Understanding PeopleSoft Tax Solutions

This section discusses:

Comparing PeopleSoft tax tables to third-party tax suppliers.

Understanding tax integration technologies.

PeopleSoft Billing supports the use of five sales and use tax solutions: PeopleSoft Tax Tables and two solutions each from the suppliers Vertex and Taxware. PeopleSoft Tax Tables, included with PeopleSoft Billing, meets simple sales tax requirements but requires you to maintain tax rates. Provided interfaces enable PeopleSoft Billing to use two third-party tax suppliers: Taxware and Vertex. These suppliers provide solutions to the most complex sales tax requirements and maintain tax rates for you.

Note: If you use Taxware Sales and Use Tax, the Taxware STEP and Verazip modules are optional but recommended. Check with the tax suppliers for the versions of their software that are available for the different releases of PeopleSoft.

Third-party tax solutions provide a more complex set of features for sales and use tax calculations than PeopleSoft tax tables. The following table compares PeopleSoft tax tables with third-party solutions:

|

PeopleSoft Tax Tables |

Third-Party Solutions |

|---|---|

|

You must manually maintain tax rates. |

The supplier provides monthly tax updates. |

|

You must determine and manually check for exemptions. Exemption status is not determined at the time of calculation. If an order line, bill line, or purchase order line is not marked as tax-exempt, taxes are calculated. |

The tax supplier system determines exemption status at the time of tax calculation. The tax supplier system maintains customer exemption certificates and product tax rules. |

|

Tax rates come from the tax authorities of a tax code on the transaction. A tax code loosely represents a taxing jurisdiction. In PeopleSoft Billing, the tax code can be entered manually on a bill line, or it can be populated automatically from the ship to customer onto the bill during bill entry or through the bill interface. In PeopleSoft Order Management, the tax code can be entered manually, or it can be populated automatically from the ship to customer for the order line or schedule. In PeopleSoft Purchasing, the tax code can be entered manually on a purchase order, or it can be populated automatically from the ship to location to the purchase order schedule. |

Tax rates and jurisdictions are determined from ship to, ship from, order origin, and order acceptance address information on the transaction. |

|

Tax liability is maintained in separate accounts for each tax authority. |

Tax liability is maintained in one account for the business unit. |

PeopleSoft supports integration with four sales and use tax solutions from two third-party suppliers:

Taxware Enterprise

Vertex O Series

Taxware Sales and Use Tax

Vertex Q Series

Web Service Integrations

Taxware Enterprise and Vertex O Series are both implemented as web services. PeopleSoft applications communicate with these web services through the PeopleSoft Integration Broker. The Integration Broker uses the URL of the web service to conduct transactions with these tax solutions.

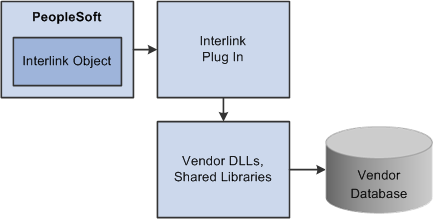

Business Interlink Integrations

PeopleSoft applications communicate with Taxware Sales and Use Tax and Vertex Q Series through Business Interlink objects and plug-ins. The Business Interlink object is part of the PeopleSoft system, but the Interlink plug-ins and associated integration software are provided by Taxware or Vertex. The plug-in and integration software must be installed on the PeopleSoft application and Process Scheduler servers. Initialization files, the Microsoft Windows Registry, or environment variables are used to store the information needed to connect to the main tax solution software and databases.

Note: PeopleSoft Business Interlink is a deprecated product. These options currently exist for upgrade compatibility and transition.

The following diagram shows how the PeopleSoft interlink object communicates with the interlink plug-in, which in turn communicates with the tax solution and database through the supplier shared libraries.

The following diagram shows how the PeopleSoft interlink object communicates with the interlink plug-in

The generic tax supplier dynamic link libraries (DLLs), or shared libraries, are typically delivered by the tax suppliers to all customers. Each supplier has a unique set of DLLs. The tax supplier database objects are the repositories for geocodes, tax rates, exception information, and transactions.

Note: An Interlink plug-in can also be installed on a Windows client running the PeopleSoft Application Designer to facilitate two-tier testing. Additional supplier-supplied software may be required, as typically only software for the target production operating system is provided.

For technical details about individual EIPs, use the Interactive Services Repository (ISR) in the My Oracle Support website located at https://support.oracle.com/CSP/ui/flash.html.