Setting Up for Journal Generator

To set up the journal generator, use the Accounting Entry Definition component (JRNLGEN_DEFN), Journal Generator Template - Defaults component (JRNLGEN_APPL_ID) and the Journal Generator Template - Summarization component (JRNLGEN_APPL_ID).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

JRNL_GEN_ACCTG_DEF |

Identify the system source that distributes data to your general ledger and identify the record and field names for the Accounting Entry table. |

|

|

JRNL_GEN_DEFAULTS |

Specify Journal Generator defaults. |

|

|

JRNL_GEN_SUM |

Define how Journal Generator summarizes accounting entries when it generates journals. Summarize at the account or ChartField level. The generator creates a distinct journal header for each ledger group; multiple ledgers can be in one journal as long as they belong to the same ledger group. |

The Journal Generator process creates general ledger journals for any application. The process uses the record and field names from the accounting entry definition to extract data from the Accounting Entry table and create journals.

It extracts data from any table in the database as long as the table contains the required fields listed in the Reviewing Journal Generator Required Field Names.

Your application may contain field names that are different from the required fields in the Accounting Entry table but have the same attributes. If this is the case, create a view in your system's distribution line table and point the Journal Generator to it by specifying its name in the Accounting Entry Record field on the Accounting Entry Definition page.

If you changed or added fields and want to pass values associated with these fields to journals—that is, retain detail—you insert the new fields in five tables: Accounting Entry, Journal Generator Work (JGEN_WRK_TMP), Journal Generator Dynamic State Records (FS_JGEN_UPD_AET and FS_JGEN_PRV_AET), and Journal Line. The fields must have the identical field names and attributes in each table. Finally, in the journal generator template select Retain Detail.

Non-PeopleSoft systems can use the GENERIC accounting entry definition or create their own modified accounting entry definition.

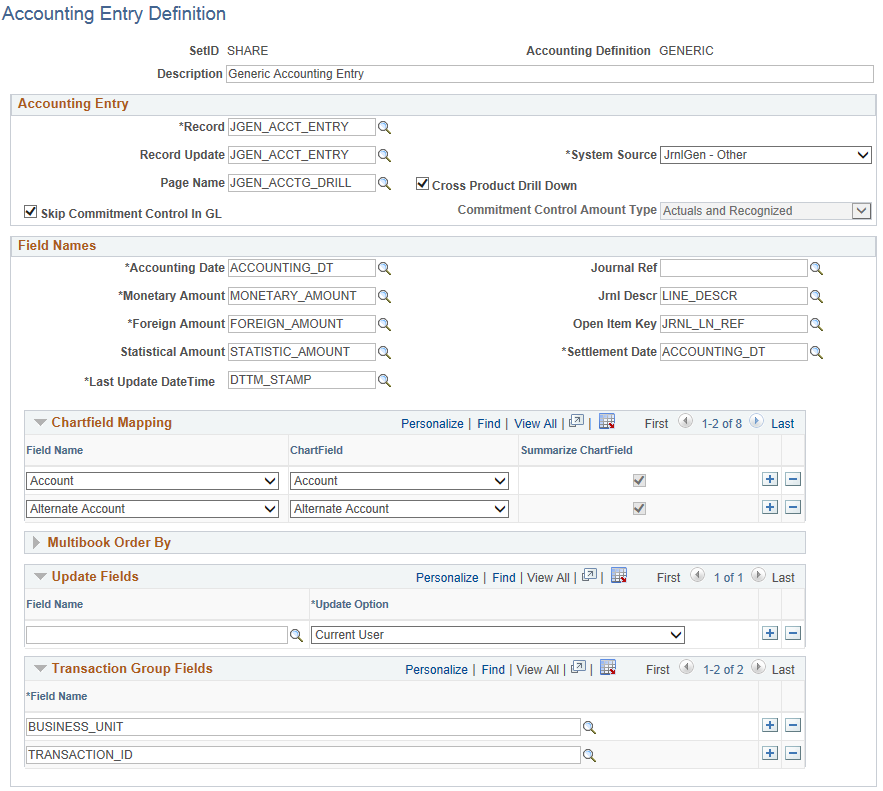

Use the Accounting Entry Definition page (JRNL_GEN_ACCTG_DEF) to identify the system source that distributes data to your general ledger and identify the record and field names for the Accounting Entry table.

Navigation:

This example illustrates the fields and controls on the Accounting Entry Definition page.

Field or Control |

Description |

|---|---|

Accounting Definition |

Use this unique name on the Journal Generator Request page to tie your request to an accounting entry table and field definition. |

Accounting Entry

Field or Control |

Description |

|---|---|

Record |

Select the record from which Journal Generator gets the information needed to create journals. This is the data source (accounting entry) table to be used when creating a journal. If you created a view of a third-party system table, enter its name here. |

Record Update |

Select an accounting entry record update name. This is the record that Journal Generator updates. It is the accounting entry table that Journal Generator updates with journal information after it creates the journal. |

System Source |

Identifies the source of an accounting entry from which a transaction arises. For example, the source of receivables transactions is Accounts Receivable. Journal Generator uses system source to:

For a non-PeopleSoft application, select the JrnlGen - Other value. For a PeopleSoft application, select one of the other System Source values. |

Page Name |

For cross-product drilldown, each product that generates journals to General Ledger can supply a drill page for each of its accounting line tables. In the Page Name field, enter the names of the drill pages to display the corresponding accounting line table. |

Cross Product Drill Down |

Select this check box to enable cross product drilldown. This feature enables you to identify the source of accounting transactions across product lines. This option causes Journal Generator to populate the journal line number and other journal key fields in the Accounting Entry table. Using these field values, the system enables you to drill down from account balances in General Ledger to specific transactions in other PeopleSoft applications for detailed supporting information. Note: The accounting line table must have a unique index if you use the cross-product drilldown feature. |

Skip Commitment Control in GL |

When the system source supports commitment control, the system selects the Skip Commitment Control in GL check box and makes it unavailable for deselecting, because commitment control functions are done at the application level. When the system source does not support commitment control, you can choose to do a commitment control budget check in general ledger by leaving this deselected, or choose not to do so by selecting this option. Some of the applications that do not support commitment control include: Asset Management, Contracts, Global Payroll, Cash Management, and any external systems. |

Commitment Control Amount Type |

The values that appear for this field depend on the contents of the accounting entry record. When you enter a value for the accounting entry record name, the system looks at that record's record definition to see if it contains a field named KK_AMOUNT_TYPE. Only if the system finds KK_AMOUNT_TYPE in the record definition, does the Commitment Control Amount Type field become enabled for you to enter data. If KK_AMOUNT_TYPE does not exist in the record table, then the system assumes that all accounting entries are actuals transactions. Select one of the following values: (none): All values are selected. Actuals: The actual amount of the expenditure or the recognized revenue. Collected: The amount of revenue collected. Reg/Col: Combination of actuals and collected. For an expense transaction, the actual amount of the expenditure. For a revenue transaction, the actual amount of the recognized revenue and the amount of revenue collected. Dynamic: Specify this amount type when you enter the transaction. Not applicable to generic transactions. Encum: Encumbrance is often the second step in the procurement life cycle, and usually takes the form of a purchase order or contract. It is used to record the legal obligation to spend funds. Planned: The amount that you plan to spend. This amount is only an estimate and the process does not use it to determine if you have exceeded the budgeted amount. Pre-Encum: Preencumbrance is often the first step in the procurement life cycle, and usually takes the form of a requisition. It often precedes an encumbrance (purchase order), although it is not mandatory that a preencumbrance exist in order to create an encumbrance. The requisition is used to indicate the intent to consider, not the legal requirement, to make a purchase or to obligate funds. |

Field Names

Enter the field names to identify the columns in the Accounting Entry table that the Journal Generator uses to create the journal.

Field or Control |

Description |

|---|---|

Accounting Date |

Reflects the date of the accounting entry to be recognized in general ledger. Note: ACCOUNTING_DT appears by default, but it can be changed to another field name from the Accounting Entry table. |

Monetary Amount |

The base currency amount. |

Foreign Amount |

The foreign (transaction currency) amount. |

Statistical Amount |

(Optional) The statistical amount. |

Journal Ref (journal reference) |

(Optional) The journal line reference used to track the source of the transaction. The journal line reference is populated from the defined field name if you select the Retain Detail option on the Journal Generator Template - Summarization page. If no field name is defined, the system takes the journal line reference from the Journal Generator template defaults. |

Journal Descr (journal description) |

(Optional) Describe a transaction. This is populated from the defined field name if you select the Retain Detail option on the Journal Generator Template - Summarization page. If no field name is defined, the system takes the journal line description from the Journal Generator template defaults. |

Open Item Key |

If the open item key is mapped to a field in the subsystem table, then the Open Item value carries over to General Ledger if you select the Retain Detail summarization option on the Journal Generator Template - Summarization page. If no field name is defined, the system does not create an open item record even if the account of the transaction is an open item account. |

Settlement Date |

Reflects the date of the accounting entry to be recognized (in addition to the Accounting Date) if the Date Code is enabled for tracking and posting. See Ledgers For A Unit - Journal Post Options Page. |

Last Update Date Time |

Includes the Date Timestamp field that reflects when the journal has been generated through the Journal Generator process. |

ChartField Mapping

Expand this grid to perform mapping.

Field or Control |

Description |

|---|---|

Field Name |

Specify the accounting entry field names that map directly to the General Ledger ChartField names. |

ChartField |

Specify general ledger ChartField names. If you select the Summarize to All ChartField Level option on the Journal Generator Template - Summarization page, Journal Generator uses the listed ChartFields when it summarizes the accounting entries and creates journals. The ChartFields that are not listed have a blank value in the newly created journals. |

Summarize ChartFields |

Specifies the ChartFields that are summarized if the Summarize by Selected ChartFields on the Journal Generator Template - Summarization page is selected. The ChartFields that are not selected have a blank value in the newly created journals. |

Note: Journal Generator limits you to mapping a field once. For example, you cannot map Journal Ref and Open Item Key to the same field name. They must be mapped to different field names.

MultiBook Order By

Specify the field names for in-sync multibook accounting.

Within a ledger group, the accounting entries for one transaction that are distributed to different ledgers are referred to as in-sync accounting entries. These accounting entries have the same ChartFields, foreign currency, and foreign amounts. PeopleSoft applications that support multibook generate in-sync accounting entries to all ledgers within a ledger group.

If the Accounting Entry In Sync option is selected in the journal generator template, Journal Generator recognizes the in-sync accounting entries and marks them for the Journal Edit process to create any missing in-sync journals. When it generates the journal, Journal Generator uses the MultiBook Order By fields to determine how to group accounting entries for one transaction.

If the application subsystem supports multibook in sync, it sends in-sync entries, including those for the translation ledger, to the Journal Generator process. Journal Generator uses the MultiBook Order By fields to determine multibook entries for the same transaction.

Field or Control |

Description |

|---|---|

Field Name |

If you create new accounting entries from third party systems, you can enter field names in the sort order required to group the new accounting entries. |

Warning! Do not change any of the values in these fields as delivered. The values are set for the delivered accounting entries and any changes can cause serious data problems.

Note: PeopleSoft Purchasing does not support multibook entries.

Transaction Group Fields

Use this section to indicate that you want to hold, purge, and reload entire transactions if the transaction has an error against the accounting line. Enter the field names that are required to define a ‘whole transaction’. The system considers a ‘whole transaction’ to have all field names, specified in this section, within the transaction.

This section is only displayed when the System Source value is JrnlGen – Other.

These fields are used when the system preprocesses transactions prior to the Journal Generator (FS_JGEN) process.

Note: PeopleSoft delivers system data in these fields, but you should verify that they are valid for your organization.

For additional information about required field names for Journal Generator, see Journal Generator Required Field Names.

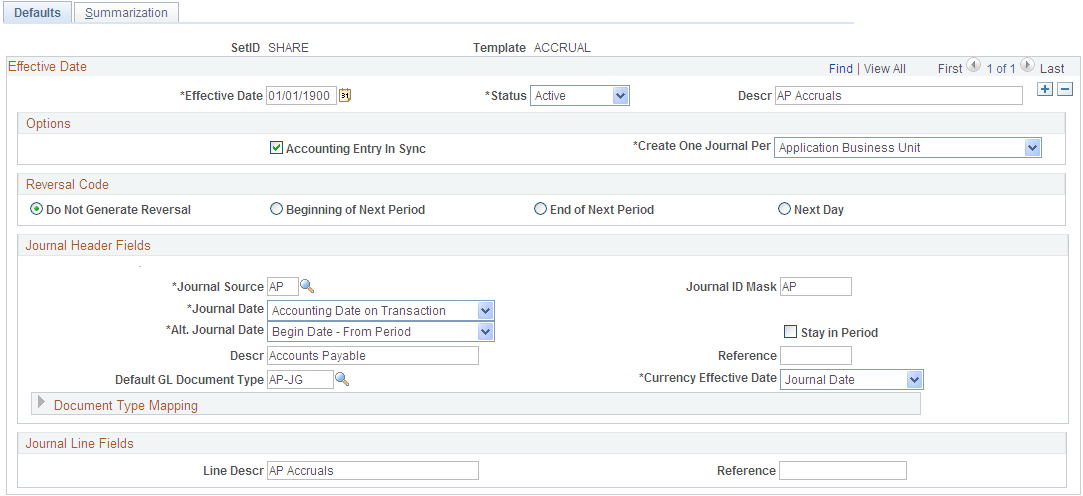

Use the Journal Generator Template - Defaults page (JRNL_GEN_DEFAULTS) to specify Journal Generator defaults.

Navigation:

This example illustrates the fields and controls on the Journal Generator Template - Defaults page . You can find definitions for the fields and controls later on this page.

The defaults and summarization options that you set up using the journal generator templates determine how journal generator summarizes accounting entries and creates journals. Typically, you set up Journal Generator templates for each application system source that distributes to the general ledger, as well as each type of transaction. For example, you can have a template for depreciation expense from Asset Management. For systems other than PeopleSoft systems, you can use the GENERIC journal generator template or create a modified journal generator template.

Journal Generator groups accounting entries together that share the same general ledger business unit, ledger group, book code (the field BOOK_CODE exists in the accounting entry table and Book Code has been activated on the Overall Installation Options page), journal template, journal date, general ledger document type, average daily balance date (the field ADB_DATE exists in the accounting entry table), and the commitment control amount type (field KK_AMOUNT_TYPE exists in the accounting entry table). Accounting entries with different foreign currencies might not be grouped in the same journal, depending on the currency balancing option for the:

Source.

Business unit ledger group.

General ledger business unit.

Options

If a PeopleSoft application that supports the multibook feature has generated in-sync accounting entries for this template, select the Accounting Entry In Sync check box. PeopleSoft applications that support multibook generate in sync accounting entries to most ledgers within a ledger group. The exception is that some products may not include the currency translation ledger. See the individual product documentation to determine if this feature is available for your product. If the Accounting Entry In Sync check box is selected, Journal Generator recognizes in-sync accounting entries and generates in-sync journals. The journals created by Journal Generator depend on the following:

Field or Control |

Description |

|---|---|

Accounting Entry In Sync |

If Accounting Entry In Sync is selected, the following occurs:

You must select the Accounting Entry In Sync check box if the subsystem is creating multibook in-sync accounting entries for Journal Generator. If Keep Ledgers in Sync is selected and Accounting Entry In Sync is deselected, the following occurs:

If the Keep Ledgers in Sync check box is not selected, and the Accounting Entry In Sync field is also deselected, the following occurs:

The Accounting Entry In Sync check box should not be used with the RECPTACCRL journal generator template (PeopleSoft Purchasing). |

Create One Journal Per |

This controls how the source accounting entries are grouped into journals. Values are: Application Business Unit: Creates one journal per general ledger business unit, per application business unit. This means that accounting entry lines with different application business units go into different journals. General Ledger Business Unit: Creates one journal per general ledger business unit. This means that accounting lines with different values for the general ledger business unit go into different journals. Accounting lines having the same value in the BUSINESS_UNIT_GL field but different values in the BUSINESS_UNIT field (as in Accounts Payable or Accounts Receivable) results in one journal for the general ledger business unit. |

For example, as this table shows, the following accounting entries go into the same business unit journal for US003:

|

Application BU |

Voucher ID |

BU_GL |

Foreign Amount |

|---|---|---|---|

|

US001 |

VCHR1200 |

US003 |

300 |

|

US003 |

VCHR1202 |

US003 |

-300 |

Reversal Code

Select a Reversal Code option to specify when reversing entries are to be automatically generated. Reversal options become effective at the time this entry is posted.

Field or Control |

Description |

|---|---|

Do Not Generate Reversal |

Journal Generator does not create the reversal entry, but it marks the journals with the reversal code. When the journals are posted later in a separate process, the system creates the reversal entry. |

Beginning of Next Period |

Creates a reversing entry dated the first business day of the next accounting period. It uses the business calendar that you assigned to the business unit on the General Ledger Definition - Definition page to determine the first business day. |

End of Next Period |

Creates a reversing entry dated the last business day of the next accounting period. It uses the business calendar that you assigned to the business unit on the General Ledger Definition - Definition page to determine the last business day. |

Next Day |

Creates a reversing entry dated the next business day. It uses the business calendar that you assigned to the business unit on the General Ledger Definition - Definition page to determine the next business day. |

Journal Header Fields

Field or Control |

Description |

|---|---|

Journal Source |

Identifies the originating entity responsible for the journal entries, and also determines how the foreign currencies are grouped for each journal. |

Journal ID Mask |

Enter a unique journal ID mask to identify information such as the source or purpose of journal entries. Spaces are not allowed. A 10-character alphanumeric ID identifies PeopleSoft-system journals. The system automatically generates IDs based on the number or letter that you enter here. For example, if you enter AP, the system supplies the remaining eight characters based on the next available journal ID number. If you do not specify a journal ID mask, you can let the system automatically assign the journal IDs by accepting the default : NEXT. |

Journal Date |

Determines the journal date for the journals created and indirectly the number of journals created. From the Journal Date options, select the source of the header and line date for journals that use a business calendar. See Defining Business Calendars. Accounting Date on Transaction: Uses the accounting date on the accounting entries as the journal date. This selection may result in multiple journals. Begin Date - From Period: Uses the first open date of the From (year) Period set up on the Open Period page. Begin Date - To Period: Uses the beginning date of the open To (year) Period set up on the Open Period page. Current Date: Accepts the current system date when the process is run. End Date − From Period: Uses the ending date of the open From (year) Period set up on the Open Period page. End Date − To Period: Uses the last open date of the To (year) Period set up on the Open Period page. Period End − Accounting Date: Uses the period-end date that corresponds to the accounting date. This selection might result in multiple journals. Process Date: This refers to the Journal Process Date option specified on the General Ledger Business Unit Definition - Journal Options page. On that page, you can specify the process date defined for the business unit, or the current date. Specify Date: If you select this, the Date field is available for you to enter a specific date. |

Alt. Journal Date (alternate journal date) |

Determines the journal date for the journals created if the journal date determined from the journal date option is not within the open accounting period's range. Select one of these values: Begin Date - From Period: Uses the first open date of the From (year) Period set up on the Open Period page. Begin Date - To Period: Uses the beginning date of the open To (year) Period set up on the Open Period page. End Date − From Period: Uses the ending date of the open From (year) Period set up on the Open Period page. End Date − To Period: Uses the last open date of the To (year) Period set up on the Open Period page. Retain Primary Journal Date: The system uses the date that you specify as the journal date in this journal generator template. |

Stay in Period |

Journal Generator derives the journal date according to the journal date options previously described. However, if you select the Stay in Period check box and the derived journal date is a not a working day, Journal Generator uses the next working day for the journal date. If the next working day is not in the same period, Journal Generator uses the day prior to the derived journal date for the journal date. If you deselect the Stay in Period check box, Journal Generator changes journal dates that fall on nonworking days to the next working day, regardless of the accounting period. |

Descr (description) |

(Optional) Identifies information about the journal. It is useful for explaining any abnormalities in the journal. |

Reference |

Tracks the source of the transaction for the journal. |

Default GL Document Type |

The system uses the default GL document type to assign a document type on the journal header when you create journals through Journal Generator. Select a default GL document type. |

Currency Effective Date |

If you want to set the currency effective date on the journal header to be the average daily balance (ADB) date, select ADB Date in the template. Otherwise, the default is the journal date. If the ADB date does not exist on your accounting entry table, or if it is null, then the ADB date on the Journal Header will default to journal date. In this instance, selecting a currency effective date option does not make any difference because the currency effective date is always equal to the journal date. However, when the ADB date exists on your accounting table and it is not null, then Journal Generator can populate the ADB date from the accounting lines even if this date is different from the journal date. In addition to other existing groupings, Journal Generator also groups accounting lines into different journals by ADB date. |

Document Type Mapping

If you use document sequencing, expand the Document Type Mapping grid to map application document types to general ledger document types. Document type mapping applies to all journals generated, whether they are summarized or retain detail.

If the application document type is not found on this mapping, it is assigned to the default GL document type. You can map multiple application document types to one GL document type, but you cannot map multiple general ledger document types to a single application document type. Each of the different GL document types results in a different journal.

Field or Control |

Description |

|---|---|

Document Type |

Select the application document type. Note: The document type on the journal line is blank if you selected summarization. If you choose to retain detail, the document type on the journal line is the application document type. Otherwise, the document type on the journal line is the default general ledger document type. |

GL Document Type (general ledger document type) |

Select the GL document type that corresponds to the value that you selected for the application document type. |

Journal Line Fields

Field or Control |

Description |

|---|---|

Line Descr (line description) |

Describes the transaction in more detail. Journal Generator uses the value entered here to populate the journal line description if one of the following is true:

|

Reference |

Refers each journal line back to a document, person, invoice, date, or any other information that helps to track the source of the transaction. Spaces are not allowed. Journal Generator uses the value entered here if one of the following is true:

|

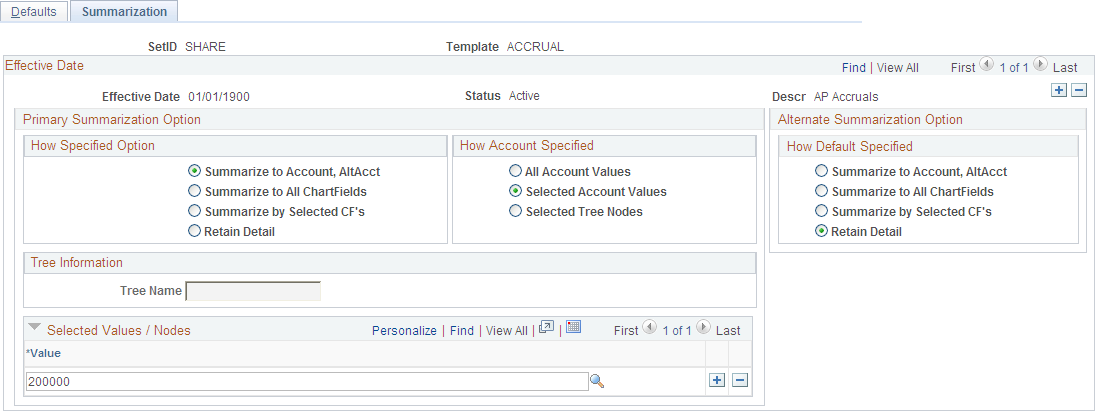

Use the Journal Generator Template - Summarization page (JRNL_GEN_SUM) to define how Journal Generator summarizes accounting entries when it generates journals.

Summarize at the account or ChartField level. The generator creates a distinct journal header for each ledger group; multiple ledgers can be in one journal as long as they belong to the same ledger group.

Navigation:

This example illustrates the fields and controls on the Journal Generator Template - Summarization page. You can find definitions for the fields and controls later on this page.

Primary Summarization Option

These options identify how Journal Generator distributes account values from the application system source to General Ledger. In addition to the specified options, Journal Generator summarizes by entry event whenever that field exists on the accounting entry table and the summarization option is not Retain Detail.

Field or Control |

Description |

|---|---|

How Specified Option |

Select to retain full details, or select a summarization level from the following values: Summarize to Account, AltAcct: Summarizes accounting entries at the account and alternate account level. All other ChartFields are blank. If alternate account is disabled at the ledger group level, it summarizes to account level only. Summarize to All ChartFields: Summarizes accounting entries to the level of all ChartFields that are listed on the Accounting Entry Definition page. Summarize by Selected CF's: Summarizes accounting entries by ChartFields that have the Summarize ChartField check box selected on the Accounting Entry Definition page. Retain Detail: Distributes accounting entries in full detail. When this is selected, the Project ChartFields can be mapped on the Accounting Entry Definition page and Journal Generator populates the Project ChartFields in the journals that it creates. |

How Account Specified |

Your selection in the How Specified Option group box affects the accounts selected in this option. You can specify accounts or a tree to indicate the accounts that you want. It is recommended that you use trees whenever possible to reduce future maintenance should ChartField values change. Select an option for How Account Specified from the following values: All Account Values: Distributes all the accounting entries according to the how specified option. Selected Account Values: Distributes the selected account values according to the how specified option. Activates the Selected Values/Nodes and the Alternate Summarization Option fields. Selected Tree Nodes: Distributes the account values that are defined by the tree name, tree level, and selected nodes according to the how specified option. Activates the Selected Values/Nodes and Alternate Summarization Option fields, as well as the Tree Name and Level fields. Enter the name of the tree and the level to use for summarization. |

Tree Name |

Specify the name of the tree to use for summarization. |

Selected Values/Nodes |

Enter either accounts or tree nodes depending on the How Account Value Specified option. |

Alternate Summarization Option

The Alternate Summarization Option check boxes provide the same options as the Primary Summarization option for the accounts that are not selected in the Selected Values/Nodes field. Select the How Default Specified value. Choose to retain detail, or to summarize one of three ways.

Field or Control |

Description |

|---|---|

How Default Specified |

Select one of these values: Summarize to Account, AltAcct: Summarizes accounting entries at the account and alternate account level if alternate account is selected for the ledger group. All other ChartFields are blank. Summarize to All ChartFields: Summarizes accounting entries at the full ChartField level defined in the ChartField mapping fields on the Accounting Entry Definition page. Summarize by Selected CF's: Summarizes accounting entries by ChartFields that have the Summarize ChartField check box selected on the Accounting Entry Definition page. Retain Detail: Distributes accounting entries in full detail. |