Setting Up VAT Entities

To set up VAT entities, use the VAT Entity ID component (VAT_ENTITY_ID).

Use the VAT_ENTITY_ID component interface to load data into the tables for the VAT Entity ID component.

This section provides an overview of VAT entity setup .

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VAT_ENTITY_ID |

Define or update VAT entities used to report VAT. |

|

|

VAT_ENT_ADDR_SEC |

Specify VAT report addresses. |

|

|

VAT_ENT_EXCPTN_SEC |

Indicate whether the VAT entity has been granted an exoneration or suspension from paying VAT in this country. |

|

|

VAT_ENT_VATRPT_SEC |

Define the contact information that you want printed on your VAT reports and the processes used to generate your reports. |

VAT entities are the level within your organization at which the VAT return is filed. You can associate one or more PeopleSoft General Ledger business units with a VAT entity. The PeopleSoft Asset Management, Billing, Receivables, Purchasing, Payables, Expenses, Treasury and, indirectly, Order Management business units associated with those general ledger business units are then VAT-enabled and all of the transactions for PeopleSoft Asset Management, Billing, Receivables, Payables, Expenses, and Treasury are available for reporting by the VAT entity.

Because the VAT entity is the entity that reports VAT, the following parameters related to filing the VAT return are recorded here:

VAT addresses.

VAT exceptions (exoneration or suspension).

VAT report details

Intrastat report details.

Complete these steps to set up VAT entities:

Create a VAT entity.

A VAT entity can have multiple business units associated with it, but a general ledger business unit cannot be associated with more than one VAT entity.

Define the address to be used by the organization.

Indicate whether the VAT entity is exempt from paying VAT in a particular country.

VAT entities are purchasing organizations, so they are sometimes granted an exemption from paying VAT because of the nature of their business. The exemption may be temporary or permanent. For example, most governments grant government agencies a permanent exoneration from paying VAT because the agencies are part of the government. In France, a VAT entity may be granted a temporary suspension from paying VAT if it regularly receives a large VAT refund. The government may grant a temporary suspension to reduce or eliminate the refund.

Define VAT report details, such as the contact information printed on reports and the process used to run reports.

Use the Identification page (VAT_ENTITY_ID) to define or update VAT entities used to report VAT.

Navigation:

Field or Control |

Description |

|---|---|

VAT Entity |

Code identifying the VAT reporting entity. |

Description and Short Description |

Enter a description and short description. |

Registration

Use this group box to specify every country where this VAT entity is registered. To add more countries, add more rows. You can select only from countries defined on the VAT Country Definition page.

Field or Control |

Description |

|---|---|

Country |

Select the country in which this VAT entity is registered. |

Name 1 and Name 2 |

Enter the names used by the VAT entity in a country. |

Home Country |

If selected, designates the home country. If you enter multiple countries, only one country can be the home country. |

VAT Registration ID |

The applicable two-character country code appears to the left of the VAT Registration ID field, so you do not need to include this code as part of your VAT registration ID. The VAT Registration ID field is a left-justified character field of up to 20 characters. For European Community countries, the registration ID that you enter here prints on each invoice for intra-EC sales. Note: PeopleSoft delivers the required 2-character country codes that appear in front of the VAT registration ID. The delivered country codes cannot be changed. The Country Stat Rpt Codes page includes a 2–character VAT country code for those countries with different requirements. (Setup Financials/Supply Chain, Common Definitions, Location, Country Statistics). See Country Stat Rpt Codes Page. See PeopleSoft Enterprise Application Fundamentals Documentation, Defining Financials and Supply Chain Management Common Definitions, Defining Countries for Reporting. |

Administrative ID |

Used in reports. For France, use Siren. For Australia, use the GST branch ID, if applicable. For Canada, use the account identifier. |

Local VAT ID |

Enter if required. In most countries, the VAT registration ID and the local VAT ID are the same. The Local VAT ID field is a left-justified character field of up to 20 characters. |

Region |

Region in which the entity is located. |

Location SetID and Location |

Location and location SetID for this entity. |

Accounting Scheme |

Specifies how you account for VAT in conjunction with the VAT declaration point. Non-cash (Accrual) is used when the declaration point is at invoice, delivery, or accounting date and Cash Accounting when the declaration point is at payment. Note: This field is for informational purposes only and is used on the Australian BAS report. |

Golden Tax Reporting Entity |

Select the check box to indicate that the VAT entity is a Golden Tax Reporting entity. Selecting this check box enables the Golden Tax features for all Billing business units linked with the VAT entity. |

VAT Default |

Click to access the VAT Defaults Setup page. The system transfers you directly to the VAT Defaults Setup component with the applicable fields for the VAT entity registration driver and entered VAT entity. Here, you can specify VAT defaults for the entity. Note: This is the same page you can access using the VAT Defaults Setup component described later in this topic. |

VAT Addresses |

Click to access the VAT Report Addresses page on which you can indicate the address to use on the VAT return. |

Exception Details |

Click to access the VAT Entity - Exceptions page, on which you can indicate whether the VAT entity should be permanently or temporarily excused from paying VAT. |

VAT Report Details |

Click to access the VAT Entity - VAT Reports page, on which you can enter the contact name, telephone number, and other identifying information that you want printed on reports. You can also use this page to select the processes to use to generate reports. |

Intrastat Report Details |

Click to access the Intrastat Reporting Details page, on which you can enter the contact name, telephone number, and other identifying information that you want printed on reports. You can also use this page to select the processes to use to generate Intrastat reports. Note: This page is not discussed in this section. See the Intrastat topic in this documentation for more detailed information about Intrastat reporting. |

GL Business Units

Use this group box to link the VAT entity to one or more general ledger business units. A VAT entity can have multiple business units associated with it, but a general ledger business unit cannot be associated with more than one VAT entity.

Note: For PeopleSoft Billing, linking a general ledger business unit to a VAT entity on this page does not automatically enable VAT for any PeopleSoft Billing business units already associated with the general ledger business unit. After you link the general ledger business unit to a VAT entity, you must go to the Billing Business Unit page to relink your Billing business unit to this general ledger business unit.

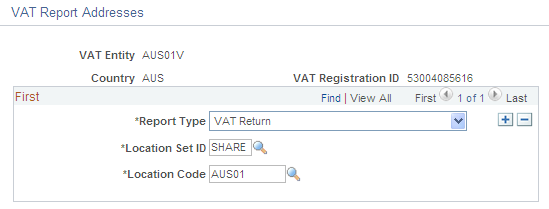

Use the VAT Report Addresses page (VAT_ENT_ADDR_SEC) to specify VAT report addresses.

Navigation:

Click the VAT Addresses link on the Identification page.

This example illustrates the fields and controls on the VAT Report Addresses page. You can find definitions for the fields and controls later on this page.

Note: You use this page to specify report addresses for your VAT return. These addresses can be used differently by each country. For example, in Germany, this page is used to print the address to which the VAT return is sent. Elsewhere, it is used to print the address of the reporting organization.

Field or Control |

Description |

|---|---|

Report Type |

Select the type of VAT report. Values are:

|

Location SetID and Location Code |

Select the location SetID and code to use for the address. |

You can add multiple rows for different report types. Click OK to save your changes and return to the Identification page.

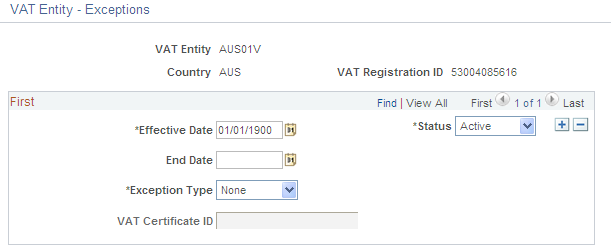

Use the VAT Entity - Exceptions page (VAT_ENT_EXCPTN_SEC) to indicate whether the VAT entity has been granted an exoneration or suspension from paying VAT in this country.

Navigation:

Click the Exception Details link on the Identification page.

This example illustrates the fields and controls on the VAT Entity - Exceptions page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date and Status |

Specify the effective date and status for each exception that you enter. |

End Date |

Enter the date that the exoneration or suspension ends, if applicable. |

Exception Type |

Select the type of exception. Options are: None. Exonerated: Select if the VAT entity is permanently excused from paying VAT. Suspended: Select if the VAT entity is temporarily excused from paying VAT. |

VAT Certificate ID |

Sometimes a government issues a certificate to show proof of an exception. Use this field to enter the VAT Certificate ID that was issued. |

Note: Generally, when an organization receives a temporary suspension from paying VAT, the suspension applies until a specific date or until the organization reaches a specified purchasing limit. Any limit based on the amount of purchases is not tracked in the PeopleSoft system; you must track it manually.

Click OK to save your changes and return to the Identification page.

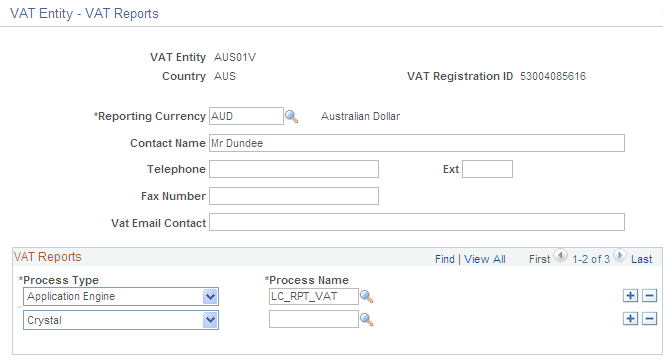

Use the VAT Entity - VAT Reports page (VAT_ENT_VATRPT_SEC) to define the contact information that you want printed on your VAT reports and the processes used to generate your reports.

Navigation:

Click the VAT Report Details link on the Identification page.

This example illustrates the fields and controls on the VAT Entity - VAT Reports page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Reporting Currency |

Select the currency to print on VAT returns for this country. If reporting currency amounts have not been entered on the transaction and if the transaction and base currencies differ from the reporting currency, conversion occurs when the report extract runs. |

Contact Name, Telephone, Ext, Fax Number, Vat Email Contact |

Enter the applicable contact information. |

Process Type |

Select the applicable process type for the report. |

Process Name |

Select the process name for this report. |

Click OK to save your changes and return to the Identification page.

Note: You cannot run a VAT report unless you specify a process type and name on this page. You define a VAT report using the VAT Report Definition component described later in this topic.

In addition, the VAT Transaction report cannot be used for an entity unless it is also defined here.