Defining Operating Expense Categories

To define operating expense categories, use the Operating Expense Categories component (RE_EXP_CLASS).

This topic provides an overview of operating expense categories and lists the pages used to define operating expense categories.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Operating Expense Categories |

RE_EXP_CLASS |

Create an operating expense category. |

When landlords lease properties to tenants, terms for recoverable expenses that are incurred on general operations and maintenance of the building are written into the lease. Operating expenses is also commonly referred to as common area maintenance (CAM). You can identify the different recoverable expenses incurred by assigning them to an operating expense category. Operating expense categories enable you to associate a transaction routing code to ensure that financial processing occurs to handle the expense.

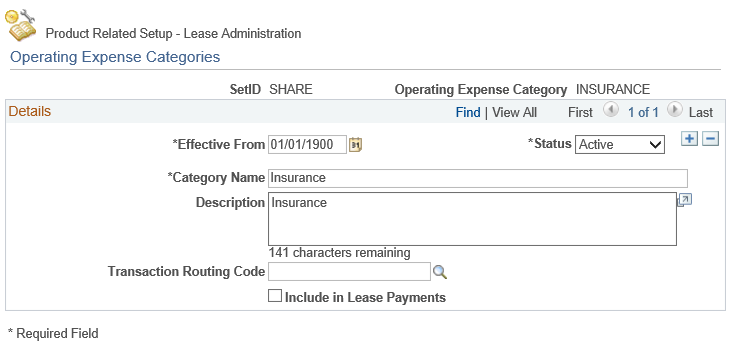

Use the Operating Expense Categories page (RE_EXP_CLASS) to create an operating expense category.

Navigation:

This example illustrates the fields and controls on the Operating Expense Categories. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Include in Lease Payments |

Select to include the payment in both ROU (Right Of Use) Asset and Lease payments. If the check box is selected for an operating expense category, then the payments generated from the lease financial term having that operating expense category are included in the capitalized lease amount. If the check box is not selected, then the expense accounting using the LA accounting rules will be used to send the debit entry to the Accounts Payable. |