Using ChartField Inheritance

To use and setup ChartField inheritance, use the ChartField Inheritance component (CF_INHERIT) and the Detail Ledger Group component (DETAIL_LEDGER_GROU).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CF_INHERIT |

Use to maintain the Inheritance Options for an Inheritance Group. |

|

|

Ledger Groups - Balancing Page |

LEDGER_GROUP3 |

Elect to use IntraUnit Balancing Entries, and select Balancing ChartFields and Affiliates for a Ledger Group. Navigate to . See the ChartField Inheritance Page for more information. |

ChartField inheritance, in and of itself, does not generate additional entries to complete a transaction. Instead it drives how the ChartFields are determined for the system-generated entries that are normally created for the transaction. In many cases this is an offset, such as AP (accounts payable) Vouchers, where the user enters the distribution lines and the system generates the customer liability. Inheritance also applies to other system generated entries that are not offsets, like the VAT entries generated for a GL (general ledger) journal.

Note: Even if you do not want to inherit any ChartField values, you must access the ChartField inheritance page to setup Inheritance Groups for each SetID, setting all Inheritance Options to Do Not Inherit.

ChartField Inheritance uses the ChartField Offset Balancing Method to complete transactions by inheriting ChartField values from partial entries, accounting lines or voucher lines to generate complete accounting entries. It is used extensively in education and governmental accounting, and to a lesser extent in commercial accounting.

It enables you to select automatically the source for certain ChartField values to complete partial entries for a given number of system generated accounting entries that are predefined by Inheritance Groups.

Inheritance functionality does not necessarily relate to centralized inter and intraunit processing. This is because it may or may not involve inter or intraunit transactions, and inheritance processing is performed by the individual general ledger feeder systems, such as Receivables and Payables to arrive at offset accounts before any inter and intraunit processing is required.

For example, when posting accounts payable vouchers, you can choose to have the Fund Code on the Vendor Liability entry derived from the Voucher Distribution Line, the GL Business Unit Definition ChartField Defaults, or the Accounting Entry Template.

When you balance on ChartFields other than business unit, and inherit ChartField values onto the system generated offset entries, the transaction often self-balances, making additional intraunit balancing entries unnecessary. For this reason, applications use inheritance functionality before calling the inter and intraunit processor.

The following terms and concepts are important to an understanding of ChartField Inheritance and the examples provided:

Term |

Definition |

|---|---|

Fund |

A fund is a fiscal and accounting entity with a self-balancing set of accounts recording cash and other financial resources, together with all related liabilities and residual equity or balances. Inheritance is often used with this ChartField, but can also be used for any ChartField. |

Pooled Bank Account |

Pooled is a term used in education and governmental accounting to describe a single bank account that is used for multiple funds. When defining a pooled bank account, you do not associate it with any specific fund or funds. Instead, the fund from the item and or voucher being paid is carried forward (inherited) to the cash entry. The PeopleSoft equivalent of a Pooled bank account is one in which the Inheritance Option for the Fund ChartField is set to Always Inherit or Inherit Within Unit. |

Non-pooled Bank Account |

Non-pooled is a term used in education and governmental accounting to describe a bank account that is for a single fund, which is identified on the bank account definition. If a non-pooled bank account is used for payments of items or vouchers belonging to other funds, then InterFund entries must be generated to balance the transaction. The PeopleSoft equivalent of a Non-pooled bank account is one in which the Inheritance Option for the Fund ChartField is set to Do Not Inherit. |

Offset Inheritance Balancing |

For transactions that include system-generated entries (often as offset entries), the system generated entries can be defined to inherit ChartField values from the other entries in the transaction (such as the distribution lines you entered) to balance the transaction and distribute the offset as needed. For example, you enter a voucher that records expenses to two different funds. Using Offset Inheritance, the offsetting entries are properly distributed by the system to the appropriate accounts payable accounts for the two funds. |

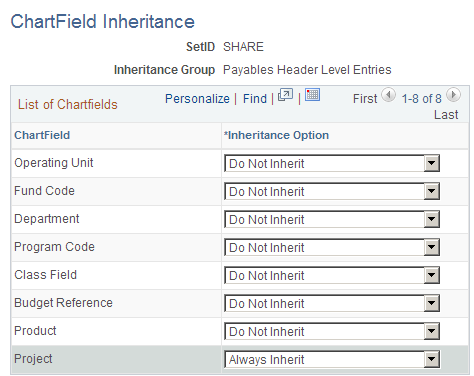

Use the ChartField Inheritance page (CF_INHERIT) to maintain the Inheritance Options for an Inheritance Group.

Navigation:

This example illustrates the fields and controls on the ChartField Inheritance page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Inheritance Group |

Along with SetID, this it is a key field for the table. PeopleSoft delivers the following predefined Inheritance Groups for its various products:

|

ChartField |

The page is pre-populated with the fully and partially configurable ChartFields other than Account, Alternate Account and the Affiliates. Account and Alternate Account are not available for inheritance and Affiliate values are automatically supplied by the system. |

Inheritance Option |

The following ChartField Inheritance options apply to all Inheritance Groups:

Some Inheritance Groups have edits that restrict which inheritance options are valid for each ChartField, often based on whether or not the ChartField is balanced. Refer to the next section for details. |

Refer to the documentation for ChartField Inheritance for each product for variations in functionality or information specific to that product.

For some Inheritance Groups, the Inheritance Options are restricted based on whether or not ChartFields are balanced ChartFields. For this reason, the Inheritance Options table shares the same Record Group control as the Ledger Group definition. There may be multiple Ledger Groups defined for a given SetID. If any one of these Ledger Groups, having a Ledger Group Type of Standard or Translation, defines a ChartField as balanced, the ChartField is considered balanced for Inheritance Option validation.

This cross-validation occurs when you save the ChartField Inheritance page or the Detail Ledger Group page. If you change a ChartField from balancing to non-balancing or vice versa for a Ledger Group, the system checks whether the change has invalidated any existing ChartField inheritance groups. When you select Inheritance Options for an Inheritance Group, the system checks for balancing ChartFields that make the selected Option invalid.

The specific validation requirements for the individual product Inheritance Groups depends not only on whether balanced or non-balanced ChartFields are involved but in the case of accounts payable on whether the posting method is Summary Control or Detail Offset.

If you receive an error message when saving either the ChartField Inheritance page or the Detail Ledger Group - Inter/IntraUnit page, refer to the following table for correct settings:

|

Inheritance Group |

Valid Options for a Balanced ChartField |

Valid Options for a Non-Balanced ChartField |

|---|---|---|

|

Payables (When the Post Method is Summary Control) |

|

|

|

APCA - Control |

Use Unit Default |

Use Unit Default, Do Not Inherit |

|

APEA - Expense |

Always Inherit |

Any of the 4 options |

|

APVN - Non-Recoverable VAT |

Always Inherit, Inherit Within Unit |

Any of the 4 options |

|

Payables (When the Post Method is Detail Offset |

|

|

|

APCA - Control |

Always Inherit, Inherit Within Unit |

Any of the 4 options |

|

APEA - Expense |

Always Inherit |

Any of the 4 options |

|

APVN - Non-Recoverable VAT |

Always Inherit, Inherit Within Unit |

Any of the 4 options |

|

Purchasing |

|

|

|

POCA - Control |

Always Inherit |

Any of the 4 options |

|

POEA - Expense |

Always Inherit |

Any of the 4 options |

|

POVN - Non-Recoverable VAT |

Always Inherit |

Any of the 4 options |

|

Receivables |

|

|

|

ARRE - Revaluation Gain/Loss |

Always Inherit |

Any of the 4 options |

|

Translate Gain/Loss |

Always Inherit |

Any of the 4 options |

|

Promotions Management |

|

|

|

TDAC - Promotions Mgt Accounts |

Always Inherit |

Any of the 4 options |