Performing Year End Closing

This topic provides an overview of year end closing and discusses:

Before year end close begins, the process uncloses the periods in the fiscal year that is processed. It then closes the P/L accounts to retained earnings (storing them in period 999) and generates the balance forward amounts (storing these balances in period 0). It directly updates the ledger and creates offsets to the retained earnings amounts.

Because final adjustments may not be known for weeks after year end, closing a year and opening a new one is often an iterative process. General Ledger enables you to carry on normal accounting and reporting activities during year end, while maintaining control over the closing process. The following procedures are typical of most year end activities.

To complete the year end process:

Run revaluation (if you manage financial information in multiple currencies).

Stop processing accounting transactions for the old year.

As you would at the end of any accounting period, use the Open Period Update page or Open Periods Mass Update page to change the range of open fiscal years and accounting periods to prohibit the entry and posting of additional transactions to the old year.

Produce preliminary year end reports.

Produce the usual period-end reports and any other special year end reports.

Begin to process the new year.

As you do at other times of the year, you can use the Open Period Update page or Open Periods Mass Update page to open the first accounting period in the new year for entry and posting.

Record adjustments to the old year.

When you are ready to post adjusting entries to the old year:

Enter them as adjusting journals.

Alternatively, reopen the appropriate accounting period, enter and post the entries, and close the period again.

Close the old year.

To close revenue and expense accounts to retained earnings and roll forward beginning balances to the new year, use the Close Request page to initiate the background request. General Ledger performs closing according to the options selected in the closing rules.

Produce reports for the new year.

Until you run year end closing, reports for the next year do not include any results from prior years. Once you run the close process, balance sheet accounts and inception-to-date revenue and expense accounts are available for reporting.

Make additional adjustments to the old year.

When you must make additional adjustments for the old year, follow the same process that you use to record adjustments to the old year.

Reclose the old year.

Whenever you make adjustments to a closed year, you must run year end closing again to ensure that the opening balances for the new year reflect all activity for prior years.

Year end closing involves three major tasks.

To perform a year end close:

Define ChartField value sets.

If you plan to close to multiple retained earnings accounts, you must define the sets of values for the ChartFields that the system uses as the source for the year end closing. These can be the same sets of ChartFields that you use for interim closing or different value sets.

Specifically, you must create ChartField value sets for the ChartFields to be closed to retained earnings. (You define ChartField value sets on the ChartField Value Set page.)

Define closing rules.

Define the rules for the year end close. Specifically, you must identify:

Which P/L accounts are closed to the various retained earnings accounts.

Whether to store P/L reversal entries.

Whether to have beginning balances reflect separate debits or credits, or whether to reflect the net of the debits and credits.

Whether to close the general ledger periods.

Whether to create journal entries for the year end entries.

Which ChartField value sets to use for the roll-forward amounts.

Run the closing request.

When you request that the year end close be processed, you identify:

Which ledger to close.

Which closing rule to use.

Which date to use as the closing date.

Which business units to close.

In addition, note the following points:

If you perform interim closes using an offset to retained earnings, you must perform all interim closes for all the interim periods and use the offset account defined for the interim closes as the target retained earnings for the year end close.

You run year end close using the Close Request page.

You can undo a close, if necessary, using the undo procedure.

Note: Whereas you can select a year-end close option to close the GL open periods upon successful completion, if you run the undo process, it does not reopen the closed year. If you should need to post additional journals after initially closing the year, use the Open Period Update page (or Open Period Mass Update page) to open the closed year for additional entries.

The process of year end closing closes the profit and loss (P/L) accounts to retained earnings and generates the balance forward amounts. To maintain the integrity of financial reporting, the entries generated by year end closing are stored in special system-defined periods. The year end closing entry to book the current year net income to retained earnings is stored in period 999, and the balance forward amounts are stored in period 0.

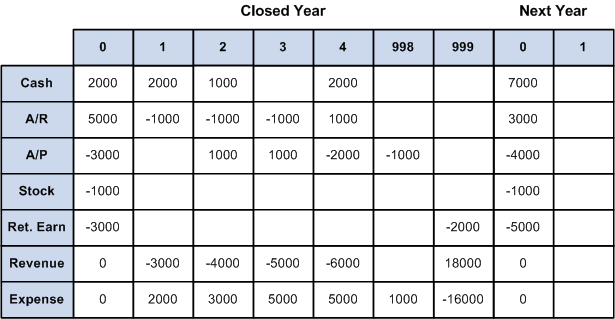

The following example illustrates how General Ledger stores amounts in a ledger after closing has been performed for the old year (998 is an adjustment period). This ledger uses a simplified calendar containing only four accounting periods:

Amounts Stored in Ledger After Year End Closing

Note: The General Ledger financial statement reports do not include beginning balances for profit and loss accounts.

Once you have determined to use interim close, you should run it consistently for the daily, monthly, or quarterly period chosen. If at any time you do an ad hoc interim close, you should subsequently perform an undo of that close.

If you do not use an offset to the retained earnings account when performing interim closes, the P/L accounts are closed and the balance is transferred to the retained earnings account as shown in the following example:

|

P/L Balance 410000 |

Retained Earnings Offset 360101 |

Retained Earnings 360100 |

|---|---|---|

|

100 CREDIT 100 DEBIT |

100 CREDIT |

When the interim closes are performed consistently, the P/L accounts is correctly closed at year end and the correct amount is recorded in the applicable retained earnings account. Completing the year end close then involves closing any remaining unclosed P/L accounts to retained earnings.

If you use an offset to the retained earnings account when performing interim closes, the offset must be defined as the target for the year end close. All P/L accounts must be closed to the offset account rather than to the retained earnings.

This is because when using an offset account for interim close, the P/L accounts retain their balances—they are not zeroed out during interim close. The following example shows the results of an interim close in which account 360101 offsets the amount in the revenue account 410000 and the revenue is correctly reflected in the retained earnings account 360100:

|

P/L Balance 410000 |

Retained Earnings Offset 360101 |

Retained Earnings 360100 |

|---|---|---|

|

100 CREDIT |

100 DEBIT |

100 CREDIT |

When the final interim close is performed, the year end closed must be performed with the P/L accounts closed to the offset account 360101.