Performing Manual Straightline Adjustments

This topic discusses how to perform manual straightline adjustments.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RE_FASB_ADJUSTMENT |

Review or adjust the generated straightline schedule. You can optionally adjust the straightline schedule prior to posting to the general ledger. |

|

|

RE_FASBADJ_DST_SEC |

Override the business unit accounting rules by percentage or area. |

Use the Manual Straightline Adjustments page (RE_FASB_ADJUSTMENT ) to review or adjust the generated straightline schedule.

You can optionally adjust the straightline schedule prior to posting to the general ledger.

Navigation:

Note: As part of the shared product functionality, the Manual Straightline Adjustment page can also be accessed through the Asset Management navigation.

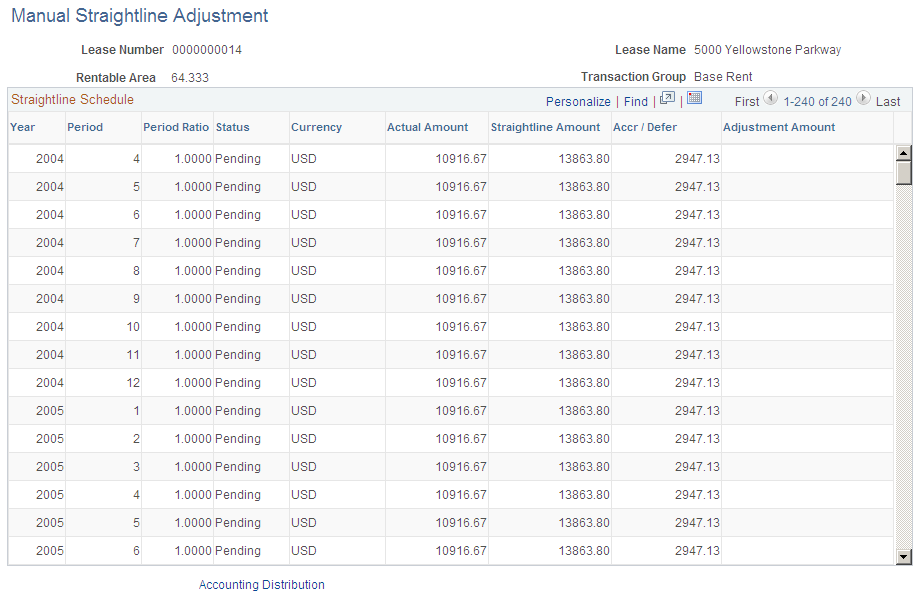

This example illustrates the fields and controls on the Manual Straightline Adjustment page (partial). You can find definitions for the fields and controls later on this page.

Note: Specific months posted to the general ledger are shown as display-only and cannot be adjusted.

Field or Control |

Description |

|---|---|

Period |

Displays the accounting period that the straightline accrual or deferral is in. |

Period Ratio |

Displays the period ratio. This is the number of days in a lease period (to the total number of days for the accounting period). |

Status |

Displays the status of the of the transaction. Transactions posted to the general ledger are display-only and cannot be modified. |

Actual Amount |

Displays the actual monthly rent amount prior to the straightline process. This amount is the recurring amount scheduled from the lease financial terms. |

Straightline Amount |

Displays the calculated straightline amount. The calculation method is (Total Lease Amount – Total Paid Amount) divided by (Sum of Unpaid Period Ratio). |

Accr/Defer (Accrual/Deferral) |

Displays the amount to be accrued or deferred in the general ledger. The amount is the Actual Amount – Straightline Amount = Accrual or Deferral (negative value). |

Adjustment Amount |

Enter the amount to adjust the straightline value. The calculation method used is (Total Paid Amount) divided by (Total Unpaid Period Ratio). |

Calculate |

Click the button to recalculate the amounts after entering the adjustment amount. |

Reset |

Click to return all values on the page back to the original values from the database. This page can be used as a worksheet for what-if processing that you might want to undo later. If you have not saved your changes to the database yet, clicking on this button resets the values. |

Accounting Distribution |

Click this link to access the Accounting Distributions page and override to override the business unit accounting rules. |

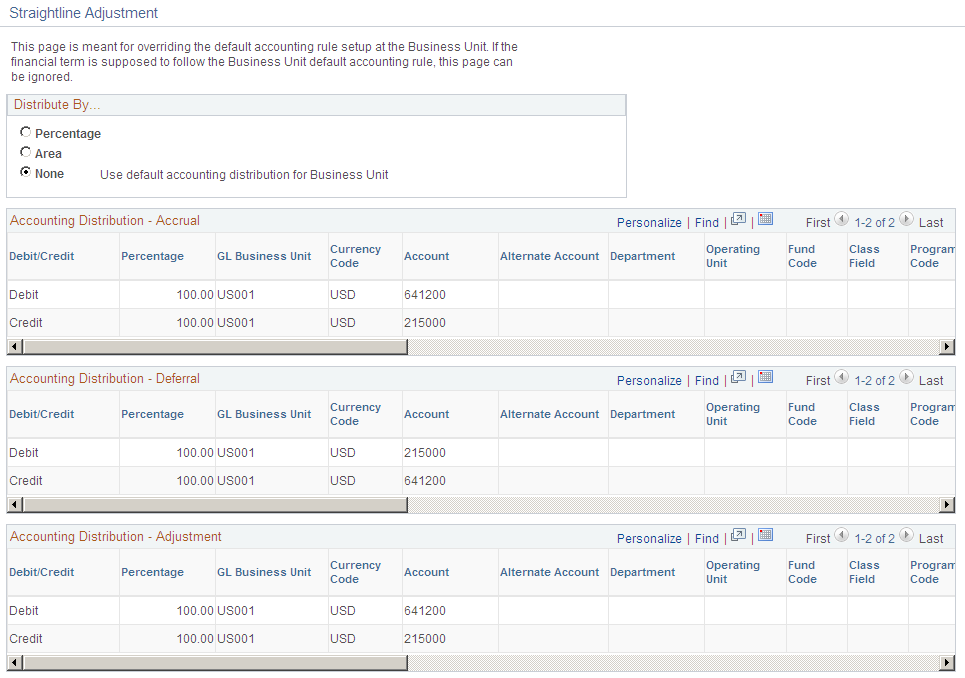

Use the Accounting Distributions page (RE_FASBADJ_DST_SEC) to override the business unit accounting rules by percentage or area.

Navigation:

Click the Accounting Distributions link on the Manual Straightline Adjustments page.

This example illustrates the fields and controls on the Manual Straightline Adjustment - Accounting Distribution page. You can find definitions for the fields and controls later on this page.

If you want to keep the accounting distributions defined on the business unit, you can ignore this page.

The fields on this page differ based on the distribute by method chosen.

When you select Percentage or Area as the distribution method, the ChartField values become available for edit.

Field or Control |

Description |

|---|---|

Distribute By |

Chose a distribution method:

|

Add Distribution |

Click this button to insert a new row in the distribution lines. This button appears only if you select Percentage or Area as the distribution method. |

Delete Distribution |

Select the Select option and click this button to delete the distribution row. This button appears only if you select Percentage or Area as the distribution method. |

Select |

This option is used to delete the distribution rows. Users can select all the distribution rows that they want to delete and then click the Delete Distribution(s) button to delete them. This option appears only if you select Percentage or Area as the distribution method. |

Percentage |

Enter the percentage to apply to this distribution line. The total percentage for all debit entries must equal 100 and the total percentage for all credit entries must be 100. This field appears only if you select Percentage as the distribution method. |

Area |

Enter the area to apply to the distribution line. This field appears only if you select Area as the distribution method. |

Valid |

This option indicates whether the combination of ChartFields selected for the distribution row is valid or not. The Combo Edit check is performed when you exit the accounting distribution page. If the distribution line has a valid combination, then the option for that row will be checked. If there are accounting distributions with invalid combinations, then an error will be displayed when you exit the page, save the lease or activate the lease. This option appears only if you select Percentage or Area as the distribution method. |