Setting Up the Organizational Structure

To operate in India, an organization must register with tax authorities and obtain permits that identify registration numbers. In India customs duty calculations are determined by the location of the business transaction, the supplier or customer category, exemptions that an organization, supplier, or customer obtains (identified by appropriate license numbers), and the tax rate.

You can define registration data at the organization setup level. You can define, for example, multiple tax locations for each organization and define for each tax location the ChartFields. You can also associate multiple business units with a tax location and capture business unit tax applicability.

Note: Organizational structure setup for customs duty is shared unless otherwise specified.

To set up the organizational structure, use these components Organization Details (ORG_RGSTN_DTL), BU Tax Applicability (ORG_BU_TAX_APPL), and Tax Location (ORG_TAX_LOC).

This section discusses how to set up the organizational structure.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ORG_RGSTN_DTL |

Define registration data at the organization level. |

|

|

ORG_BU_TAX_APPL |

Assign a business unit to an organization and tax location code, and specify the business unit's customs duty applicability. |

|

|

ORG_TAX_LOC |

Specify the TAN registration numbers, as well as the default journal template, currency code, and rate type that is associated with a tax location. |

|

|

ORG_EXD_CF_DET |

The customs duty and GST account types are also specified at the tax location level. |

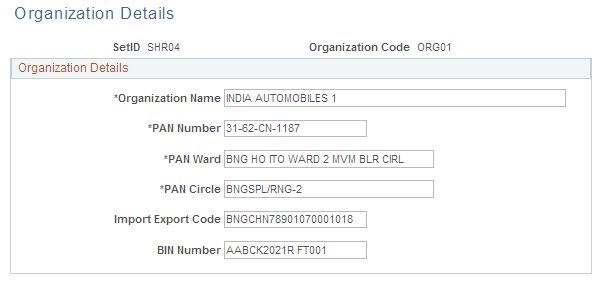

Use the Organization Details page (ORG_RGSTN_DTL) to define registration data at the organization level.

Navigation:

This example illustrates the fields and controls on the Organization Details page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

PAN Number (permanent account number) |

Enter the number that is assigned by the income tax authority to identify the organization's tax returns. This number is usually a 10-digit alphanumeric code. Oracle allows you to enter a 20-digit alphanumeric value. |

PAN Ward (permanent account number ward) and PAN Circle (permanent account number circle) |

Enter the location of the income tax offices to which the organization submits its taxes. Tax authorities assign these values. Wards and circles can change at the discretion of the income tax authority. |

Import Export Code |

Enter the code that is assigned to the organization by the Director General of Foreign Trade (DGFT) for identification purposes. The Import Export code must be used for all correspondence with customs authorities for import purchases. For example, this code is required on the Bill of Entry worksheet. |

BIN Number (business identifier number) |

Enter the business identification number (BIN) that is assigned to the organization by the DGFT. The BIN must be used for all correspondence with the customs authorities for export purposes. For example, the BIN is required on the shipping documents that are sent to customs clearance. Note: Oracle does not produce those Export Shipping Documents. |

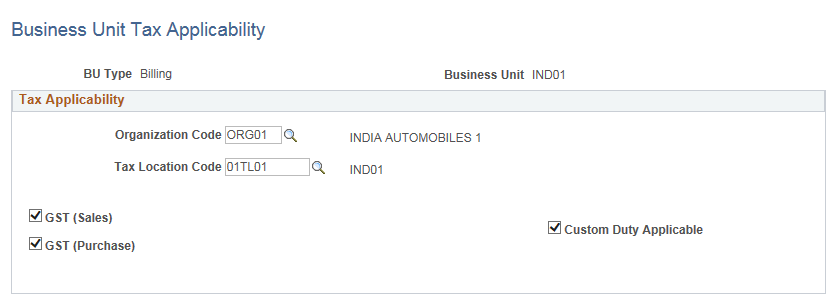

Use the Business Unit Tax Applicability page (ORG_BU_TAX_APPL) to assign a business unit to an organization and tax location code, and specify the business unit's customs duty applicability.

Navigation:

This example illustrates the fields and controls on the Business Unit Tax Applicability page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Organization Code |

Select a valid organization code. You define organization codes on the Organization Details page. |

Tax Location Code |

Select a valid tax location code. You define tax location codes on the Tax Location page. |

Field or Control |

Description |

|---|---|

Custom Duty Applicable |

Select this option if customs duty is applicable for the corresponding business unit. |

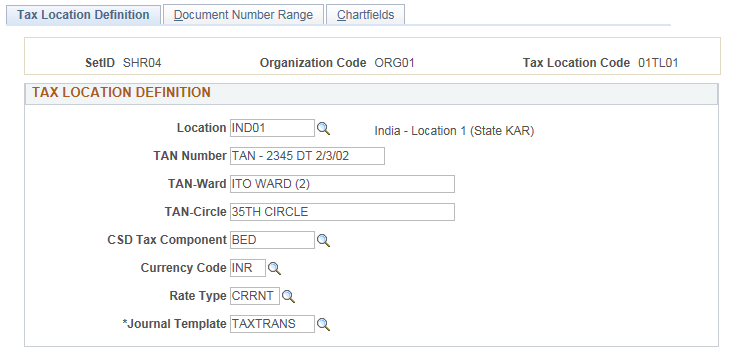

Use the Tax Location - Tax Location Definition page (ORG_TAX_LOC) to specify the TAN registration numbers, as well as the default journal template, currency code, and rate type that is associated with a tax location.

Navigation:

This example illustrates the fields and controls on the Tax Location - Tax Location Definition page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Location |

Select a valid tax location. |

TAN Number |

Enter the code that is assigned to you by the tax authority that represents the location of the income tax office where you pay taxes. |

TAN-Ward |

Enter the TAN ward number. For administrative convenience, income tax authorities divide the country into circles and wards. Depending on its location, each organization belongs to a certain ward and circle. |

TAN-Circle |

Enter the TAN circle number. For administrative convenience, income tax authorities divide the country into circles and wards. Depending on its location, each organization belongs to a certain ward and circle. |

Currency Code |

Select the default currency code to associate with this location. |

Rate Type |

Select the default rate type to associate with this location. |

Journal Template |

Select the journal template to associate with this location. |

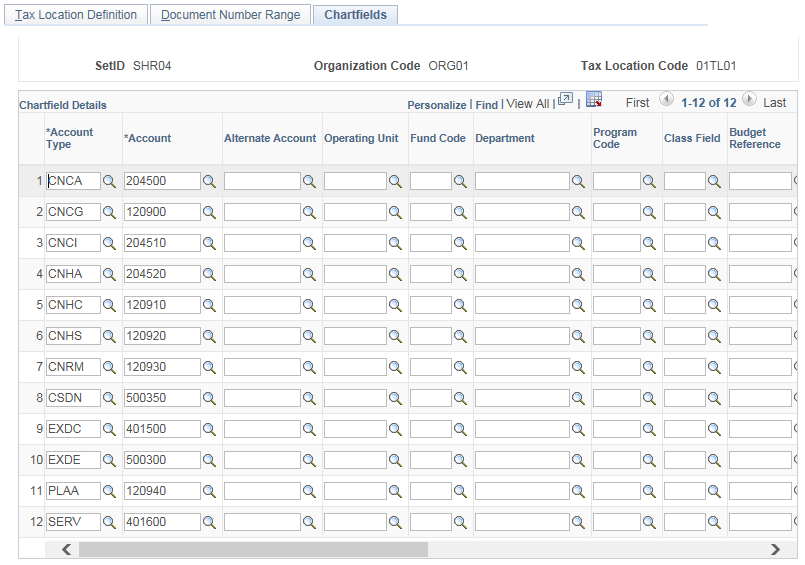

Use the Tax Location - Chartfields page (ORG_EXD_CF_DET) to the Register Update process creates the accounting entries to record customs duty and GST account types.

The

Navigation:

This example illustrates the fields and controls on the Tax Location - Chartfields page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Account Type |

Enter the account that is to be used to create accounting entries. Insert a new row for each account and identify the ChartField combination. The options are: CSDN: Custom Duty Non-Recoverable. PLAA: PLA account. SERV: Service Tax. SST: Suspense Service Tax. |