Defining Detail Calendars

To define Detail Calendars, use the Detail Calendar component (DETAIL_CALENDAR).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DETAIL_CALENDAR1 |

Detail calendars, each identified by a unique alphanumeric code, define how many accounting periods are in your fiscal year and the beginning and ending dates for each period. They determine the accounting period to which you post journal entries and other transactions. |

|

|

DETAIL_CALENDAR2 |

Set up depreciation allocations per calendar period. |

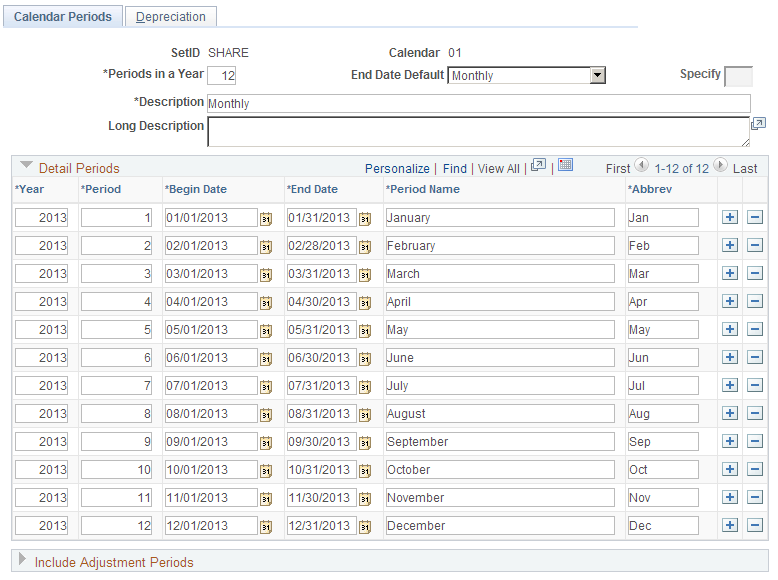

Use the Calendar Periods page (DETAIL_CALENDAR1) to define detail calendars, each identified by a unique alphanumeric code, and specify how many accounting periods are in your fiscal year and the beginning and ending dates for each period.

They determine the accounting period to which you post journal entries and other transactions.

Navigation:

This example illustrates the fields and controls on the Calendar Periods page (1 of 2). You can find definitions for the fields and controls later on this page.

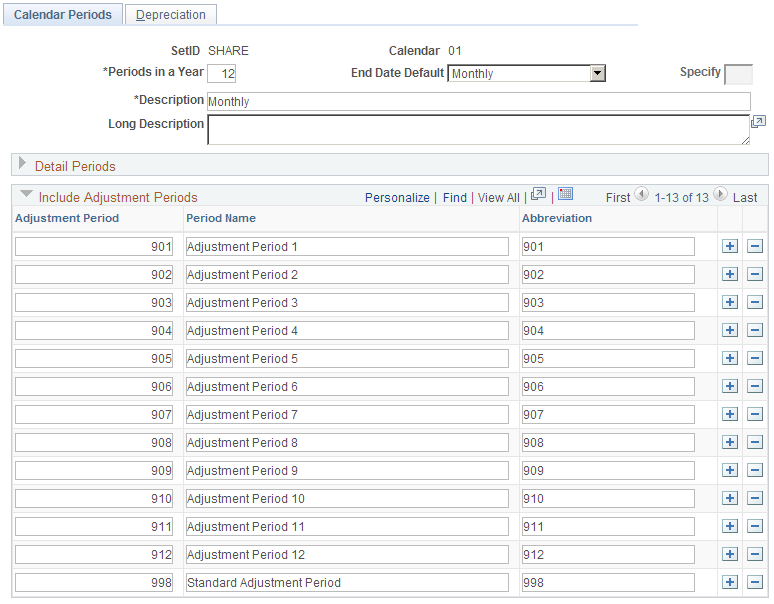

This example illustrates the fields and controls on the Calendar Periods page (2 of 2). You can find definitions for the fields and controls later on this page.

You can define a detail calendar from scratch, or you can use a base calendar, defined in Calendar Builder, to create a detail calendar and further define it using the Calendar Periods page.

Field or Control |

Description |

|---|---|

Calendar |

Enter the calendar ID or name to appear on prompt lists, inquiries, and reports. If you select a calendar that you built using Calendar Builder, you can change the name. |

Periods in a Year |

Enter the number of periods based on the type of calendar. Do not count adjustment periods or special system-maintained periods (0, 998, 999). PS/nVision reporting uses the number of periods that you enter here to identify TimeSpans that roll from one year into another, such as a rolling 12-month report. |

End Date Default |

Select an end date default. Options are: Year, Month, BiMonth, Quarter, SemiAnnual, and Days. |

Specify |

Enter the number of days to include on your calendar if you select Days in the End Date Default field. For example, enter 365. |

Detail Periods |

To create a new detail calendar rather than set one up in Calendar Builder, enter the first row of detail and include the Year, Period, Begin Date, End Date, Period Name, and Abbreviation values for period 1. When you add one or more rows, the system updates each row with the correct year, period, begin, and end dates. Enter the period name and abbreviation for each new row only. Every day of the year must be included in a period; do not leave gaps between period dates, and do not allow dates to overlap. |

Adjustment Period |

The period 998 is the default period for fiscal year-end adjustments. If you have only one adjustment period, accept the default. If you have other adjustment periods, enter them in addition to or as a replacement for the default adjustment period. Enter an adjustment period, period name, and abbreviation for each adjustment period. Adjustment period (for example, 901 or 902) identifies the adjustment period. The adjustment period cannot be an actual period (such as 1 through 12 for a monthly calendar) or any of the system-maintained periods (such as 0 or 999). |

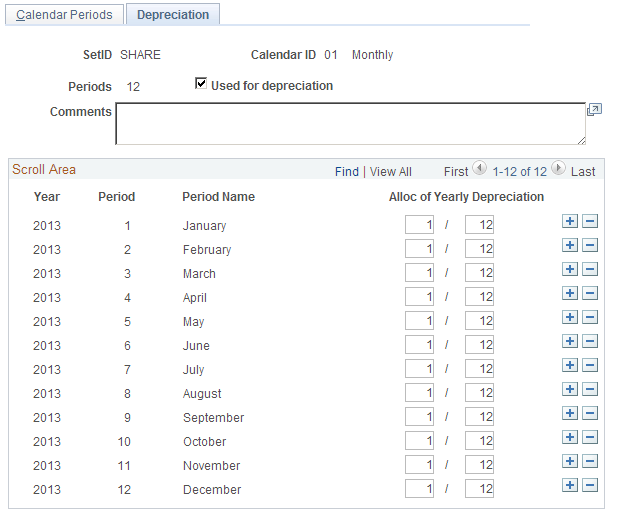

Use the Calendar Periods - Depreciation page (DETAIL_CALENDAR2) to set up depreciation allocations per calendar period.

Navigation:

This example illustrates the fields and controls on the Depreciation page. You can find definitions for the fields and controls later on this page.

Use this page of a detail calendar if you are using Asset Management. In each calendar that you establish, define the number of periods across which to allocate annual depreciation.

Field or Control |

Description |

|---|---|

Alloc of Yearly Depreciation (allocation of yearly depreciation) |

The depreciation allocation period that you establish here is used to determine how much of the annual depreciation calculated in Asset Management for each asset is allocated to each defined period. You can set up as many periods for as many years as you want by adding lines to the detail calendar. You can also modify the depreciation allocation on this page. |