Establishing Intrastat Characteristics

Each EU member state may require different information on Intrastat reports. You need to set up reporting characteristics for both arrivals and dispatches for each country in which you file an Intrastat return.

Note: Only countries that are designated as EU member states on the Country page in the Location menu are available for selection. Select Set Up Financials/Supply Chain and then Common Definitions to access the Location menu.

To establish Intrastat characteristics, use the Intrastat Characteristics component (IST_COUNTRY_TBL).

This section discusses how to establish Intrastat characteristics.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

IST_COUNTRY_TBL |

Select the information that individual countries require for Intrastat reports. |

|

|

IST_COUNTRY_TBL2 |

Select additional data, and specify the format of the information for the Intrastat form. |

|

|

IST_STATVAL_SEC |

Define the statistical value calculation factors to apply against invoice amounts to calculate the statistical value. |

|

|

IST_CNTRY_EXCP_SEC |

Limit the Intrastat information that is reported for exception transactions. |

Use the Country Characteristics - Statutory GL Activity page (IST_COUNTRY_TBL) to select the information that individual countries require for Intrastat reports.

Navigation:

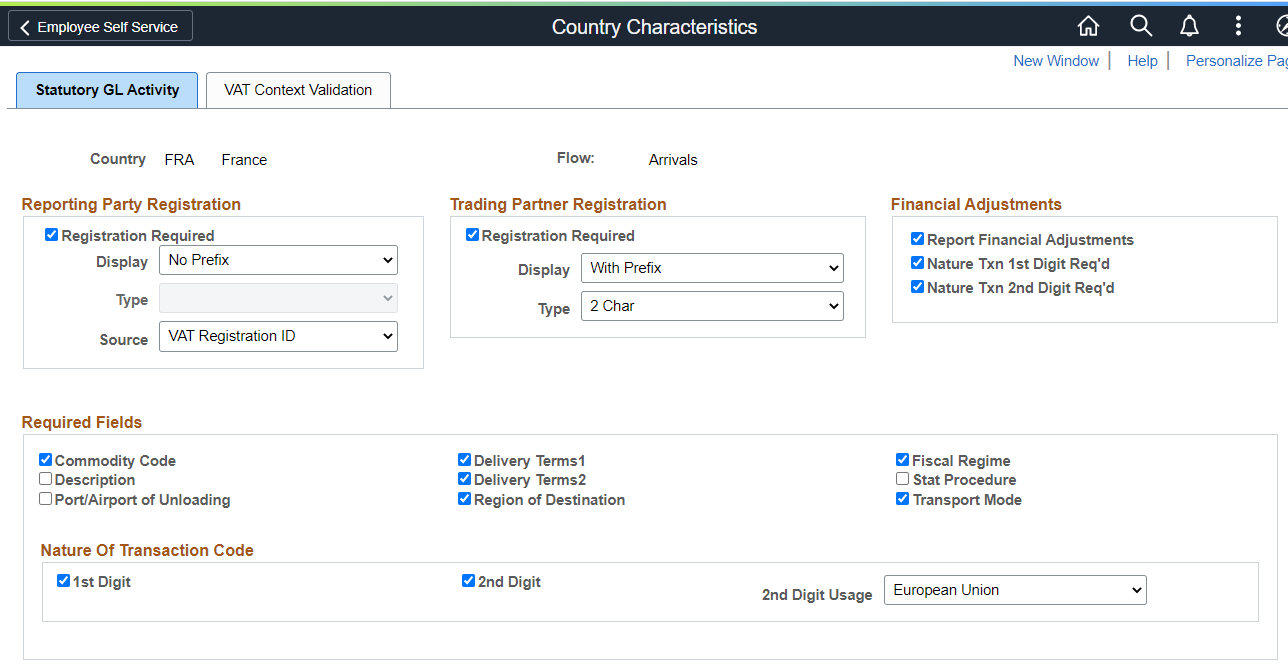

This example illustrates the fields and controls on the Country Characteristics - Statutory GL Activity page.

Reporting Party Registration

Field or Control |

Description |

|---|---|

Registration Required |

Indicates that you, as an Intrastat declarant, are required to include your VAT registration ID on Intrastat reporting forms. |

Display |

Indicates if you are required to include a country code prefix for the VAT ID. Options are Prefix and No Prefix. |

Type |

Select a type of country code prefix. |

Source |

The VAT registration ID values include: VAT: The VAT registration number. Local: A local tax ID that some countries use. |

Trading Partner Registration

Field or Control |

Description |

|---|---|

Registration Required |

Select to indicate that you must provide your trading partner's VAT registration ID. The partner VAT number is printed on these report: ISTX0050, ISTX0100, and ISTX0200 |

|

Display |

Select With Prefix if you are required to include a country prefix for the trading partner's VAT ID. This field is only available when the Registration Required check box is selected. |

|

Type |

Select the prefix type. This field is only available when the Display field has a value. |

Financial Adjustments

Field or Control |

Description |

|---|---|

Report Financial Adjustments |

Indicates that you must report financial adjustments, such as debit and credit notes |

Nature Txn 1st Digit Req'd (nature of transaction first digit required) |

Indicates that reporting rules require that you identify the nature of the transaction for financial adjustments. |

Nature Txn 2nd Digit Req'd (nature of transaction second digit required) |

Indicates that you require the additional detail that is provided by a second set of nature-of-transaction values. |

Required Fields

Select the information to include on the Intrastat report forms. You cannot select both Fiscal Regime and Stat Procedure (statistical procedure). Several of the field labels in the Required Fields group box change depending on the flow that you selected.

Nature of Transaction Code

Field or Control |

Description |

|---|---|

1st Digit |

Indicates that you must provide a nature of transaction code on Intrastat reports for the selected country and flow. |

2nd Digit |

Click this check box to indicate that you require the additional detail that is provided by a second set of nature-of-transaction values. |

2nd Digit Usage |

Select the delivered European Union, or United Kingdom 2nd digit usage identifier. You can also select from this prompt an appropriate usage identifier for a user defined set of 2nd digits if you have previously defined that set for another EU country. When you select a 2nd digit usage identifier option, its value determines which set of 2nd digit values the system uses. |

When you complete this setup, the Nature of Transaction Code values are available for use on the Intrastat-applicable transaction. When entering a transaction, you are prompted for the first and second digits of the Nature of Transaction Code on the Line Detail page. The list of values that are available for the 2nd digit is dependent on the usage identifier that you specify for the Intrastat reporting country, the value that you specify for the first digit, and the set of 2nd digit values that are associated with that 1st digit for that usage identifier

Use the Country Characteristics - VAT Context Validation page (IST_COUNTRY_TBL2) to select additional data, and specify the format of the information for the Intrastat form.

Navigation:

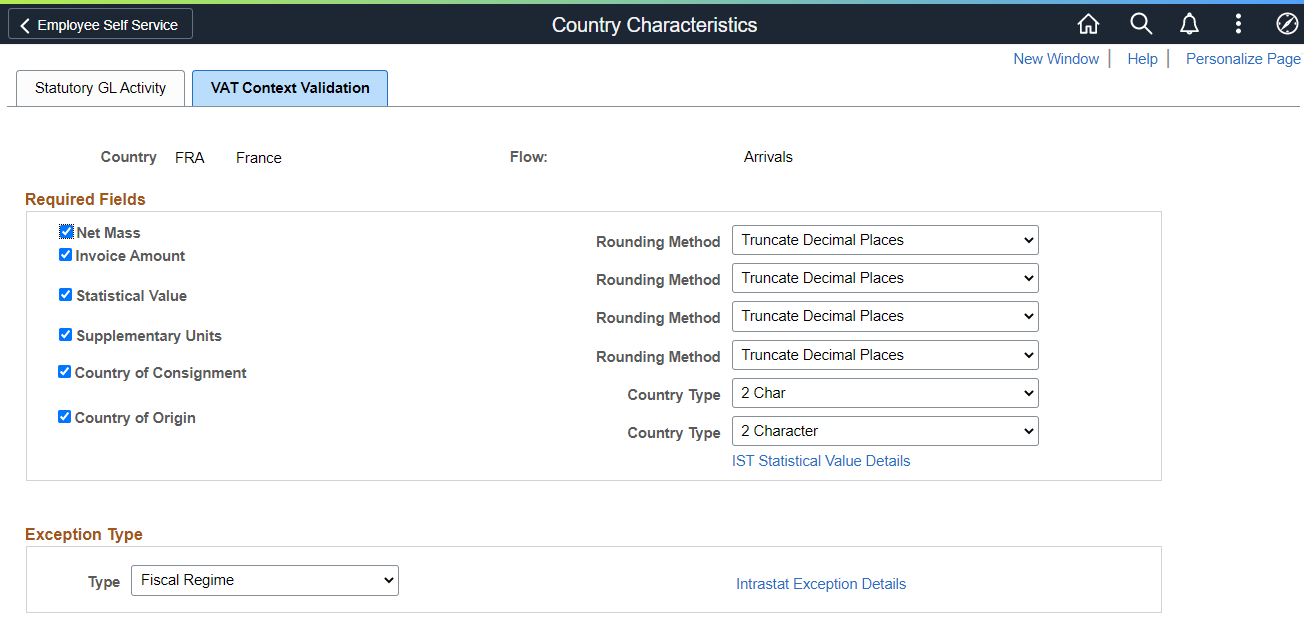

This example illustrates the fields and controls on the Country Characteristics - VAT Context Validation page.

Required Fields

Field or Control |

Description |

|---|---|

Rounding Method (Applicable to Net Mass, Invoice Amount, Statistical Value, and Supplementary Units) |

Determines the format for the corresponding fields. The following results are available: Normal: Rounds up or down to the nearest whole unit. For example, quantities less than 500 grams round down, and those between 500 and 999 grams round up. Truncate: Rounds down to the nearest whole unit. Up: Rounds up to the nearest whole unit. |

Country Type (Applicable to Country of Destination or Consignment, and Country of Origin) |

Determines the format for the corresponding country codes. The following values are available: 2 Char — prints the 2 character country code 3 Char — prints the 3 character country code 3 Numeric — prints the 3 digit numeric country code |

Invoice Amount |

The invoice amount for the goods shipped or received. |

Statistical Value |

This may be the same as the invoice amount, but the value generally differs. Within PeopleSoft applications, user-defined statistical value calculation factors are applied to the invoice amount to calculate the reported statistical value. Refer to each country's Intrastat Reporting requirements documents to establish how the statistical value is determined and to guide the setup of the calculation factors. |

Supplementary Units |

Indicates that you must use supplementary units for the selected country and flow to report transactions that involve commodity codes that include supplementary units. |

Country of Destination or Consignment (depending on the flow selected) |

Represents a trading partner's country. |

Country of Origin |

For arrivals, the country in which the goods were created or assembled. |

IST Statistical Value Details |

Click to access a page where you define the calculation factors that the system applies to the invoice amount to determine the statistical value for reporting. |

Exception Type

For some EU member states, entries for certain categories of transactions, such as financial adjustments or reconciliation entries, may not require all the information that Intrastat transactions normally require. Each member state has its own mechanism for identifying these exception transactions. France, for example, uses fiscal regimes, while the U.K. uses the second digit of the nature of transaction code.

Field or Control |

Description |

|---|---|

Type |

Specify the type of information that is used to identify exception transactions. |

Intrastat Exception Details |

Click to access a page where you define the information that is required for specific exceptions. |

Note: You cannot select Nature of Txn 2nd Digit, Fiscal Regime, or Statistical Procedure as an exception type unless they are selected in the Required Fields group box on the Intrastat Characteristics - Option a page.

Use the IST Statistical Value Details page (IST_STATVAL_SEC) to define the statistical value calculation factors to apply against invoice amounts to calculate the statistical value.

Navigation:

Click the IST Statistical Value Details link on the Option 2 page.

For each country and flow, specify whether Port/Airport, EU Commodity Code, Delivery Terms, or Transport Mode are required for defining the statistical value factors. Select values for those fields in the lower portion of the page.

Field or Control |

Description |

|---|---|

Country of Cons/Dest (country of consignment/destination) |

Select a country code for the trading partner. |

Port or Airport |

Select the port or airport code. This is required if you have specified that port or airport is required for the statistical value calculation. |

Delivery Terms 1 |

Select if you have specified that Delivery Terms are required for the statistical value calculation. |

Transport Mode |

Select if you have specified that Transport Mode is required for the statistical value calculation. |

Statistical Value Factor |

Specify a number or an amount to apply against the invoice amount. |

Multiply or Divide |

Specify how to calculate the Statistical Value. Select Multiply if you want to multiply the invoice value by the statistical value factor. Select Divide if you want to divide the invoice value by the statistical value factor. |

Note: Only countries that are designated as EU member states on the Country page in the Location menu are available for selection. Select Set Up Financials/Supply Chain, Common Definitions to access the Location menu.

Use the Intrastat Exception Details page (IST_CNTRY_EXCP_SEC) to limit the Intrastat information that is reported for exception transactions.

Navigation:

Click the Intrastat Exception Details link on the Option 2 page.

Select an exception code. Depending on the value that you select on the Intrastat Characteristics - Option b page, this is either the second digit of a nature of transaction code, a fiscal regime, or a statistical procedure.

Required Fields

Select only those pieces of information that are required for the specific exception.

Note: Fields that are not selected on the Option a and Option b pages of the Intrastat Characteristics component are not available here.