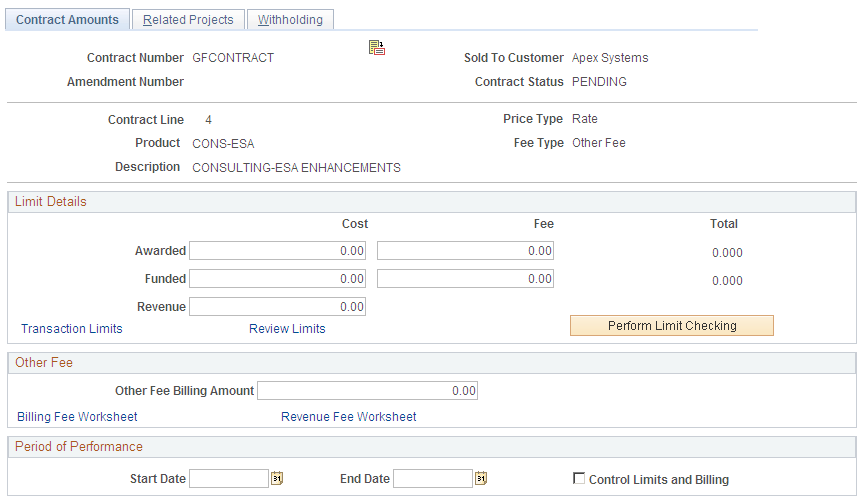

Access the Contract Amounts page for other fees.

This example illustrates the fields and controls on the Contract Amounts page (other fee type). You can find definitions for the fields and controls later on this page.

Other Fee

The fee type of Other is used to track and calculate fees that have no specific attributes. Using this fee type, you can enter a user-defined fee amount that is billed by the system each time that you run the fee process.

Note: You can also use this fee type to enable cost-plus functionality for your contract lines, but not generate fees by assigning the fee type of Other to the contract line and entering a fee billing amount of zero.

Field or Control |

Description |

|---|---|

Other Fee Billing Amount |

Enter the other billing fee amount for the contract line. |

Revenue Fee Worksheet |

Click to access the revenue fee worksheet and define, calculate, and manage fee limit amounts and fee amounts for revenue. This link only appears if you have selected the Separate Billing and Revenue check box on the Installation Options-Contracts page, and after the revenue plan is defined for the contract line. |