Defining Equitization Rules

You can define multiple equitization rules for a process. For example, you can define one rule for subsidiary net income and another rule for unrealized gain and loss. Equitization processes all the rules in one ownership set and then proceeds to the next set.

To define equitization rules, use the Equitization Rules component (EQUITIZATION_RULE).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EQTZ_RULE |

Define equitization rules. |

|

|

EQTZ_TARGET |

Specify ChartField values and details for creating equitization entries. |

|

|

EQTZ_OFFSET |

Define an equitization offset, which is used to offset the equitization source. It then becomes part of the subsidiary entities. |

|

|

EQTZ_MIN_INT |

Specify values for minority interest entries. |

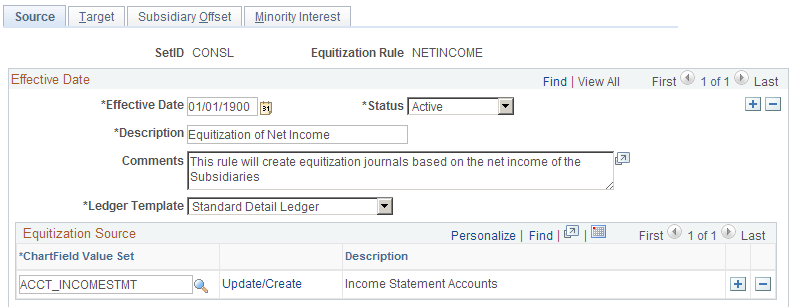

Use the Equitization Rules - Source page (EQTZ_RULE) to define equitization rules.

Navigation:

This example illustrates the fields and controls on the Equitization Rule - Source page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Ledger Template |

Specify the template to limit ChartFields applicable to setting up the equitization rule. |

Equitization Source

Field or Control |

Description |

|---|---|

Chartfield Value Set |

Defines which entries in the ledgers of the subsidiary will be selected as the equitization source. |

Update/Create |

Click the link to access the ChartField Value Set page if you want to edit or create a new set. |

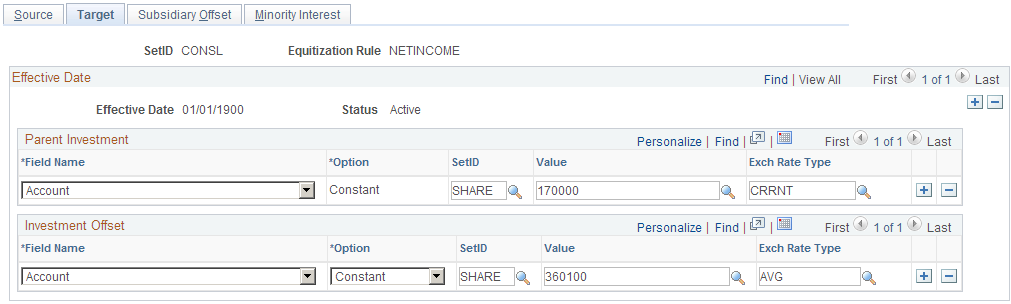

Use the Equitization Rules - Target page (EQTZ_TARGET) to specify ChartField values and details for creating equitization entries.

Navigation:

This example illustrates the fields and controls on the Equitization Rule - Target page. You can find definitions for the fields and controls later on this page.

Parent Investment and Investment Offset

Field or Control |

Description |

|---|---|

Field Name |

For a parent investment, you must specify Account or AltAcct for this required ChartField, and you must specify a value for it. |

Option |

Specify either a Constant value or Retain the ledger value. |

Value |

This field is activated only if the Option field specifies Constant. Enter a ChartField value for the parent investment or investment offset. |

Exch Rate Type (exchange rate type) |

The system supplies the current exchange rate as a default, but you can also select a specific one. When Equitization is done in a currency other than base currency of Parent entity, the foreign amount for the target translate ledger cannot be copied from the source ledger data. Here, the rate type specified in Equitization rule is used for calculating the foreign amount for translate ledgers in Equitization journal. Corresponding primary journal line and any other secondary ledger(translate and non-translate) lines are created by the journal edit process using the rate type from the ledger group page. |

The system summarizes source amounts (debits) at the level specified by the parent investment ChartField and books them to the account specified in the Value field. However, it creates only one row (with the investment offset Value field) for the credit side.

If the Affiliate ChartField is used in the ledger, the system populates the target entries with the subsidiary business unit value.

When creating an equitization rule, you can establish one or more investment and equity offsets by SetID and business unit.

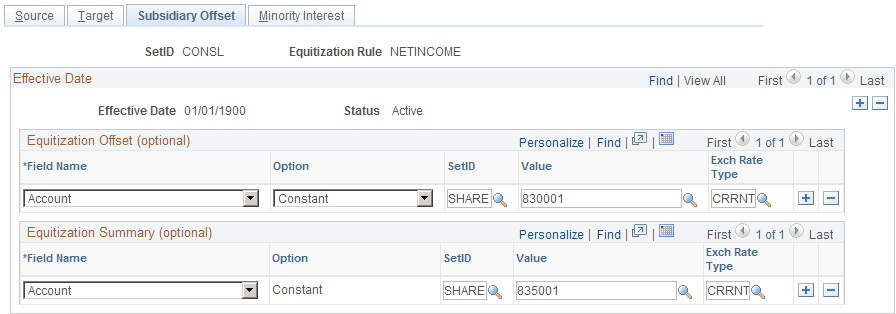

Use the Equitization Rules - Subsidiary Offset page (EQTZ_OFFSET) to define an equitization offset, which is used to offset the equitization source. It then becomes part of the subsidiary entities.

Navigation:

This example illustrates the fields and controls on the Equitization Rule- Subsidiary Offset page. You can find definitions for the fields and controls later on this page.

You can use these accounts as an income summary on the subsidiary. The equitization summary represents the gross change in an individual subsidiary's value. In the case of net income, you can place the value in the minority interest definition for equity. In this way, you avoid a minority interest elimination entry for each detail value in the net income node.

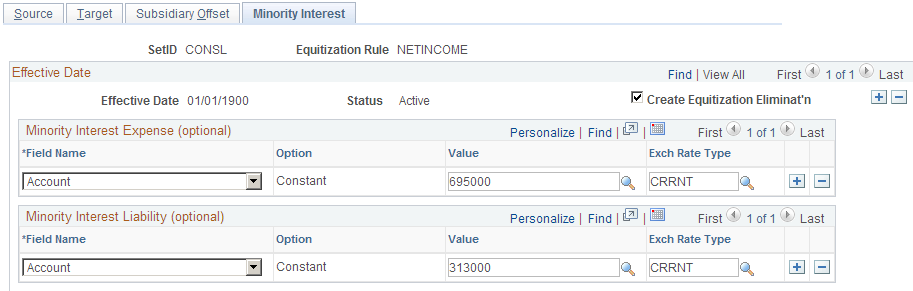

Use the Equitization Rules - Minority Interest page (EQTZ_MIN_INT) to specify values for minority interest entries.

Navigation:

This example illustrates the fields and controls on the Equitization Rule - Minority Interest page. You can find definitions for the fields and controls later on this page.

If you select Create Equitization Eliminat'n (create equitization elimination), the system generates elimination entries to eliminate the equitization target entries. If you want to generate minority interest entries, specify their value, and the system generates minority interest as part of the elimination. Elimination entries are booked to elimination business units in the consolidation tree.