Understanding Credit Card Processing

The credit card processing documentation provides an overview of traditional credit card processing, credit card processing using the hosted model, and the prerequisites for each.

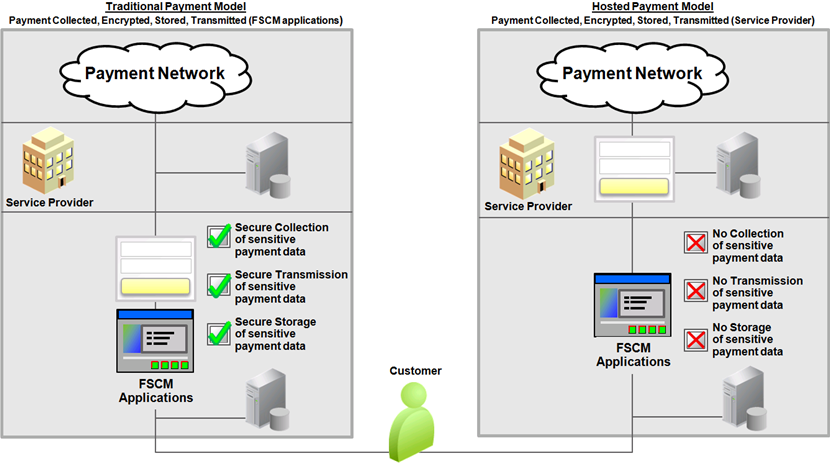

This diagram illustrates a side-by-side comparison of the traditional payment model in FSCM applications and the hosted payment model in which a third-party service provider stores and processes payments.

The following table provides a side-by-side comparison of data storage in the traditional model versus hosted model:

|

In the traditional credit card model, the following are stored locally: |

In the hosted implementation, the PeopleSoft Order to Cash system stores the following: |

|---|---|

|

First and last name of the card holder |

|

|

Credit Card type |

Credit card type |

|

Credit card number (encrypted) |

|

|

Last four digits of the credit card number |

Last four digits of the credit card number |

|

Expiration month and year |

|

|

Payment processor name |

Payment processor name |

|

Credit card address |

|

|

Phone number |

|

|

Email address |

|

|

Profile ID |

This section includes:

Prerequisites for using the traditional credit card model.

Credit card authorization status codes.

Authentication and security for credit card numbers.

You enter the same basic data for credit card payments, regardless of which PeopleSoft Order to Cash application you are using; the difference is where you enter it.

Note: After credit card numbers are entered, they are stored in an encrypted format. Once saved, only the last four digits of the card number appear on pages used to enter credit card information. Pages used to review the credit card information, such as the Customer Summary using Quick Customer Create, also display only the last four digits of the number.

Prerequisites for Using the Traditional Credit Card Model

Before you begin accepting credit card charges from customers, you must prepare the following:

Set up integration with a third-party credit card processor. See Setting Up Credit Card Integration for Integration Broker.

For more information about setting up credit card processors, see the product documentation for PeopleSoft Integration Interfaces.

Establish the types of credit cards (Visa, Master Card, and so on) that you will accept for payment. Use the Credit Card Type page () to specify different processors for each credit card type.

Create a default credit card group on theCredit Card Groups Page ().

See Setting Up Credit Card Options and Groups for more information.

Set up common credit card options on the Credit Card Options page ().

SeeSetting Up Credit Card Options and Groups for more information.

Credit Card Authorization Status Codes

The following table lists the authorization status codes that are used throughout credit card processing in PeopleSoft Order Management, Billing, and Receivables. The system either displays the status code or the description of the status.

|

Status Code |

Short Name, Long Name |

Comments |

Used In |

|---|---|---|---|

|

A |

Auth Authorized |

The transaction is approved and funds are reserved. You can obtain approvals through batch or manual credit card processing. |

OM - batch and manual |

|

B |

Billed |

The transaction is complete. The funds are charged to the credit card. All bill transactions must be preceded by an authorization. The term Captured is also used. |

BI |

|

C |

Cred Credited |

A credit has been authorized and processed for the transaction. The funds are credited back to the specified card. |

BI, OM Refunds |

|

D |

Denied |

The transaction has failed credit card processing and has been declined, or disallowed, by the organization issuing the credit card. |

OM, BI, AR |

|

E |

Validation Errors |

The credit card payment has failed PeopleSoft application validation edits and has not been processed by the third-party provider for authorization and settlement. Most errors are discovered when editing customer or credit card information. |

AR |

|

F |

Reversal Auth Reversal |

An authorization was canceled to free up funds on a credit card. |

OM, BI |

|

G |

Validated |

OM |

|

|

H |

Rev Denied Auth Reversal Denied |

The authorization reversal transmission was denied by the third-party processor. |

OM |

|

J |

Reauth Reauthorize |

Issue another authorization request for authorizations that have become stale. |

OM |

|

K |

No Action |

A credit card payment worksheet has been created but is not ready to be submitted for authorization and settlement. |

OM, BI, AR |

|

M |

Man Apprv Manually Approved/Settled |

The transaction received verbal approval. Enter manual approvals on the Review Pending Cred Card Trans - Credit Card Address page in PeopleSoft Billing. |

BI, AR |

|

N |

Chg to Trm Change to Terms |

The payment type for the transaction has been changed from Credit Card to Payment Terms. Changes to payment terms are made on the Pending CC Trans page in PeopleSoft Order Management and the Review Pending Cred Card Trans page in PeopleSoft Billing. The Process Credit Card Invoices process picks up the transaction the next time you run the process. |

OM, BI |

|

P |

Auth/Bill Authorized and Billed |

The transaction was successfully authorized and billed. |

OM, BI, AR |

|

R |

Processing |

Indicates that the Credit Card Processor is working with the payment. |

AR |

|

T |

Cancel Ord Cancel Order |

Indicates a canceled credit card order. The transaction is not subject to further processing. Cancellations are entered on the Pending Credit Card Trans page and on the sales Order Entry Form page. |

OM only |

|

U |

Unproc/Ret Unprocessed/Retry |

The transaction has not been processed or a previous authorization has failed and is being resubmitted for inclusion in the next CC Processing run. |

OM, BI, AR |

|

V |

Pending Approval |

The credit card payment cannot be sent to the third-party provider for authorization and settlement until a user manually reviews and submits the payment. |

AR |

|

W |

DelSettle Delete after Settlement |

A credit card payment that had been previously authorized and billed or manually approved/settled has been deleted. |

AR |

|

X |

Deleted |

A credit card payment worksheet has been created but has been deleted before authorization and settlement. |

AR |

|

Y |

Cancelled |

A credit card payment that has been ready for authorization and payment has been withdrawn for payment. The credit card payment worksheet has not been deleted, but the credit card payment will not be attempted. |

AR |

|

Z |

Zero Dollar Payment |

A credit card payment worksheet has been created with a monetary value of 0. This status accommodates credit card payment worksheets that are created for maintenance purposes, for example, for automated write-off processing or in situations of the net credit and debit items selected on a credit card worksheet being 0. |

AR |

Authentication and Security for Credit Card Numbers

CVV is an authentication procedure established to reduce card mishandling during internet transactions. A Security Code field is available on all credit card related pages to prompt for CVV number. A link next to the Security Code field enables users to get additional information about the CVV number. Click the link to open a secondary page that explains what a security code is and how to find it on a credit card.

The CVV number is not permanently stored in the database. Also, the CVV number is not retained after a particular transaction is authorized or declined. A CVV number needs to be stored temporarily only in special cases, such as during batch processing of authorization transactions in Order Management and Billing. In such a scenario, the CVV number will be temporarily stored and discarded as soon as the batch transaction is processed.

The security code for credit cards needs to be enabled on the Credit Card Options Page (). If the security code field is not enabled, the field will not appear in the credit card pages.

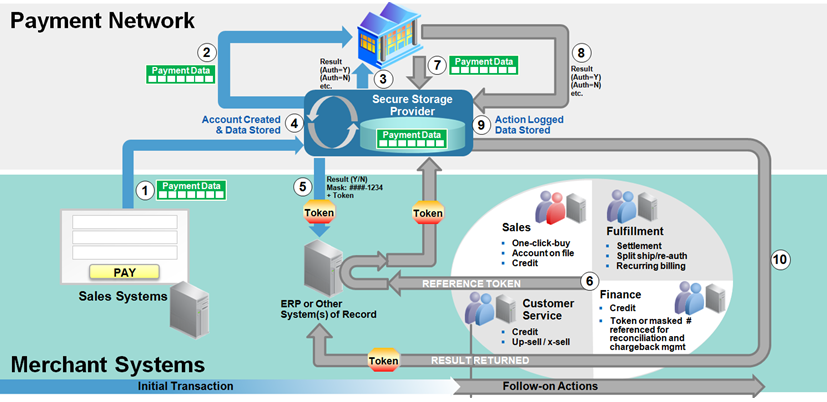

PeopleSoft FSCM provides a framework in the Order to Cash modules (Order Management, Billing, eBill Payment, and Accounts Receivable) to facilitate the collection and processing of payment information by third-party credit card hosts. Businesses with an Order to Cash system can convert from a traditional credit card model (local storage of credit card data) to a hosted model, where a third party hosts or stores credit card data.

This diagram illustrates the pathway of a payment beginning in a merchant system such as PeopleSoft Order to Cash and processed through a third-party payment network. Payment results are referenced by the appearance of tokens between the merchant system and the payment network.

This section includes:

Prerequisites for using the hosted credit card model.

Example of the Credit Card Data page in a system that uses hosted processing.

Prerequisites for Using the Hosted Credit Card Model

Before you begin using the hosted credit card model, you must prepare your system:

Set up a third-party payment processor. Multiple processors can now be set up and assigned to a specific credit card type.

Create a default credit card group for a specific credit card type at the system level and, optionally, at the business-unit level.

Convert your existing credit card data into profiles and transfer locally stored credit card data to the third-party credit card processor.

See the documentation for the Convert Credit Card Data Page or Setting Up Credit Card Processing for a Hosted Implementation

Wipe all credit card data from records in your PeopleSoft system.

See the documentation for the Remove Credit Card Data Pageor Setting Up Credit Card Processing for a Hosted Implementation

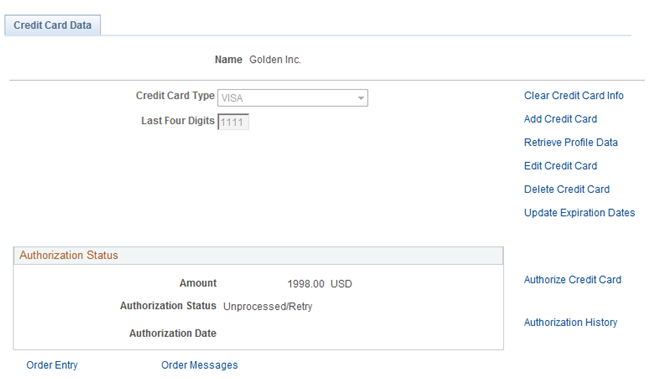

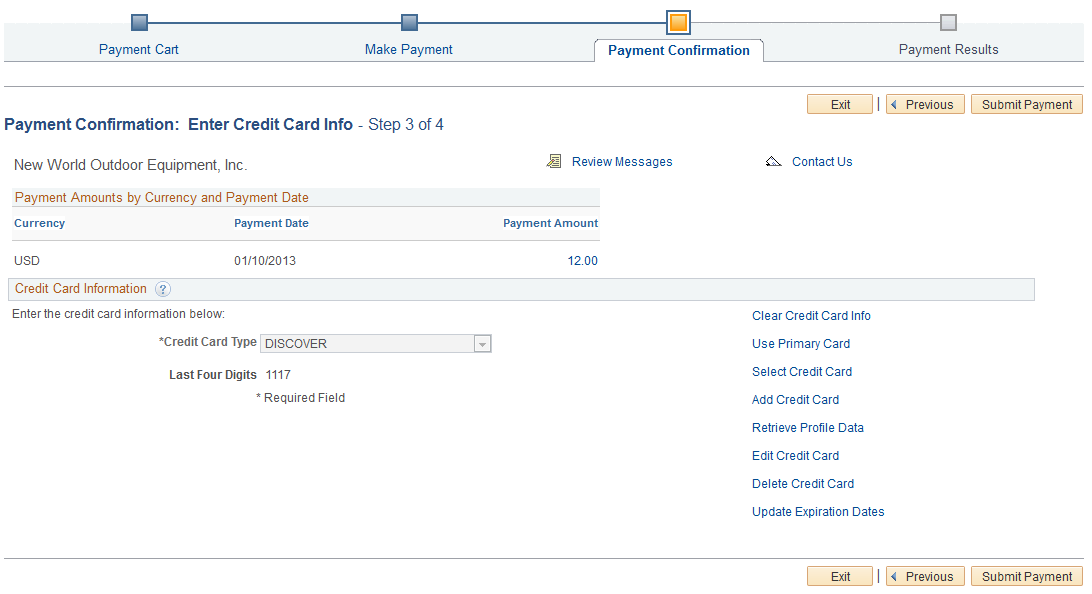

The action links on the credit card data or detail pages vary depending on the setup of your Order to Cash system for a traditional credit card implementation or a hosted credit card implementation. For example, after converting to a hosted credit card implementation, the Credit Card Data page shows only the credit card data needed to create a token ID that matches up information between the PeopleSoft Order to Cash system and the profile now administered by the third-party processor.

Credit card action links appear on Order to Cash pages, including but not limited to those listed here:

Header - Credit Card page (Billing)

This page is accessed during express bill entry or standard bill entry when the payment type is Credit Card.

Payment Confirmation: Enter Credit Card Info page in the Payment Cart horizontal navigation (eBill Payment)

Credit Card Data page (Order Management)

Payment Option page under Express Order Add/Edit, Additional Information - Card page under Counter Sale, Refund Payment Groups page under RMA, Edit Credit Card Transactions page under Identify Pending Transactions (Order Management)

Cash Drawer Receipt - Additional Information page for Credit Card (Receivables)

Credit Card Details page (Receivables)

This page is available wherever the Pay by Credit Card or Credit Card Details links appear, such as on credit card worksheets and on the Credit Card Workbench, Item Detail, Account Overview, and Receivables WorkCenter pages.

Using Credit Card Action Links in the Hosted Model

In general, the action links appear on the right side of a page that contains credit card data.

This example illustrates the fields and controls on the Credit Card Data page in a system with hosted credit card processing.

This example illustrates the fields and controls on the Payment Confirmation: Enter Credit Card Info page in a hosted credit card implementation.

Field or Control |

Description |

|---|---|

Clear Credit Card Info |

Click this link to clear the data existing in fields that appear on the page. This action does not affect stored credit card data. |

Use Primary Card |

Click this link to populate the Credit Card Information fields with card type and last four digits using the primary credit card as designated in this contact’s profile for a customer. |

Select Credit Card |

Click this link to open the Credit Card Selection page, which lists credit cards associated with this customer contact. This link is available if the contact has at least one saved temporary credit card profile. |

Add Credit Card |

Click this link to add data for a new credit card. This link transfers you to the third-party supplier set up for payment storage and processing in the hosted model. You enter credit card information on the hosted page, which is pre-populated with the customer contact’s billing information. |

Review Profile Data |

Click this link to send a request to the hosted site to retrieve profile data and then display it on the PeopleSoft page. Retrieved profile data is display-only. This link is available when the credit card type and last four digits appear on the page. |

Edit Credit Card |

Click this link to transfer to the hosted Website, where the customer contact can edit the card information. This link is available when the credit card type and last four digits appear on the page. |

Delete Credit Card |

Click this link to delete a credit card profile associated with this customer contact. If the profile is not used in any pending transaction, a background request deletes the profile in the hosted site. This link is available when the credit card type and last four digits appear on the page. |

Update Expiration Dates |

Click this link to update expiration month and year without transferring to the hosted site. When you enter the new expiration date, a background process updates the hosted site. This link is available when the credit card type and last four digits appear on the page. |

If payment tokenization is enabled for online transactions, the PeopleSoft Order to Cash system requires the use of hosted profiles and order pages. For transactions involving customer contacts that do not have permanent profiles, the PeopleSoft system may create a temporary profile. In this case, the PeopleSoft system is set up with one of these two options:

The temporary profile is set up before the credit card is processed on the hosted order page. This value is the default.

In this case, if no credit card profile exists for the customer contact in the PeopleSoft system, the customer must click the Add Credit Card link to establish a profile before continuing with the transaction.

The temporary profile is automatically created after the online transaction is complete, using the same data as in the credit card transaction.

Using Credit Card Action Links in the Traditional Model

In general, the action links appear on the right side of a page that contains credit card data.

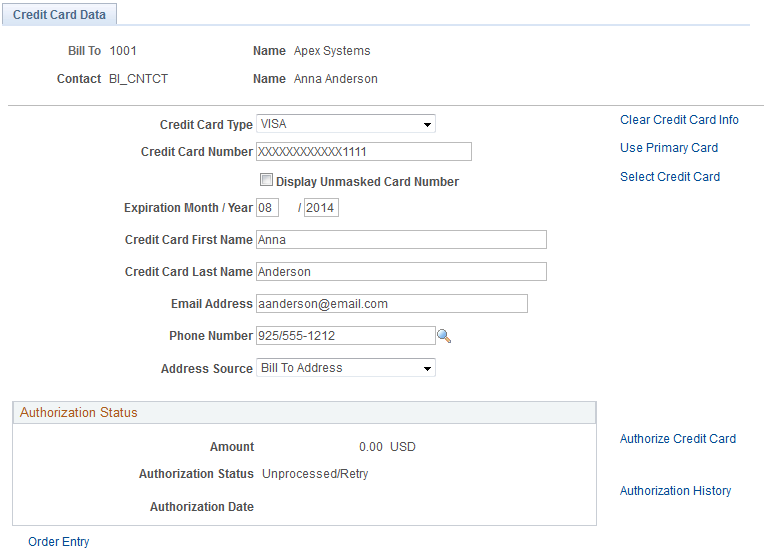

This example illustrates the fields and controls on the Credit Card Data page in Order Management, using the traditional credit card model. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Clear Credit Card Info |

Click this link to clear the data existing in fields showing on the page. This action does not affect stored credit card data. |

Use Primary Card |

Click this link to populate the Credit Card Information fields with data using the primary credit card as designated in this contact’s profile for a customer. |

Select Credit Card |

Click this link to open the Credit Card Selection page, which lists credit cards associated with this customer contact. This link is available if the contact has at least one saved permanent credit card stored in the system. |

Authorize Credit Card |

Click this link to authorize payment on this credit card. |

Authorization History |

Click this link to review the authorization history for this credit card. |