Understanding Letters of Credit

Use letters of credit to:

Protect against buyer risk.

If the buyer is of unknown creditworthiness, then the seller has the security of the bank's payment undertaking.

Protect against country risk.

The buyer may be willing and able to pay, but economic or political conditions in the buyer's country may prevent or delay payment. In these situations, a confirmed letter of credit is necessary. A bank in the seller's country will (for a fee) add its own payment undertaking to that of the issuing bank.

Meet mandatory requirements.

Letters of credit are also used as part of exchange control or import control regimes operating in the buyer's country.

Before the letter of credit can be issued, the buyer and seller must agree on all details of the commercial transaction, including:

Quantity, specification, and price.

Means of transport and latest date of dispatch.

Carriage and insurance arrangement.

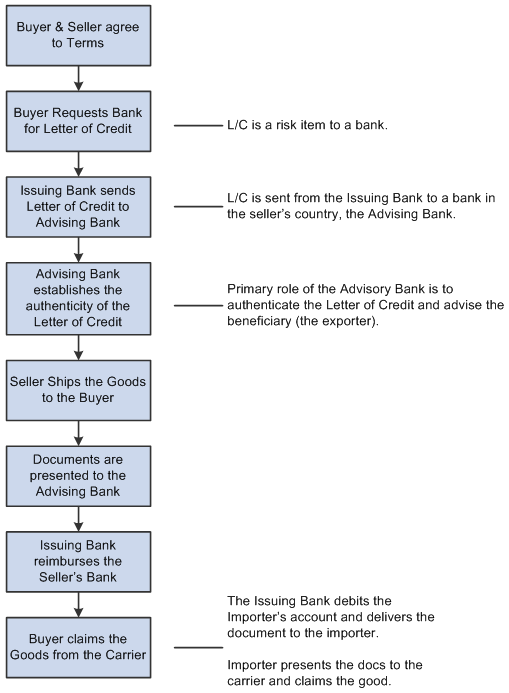

This diagram shows the letter of credit process between the buyer, seller, the buyer's issuing bank, and the seller's advising bank. In this process flow you begin with a terms agreement between the buyer and seller and then work through the buyer and seller's banks to validate funds so that the buyer can obtain the goods being purchased