Establishing Line of Credit and Commercial Paper Facilities

This topic discusses how to establish line of credit and commercial paper facilities.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TR_DEBT_FACILITY |

Establish a new line of credit or commercial paper facility. |

|

|

Contact Information Page |

FCLTY_CONTACT_SEC |

Enter contact information for the facility. See the Facilities for Issuing Debt Page for more information. |

|

Facility Activity Information Page |

FCLTY_LOC_ACT_SEC |

View a summary of line-of-credit activity. See the Facilities for Issuing Debt Page for more information. |

|

Enter Fees Page |

FEE_GENERATOR |

Record actual fees that are incurred on behalf of the line-of-credit facility. See the Facilities for Issuing Debt Page for more information. |

|

RUN_TRC4120 |

Review all lines of credit and associated usage and costs, and create a report. |

|

|

Debt Ratings Maintenance Page |

TRX_DEBT_RATINGS |

Record Credit Ratings on Enterprise as rated by external Rating Agencies. The Ratings are normally divided into short and long term ratings. |

|

RUN_TRC4130 |

Create a report detailing the all-in costs of issuing commercial paper, including fees on lines of credit, as well as dealer fees that are not recorded as part of the commercial paper instrument. |

To establish line of credit and commercial paper facilities, use the Debt Facilities component (TR_DEBT_FACILITY_GBL).

To maintain debt ratings, use the Debt Ratings Maintenance component (TR_DEBTISSUE_RATNG_GBL).

The fields on the Debt Facilities page change depending on the facility type.

Use the Facilities for Issuing Debt page (TR_DEBT_FACILITY) to establish a new line of credit or commercial paper facility.

Navigation:

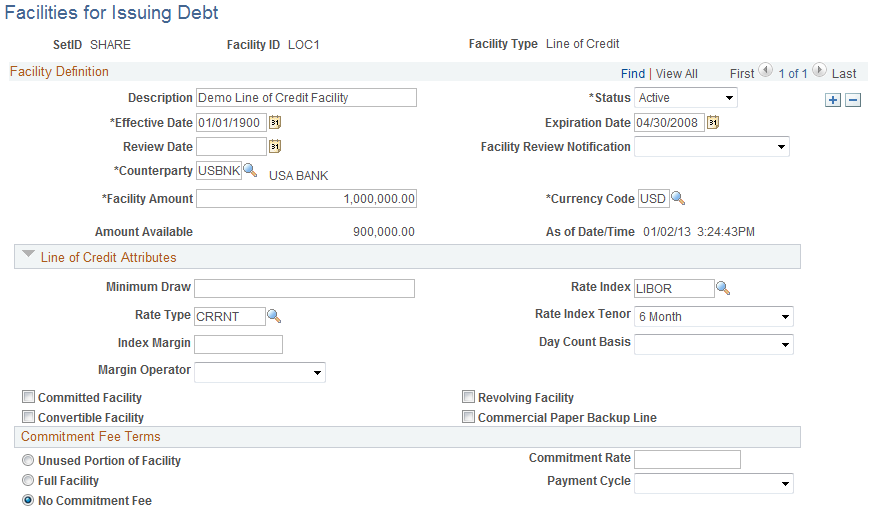

This example illustrates the fields and controls on the Facilities for Issuing Debt page – for a line of credit (1 of 2). You can find definitions for the fields and controls later on this page.

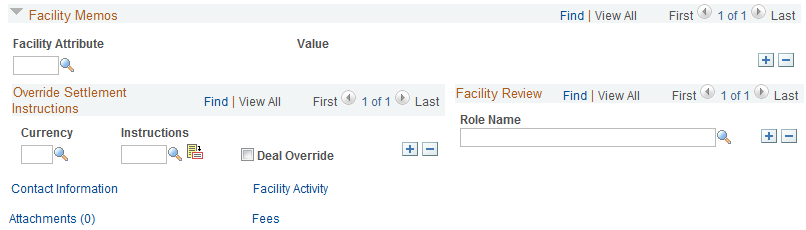

This example illustrates the fields and controls on the Facilities for Issuing Debt page – for a line of credit (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Facility Amount |

Enter the original amount of the facility. |

Amount Available |

Displays the remaining value of the facility. If the Revolving Facility field is selected, then the system calculates this value by subtracting the remaining principal for line-of-credit deals for this facility ID and facility type from the facility amount. If the Revolving Facility field is not selected, then the system calculates this value by subtracting all of the deal transaction amounts that have been issued on the facility from the facility amount. |

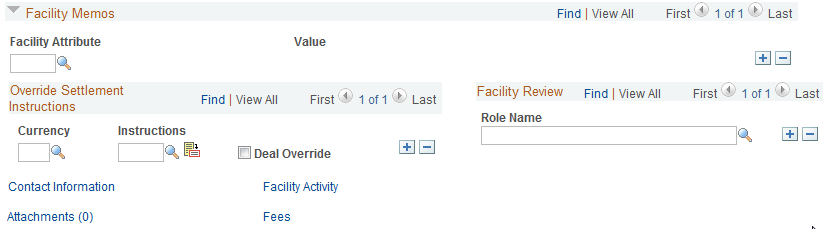

Contact Information |

Displays the Contact Information page (FCLTY_CONTACT_SEC), where you can enter contact information for the facility. |

Facility Activity |

Displays the Facility Activity Information page (FCLTY_LOC_ACT_SEC), which provides a summary of borrowings and payments as well as an overall estimated cost of borrowings for the respective facilities. |

Fees |

Displays the Enter Fees page (FEE_GENERATOR), where you can record actual fees that are incurred on behalf of the line-of-credit facility. |

Line of Credit Attributes

Field or Control |

Description |

|---|---|

Minimum Draw |

Enter the minimum amount that is required for each borrowing transaction on this facility. |

Committed Facility |

Select to indicate that the counterparty is committed to grant the request for loans. The line cannot be unilaterally withdrawn under circumstances that are not stipulated in the Line of Credit agreement. If the Commitment Fee Terms region has been completed, you must select this field. |

Revolving Facility |

Select to indicate that the borrower can continue to borrow against and repay this line of credit. This type of line-of-credit facility is commonly referred to as a revolver. Note: This option is available only if the Committed Facility check box is selected. |

Convertible Facility |

Select to indicate that this line of credit is convertible to a term loan. Note: If the Commercial Paper Backup Line field is selected, you cannot select the Convertible Facility check box. |

Commercial Paper Backup Line |

Select to indicate that this line of credit is an assurance of available funds protecting a commercial paper investor from any payment defaults. This type of line cannot be borrowed against for general purposes. A line of credit may be tied to multiple commercial paper facilities. |

Commitment Fee Terms

Field or Control |

Description |

|---|---|

Commitment Rate |

Enter the percentage rate to use for calculating the commitment costs that are tied to the line of credit. This is typically entered as a decimal of 1% such as .25 (¼ of 1%). The system uses this in calculating the estimated commitment costs on the Line of Credit Activity report. |

Payment Cycle |

Select the interval between commitment fee payments. The options are:

|

Unused Portion of Facility, Full Facility, or No Commitment Fee |

Select the correct option for calculating the commitment fee for this facility. Select Unused Portion of Facility to indicate that the commitment rate is applied to the unused portion of the line of credit, rather than to the entire facility amount. |

Note: If the Commitment Fee Terms region has been completed, then you cannot select the Committed Facility check box.

Use the Facilities for Issuing Debt page (TR_DEBT_FACILITY) to establish a new line of credit or commercial paper facility.

Navigation:

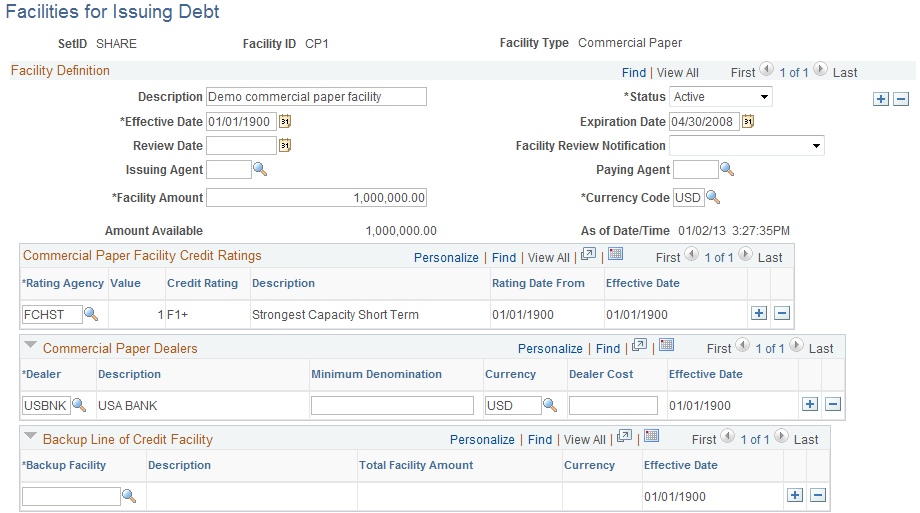

This example illustrates the fields and controls on the Facilities for Issuing Debt page - for a commercial paper facility (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Facilities for Issuing Debt page for commercial paper (2 of 2). You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Issuing Agent |

Enter the agent for the issuer of the commercial paper that provides issuing instructions to the DTCC. This is usually the receive into counterparty. |

Paying Agent |

Enter the agent for the issuer of the commercial paper that is authorized to make principal and interest payments. This is usually the pay into counterparty. |

Facility Amount |

Shows the original amount of the facility. |

Amount Available |

Displays the remaining value of the facility. |

Rating Agency |

Select the agency that has rated this commercial paper facility. The credit rating agencies to be selected and their rating values are set up through the Debt Ratings Maintenance page (TRX_DEBT_RATINGS). |

Commercial Paper Dealers

Field or Control |

Description |

|---|---|

Dealer |

Select the security firm whose principal role is to intermediate the process of identifying commercial paper investors. Not all commercial paper issuers use dealers, and commercial paper could be issued without a dealer even if a dealer is not listed on the facility. |

Minimum Denomination |

Enter the minimum amount that is required by this dealer. If the minimum denomination that you enter is greater than the par amount of the deal, the system issues a warning but allows the deal to be booked. |

Dealer Cost |

Enter the cost that is associated with this dealer. This is typically entered as a decimal of 1% such as .25 (¼ of 1%). The system uses this in calculating the dealer's cost on the Commercial Paper Activity report. |

Use the Line of Credit Report page (RUN_TRC4120) to review all lines of credit and associated usage and costs, and create a report.

Navigation:

The Line of Credit report (TRX4120) shows all lines of credit and the associated costs.

Use the Commercial Paper page (RUN_TRC4130) to create a report detailing the all-in costs of issuing commercial paper, including fees on lines of credit, as well as dealer fees that are not recorded as part of the commercial paper instrument.

Navigation:

The Commercial Paper report (TRX4130) enables you to determine the all-in costs of issuing commercial paper debt. This report is organized by facility, and you can print any or all of the commercial paper facilities. Information on the report includes facility information, commercial paper issued, the interest rate, prorated dealer costs, prorated line-of-credit costs, and the effective annual rate for each commercial paper deal. The effective annual rates are expressed using this formula: