Understanding PeopleSoft Lease Administration Accounting Rules

To define PeopleSoft Lease Administration accounting rules, use the LA Accounting Rules Definition component (CA_ACCT_RULES).

Accounting rules for PeopleSoft Lease Administration are essential for providing lease transactions with appropriate accounting entries sent to PeopleSoft Payables, Billing, and General Ledger. PeopleSoft Payables and Billing provide the offsetting entries to the expense or revenue accounting passed over. You must specify default accounting rules for each transaction destination with an option of providing defaults for each transaction group. You can further define accounting for specific transaction codes within a transaction group that requires its own set of accounting rules. For example, you can set up a standard accounting rule for the transaction group of operating expenses with a transaction destination of PeopleSoft Payables.

When operating expense transactions are generated and are sent to PeopleSoft Payables the defined standard accounting rule for those transactions are applied and sent as well. If a specific operating expense such as janitorial services has a unique account requirement, you can set up an accounting rule for the transaction destination of PeopleSoft Payables, transaction group of operating expenses, and a transaction routing code for janitorial services with the accounting specific to janitorial services.

Three sets of debit/credit pairs are defined in the lease administration accounting rules for PeopleSoft Lease Administration:

Transactions sent to the PeopleSoft Billing (BI) destination contain accounting rules that credit the revenue.

The offset of Accounts Receivable is determined in PeopleSoft Billing setup.

Transactions sent to the PeopleSoft Payables (AP) destination contain the debit to expenses.

The offset of Payable is determined in PeopleSoft Payables setup.

Transactions sent to the PeopleSoft General Ledger (GL) destination contain both the debit and credit accounts as these are the straightline accounting entries generated from PeopleSoft Lease Administration.

The following table shows the valid and invalid combinations that can exist in the accounting rules for PeopleSoft Lease Administration. Edit checking is added to the Accounting Rules for Lease Administration page to ensure that only valid combinations are saved:

|

Transaction Destination |

Transaction Group |

Valid Combination? |

|---|---|---|

|

AP |

Base Rent |

Yes |

|

BI |

Base Rent |

Yes |

|

GL |

Base Rent |

No |

|

AP |

Security Deposit |

Yes |

|

BI |

Security Deposit |

Yes |

|

GL |

Security Deposit |

No |

|

AP |

Straightline Accounting |

No |

|

BI |

Straightline Accounting |

No |

|

GL |

Straightline Accounting |

Yes |

|

AP |

Operating Expense |

Yes |

|

BI |

Operating Expense |

Yes |

|

GL |

Operating Expense |

No |

|

AP |

Percent Rent |

Yes |

|

BI |

Percent Rent |

Yes |

|

GL |

Percent Rent |

No |

|

AP |

Miscellaneous Rent |

Yes |

|

BI |

Miscellaneous Rent |

Yes |

|

GL |

Miscellaneous Rent |

No |

|

AP |

Manual Fee |

Yes |

|

BI |

Manual Fee |

Yes |

|

GL |

Manual Fee |

No |

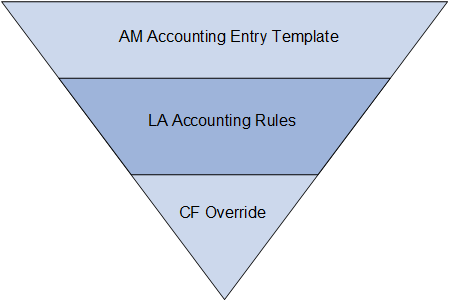

The lease accounting hierarchy provides flexible defaulting for lease payment-related accounting entries. The lease payment (LPY) and the prior period lease payment (PLP) accounting entry templates in Asset Management serve as the highest level of the lease payment accounting entry default hierarchy. The lease obligation (LO) can be overridden by the lowest level of Transaction Group/Routing code combination LA Accounting Rule, followed by ChartField Override at the lease term level.

The following graphic illustrates the PeopleSoft Lease Accounting Hierarchy.

Note: Accounting Hierarchy is applicable only for payable leases.

For additional information, refer Understanding Accounting Entry Setup

Implementation Considerations

Considerations when implementing lease accounting include:

The highest level in the default hierarchy is the AM accounting entry templates. A LA business unit option permits can be enabled to limit the default hierarchy to LA accounting rules and ChartField override at the lease term level.

The default hierarchy applies to the recognition of the lease obligation reduction only.

LA accounting rules must be configured for percent rent, operating expenses, manual fees, miscellaneous rent, and straightline accounting, as these payments do not typically share the same accounting as lease payments recorded under base rent.

Multiple ChartField distributions are configured at the ChartField Override level.