Defining PeopleSoft Contracts Business Units

This section provides an overview of PeopleSoft Contracts business units and discusses how to define PeopleSoft Contracts business units.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_TBL_CA |

Create a new business unit definition or modify an existing one for your government contracts. |

|

|

BUS_UNIT_TBL_CA1 |

Specify field value defaults that the system uses to automatically populate fields on the contract for contract processing and management. |

|

|

BUS_UNIT_TBL_CA2 |

Define processing attributes to incorporate flexibility and automation in your Contracts system when managing revenue or performing billing and revenue credits and adjustments. |

|

|

CA_BU_FEE_DEF |

You must associate cost-reimbursable (cost-plus) contract lines with a fee type for the rate-based contract line to have cost-plus functionality. Contracts support the fee types of Fixed, Award, Incentive and Other. You must define each fee type and its associated attributes at the business unit level. The fee type definition is used by the system to calculate the appropriate fees for the cost-plus contract line. |

|

|

CA_BU_XS_DEF |

Define Contracts business units excess and reclaimed definitions. This page is available only if the Summ. Limit for Govt Contracts (summary limit for government contracts) option is selected on the Installation Options - Contracts page. |

PeopleSoft Contracts business units represent an operational subset of your business organization. Whether you work exclusively with government funded contracts or with a combination of government and non-government contracts, the PeopleSoft Contracts business unit is the backbone of the contracts system and must be defined before you can create or manage any of your contracts. Most of the configuration for the contracts business unit impacts both government and standard contracts similarly. However there is certain configuration that specifically applies to government contracts.

To define PeopleSoft Contracts business units for your government contracts, use the Contracts Definition component (BUS_UNIT_TBL_CA).

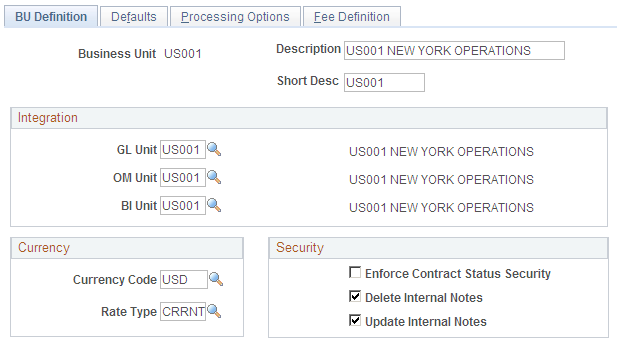

Use the BU Definition (Business Unit Definition) page (BUS_UNIT_TBL_CA) to create a new business unit definition or modify an existing one.

Navigation:

This example illustrates the fields and controls on the Contracts Definition - BU Definition page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Business Unit |

When you first add a business unit, you must provide a description and specify a value in the Default SetID field. Clicking the Create BU button adds the PeopleSoft Contracts business unit to the system tables, displays additional fields that must be completed and hides the Create BU button after the process is complete. |

Integration

Field or Control |

Description |

|---|---|

GL Unit (PeopleSoft General Ledger Unit) |

Associate each PeopleSoft Contracts business unit with a general ledger business unit. PeopleSoft General Ledger business units define the accounting processing for associated PeopleSoft Contracts business units. All contracts created for this PeopleSoft Contracts business unit use this PeopleSoft General Ledger business unit to generate entries that interact with PeopleSoft General Ledger. After you create government contracts using this business unit, the general ledger business unit should not be modified or your ledgers might become out of sync. |

OM Unit (PeopleSoft Order Management Unit) |

Select a default PeopleSoft Order Management business unit for contracts that are created under this PeopleSoft Contracts business unit. You can only select PeopleSoft Order Management business units that are linked to the same PeopleSoft General Ledger business unit as this PeopleSoft Contracts business unit |

BI Unit (Billing Unit) |

Select a default PeopleSoft Billing business unit for contracts that are created under this PeopleSoft Contracts business unit. You can only select PeopleSoft Billing business units that are linked to the same PeopleSoft General Ledger business unit as this PeopleSoft Contracts business unit. |

Currency

Field or Control |

Description |

|---|---|

Currency Code |

Select a default currency for contracts that are created using this business unit. |

Rate Type |

Select the group of exchange rates that are used to convert contract currency amounts to the base currency of the PeopleSoft General Ledger system. You set up rate types when defining your general options. |

Security

Field or Control |

Description |

|---|---|

Enforce Contract Status Security |

Select to limit the list of users who can change the status of a contract to only those to whom you have given security access on the User Preferences - Contracts page. |

Delete Internal Notes |

Select to enable users to delete internal notes. |

Update Internal Notes |

Select to enable users to update internal notes. |

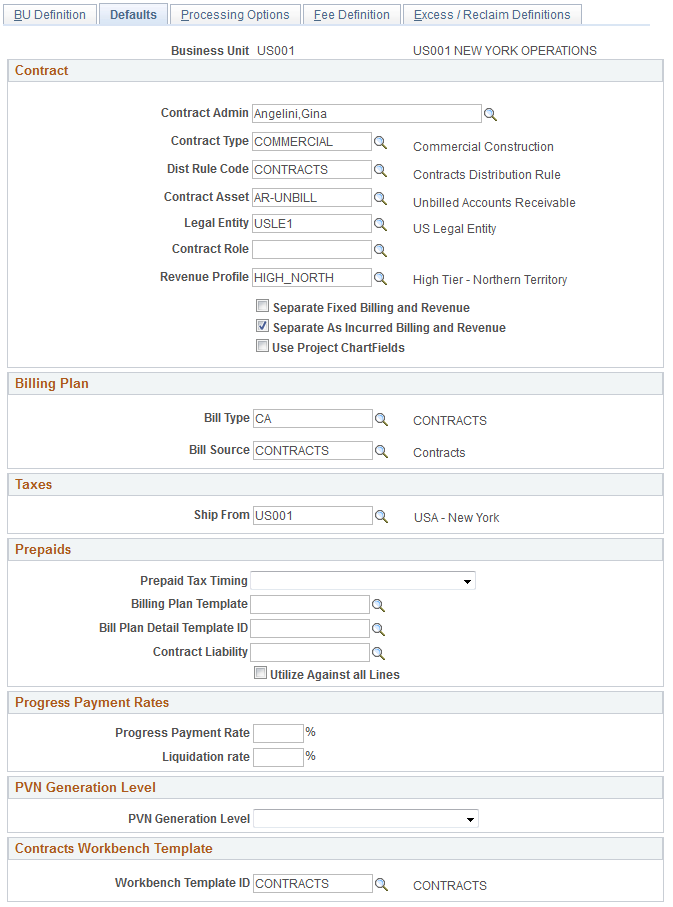

Use the Defaults page (BUS_UNIT_TBL_CA1) to define field value defaults for contracts created in this business unit. Information entered here defaults to the contract when it is added.

Navigation:

This example illustrates the fields and controls on the Contracts Definition - Defaults page. You can find definitions for the fields and controls later on this page.

Contract

Field or Control |

Description |

|---|---|

Contract Admin (Contract Administrator) |

Select a default contract administrator to associate to this business unit. |

Contract Type |

Select a default contract type to categorize your contracts for reporting purposes. |

Dist Rule Code (Distribution Rule Code) |

Select a default distribution rule code to associate to the PeopleSoft Contracts business unit. Distribution rules identify the distribution accounting that the system associates with an amount-based contract line. The distribution rule code identifies the distribution rules to use for a particular product when the product is selected for the contract within this PeopleSoft Contracts business unit. You can define any number of combination criteria and hierarchy for the distribution rules. These rules identify the accounting distribution sets and determine in what order to apply them. |

Contract Asset |

When revenue is managed from PeopleSoft Contracts, revenue is recorded to a contract asset account. When billing occurs, PeopleSoft Billing generates an offsetting entry. The system uses the contract asset account that are defined at the business unit level as the high-level default value for every contract that is created under this business unit. |

Legal Entity |

Select a default legal entity to appear by default for contracts created using this business unit. While this legal entity is not directly linked to the legal entity in PeopleSoft General Ledger, this field enables you to capture your organization's legal entity that enters into a contractual agreement with the customer. |

Revenue Profile |

Select a default revenue profile from the available values in the prompt list. |

Billing Plan

Field or Control |

Description |

|---|---|

Bill Type |

Select a default bill type for contracts that are created under this PeopleSoft Contracts business unit. The bill type represents the category of activity that is being billed. |

Bill Source |

Select to enable PeopleSoft Billing to identify from where the billing activity came and then to associate default billing information with that billing activity. |

Taxes

Field or Control |

Description |

|---|---|

Ship From |

Select from location codes that are defined on the Location Definition page. This value is a default for each contract but can be overridden on the billing plan. |

Prepaid Tax Timing |

Select the timing of when prepaids are taxed. Select from Tax on Initial Bill or Tax on Utilization. This value appears by default on the prepaid setup for contracts created using this business unit. You can override this value on the prepaid setup pages. |

Prepaids

You can enter values at the business unit level to populate by default onto the Prepaid component for prepaid setup.

Note: Prepaid defaulting applies to new prepaid billing plans only. If you change these values at the business unit level, the system does not update existing billing plans to which the changed business unit applies. The new values apply only to new billing plans that are created on this business unit.

Field or Control |

Description |

|---|---|

Prepaid Tax Timing |

Select the timing of when prepaids are taxed. Select from Tax on Initial Bill or Tax on Utilization. This value appears by default on the prepaid setup for contracts created using this business unit. You can override this value on the prepaid setup pages. |

Billing Plan Template |

Select a billing plan template to associate with the prepaid contract line. The billing plan template automates the creation of the billing plan. |

Bill Plan Detail Template |

Select a billing plan detail template to associate with the prepaid contract line. Use the billing plan detail template to override the billing defaults that are defined for a contracts billing business unit and contract header. Note: If you want to select a billing plan detail template, you must also select a value in the Billing Plan Template field. |

Contract Liability |

Select the contract liability distribution code to associate with the prepaid contract line. Booking to contract liability enables you to post to the general ledger revenue that you expect to realize in a future accounting period. |

Utilize Against All Lines |

Select this check box to apply the prepaid towards all contract lines. Note: If you want to apply the prepaid against a specific contract line, you must enter the contract line manually in the Prepaid component. |

Progress Payment Rates

Field or Control |

Description |

|---|---|

Progress Payment Rate |

Enter the progress payment rate percentage as defined by the Federal Acquisition Regulations (FAR). This value appears by default on the Progress Payment Terms - General page and can be overridden at the progress payment terms level. |

Liquidation Rate |

Enter the progress payment liquidation rate percentage as defined by the Federal Acquisition Regulations (FAR). This value appears by default on the Progress Payment Terms - General page and can be overridden at the progress payment terms level. |

PVN Generation Level

This group box is used to determine the public voucher number generation level for the business unit.

This group box appears only when the Summ. Limit for Govt Contracts (summary limit for government contracts) check box is selected on the Installation Options - Contracts page.

Field or Control |

Description |

|---|---|

PVN Generation Level public voucher number generation level |

Select an option that determines the PVN generation level for the business unit. This option indicates the fields that are required to create a PVN. The PVN generation level is passed to PeopleSoft Billing. PeopleSoft Billing can use the PVN generation level that is passed from PeopleSoft Contracts, or override it. The PVN is printed on billing invoices. This option appears as a default and can be overridden on the contract header. Selecting a different option at the contract header level overrides the option selected for the business unit.

|

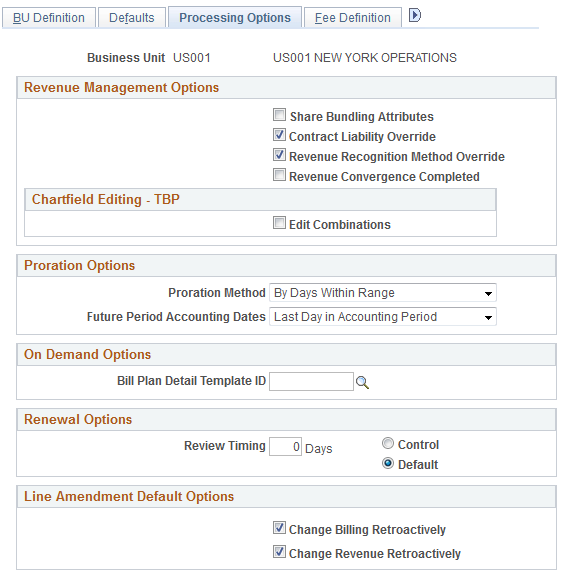

Use the Processing Options page (BUS_UNIT_TBL_CA2) to define processing attributes to incorporate flexibility and automation in your Contracts system when managing revenue or performing billing and revenue credits and adjustments.

Navigation:

This example illustrates the fields and controls on the Contracts Definition - Processing Options page. You can find definitions for the fields and controls later on this page.

Revenue Management Options

Field or Control |

Description |

|---|---|

Share Bundling Attributes |

Select the check box to share bundling attributes across contracts in the business unit. When selected, the bundling attributes defined on the Bundling Attributes page are available for the contracts created in this Business Unit. When not selected, bundling attributes on the contract are contract specific and cannot be shared. |

Contract Liability Override |

Select the Contract Liability Override check box to indicate whether a user can override the contract liability option on the contract line. The contract liability option can be selected at the product group option level to automatically populate the contract liability settings on a contract line when a product that is associated with that product group option is added to the contract. Note: The contract liability feature only applies to amount-based contract lines. After a contact is in Active processing status, you cannot modify the contract liability options for the contract line. Instead, you must make any modifications using amendment processing. |

Revenue Recognition Method Override |

Select this override check box to indicate whether a user can override the revenue recognition method on a contract line. Revenue recognition methods dictate the type of revenue recognition plan or template that can be associated with a contract line. The contract line can inherit its revenue recognition method from the product definition. When this override check box is not selected, the system processes the revenue for the contract line using the default revenue recognition method. |

Edit Combinations |

Select the Edit Combinations check box if you want the Accounting Rules Process (PSA_ACCTGGL) to run the combination edit process for transactions that are processed by the Transaction Billing Processor. Note: The Edit Combinations feature is only used by the Transaction Billing Processor. Government contracts do not use this feature. |

Proration Options

Field or Control |

Description |

|---|---|

Proration Method |

Provides the rules that the system uses to determine how much to apportion to each event for revenue plans with a revenue recognition method of apportionment. Select from:

|

Future Period Accounting Dates |

Select the date to use as the accounting date for apportionment revenue recognition events. Select from:

|

On Demand Options

Field or Control |

Description |

|---|---|

Bill Plan Detail Template ID |

Select a bill plan detail template ID to override the fields on the billing plan for on-demand contracts. If you select a template on this page, the billing plan detail template overrides the corresponding fields on the billing plan when a billing plan is created. |

Note: The On Demand Options feature is used by the Transaction Billing Processor for PeopleSoft Lease Administration and PeopleSoft Customer Relationship Management. Government contracts do not use this option.

Renewal Options

Field or Control |

Description |

|---|---|

Review Timing |

Enter a value in days. The system uses this value to determine when you must begin reviewing renewable contract lines. You can override this value for each renewable contract line on the Review Renewals page using either the control or default settings that you select on this page. |

Control |

Select the Control option to enable users to override the Review Timing Days field on the Review Renewals page with a value that is greater than or equal to the value that is entered in the Review Timing field. |

Default |

Select the Default option to enable users to override the Review Timing Days field on the Review Renewals page with a value that is less than, greater than, or equal to the value that is entered in the Review Timing field. |

Note: The Renewal Options feature is not used by government contracts.

Line Amendment Default Options

Field or Control |

Description |

|---|---|

Change Billing Retroactively |

Select this option to enable the system to adjust billing events retroactively when a contract line is cancelled or the contract line amount is modified during amendment processing. The option that is selected at the business unit level can be overridden at the contract line level. If this option is not selected at the business unit or contract line level, the user can only adjust any remaining future events for the contract line. |

Change Revenue Retroactively |

Select this option to enable the system to adjust revenue events retroactively when a contract line is cancelled or if the contract line amount is modified during amendment processing. The option that is selected at the business unit level can be overridden at the contract line level. If this option is not selected at the business unit or contract line level, the user can only adjust any remaining future events for the contract line. |

Note: Line Amendment Default Options only apply to amount-based contract lines. These options can be selected independently of one another.

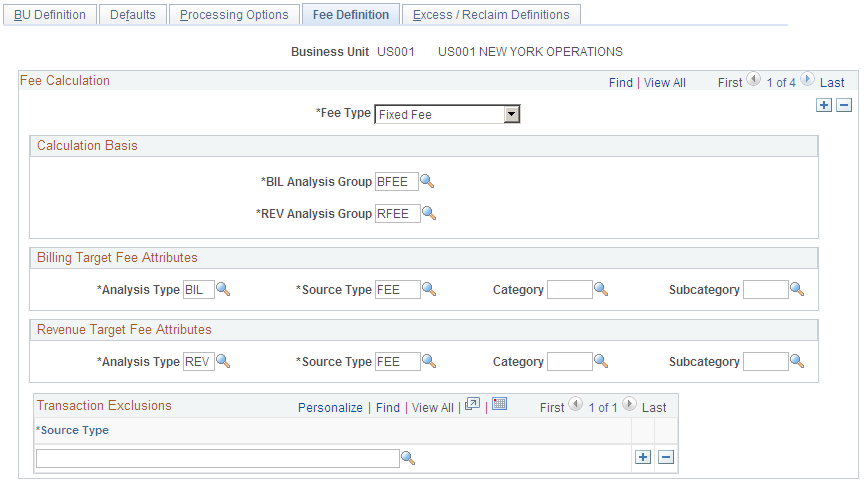

Use the Fee Definition page (CA_BU_FEE_DEF) to you must associate cost-reimbursable (cost-plus) contract lines with a fee type for the rate-based contract line to have cost-plus functionality.

Contracts support the fee types of Fixed, Award, Incentive and Other. You must define each fee type and its associated attributes at the business unit level. The fee type definition is used by the system to calculate the appropriate fees for the cost-plus contract line.

Navigation:

This example illustrates the fields and controls on the Contracts Definition - Fee Definition page. You can find definitions for the fields and controls later on this page.

For cost reimbursable contract lines, an organization must be able to calculate direct costs, indirect costs, and fees, and report these calculations to the government to receive proper payment for their services. Contracts enables organizations to calculate and track these costs using the cost-plus functionality associated with government contracts.

To calculate fees, you must first set up the fee definitions at the business unit level. Once defined, you must associate a fee type to the rate-based contract line to enable cost-plus functionality. The system uses the fee definition to calculate appropriate fees for the contract line.

Only one fee definition can be set up for each fee type that is defined for a business unit. Multiple fee types can be associated with a singular contract, but only one fee type can be assigned to a singular contract line.

Field or Control |

Description |

|---|---|

Fee Type |

Select the fee type for which you will define fee calculation criteria. You must set up fee definitions for every fee type that will be associated to cost-plus contract lines on contracts that were created under the business unit. Contracts supports the following four fee types:

Note: Fee definitions for billing should always be entered. Also enter fee definitions for revenue if you plan to separate billing and revenue on any contracts. |

Calculation Basis

Field or Control |

Description |

|---|---|

BIL Analysis Group (Billing Analysis Group) |

Select the billing analysis group that contains the transaction analysis types that are included in the billing fee calculations. Note: This is a required field. |

REV Analysis Group (Revenue Analysis Group) |

Select the revenue analysis group that contains the transaction analysis types that are included in the revenue fee calculations. |

Billing Target Fee Attributes

Field or Control |

Description |

|---|---|

Analysis Type |

Select the analysis type to stamp on the target billing fee rows that are created from the billing fee worksheets. The billing target fee attributes analysis types identify rows for bill processing for the contract lines. Note: The analysis type selected must be associated with the PSWKS analysis group in PeopleSoft Project Costing. This is a required field. |

Source Type |

Select the source type to stamp on the target billing fee rows that are created from the billing fee worksheets. Note: Only one source type can be selected for the target billing fee row. This is a required field. |

Category |

Select the category to stamp on the target billing fee rows that are created from the billing fee worksheets. Specifying a category is optional, but enables you to further identify the billing fee row that is created. For example, you can identify billing fee rows for fixed fees as CPFF (Cost-Plus Fixed Fee). Only one category can be selected for the target billing fee row. Only categories that were previously defined in PeopleSoft Project Costing can be selected. |

Subcategory |

Select the subcategory to stamp on the target billing fee rows that are created from the billing fee worksheets. Specifying a subcategory is optional, but enables you to further identify the billing fee row that is being created. Only one subcategory can be selected for the target billing fee row. Only subcategories that were previously defined in PeopleSoft Project Costing can be selected. |

Revenue Target Fee Attributes

The data that you enter in this section stamps the target revenue fee rows that are created by fee processing.

Field or Control |

Description |

|---|---|

Analysis Type |

Select the analysis type to stamp on the target revenue fee rows that are created from the revenue fee worksheets. Revenue target fee attribute analysis types identify rows for revenue recognition processing for the contract lines. Note: The analysis type that you select must be associated with the PSRV2 analysis group in PeopleSoft Project Costing. This is a required field. |

Source Type |

Select the source type to stamp on the target revenue fee rows that are created from the revenue fee worksheets. Note: Only one source type can be selected for the target revenue fee row. This is a required field. |

Category |

Select the category to stamp on the target revenue fee rows that are created from the revenue fee worksheets. Specifying a category is optional, but enables you to further identify the revenue fee row that are being created. For example, you can identify revenue fee rows for fixed fees as CPFF (Cost-Plus Fixed Fee). Only one category can be selected for the target revenue fee row. Only categories that were previously defined in PeopleSoft Project Costing can be selected. |

Subcategory |

Select the subcategory to stamp on the target revenue fee rows that are created from the revenue fee worksheets. Specifying a subcategory is optional, but enables you to further identify the revenue fee row that is being created. Only one subcategory can be selected for the target revenue fee row. Only subcategories that were previously defined in PeopleSoft Project Costing can be selected. |

Transaction Exclusions

Field or Control |

Description |

|---|---|

Source Type |

Select the PeopleSoft Project Costing ChartField source types that you want to fully exclude in the fee calculations for the fee type defined under the PeopleSoft Contracts business unit. You can exclude as many source types as needed, but you cannot use a wildcard in this field. The system cannot calculate billing or revenue fees when you use a wildcard. Note: The system will exclude any source types that are selected on this page from both billing and revenue fee calculations. |

Use the Excess/Reclaim Definitions page (CA_BU_XS_DEF) to define Contracts business units excess and reclaimed definitions.

This page is available only if the Summ. Limit for Govt Contracts (summary limit for government contracts) option is selected on the Installation Options - Contracts page.

Navigation:

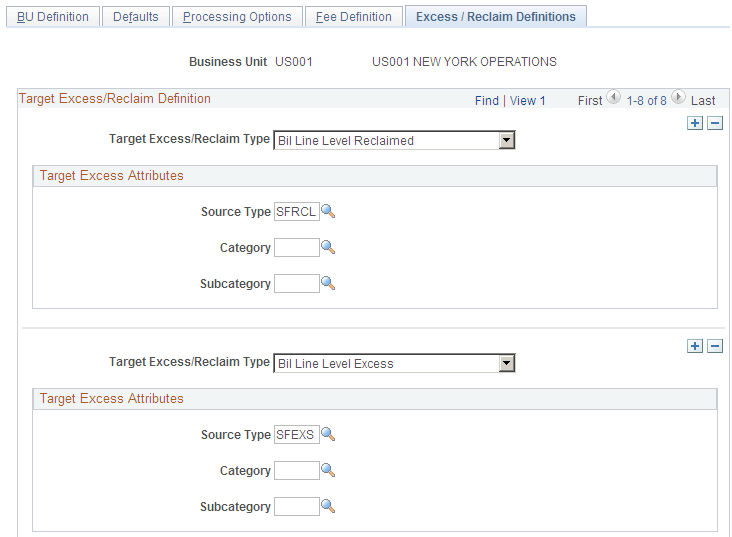

This example illustrates the fields and controls on the Excess/Reclaim Definitions page (1 of 3). You can find definitions for the fields and controls later on this page.

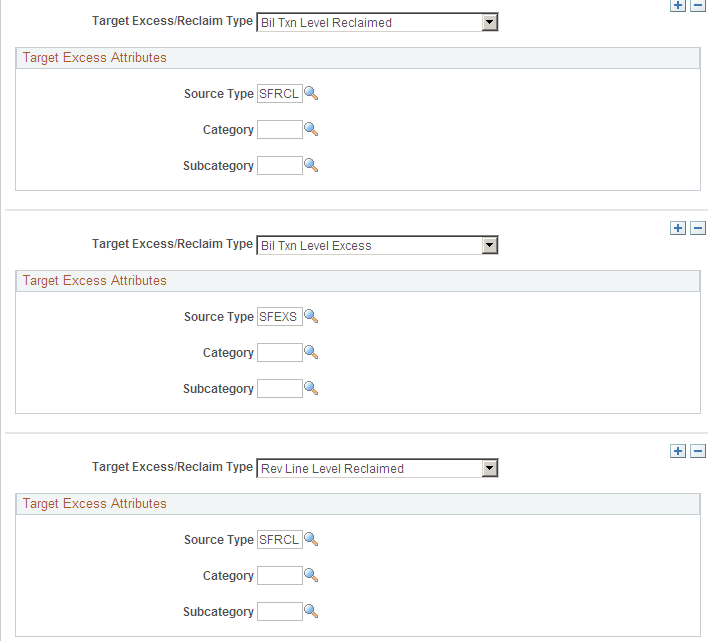

This example illustrates the fields and controls on the Excess/Reclaim Definitions page (2 of 3). You can find definitions for the fields and controls later on this page.

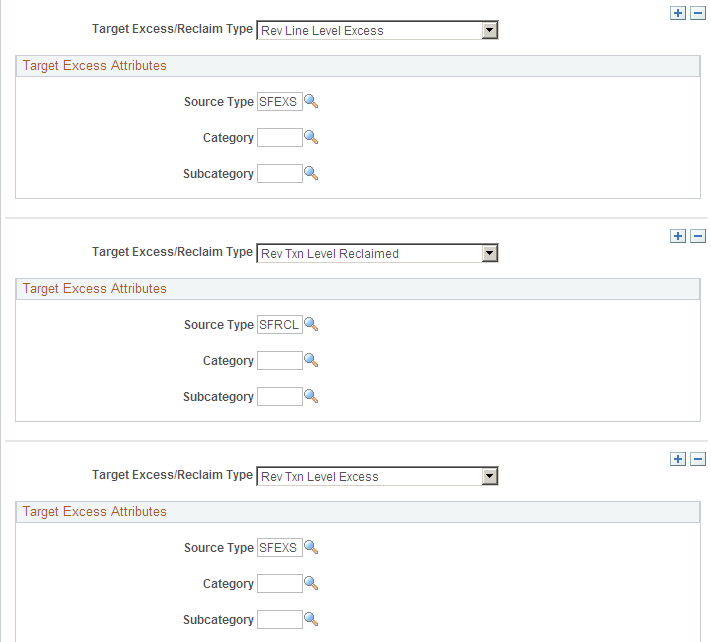

This example illustrates the fields and controls on the Excess/Reclaim Definitions page (3 of 3). You can find definitions for the fields and controls later on this page.

Use this page to determine the resource type (source type), category, and subcategory values when excess rows and reclaimed rows are written to the PROJ_RESOURCE table. These values help you to differentiate regular bill lines from excess bill lines in the PROJ_RESOURCE table.

You can define these values for bill (BIL) and for revenue (REV) rows, for transaction level and for line level rows, and for amount in excess and for reclaimed amount in excess rows. Therefore, there is a combination of these three options in the Target Excess Type for GC field.

Note: This page is available only when the Summ Limit for Govt Contracts (summary limit for government contracts) option is selected on the Installation Options - Contracts page.

Field or Control |

Description |

|---|---|

Target Excess Type for GC (target excess type for government contracts) |

Select the target excess type from a government contract that has excess amounts.

|

Source Type, Category, and Subcategory |

Enter values to identify amounts in excess rows and reclaimed amount in excess rows to the PROJ_RESOURCE table. Different values can be defined for each target excess type selected in the Target Excess Type for GC field. The value in the Source Type field is written to RESOURCE_TYPE in the PROJ_RESOURCE table. |