Performing Book to Bank Reconciliation

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BNK_BTB_STMT_SEL |

Select bank statements for Book to Bank reconciliation. Schedule the process to perform Book to Bank data extraction and balance calculations. |

|

|

BNK_BTB_REC_MGR |

Search for statements marked ready for Book to Bank reconciliation, review balance details, and schedule the process to perform Book to Bank data extraction and balance calculations. |

|

|

BNK_BTB_HDR |

Review your company's general ledger balances against bank-reported account balances in the bank statement. You can also print a report of your Book to Bank adjustments. |

|

|

Bank Balance Entry Page |

BANK_BALANCE_ENTRY |

Review the bank balances and funds availability. See the Book to Bank Reconciliation Details Page for more information. |

|

Bank Transaction Entry Page |

BNK_STMT_ENTRY |

Review the bank transaction information, the bank reconciliation information, and the bank addenda information. See the Book to Bank Reconciliation Details Page for more information. |

|

Payments in Transit Page |

BNK_BTB_DET_SEC |

Specify which payment transactions in transit to include in the bank adjustment subtotal amount. See the Book to Bank Reconciliation Details Page for more information. |

|

Deposits in Transit Page |

BNK_BTB_DET_SEC |

Specify which deposit transactions in transit to include in the bank adjustment subtotal amount. See the Book to Bank Reconciliation Details Page for more information. |

|

GL Adjustments Page |

BNK_BTB_DET_SEC |

Specify which general ledger adjustments to include in the bank adjustment subtotal amount. See the Book to Bank Reconciliation Details Page for more information. |

|

Ledger Balance Page |

BNK_BTB_LED_SEC |

View ledger balance and bank account ChartField information. See the Book to Bank Reconciliation Details Page for more information. |

|

Unbooked Fees and Interest Page |

BNK_BTB_DET_SEC |

Specify which unbooked fees and interest transactions to include in the general ledger subtotal amount. See the Book to Bank Reconciliation Details Page for more information. |

|

Unbooked Payments Page |

BNK_BTB_DET_SEC |

Specify which unbooked payment transactions to include in the general ledger subtotal amount. See the Book to Bank Reconciliation Details Page for more information. |

|

Unbooked Deposits Page |

BNK_BTB_DET_SEC |

Specify which unbooked deposit transactions to include in the general ledger subtotal amount. See the Book to Bank Reconciliation Details Page for more information. |

|

Bank Adjustments Page |

BNK_BTB_DET_SEC |

Specify which bank adjustments to include in the general ledger subtotal amount. See the Book to Bank Reconciliation Details Page for more information. |

|

Book to Bank Notes Page |

BNK_BTB_FREEFORM |

Enter notes to account for a book-to-balance reconciliation difference. See the Book to Bank Reconciliation Details Page for more information. |

|

Book to Bank Reconciliation Page (report) |

RUN_TRC4090 |

Generate a report of your book to bank reconciliation activities for a bank statement. See the Book to Bank Reconciliation Details Page for more information. |

|

BNK_BTB_REC_MGR |

Override the book to bank status Confirmed for a given bank statement. |

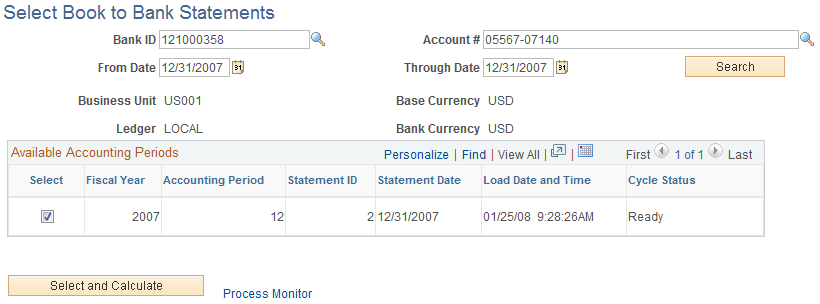

Use the Select Book to Bank Statements page (BNK_BTB_STMT_SEL) to select bank statements for Book to Bank reconciliation.

Schedule the process to perform Book to Bank data extraction and balance calculations.

Navigation:

This example illustrates the fields and controls on the Select Book to Bank Statements page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Bank ID |

Select the bank that the bank statements, which are ready for book to bank reconciliation, are associated. |

Account # (account number) |

Select the account number of the selected bank that the bank statements, which are ready for book to bank reconciliation, are associated. |

From Date and Through Date |

You can override these dates to display any accounting periods containing statements that have not been book to bank reconciled. |

Business Unit |

Displays the GL business unit specified for the selected bank account. |

Base Currency |

Displays the currency specified for the GL business unit specified for the selected bank account. |

Ledger |

Displays the primary ledger in the ledger group defined for the GL business unit specified for the selected bank account. |

Bank Currency |

Displays the currency specified for the selected bank account. |

Search |

Click this button to display any book to bank statements, which have not been reconciled, in the Available Accounting Periods grid. |

Available Accounting Periods Grid

A list of one or more accounting periods containing bank statements, which have not been scheduled for book to bank reconciliation appears in this grid.

Field or Control |

Description |

|---|---|

Select |

Select the check box for each of the bank statements for which you want run the Book to Bank Reconciliation process. If you select more than one statement for a fiscal year and accounting period, the system designates the statement with the highest Statement ID number as the statement from which it obtains the closing balance. This logic assumes that the statement with the highest Statement ID is the last statement for the period. |

Statement ID |

Identifies the bank statement that requires book to bank reconciliation for a specific fiscal year and accounting period. |

Statement Date |

Displays the date the bank statement was created. |

Load Date and Time |

Displays the date and time the bank statement transactions were loaded for reconciliation. |

Cycle Status |

Displays the current status of the reconciliation for each bank statement listed. This field displays one of these statuses:

|

Select and Calculate |

Select this button to create a process request, which schedules the Book to Bank Reconciliation Application Engine (TR_BTB_CALC) to run. Once the process runs, it performs the data extraction and balance calculations. |

Process Monitor |

Click this link to access the Process List page, which enables you to track the progress of the book to bank reconciliation processing by means of the process Instance. |

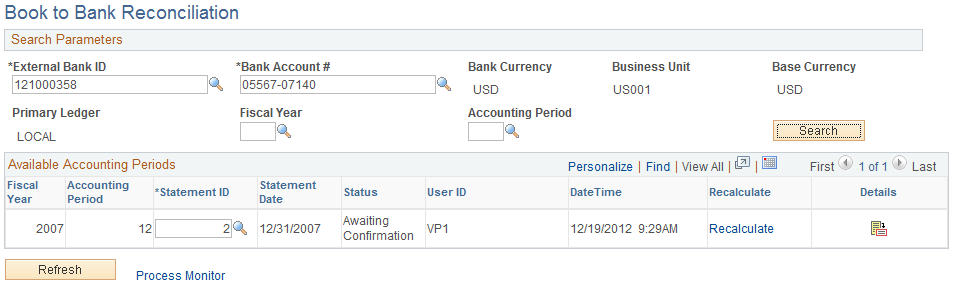

Use the Book to Bank Reconciliation page (BNK_BTB_REC_MGR) to search for statements marked ready for Book to Bank reconciliation, review balance details, and schedule the process to perform Book to Bank data extraction and balance calculations.

Navigation:

This example illustrates the fields and controls on the Book to Bank Reconciliation page. You can find definitions for the fields and controls later on this page.

Search Parameters

The search parameters are identical to the search parameters used for the Select Book to Bank Statements section.

Available Accounting Periods

Field or Control |

Description |

|---|---|

Statement ID |

The bank statement ID appears in this field. You can override this value to identify another bank statement. |

Status |

Displays the current status of the bank statement with regards to the Bank-to-Bank Reconciliation process. The statuses are:

|

Recalculate |

This process deletes any previously saved data and runs the Book to Bank Reconciliation Application Engine (TR_BTB_CALC) again, where it recalculates new balances using the original statement balance amounts with any added adjustment data to update any balance data that you changed on the Book to Bank Reconciliation Details page. Note: The Recalculate link is not available for selection for statements with a status of Calculating or Confirmed. |

|

Click the Details icon to access the Book to Bank Reconciliation Details page, where you can review and reconcile balances before and after each time you run the Book to Bank Reconciliation Application Engine program). Note: The Details icon is not available for selection for statements with a status of Calculating. |

Refresh |

Click this button to refresh the Available Accounting Periods grid. |

Process Monitor |

Click this link to track the progress of the Book to Bank Reconciliation Application Engine program after selecting the Recalculate button. |

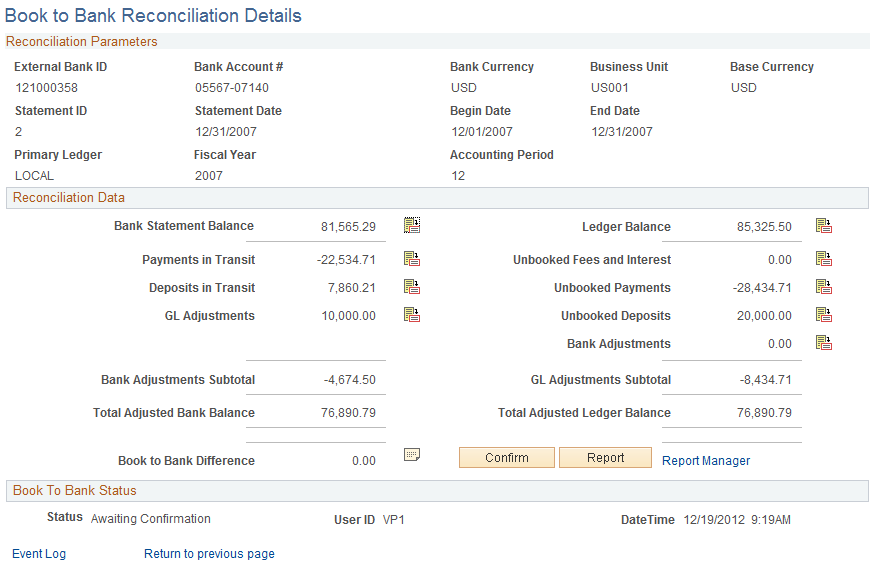

Use the Book to Bank Reconciliation Details page (BNK_BTB_HDR) to review your company's general ledger balances against bank-reported account balances in the bank statement.

You can also print a report of your Book to Bank adjustments.

Navigation:

Click Details icon in the Available Accounting Periods grid on the Book to Bank Reconciliation page.

This example illustrates the fields and controls on the Book to Bank Reconciliation Details page. You can find definitions for the fields and controls later on this page.

Reconciliation Data

Field or Control |

Description |

|---|---|

Bank Statement Balance |

Displays the Closing Balance (Statement Code 015) on the bank statement that occurs within the displayed fiscal year and accounting period Click the Bank Statement Balance icon to access the Bank Balance Entry page. This page displays the details concerning the statement bank balance and the funds available based on the balance. You can select the Bank Transaction Entry tab to display a list of the transactions that comprise the bank statement balance, along with transaction information, reconciliation information, and addenda information details. The bank statement balance appears as a link. Click this link to view currency revaluation information (when enabled). The system displays this link when the bank account's base currency and the general ledger account base currencies are different. |

Payments in Transit |

Displays the total of all disbursements that are not yet reconciled (outstanding transactions not yet presented to the bank but recorded in the system). It also includes manual accounting entries (created in Treasury) that have been finalized and posted to a ledger. This amount reduces the bank statement balance, which appears in the Bank Adjustments Subtotal field. Click the Payments in Transit icon to access the Payments in Transit page (BNK_BTB_DET_SEC), where you can review the transaction details of each of the payments in transit, and specify which payment transactions in transit to include in the bank adjustment subtotal amount. The transactions are automatically selected. Remove the check mark from the Select check box associated with a transaction and exclude the transaction from the Bank Adjustments Subtotal amount on the Book to Bank Reconciliation Details page, and from the book to bank reconciliation calculations. |

Deposits in Transit |

Displays the total of all the deposits that are booked into the system but not yet acknowledged by the bank. This amount increases the bank statement balance, which appears in the Bank Adjustments Subtotal field. Click the Deposits in Transit icon to access the Deposits in Transit page (BNK_BTB_DET_SEC), where you can review transaction details for each of the deposits in transit, and specify which deposit transactions in transit to include in the bank adjustment subtotal amount. The transactions are automatically selected. Remove the check mark from the Select check box associated with a transaction to exclude the transaction from the Bank Adjustments Subtotal amount on the Book to Bank Reconciliation Details page, and from the book to bank reconciliation calculations. |

GL Adjustments |

Displays the total of all posted general ledger transactions that have transaction dates that occur before or on the general ledger period end date. Click the GL Adjustments icon to access the GL Adjustments page (BNK_BTB_DET_SEC), where you can review transaction details for each adjustment, and specify which general ledger adjustments to include in the bank adjustment subtotal amount. The transactions are automatically selected. Remove the check mark from the Select check box associated with a transaction to exclude the transaction from the Bank Adjustments Subtotal amount on the Book to Bank Reconciliation Details page, and from the book to bank reconciliation calculations. |

Revaluation Amount |

Enter the currency revaluation amount to account for any currency conversion rounding errors. Use this field only if the bank account's base currency is different than the general ledger business unit's base currency. Important! Any changes that you make manually are lost when the system recalculates the balances and adjustments. |

Bank Adjustments Subtotal |

Displays the total of the values in the Payments in Transit, Deposits in Transit, and GL Adjustments fields. |

Total Adjusted Bank Balance |

Displays the sum of the values in the Bank Statement Balance and the Bank Adjusted Subtotal fields. |

Ledger Balance |

Displays the system side ledger balance for the bank account. The balance as of date is determined by the ledger's period end date. Click the Ledger Balance icon to access the Ledger Balance page (BNK_BTB_LED_SEC), where you can review the ChartField distribution amounts that comprise the total ledger balance. |

Unbooked Fees and Interest |

Displays the total of all bank transactions not yet booked in the system and which have transaction dates that are on or before the bank statement date. Click the Unbooked Fees and Interest icon to access the Unbooked Fees and Interest page (BNK_BTB_DET_SEC), where you can review transaction details, and specify which unbooked fees and interest transactions to include in the general ledger subtotal amount. The transactions are automatically selected. Remove the check mark from the Select check box associated with a transaction to exclude the transaction from the GL Adjustments Subtotalamount on the Book to Bank Reconciliation Details page, and from the book to bank reconciliation calculations. |

Unbooked Payments |

Displays the total of all unposted disbursements that exist in the bank statement but are not in the system, and which have transaction dates that are on or before the bank statement date. Click the Unbooked Payments icon to access the Unbooked Payments page (BNK_BTB_DET_SEC), where you can review transaction details, and specify which unbooked payment transactions to include in the general ledger subtotal amount. The transactions are automatically selected. Remove the check mark from the Select check box associated with a transaction to exclude the transaction from the GL Adjustments Subtotalamount on the Book to Bank Reconciliation Details page, and from the book to bank reconciliation calculations. |

Unbooked Deposits |

Displays the total of all unposted deposits that exist in the bank statement but are not in the system, and which have transaction dates that are on or before the bank statement date. Click the Unbooked Deposits icon to access the Unbooked Deposits page (BNK_BTB_DET_SEC), where you can review transaction details, and specify which unbooked deposit transactions to include in the general ledger subtotal amount. The transactions are automatically selected. Remove the check mark from the Select check box associated with a transaction to exclude the transaction from the GL Adjustments Subtotalamount on the Book to Bank Reconciliation Details page, and from the book to bank reconciliation calculations. |

Bank Adjustments |

Displays the total of all unposted bank transactions that exist in the bank statement but not in the system, and which have transaction dates that occur before or on the general ledger period end date. The displayed total includes:

Click the Bank Adjustments icon to access the Bank Adjustments page (BNK_BTB_DET_SEC), where you can review transaction details, and specify which bank adjustments to include in the general ledger subtotal amount. The transactions are automatically selected. Deselect the Select check box associated with a transaction to exclude the transaction from the GL Adjustments Subtotal amount on the Book to Bank Reconciliation Details page, and from the book to bank reconciliation calculations. |

GL Adjustments Subtotal |

Displays the total of the values in the Unbooked Fees and Interest, Unbooked Payments, Unbooked Deposits, and Bank Adjustments fields. |

Total Adjusted Ledger Balance |

Displays the sum of the values in the Ledger Balance and GL Adjustments Subtotal fields. |

Book to Bank Difference |

Displays the sum of the values in theTotal Adjusted Bank Balance and Total Adjusted Ledger Balance fields. Click the Book to Bank Notes icon to access the Book to Bank Notes page (BNK_BTB_FREEFORM), where you can add comments. |

Confirm |

Click to confirm that the Book to Bank Reconciliation process for this specific bank statement and fiscal period is complete. Then save the page. The Status field (in both the Book to Bank Status group box on the Book to Bank Reconciliation Details page and in the Available Accounting Period grid on the Book to Bank Reconciliation page) changes to Confirmed. This prevents other users from editing this particular reconciled statement. Note: You should carefully analyze your book to bank reconciliation results before confirming a statement. |

Report |

Click this button to generate the Book to Bank Reconciliation report. Use the Book to Bank Reconciliation report page (RUN_TRC4090) to generate a report of your book to bank reconciliation activities for a bank statement. |

Return to previous page |

Click to access the Book to Bank Reconcile page. |

Event Log |

Click this link to access the Event Log page, which is used to track the original book to bank reconciliation process, confirmation of the book to bank reconciliation process, and any overrides of a calculating or confirmed book to bank reconciliation. |

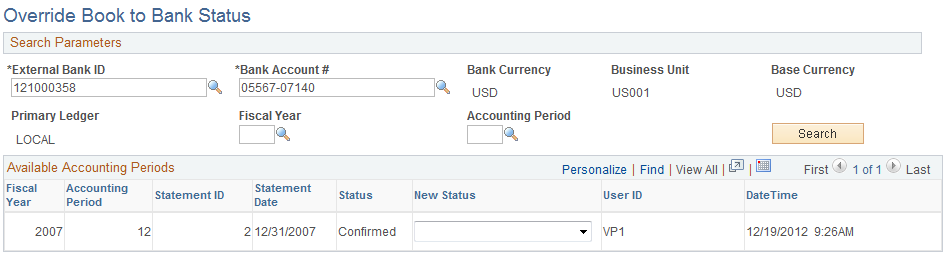

Use the Override Book to Bank Status page (BNK_BTB_REC_MGR) to override the book to bank status Confirmed for a given bank statement.

Navigation:

This example illustrates the fields and controls on the Override Book to Bank Status page. You can find definitions for the fields and controls later on this page.

Search Parameters

The search parameters are identical to the search parameters used for the Select Book to Bank Statements section.

Available Accounting Periods Grid

Field or Control |

Description |

|---|---|

Status |

Displays the current status of the book to bank reconciliation statement. |

New Status |

Select a status of Awaiting Confirmation from the drop-down list, when the current Status for the book to bank reconciliation statement is either Calculating or Confirmed. If the current Status field contains value of either New or Awaiting Confirmation, the New Status drop-down menu is not enabled. |

User ID |

Displays the ID of the user, who is accessing the Override Book to Bank Status component and page. Important! Your organization can limit access to this component and the ability to change the status of the book to bank reconciliation statement to users who are assigned to an administrator role using PeopleSoft Security. |

Date Time |

Displays the date and time the status was changed. Note: You can click the Event Log link on the Book to Bank Reconciliation Details page to view a history of the original book to bank processing, any confirmations, and any overrides for each bank statement. |