Creating On-Behalf-Of Deals

This topic provides an overview of on-behalf-of deals and discusses how to use on-behalf-of deals.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRX_INTERNAL_TR |

Create the treasury's on-behalf-of deal transactions. |

On-behalf-of deals enable PeopleSoft Deal Management to interact with other internal units in an organization. You use this feature to assist other internal units in obtaining outside loans or deals through the treasury of the organization.

Organizational treasuries generally have more trading volume and established counterparty relationships than other internal units. Consequently, the treasury can facilitate a large block trade on behalf of several internal units, obtaining a better rate than the units can obtain independently.

On-behalf-of deals can contain several types of deals, depending on the originator and receiver of the deal. The deal types are outside deal, back-to-back deal, and mirror deal.

A treasury outside deal is a large block trade between the treasury and the outside counterparty. To the outside counterparty, the deal appears to be a single deal, but it consists of all the trades for the individual business units.

Treasury internally manages the deal by dividing the single outside deal among the other internal units. Two additional deals are needed for each subdivision. The first deal involves the treasury's selling off a portion of the original position. This is called a back-to-back deal. The second deal is the reverse of the back-to-back sale; the individual unit receives the sold-off portion. It is called a mirror deal.

For example, suppose that the treasury buys a 50 million USD certificate of deposit on behalf of other units. The treasury will then use two deals to transfer a portion of this purchase to another unit. The first deal, the back-to-back deal, is a sale of 10 million USD that removes that amount from the treasury's position. The second deal, the mirror deal, is a purchase from treasury of 10 million USD by the internal unit, which puts the 10 million USD onto its books.

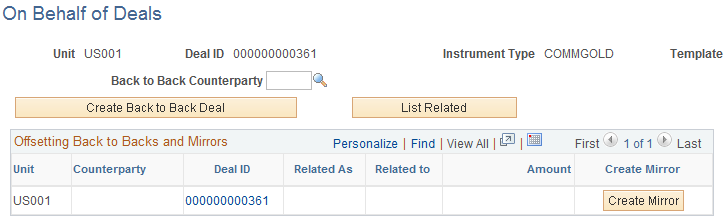

Use the On Behalf of Deals page (TRX_INTERNAL_TR) to create the treasury's on-behalf-of deal transactions.

Navigation:

This example illustrates the fields and controls on the On Behalf of Deals page. You can find definitions for the fields and controls later on this page.

To use on-behalf-of deal functionality:

Enter an external deal using the deal capture pages.

Select the external deal on the On Behalf Of Deals page.

Offset the original deal with back-to-back deals that move the external position out of treasury's net holdings.

For each deal, first select a counterparty, and then request a back-to-back deal. The back-to-back counterparty can be external, but normally it is an internal unit.

Specify the amount of principal to be transferred by modifying the principal on the Deal Detail page of the newly created deal, save the page, and return to the On Behalf Of Deals page.

Select the back-to-back deal and create a mirror deal.

The system stores the mirror deal with the internal unit as the owner, the treasury as the counterparty, and the position amount added to the internal unit's ledger.

The mirror deal reverses the back-to-back deal, causing the mirror to act in a similar fashion as the external deal. Therefore, if the original deal is a buy, the mirror is a buy.

Note: For you to use this page, the deal status must be Under Negotiation.

Field or Control |

Description |

|---|---|

Back to Back Counterparty |

Click to select a counterparty for the back-to-back deal. |

Create Back to Back |

Click to automatically create a back-to-back deal. The system uses the defined back-to-back counterparty and the original deal information. You can edit information for the back-to-back deal in the deal component, as necessary. |

List Related |

Click to list all back-to-back and mirror deals that are created for the displayed deal ID. |

Deal ID |

Click to access the deal capture pages and view back-to-back deal or mirror deal details. |

Mirror Deal |

Click to automatically create a mirror deal for the internal treasury. You can create mirror deals only from back-to-back deals that are defined with an internal business unit counterparty. |