Understanding Cash Sweep Functionality

Cash Sweep enables you to perform a sweep across multiple external bank accounts to manage the liquidity in your organization. Cash Sweep leverages the functionality of these PeopleSoft Treasury features:

External bank accounts.

Cash position.

Fund transfers - Bank account and EFT (electronic fund transfer) requests.

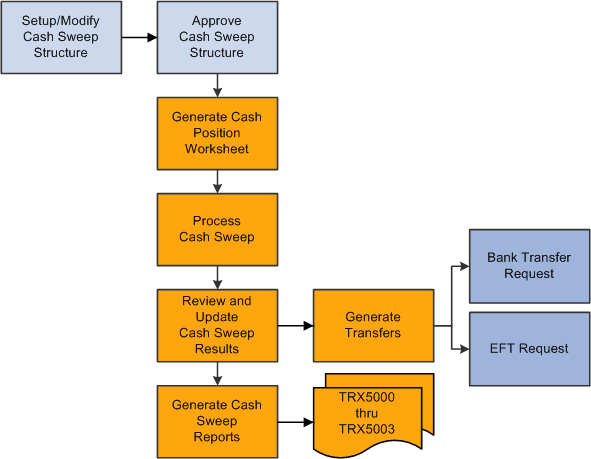

The Cash Sweep process flow includes these steps:

Set up the cash sweep structure.

You set up the cash sweep structure across multiple external bank accounts. The cash sweep structure consists of a master account, overall processing attributes, sub-accounts and sub-account processing attributes.

Approve the cash sweep structure.

You must approve any new or modified cash sweep structure before you can run the Cash Sweep process (TR_CSH_SWEEP).

Generate the Cash Position worksheet.

Run the Cash Sweep process.

Review and update the cash sweep results.

Generate transfers using bank transfer or EFT request.

Generate cash sweep reports.

Cash sweep process flow from setting up or modifying the cash sweep structure and approving the cash sweep structure through generating transfers and reporting

Complete these prerequisites prior to setting up a cash sweep structure:

Set up external bank accounts.

Set up internal bank accounts.

Set up bank transfer templates.

Set up EFT templates.

Define cash position.