Managing VAT Accounting

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Automated Accounting Page |

TRA_ACCTG_REQ |

Run the Automated Accounting process, which creates accounting entries and prepares them for Journal Generator process (FSPGJGEN). See Processing VAT with Automated Accounting and the Automated Accounting Page. |

|

Accounting Summary Page |

TRA_ENT_SUM_PNL |

View line by line accounting events. You can retrieve information according to ad-hoc search criteria and navigate to all functional areas of accounting. See the Accounting Summary Page for more information. |

|

Accounting Entries Page |

TRA_ACCTG_LINE_1 |

Review and possibly adjust automated accounting entries, or create manual accounting entries online. See Reviewing VAT Accounting Entries and the Accounting Entries Page. |

|

TRV_ACCTG_LINE_VAT |

Use the Treasury VAT Information page to view VAT information for a specific accounting line. |

The only VAT accounting activity you need to perform is setting the VAT option on the accounting template. To enable automated VAT processing, VAT attributes and VAT amounts are recorded on a shadow table (VAT Transaction Record table, TRV_VAT_TRAN) associated with the VAT accounting lines. This process works in the background. Once you process VAT transactions through Automated Accounting process (TR_ACCTG), the system automatically generates the necessary accounting entries and VAT accounting lines based on data in the VAT Transaction Record.

To manage VAT accounting:

Process VAT entries with Automated Accounting.

Review VAT accounting entries.

Review Treasury VAT information.

Use the Automated Accounting page (TRA_ACCTG_REQ) to run the Automated Accounting process, which creates accounting entries and prepares them for Journal Generator process (FSPGJGEN).

Navigation:

To process VAT:

Specify the Business Unit and Template.

Enter a Fiscal Year and Period, or specify an Acctg Events End Date (accounting events end date).

Select the Bank Stmt/Trans (bank statement/transaction), Facility Fees, Deal Fees, L/C (letter of credit), or EFT Fees check boxes.

Use the Accounting Entries page (TRA_ACCTG_LINE_1) to review and possibly adjust automated accounting entries, or create manual accounting entries online.

Navigation:

Click VAT on the Accounting Entries tab.

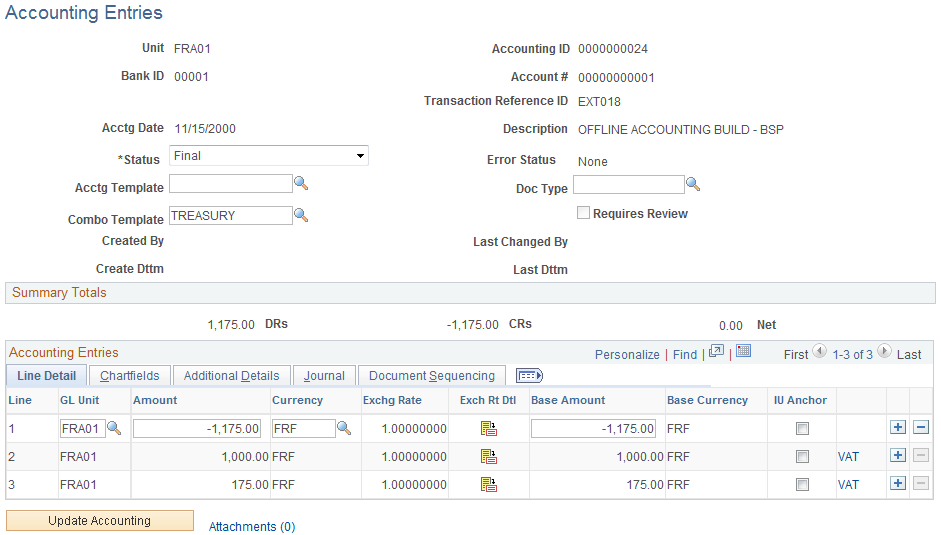

This example illustrates the fields and controls on the Line Detail tab - Treasury Accounting Entries page. You can find definitions for the fields and controls later on this page.

When the Automated Accounting process is complete, you can review the created accounting entries and VAT transactions. The VAT link displays on the Accounting Entries page when the accounting line has VAT information.

Field or Control |

Description |

|---|---|

Line |

As the example above shows, the Automated Accounting process created three accounting entries. Line 3 is the VAT amount. Click a Line link to access the Accounting Entries page and review the VAT transaction detail. |

Note: The number of VAT accounting lines created varies, depending on the accounting scenario.

Note: The number and types of accounting entries depends on the VAT Treatment and whether or not any of the VAT is recoverable or subject to rebate.

The system obtains the ChartFields used to create each accounting entry from the VAT accounting template (which is defined by VAT Code, VAT Transaction Type, and optionally the General Ledger business unit). Additionally, for nonrecoverable VAT, the ChartFields used are also dependent upon whether or not the nonrecoverable amount is being prorated or allocated to the associated expense account. If the nonrecoverable amount is not prorated or allocated to the associated expense account, the system obtains the non-account ChartFields from the VAT accounting template.

In situations when the VAT accounting entries have two different business units—one for the Transaction General Ledger business unit (Unit field in the Accounting Entries page header), and one for the Distribution General Ledger business unit (GL Unit field in Accounting Entries - Line Detail tab), you can direct the system to inherit either business unit. You specify this option during implementation on the VAT Business Unit Option page (VAT_BU_OPT). During the Automated Accounting process, if the system registers two different business units in use, it refers to the options specified on this page. The system then enters the correct inherited business unit into the GL Unit field of each entered distribution line of the system generated VAT accounting entries.

Note: Accounting entries that the Automated Accounting process creates and distributes to General Ledger are display only and you cannot adjust them on this page. You must adjust VAT accounting through the General Ledger journal.

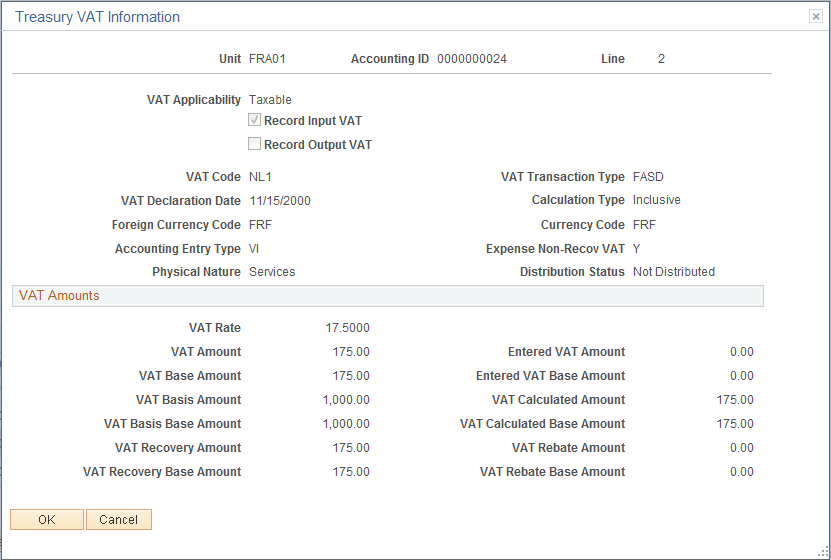

Use the Treasury VAT Information page (TRV_ACCTG_LINE_VAT) to use the Treasury VAT Information page to view VAT information for a specific accounting line.

Navigation:

Click VAT on the Accounting Entries − Accounting Entries tab.

This example illustrates the fields and controls on the Treasury VAT Information page. You can find definitions for the fields and controls later on this page.

Note: Treasury Management VAT functionality is currently limited to VAT on bank fees and other fees, recording only input VAT or the combination of input and output VAT. As such, it is unlikely that you will be using either the VO or VONT types for your VAT transactions.

Field or Control |

Description |

|---|---|

VAT Applicability |

Displays the default value derived from the accounting template. |

Record Input VAT |

This field is based on the defined VAT treatment. This check box is selected by default. |

Record Output VAT |

This check box is selected by default if the defined VAT treatment is EU Services Purchases or Self-Assessed Services Imports. |

VAT Code |

Displays the default value derived from the appropriate VAT defaulting hierarchy—this is also dependent on the VAT Treatment and/or VAT Applicability. |

VAT Transaction Type |

Displays the default value derived from the appropriate VAT defaulting hierarchy—this is also dependent on the VAT Treatment and/or VAT Applicability. |

VAT Calculation Type |

Displays Inclusive or Exclusive. |

VAT Declaration Date |

Displays the default value derived from the transaction date. |

Accounting Entry Type |

Displays the VAT accounting entry type. VAT distribution account types define the different types of VAT accounting entries that may be required. Treasury Management only uses the following VAT distribution account types:

|

Expense Non-Recov VAT (expense nonrecoverable VAT) |

Displays one of the following values:

|

Distribution Status |

Indicates if the transaction has been loaded to the VAT Transaction Loader. Displays one of the following values:

|

VAT Rate |

Displays the VAT percentage that is applied to the transaction. |

VAT Amount |

Displays the VAT amount in the transaction currency. |

VAT Base Amount |

Displays the VAT amount in the base currency. |

VAT Basis Amount |

Displays the VAT basis amount in transaction currency. |

VAT Basis Base Amount |

Displays the VAT basis amount in the base currency. |

VAT Recovery Amount |

Displays the VAT recovery amount in the transaction currency. |

VAT Recovery Base Amount |

Displays the VAT recovery amount in the base currency. |

Entered VAT Amount |

The default value is zero (0). If either the VAT calculation type is Inclusive, or both Record Input VAT and Record Output VAT check boxes are selected, this field is set to zero and unavailable. You can override this default value by selecting Exclusive for the calculation type. This is the actual VAT amount in transaction currency that prints on the external document. If it is not equal to the calculated VAT amount (and not equal to zero), tolerance checking is performed. |

Entered VAT Base Amount |

Displays the entered VAT amount in base currency. The system uses the transaction currency for the entered VAT amount, based on the exchange rate that is applicable to the transaction. |

VAT Calculated Amount |

Displays the calculated VAT amount in the transaction currency. |

VAT Calculated Base Amount |

Displays the calculated VAT amount in the base currency. |

VAT Rebate Amount |

Displays the calculated VAT rebate amount in the transaction currency. |

VAT Rebate Base Amount |

Displays the calculated VAT rebate amount in the base currency. |

Note: This page is display-only. Once the Automated Accounting process creates the VAT accounting entries and distributes them to General Ledger, you cannot adjust the entries on a Treasury application page. You must use the General Ledger Journal Entry page to adjust VAT accounting entries.