Defining Statement Activities

This topic discusses how to create statement activity types.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BANK_ACT_TYPE |

Define statement activity types. |

To define statement activities, use the Statement Activity Type component (STMT_ACT_TYPE_GBL).

The system flags bank transactions such as overdraft fees, interest, or other miscellaneous fees as MISC (miscellaneous) exception items during reconciliation processing because there are no corresponding system transactions. You associate statement activity types with these items, so that the Treasury products generate accounting entries for the transactions based on the ChartFields that are specified in an accounting template when you force them to reconcile.

Use the Statement Activity Type page (BANK_ACT_TYPE) to define statement activity types.

Navigation:

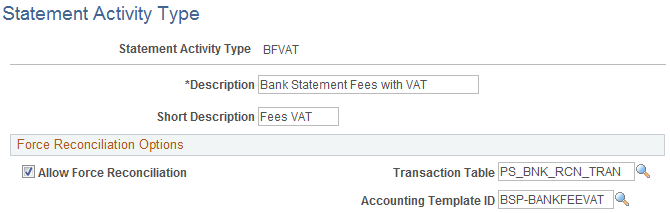

This example illustrates the fields and controls on the Statement Activity Type page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Allow Force Reconciliation |

Select to enable the reconciliation of transactions that are associated with this statement activity type. When you select this option, you can select and force reconciliation transactions that are associated with this category of statement activity on the AutoRecon Exceptions page. The system adds the item to the system transactions and schedules the appropriate accounting event based on the accounting template that is assigned. You must select this option to complete the Transaction Table and Accounting Template ID fields. |

Transaction Table |

Database table that contains the transactions for this type of statement activity. Unless you have modified the PeopleSoft application, you should use the default table, PS_BNK_RCN_TRAN, which stores system transactions for reconciliation processing. |

Accounting Template ID |

Select the accounting template that defines what accounting entries that the system creates when you force reconciliations. |