Understanding Tax Processing

This topic discusses:

Delivered tax elements.

Overall tax calculation process.

Normal tax calculation.

Annual bonus tax calculation.

Severance tax calculation.

Remunerated (REM) employee tax calculation.

Global Payroll for China delivers five tax deductions:

NORM TAX (Normal Income Tax Deduction)

DONATION (Donation)

ANN BON TAX (Annual Bonus Tax)

SEVERANCE TX (Severance Tax)

REM TAX (Remuneration Services Tax)

These deductions along with the key supporting elements associated with them are discussed in Understanding Deductions and Delivered Elements for China.

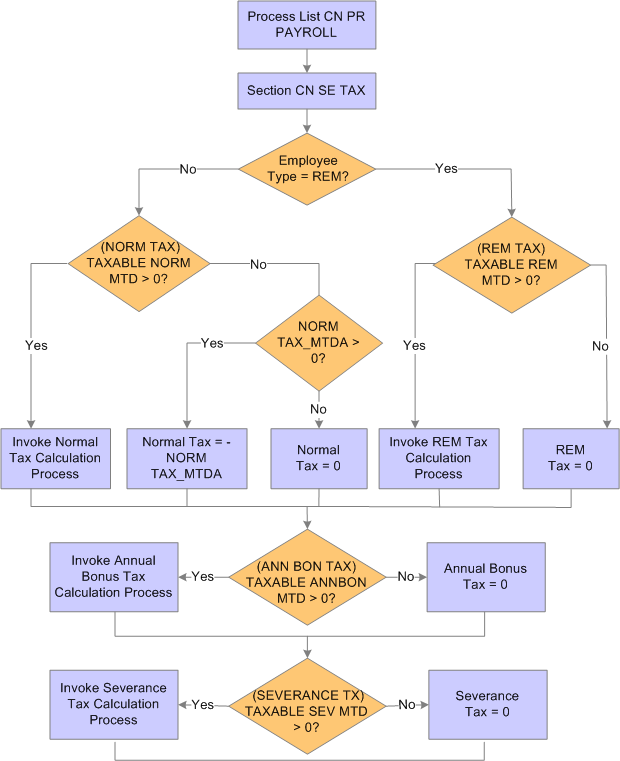

This diagram illustrates the flow of the overall tax calculation process:

This diagram illustrates the flow of the overall tax calculation process.

The tax section CN SE TAX calls each tax deduction sequentially to perform tax calculation: NORM TAX, ANN BON TAX, SEVERANCE TX, and REM TAX. It then calls a formula to insert tax values into the tax writable array CN WA TAX REPORT after each calculation.

The system uses the accumulative withholding method to calculate the normal tax (or individual income tax) for employees based on year-to-date (YTD) amounts. Using this method, the tax payable for the current month is calculated as follows:

Note: The system delivers a number of YTD accumulators for use in the calculation of normal tax using the accumulative withholding method. In these accumulators, variable CN VR TAX REGNO (Tax Registration Number) is set as the default user key. With that, any change in tax registration number resets the accumulator value. Oracle recommends that you review these accumulators and make sure that this reset behavior aligns with your organization’s requirement. If you decide not to use Tax Registration Number as the default user key, it will be your responsibility to update and maintain these accumulators.

Delivered accumulators include: CN AC PHF EE YTD, CN AC REDT AMT YTD, CN AC SI EE YTD, CN AC SP DED YTD, CN AC TAX PHF YTD, CN AC UNUSE RD YTD, CONT EDU FEE YTD, EDU FEE YTD, ELDERLY SUPP YTD, HOUSE LN INT YTD, HOUSING RENT YTD, NORM TAX YTD, TAX EXEMPTION YTD, and TAXABLE NORMAL YTD.

SPECIAL ADDITIONAL DEDUCTIONS

Employees are entitled to these special additional deductions:

Children’s Education Fee

Continuing Education Fee

Housing Loan Interest

Housing Rentals

Expense for Elderlies Support

The accumulator CN AC SP DED YTD includes all these special additional deductions (regular and retro) as members for ease of calculation.

It is the employees’ responsibility to report their special additional deductions to the China Tax Bureau. The information is then collected by the employers for salary and tax calculation. If these deductions are not reported in time to be processed for a tax year, you can apply for a supplementary deduction to the employer in the remaining month of the year. Special additional deductions may also be deducted between March 1st and June 30th of the following year when you submit the payment declaration to the tax authority.

Note: The accumulative tax withholding method is the default method used for normal tax calculation. The system provides an option for you to switch back to the previous method used (the MTD calculation method) if the change is deemed necessary. However, before you consider switching, keep in mind that the system keeps the previous method mainly for tax calculation reversal purposes only, and it is not validated against the new accumulative tax withholding method.

If you decide to switch to the MTD calculation method, set the value of variable CN VR ACC METHOD to N either by using the supporting element override, or by changing the variable value directly. Oracle recommends that you do not make this change in the middle of the year to avoid unexpected behavior.

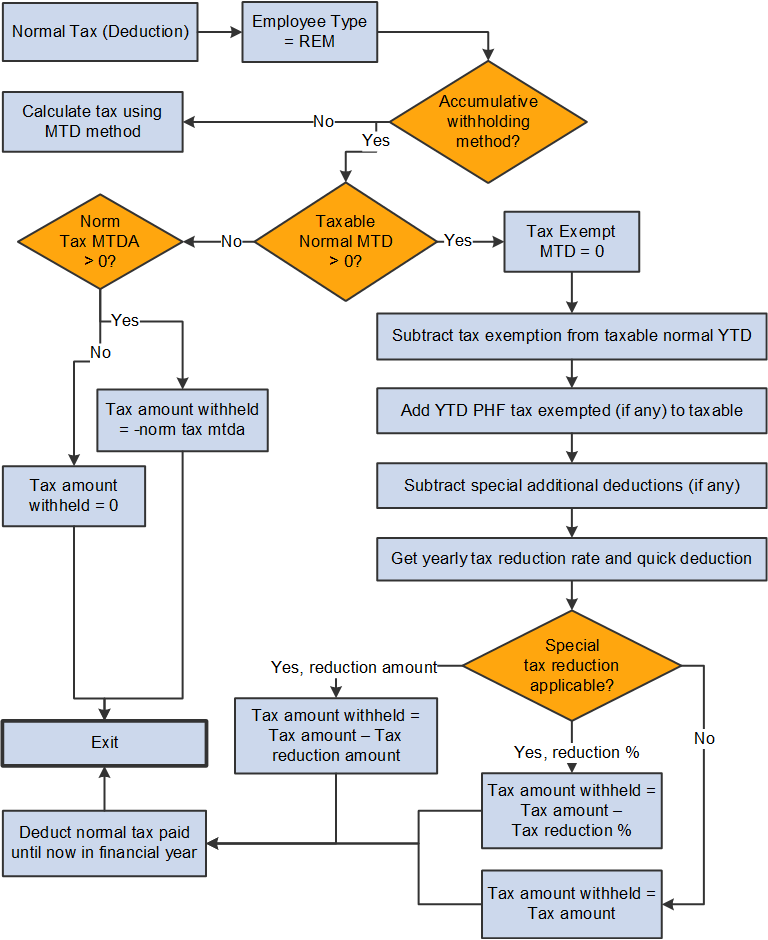

This diagram illustrates the flow of normal tax calculation:

This diagram illustrates the flow of normal tax calculation.

The NORM TAX deduction invokes the formula CN FM CALC NMYR TX, which derives normal tax from calculated normal salary. The formula references bracket CN BR TX EXEMPTION to load the tax exemption amount according to the employee type CN VR EE TYPE. It also calls formula CN FM CALC YR TAX to calculate tax.

Note: If the variable CN VR BONUS TX IND is set to Y, the system calculates tax for both annual bonus and normal salary together using the formula CN FM CALC NMYR TX.

See Also Annual Bonus Tax Calculation.

The formula CN FM CALC NMYR TX:

Deducts year-to-date monthly tax exemption TAX EXEMPTION YTD from year-to-date monthly taxable income TAXABLE NORMAL YTD to get taxable income.

Calls formula CN FM TAX PHF YTD to calculate year-to-date nontaxable PHF/SI contribution deduction amount and subtracts it from the taxable income, if applicable.

Subtracts year-to-date special additional deduction amounts CN AC SP DED YTD from the taxable income, if applicable.

Calls formula CN FM CALC YR TAX, which:

References the bracket CN BR TAX RATE YR to obtain the tax rate and quick calculation deduction to derive the withholding amount for the payee's normal salary for one pay period in the current financial year.

Subtracts the reduction from the tax withholding amount if the payee is eligible for disability reduction. If a payee override exists, the assumption is that it overrides an amount; otherwise, the formula uses the percent value retrieved from the CN BR TX EXEMPTION bracket.

Therefore, if an override exists, the tax withheld equals the tax amount from step 4a minus the override amount. If the tax withheld is less than zero, the formula sets the tax to zero. If no override exists, the formula subtracts the reduction percent from the tax withheld from step 4a.

Deducts any normal tax already paid year-to-date.

If TAXABLE NORMAL YTD is less than tax exemption and normal tax exists from earlier segments in the period, makes NORM TAX_MTDA negative to reverse calculated amount. Otherwise, sets NORM TAX_MTDA to 0.

Calculation of annual bonus tax by itself based on the bonus amount.

The method is the system’s default option. Based on the legislation, this method is valid until December 31, 2021.

Calculation of tax (which combines both annual bonus tax and income tax as one amount) based on the bonus amount and regular income.

This method is available for selection currently, and will become the only supported method starting on January 1, 2022.

The system uses the variable CN VR BONUS TX IND to determine the method used for the calculation. Set the value to N (default) to calculate the standalone annual bonus tax based on the bonus amount only. Specify Y to calculate tax based on the bonus amount and regular income.

Important! Select the bonus tax calculation method of your choice at the beginning of the year and refrain from making any changes. Changing the value later in the year can result in incorrect tax calculation.

Annual Bonus Tax Calculation Based on Bonus Amount

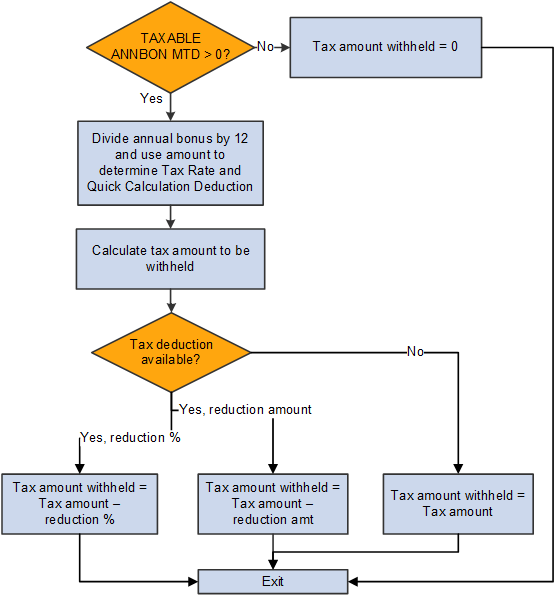

This diagram illustrates the flow of annual bonus tax calculation that is based on the bonus amount:

This diagram illustrates the flow of annual bonus tax calculation that is based on the bonus amount.

The ANN BONUS TAX deduction invokes the formula CN FM CALC SP TAX, which derives the annual bonus tax based on calculated annual bonus. CN FM CALC SP TAX then calls formula CN FM CALC TAX to calculate tax.

The formula CN FM CALC SP TAX:

Divides the annual bonus amount by 12.

Calls formula CN FM CALC TAX.

References the tax table CN BR TAX RATE to obtain the tax rate and quick calculation deduction using the calculated result from step 1, and calculates the withholding amount for the payee's annual bonus for one pay period in the current financial year.

Subtracts the reduction from the tax amount if the payee is eligible for disability reduction. If a payee override exists, the assumption is that it overrides an amount; otherwise, the formula uses the percent value retrieved from the CN BR TX EXEMPTION bracket.

Therefore, if an override exists, the tax withheld equals the tax amount from step 2a minus the override amount. If the tax withheld is less than zero, the formula sets the tax to zero. If no override exists, the formula subtracts the reduction percent from the tax withheld from step 2a.

Subtracts any annual bonus tax already calculated in the month.

Combined Tax Calculation Based on Bonus Amount and Regular Income

The system uses the delivered bonus earning 13THMNTH PAY in the tax calculation.

The bonus amount is added to these accumulators to support the calculation: Taxable ANNBON YTD (yearly taxable annual bonus), TAXABLE NORMAL MTD (monthly taxable normal earnings), TAXABLE NORMAL YTD (yearly taxable normal earnings), and CN AC SAL SUM SEG (summary of salary seg.).

Note: When you generate the Individual Income Tax Withholding Return report on the Tax Reports CHN Page, select the Salary/Wage category of income option for the bonus amount (if available) to be reflected in the taxable income amount on the report. The process does not generate any reports if the Annual Bonus option is selected.

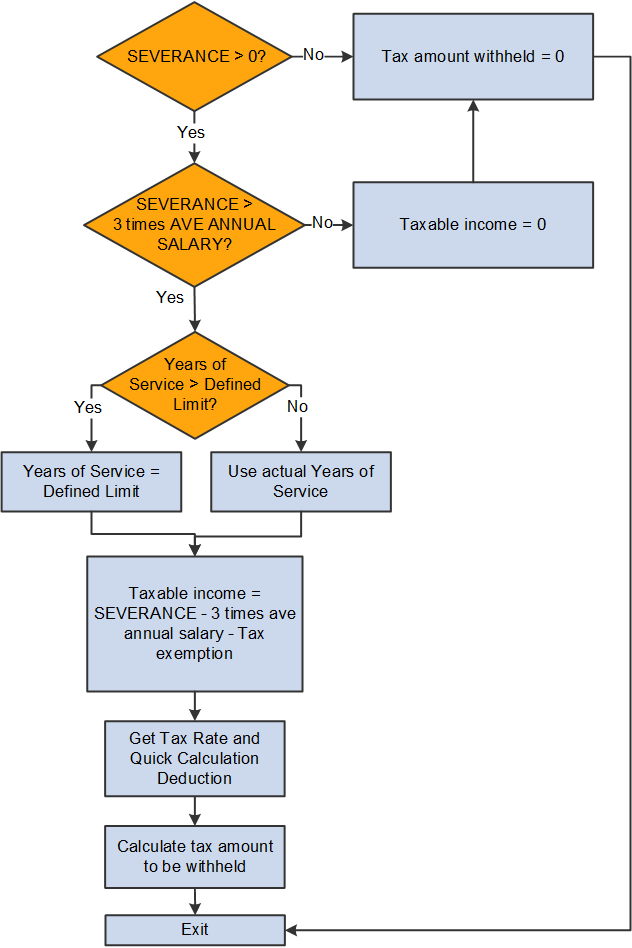

This diagram illustrates the flow of severance tax calculation:

This diagram illustrates the flow of severance tax calculation.

The SEVERANCE TX deduction invokes the formula CN FM CALC SEV TAX, which derives severance tax from the calculated severance payment. CN FM CALC SEV TAX then calls formula CN FM CALC TAX to calculate tax.

The formula CN FM CALC SEV TAX:

Calculates taxable income.

If severance pay is below 3 times the city average annual salary, the system exempts it from tax. In this case, taxable income = 0.

If severance pay is 3 times higher than last year's city average annual salary, the system calculates tax based on the amount above 3 times the city average annual salary of last year by allocating the amount into the number of months equivalent to total years of service for the current employer. If years of service is more than the defined limit, the formula caps the value at that limit. In this case, taxable income = (severance pay – 3 times city average annual salary).

Note: PeopleSoft Global Payroll for China delivers a years-of-service limit of 12. When determining years of service for a payee, the system rounds up to the nearest integer.

Calls formula CN FM CALC YR TAX, which:

References the bracket BR TAX RATE YR to obtain the tax rate and quick calculation deduction to derive the withholding amount for the payee's severance pay for one pay period in the current financial year.

Subtracts the reduction from the tax amount if the payee is eligible for disability reduction. If a payee override exists, the assumption is that it overrides an amount; otherwise, the formula CN FM TXYR REDUCT uses the percent value retrieved from the bracket CN BR TX EXEMPTION.

Therefore, if an override exists, the tax withheld equals the tax amount from step 2a minus the override amount. If the tax withheld is less than zero, the formula sets the tax to zero. If no override exists, the formula subtracts the reduction percent from the tax withheld from step 2a.

Multiplies calculated tax by the years of service to calculate the final amount of tax withheld.

Subtracts any severance tax already calculated in the month.

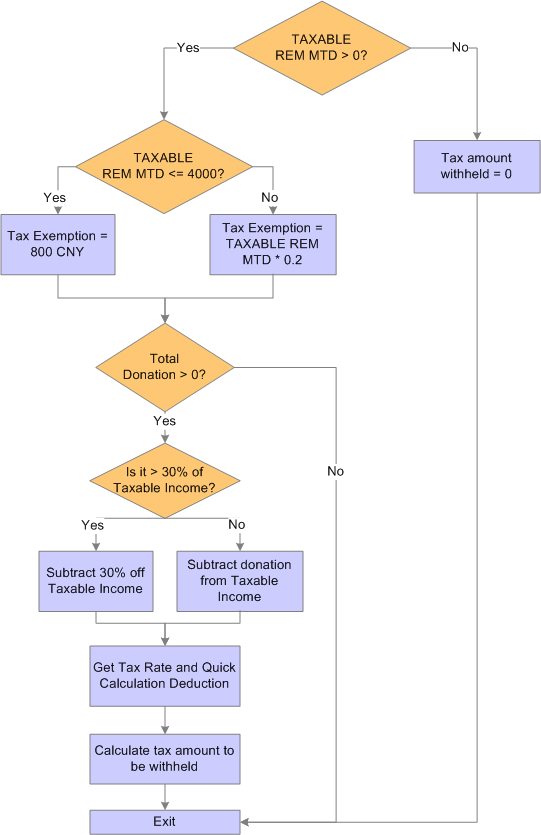

This diagram illustrates the flow of remunerated (REM) tax calculation (for interns, consultants, instructors, contractors, and other employees who are paid for services rendered):

This diagram illustrates the flow of REM tax calculation.

The REM TAX deduction invokes formula CN FM CALC REM TX, which calculates normal salary to derive REM tax. It then calls CN FM REM TAX, which inserts the REM tax calculation values into the CN WA TAX REPORT writable array for tax reporting purposes.

The formula CN FM CALC REM TX:

Calculates taxable income (CN VR TAX INCOME).

If TAXABLE REM MTD is less than or equal to 4,000 CNY, then CN VR TAX INCOME = TAXABLE NORMAL MTD – CN VR EXMPT AMT.

If TAXABLE REM MTD is greater than 4,000 CNY, then CN VR TAX INCOME = TAXABLE NORMAL MTD – (TAXABLE NORMAL MTD * CN VR EXMPT PCT).

Calls CN FM DONATION to subtract the tax-exempt portion of donation from step 1 if any donations exist.

If the total donation is greater than 30% of the taxable income from step 1, the 30% of taxable income becomes the tax-exemption portion and the system deducts it from the amount derived in step 1 to obtain the final taxable income, CN VR TAX INCOME.

If the total donation is less than 30% of the taxable income from step 1, the entire donation is tax exempted and the system deducts it from the amount derived in step 1 to get the final taxable income, CN VR TAX INCOME.

References the tax table CN BR TAX RT REM to obtain the tax rate and quick calculation deduction to derive the withholding amount for the payee's remunerated salary for one pay period in the current financial year.

Calls the formula CN FM TX REDUCTION if the employee is disabled.

Deducts any REM tax already paid.