Setting Up the Common Tax Structure

To set up the common tax structure, use the Tax (EXS_TAX_CMPNT), Tax Dependency Code (EXS_TAX_DPNDNCY), Tax Calculation Code (EXS_TAX_RATE), Tax Category (EXS_TAX_CATG) and Tax Determination (EXS_TAX_DETERM) components.

This section discusses how to set up the common tax structure.

Note: Common tax structure setup for customs duty is shared unless otherwise specified.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EXS_TAX_CMPNT |

Define a tax component code for each tax that is required. |

|

|

EXS_TAX_DPNDNCY |

Define tax dependency codes that indicate the basis for calculating tax, as well as the precedence of taxes of the same tax type that must be included in the calculation. |

|

|

EXS_TAX_RATE |

Define tax calculation codes that group tax component codes of the same tax type along with tax rates and other attributes. |

|

|

EXS_TAX_CATG |

Define tax categories for assignment to suppliers, customers, product kits, and items for customs duty tax determination. |

|

|

EXS_TAX_DETERM |

Assign a tax calculation code to one or more tax determination parameters. Available field values on the page are based on Tax Determination hierarchy. |

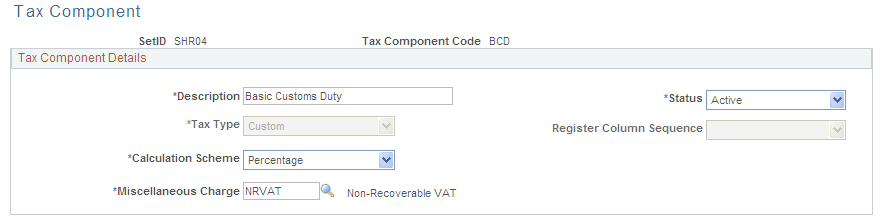

Use the Tax Component page (EXS_TAX_CMPNT) to define a tax component code for each tax that is required.

Navigation:

This example illustrates the fields and controls on the Tax Component page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Component Code |

The tax component code that you enter on the prompt page appears. You create tax component codes for each required tax. Use the Tax Calculation Code page to combine tax component codes of the same tax type. |

Tax Component Details

Field or Control |

Description |

|---|---|

Tax Type |

Select a tax type with which to associate the tax component code. Defining this information filters tax component codes in the Tax Calculation Code table (EXS_TAX_RATE) to ensure that tax calculation code definitions contain only tax component code lines of the same tax type. Values are Custom. |

Register Column Sequence |

Select the column sequence in which this tax component code should appear in the register. Entering a field value is applicable only if the Tax Type field is set to Excise. Values are: Column 1 - 6: Select the register column in which you want the details of the tax component code to appear in the excise registers. You can specify placement in up to six columns, but use the sixth column for the Others component code. For example, if you have more than six tax component codes, you can combine multiple tax codes within column 6. In this case, column 6 in the excise registers contains the sum of the multiple tax code amounts. |

Calculation Scheme |

Assign a default calculation scheme to the tax component code. The value that you assign here appears by default on the Tax Calculation Code page, where you can override it. Values are: Amount: Ad hoc amount-based tax calculation. Percentage: Percentage-based tax calculation. This is the default value. Quantity: Quantity-based tax calculation. |

Miscellaneous Charge |

Assign a nonrecoverable VAT miscellaneous charge code to the selected tax type code. The miscellaneous charge code value that you enter determines the cost element under which nonrecoverable VAT, and customs duty amounts are accounted for in Inventory and Cost Management. Values are defined on the Misc Charge/Landed Cost Defn (miscellaneous charge/landed cost definition) page. The PeopleSoft Landed Costing feature records the nonrecoverable portion of excise duty by using this charge code. When defining the miscellaneous charge code, enter the VAT Input Non-Recoverable type and select the Prorate and Landed Cost Component options. |

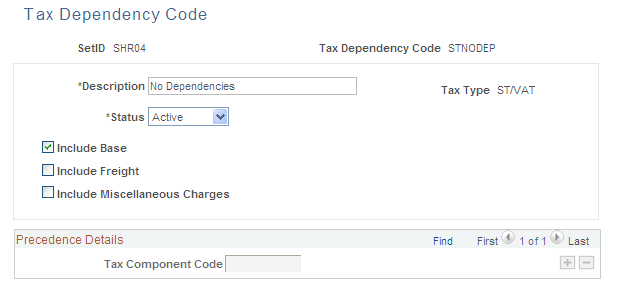

Use the Tax Dependency Code page (EXS_TAX_DPNDNCY) to define tax dependency codes that indicate the basis for calculating tax, as well as the precedence of taxes of the same tax type that must be included in the calculation.

For example, if you want to calculate additional excise duty based on the assessable value plus the basic excise duty, you define this relationship on this page.

Navigation:

This example illustrates the fields and controls on the Tax Dependency Code page. You can find definitions for the fields and controls later on this page.

Note: After you assign a tax dependency code to a tax calculation code, you cannot make further changes to the tax dependency code definition.

Field or Control |

Description |

|---|---|

Tax Dependency Code |

The tax dependency code that you enter on the prompt page appears. Tax dependency codes indicate the basis for calculating tax, as well as the precedence of taxes of the same tax type that must be included. You assign tax dependency codes to tax calculation codes, enabling tax calculation codes to be calculated accordingly. |

Tax Type |

The tax type that you enter on the prompt page appears. |

Include Base |

Select to calculate tax with the base amount included. Leave this option deselected if you want tax calculation to exclude the base amount. For example, leave this option deselected for a surcharge tax component that is calculated based on a preceding tax component rather than on a base amount. This option is selected by default. |

Include Freight |

Select to include freight as a part of the base value in tax calculation. This option is deselected by default. This setting is applicable only in the procure-to-pay process flow. In the order-to-cash process flow, freight cannot be assigned to sales order or bill lines. If required, freight must be provided on another sales order or bill line. If tax calculation on freight is required, this calculation can be performed in the same way that it is done for normal sales order or bill lines. |

Include Miscellaneous Charges |

Select to include miscellaneous charge expenses as a part of the base value for tax calculation. This option is deselected by default and is applicable only in the procure-to-pay process flow. |

Precedence Details

Field or Control |

Description |

|---|---|

Tax Component Code |

If tax precedence is required, assign as many tax component codes as needed. Only tax component codes of the same tax type can be assigned to a tax dependency code. Note: The system performs a validation to ensure that tax component codes that are assigned here are included in a tax calculation code definition. The tax component codes must be assigned to a tax calculation code definition so that appropriate tax rates can be derived. This validation is performed each time a tax calculation code is updated and saved. |

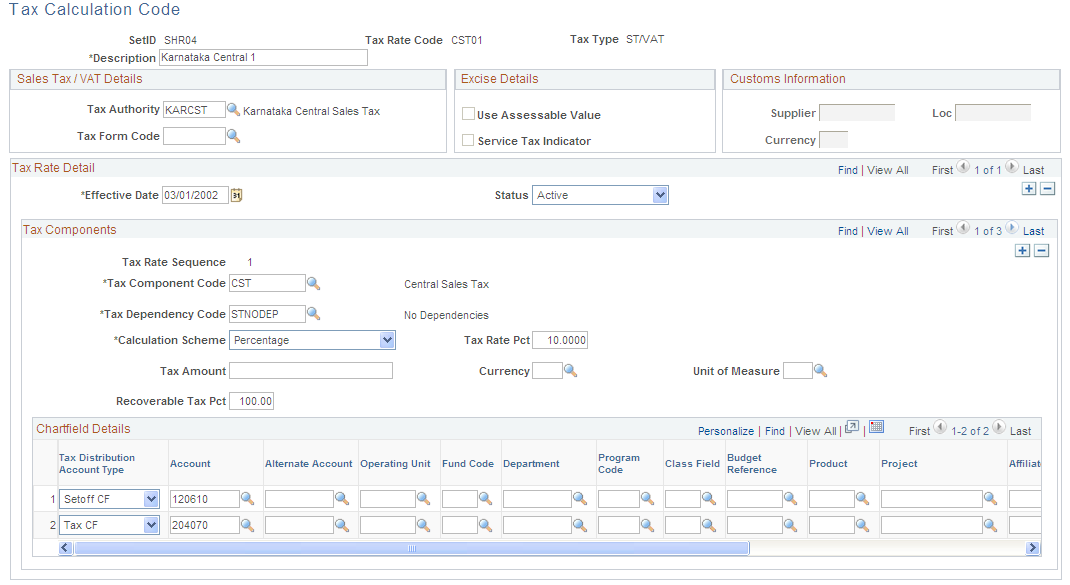

Use the Tax Calculation Code page (EXS_TAX_RATE) to define tax calculation codes that group tax component codes of the same tax type along with tax rates and other attributes.

Navigation:

This example illustrates the fields and controls on the Tax Calculation Code page (partial). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Rate Code |

The tax rate code that you enter on the prompt page appears. Tax calculation codes group tax component codes of the same tax type along with tax rates and other attributes. Tax rate codes are used in the Tax Determination table to determine the tax rate that is applicable for a combination of various parameters, such as the trading partner (customer/supplier), tax category, item, item tax category, and so forth. |

Tax Type |

The tax type that you enter on the prompt page appears. A tax calculation code can have only one tax type. Values are: Excise: This is the default value. Also select for service taxes. When this value is selected, the Service Tax Indicator and Use Assessable Value options become available for entry. ST/VAT (sales tax/VAT): When this value is selected, the Tax Authority and Tax Form Code fields become available for entry. The Chartfield Detail group box also becomes available for entry. Custom: When this value is selected, the Customs Information group box becomes available. |

Customs Information

The fields in the Customs Information group box are relevant only to customs duty processing and are available for entry when the tax type is custom. Select a supplier, location, and currency to define the third-party supplier to whom the customs duty is paid, such as a customs authority.

Tax Rate Details

Tax calculation codes must have at least one detail line. Create a detail line for each tax component code that is applicable to the tax calculation code.

Tax Components

Field or Control |

Description |

|---|---|

Tax Rate Sequence |

Indicates the order in which tax component codes in the tax calculation code should be calculated. This line number is system-generated. The system validates the relationship between a sequence number and the precedence that is defined in the Tax Dependency table for each of the tax dependency codes that are associated with the tax components of the tax calculation code. |

Tax Component Code |

Select a tax component code. Values are defined on the Tax Component page; however, only tax component codes that are associated with the selected Tax Type field value are available for selection. |

Tax Dependency Code |

Select a tax dependency code. Valid values are defined on the Tax Dependency Code page. |

Calculation Scheme |

Displays the default calculation scheme that is associated with the selected tax component code. You can override this value. Values are: Amount: Ad hoc amount-based tax calculation. Percentage: Percentage-based tax calculation. This is the default value. Quantity: Quantity-based tax calculation. |

Tax Rate Pct (tax rate percentage) |

If the Calculation Scheme field value is set to Percentage, enter a percentage that is to be applied against the taxable amount. |

Tax Amount |

If the Calculation Scheme field value is set to Quantity, enter an amount that is to be applied against the transaction quantity. The amount is applied in the Currency Code value that you enter, according to the transaction quantity in the Unit of Measure value that you enter. Note: If the transaction unit of measure is different from the tax calculation code unit of measure, the system performs the conversion by using the unit of measure conversion feature. If the Calculation Scheme field is set to Amount, enter the actual tax amount. Enter a Currency Code value. |

Currency |

If the Calculation Scheme field is set to Amount or Quantity, enter a currency code for the tax amount. Values are defined on the Currency Code page. |

Unit of Measure |

If the Calculation Scheme is set to Quantity, enter a unit of measure against which the tax amount is applied. Values are defined on the Units of Measure page. Note: If the transaction unit of measure is different from the tax rate code unit of measure, the system performs the conversion by using the unit of measure conversion feature. |

Recoverable Tax Pct (recoverable tax percentage) |

Enter the percentage of the excise tax that is recoverable. The system uses this value to split taxes into recoverable and nonrecoverable components. You can add the nonrecoverable portion to the value of the inventory item by using the PeopleSoft Landed Cost feature. If the Tax Type field value is set to Excise, enter the CENVAT percentage that can be recovered. For example, enter 100 to indicate that the full amount of tax is eligible for CENVAT credit. If the Tax Type field value is set to ST/VAT, enter the setoff percentage for the tax rate code. For example, enter 60 to indicate that 60 percent of the tax amount is recoverable and eligible for set-off. The balance is added to the inventory cost or expensed depending on the treatment that is defined for the item. If the Tax Type field value is set to Custom, enter the CENVAT percentage that can be recovered. |

Chartfield Details

Assign separate ChartField values to each available combination of tax authority and tax rate detail line in the Chartfield Details group box. Default ChartField values are supplied from the tax authority that is selected on this page, but you can override them.

Field or Control |

Description |

|---|---|

Tax Distribution Account Type |

Enter a ChartField account type. Values are: Setoff CF (setoff value ChartField): If this value is selected, the ChartFields reflect the setoff ChartField values that are to be used to account for recoverable setoff amounts in the procure-to-pay process flow. Tax CF (tax value ChartField): This is the default value. If this value is selected, the ChartFields reflect liability ChartFields that are to be used to account for sales tax in the order-to-cash process flow. |

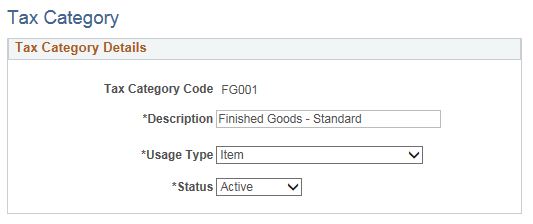

Use the Tax Category page (EXS_TAX_CATG) to define tax categories for assignment to suppliers, customers, product kits, and items for customs duty tax determination.

Navigation:

This example illustrates the fields and controls on the Tax Category page. You can find definitions for the fields and controls later on this page.

Tax Category Details

Field or Control |

Description |

|---|---|

Usage Type |

Select the tax category usage type. Values are: Supplier/Customer: Tax category for assignment to suppliers and customers. This is the default value. Item: Tax category for assignment to items and product kits. |

Use the Tax Determination page (EXS_TAX_DETERM) to assign a tax calculation code to one or more tax determination parameters.

Available field values on the page are based on Tax Determination hierarchy.

Navigation:

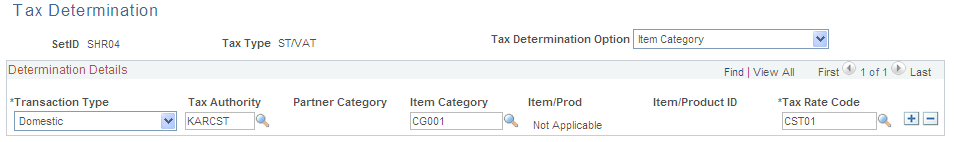

This example illustrates the fields and controls on the Tax Determination page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tax Determination Option |

Select a tax determination option for which you want to define determining factors. The available field values represent levels in the tax determination hierarchy. When a particular level of the hierarchy is invoked on a transaction, the system looks at the parameters that you define on this page to determine the tax rate code that is to be used for the transaction. Values are: Item: Select to define factors for tax determination based on the transaction item or product. Item Category: Select to define factors for tax determination based on the transaction item or product tax category. Partner Category: Select to define factors for tax determination based on the transaction trading partner tax category. Partner Category + Item: Select to define factors for tax determination based on the transaction trading partner tax category and item. Partner Category + Product: Select to define factors for tax determination based on the transaction trading partner tax category and product kit. Partner Category + Item Category: Select to define factors for tax determination based on the transaction trading partner category and item tax category. Product Kit: Select to define factors for tax determination based on the transaction product kit. Benefit + Partner Category + Item: Select to define factors for customs duty tax determination based on the benefit ID, the transaction trading partner category, and item. Benefit + Item: Select to define factors for customs duty tax determination based on the benefit ID and item |

Determination Details

Field or Control |

Description |

|---|---|

Transaction Type |

Select a tax transaction type. Values are: DEB (direct export with bond). DEWB (direct export without bond). DIMP (direct import). Domestic (default value). LEB (local export with bond). LEWB (local export without bond). LIMP (local import). |

Tax Authority |

This field is relevant only to sales tax and VAT processing and is available for entry when the Tax Type field is set to ST/VAT. Select a tax authority that is to be invoked for the tax determination combination. Values are defined on the Sales Tax/VAT Authority page. |

Partner Category |

Select a trading partner tax category that is to be invoked for the tax determination combination. Values are defined on the Tax Category page. See Tax Category Page. |

Item Category |

Select an item tax category. Values are defined on the Tax Category page. |

Item/Prod (item/product) |

Displays the type of ID that you must enter in the Item Product ID field. The value that appears in this field depends on the Tax Determination Option field value that you select. Values are NA, Product, and Item. |

Item/Product ID |

Depending on the Item/Prod field value, select an item or product kit. Values for product kits are defined on the Product Tax Applicability page. Values for items are defined on the Item Defn Tax Applicability page. |

Tax Rate Code |

Select a tax rate code. Values are defined on the Tax Calculation Code page; however, only tax calculation codes that are associated with the selected Tax Type and Tax Authority field values are available for selection. |