Selecting Accounting Templates

This topic provides an overview of interest rate swap cash flows and accounting templates, and discusses how to select accounting templates and view accounting template details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

INSTR_ACCTGTMPL |

Associate accounting templates with accounting event types of an instrument. |

|

|

Template |

TRA_TMPL_DETL |

View detailed information for a specific accounting template. |

When creating interest rate swap deals in Deal Management, depending on the specified swap option, specify the corresponding preconfigured accounting template to ensure correct cash flow processing.

The behavior of interest cash flows for interest rate swaps depends on the swapping option specified for the deal.

If the option of swapping principals at commencement or both at commencement and maturity is specified on the deal, the interest cash flows computed on the pay leg are considered to be receivable, and the interest cash flows computed on the receive leg are considered to be payable.

If the option of swapping principals at commencement or both at commencement and maturity is not specified on the deal, the interest cash flows computed on the pay leg are considered to be payable, and the interest cash flows computed on the receive leg are considered to be receivable.

To correctly calculate the cash flows for interest rate swaps, you must maintain two different types of accounting templates and specify the correct accounting template for the particular IRS deal. There are two accounting templates in the sample data for this purpose: IRSPS-PERPMT-L1 and IRSPS-PERPMT-L2. These templates are configured with the appropriate sign for each accounting line to correctly process the IRS deal accounting.

Use the IRSPS-PERPMT-L1 template for deals set with the option of Do Not Swap.

Use the IRSPS-PERPMT-L2 template for deals set with the option of Swap at Commencement and Maturity.

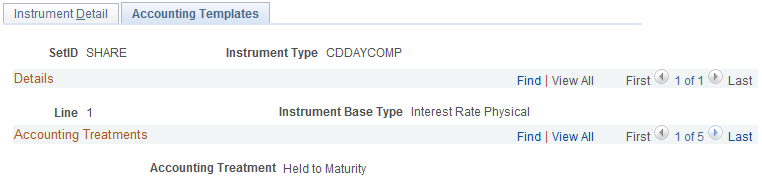

Use the Accounting Templates page (INSTR_ACCTGTMPL) to associate accounting templates with accounting event types of an instrument.

Specify accounting templates for instrument accounting event types to ensure correct system processing.

Note: For accounting to be processed on a deal, specify an accounting template for an accounting event, and also select the Include in Accounting check box for the specified accounting template.

Navigation:

This example illustrates the fields and controls on the Accounting Templates page (1 of 2). You can find definitions for the fields and controls later on this page.

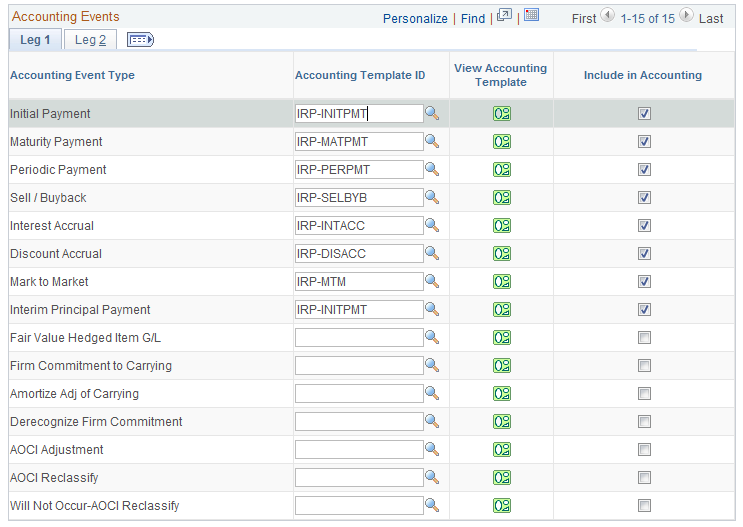

This example illustrates the fields and controls on the Accounting Templates page (2 of 2). You can find definitions for the fields and controls later on this page.

Note: The following accounting event types apply to all instrument base types: Mark-to-Market, Sell/Buyback, Deal Booking, and Deal Maturity. These event types are attached to instrument line 1 on the Accounting Entries page.

Field or Control |

Description |

|---|---|

Accounting Event Type |

Displays the accounting event type and associated accounting template ID default values. These vary depending on the instrument base type that you selected on the Instrument Detail page. |

Leg 1 and Leg 2 |

Specify different accounting templates for the accounting event types on each leg, if the instrument has multiple legs. |

Accounting Template ID |

Override the template ID that appears and enter another template. |

Include in Accounting |

Select the check box to identify the defined instrument and template relationship as eligible for automated accounting builds for the accounting event type that you specified. During processing, the system identifies the event as an error if you have not specified an accounting template ID. In this case, use the Accounting Events page to assign an accounting template ID and retry the automated accounting. You can alternatively process manual accounting for this event. If you do not select this check box, the instrument and template relationship is not eligible for automated accounting builds. |

|

Click the icon in the View Accounting Template column to open the Template page (TRA_TMPL_DETL), where you can review detailed information for a specific accounting template. Templates used for straight-discount deals should be different from the ones for interest-bearing deals. The Deal Amount must be one of the lines in the initial payment templates for straight-discount deals. Interest-bearing deals use Price. |