10. ACH Debit Receipts - Reversal Processing

10.1 Upload of Pacs.007 Message

If the ACH Debit payment is reversed by the Creditor bank, pacs.007.001.09 message is received by the Debtor bank with the reversal details.

10.1.1 Pacs.007 Message upload

File level Validations

The message is to be placed in a specified folder and the file path and Network details are to be sent in file envelope service. The file type to be used is 'ACHDDReversal'.

On upload of the message pacs.007.001.09, system performs the below validations:

l File format validations - This is done based on the XSD maintained in the 'Schema Definition File Path' for the file type 'ACHDDReversal' in File Parameters Detailed screen PMDFLPRM.

l Validation of Number of transactions and control sum in the file, if available

Branch & Network Derivation

The below details are derived from the file envelope details available for the message:

l Host Code

l Transaction Branch

l Network Code

l Source Code

The settlement date received is the Instruction Date for the Reversal transaction. If this date falls on a Network Holiday, the Instruction Date is moved forward to next Network working Day. If Instruction Date is a back date, it is moved to current date provided current date is a Network working day. If it is Network holiday, instruction date is moved to next network working day.

Activation Date is same as the Instruction Date provided it is not a branch holiday. If it is a branch holiday, it is moved to next branch working date.

Note

Instruction Date once derived is not changed during transaction processing unless a new date is returned by External FX system.

Receipt Accounting

If the parsing & upload of the inbound pacs.007 is completed, Receipt accounting is posted if Receipt Accounting Code is maintained for ACH Debit Receipts Preferences PZDINPRF - Reversal Preferences tab.

|

Reversal Accounting |

Event |

Dr/Cr |

Account |

Account Type |

Amount Tag |

|---|---|---|---|---|---|

|

DD Receipts - Reversal |

ZWRC |

Dr |

Nostro Account |

Account |

RVL_STTL_AMT |

|

DD Receipts - Reversal |

ZWRC |

Cr |

Network Clearing GL |

GL |

RVL_STTL_AMT |

The return amount received in FItoFTPmtRvsl /TxInf / RvsdIntrBkSttlmAmt is consolidated for accounting. The transaction records are grouped based on Branch, Currency and settlement date.

If the Original transaction is in 'In Progress', 'Exception' or 'Future Valued' status, the cancellation of the original transaction is initiated once the matching and business override validations of reversal transaction are completed.

If the original transaction is already in processed status, the reversal transaction is moved to ACH Reversal Response Queue to initiate Accept/Return actions.

The following processing steps are applicable, when pacs.007 message is received for a settled ACH Debit Receipt:

l Matching with the original transaction

l Secondary fields Matching

l Reversal Days/Reason Code validation

l Sanctions screening

l Moving to Reversal Response Queue

On acceptance of the Reversal

l Sanctions screening based on Retry days

l FX rate fetch

l ECA Check

l Reversal Accounting

l Notification/IR XML generation

On return of the Reversal

l Sanctions screening based on retry days

l Return pacs.004 generation

l Notification/IR XML generation

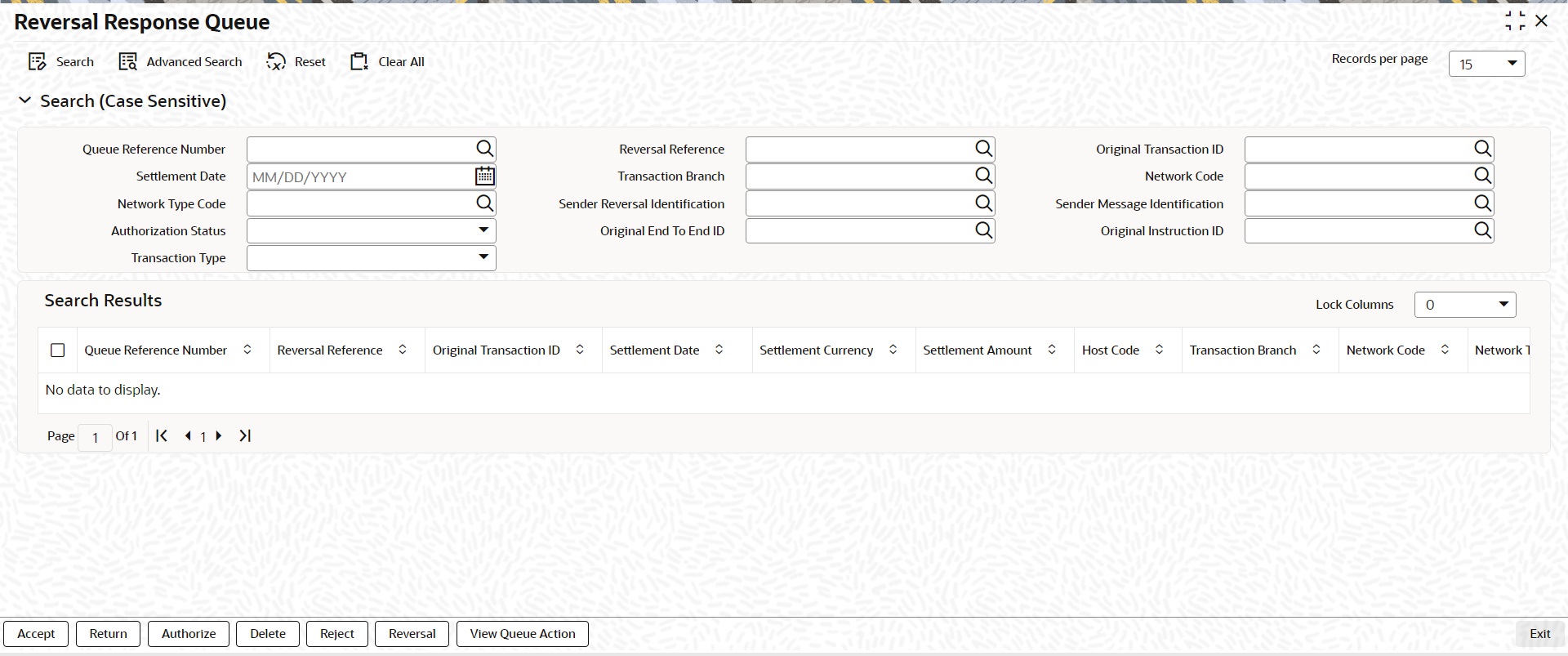

10.1.3 ACH Reversal Response Queue

If the Original transaction is in 'Processed' status and the sanction screening of Reversal transaction is completed, it is moved to Reversal Response queue (Function ID: PQSACHRS). The Original Transaction Status is changed as 'Reversal Requested'. Reversal transaction status is 'Awaiting Response'. From Reversal Response Queue, you can manually Accept/Reject the reversal.

Queues access rights are required for the queue actions listed. Role Queue Access maintenance and User queue access maintenance screens have the new queue and actions added. Role/User level limit check is applicable for the Accept /Reject actions, if configured.

The following actions are supported:

l Accept

l Return

Both the actions require authorization. you can Delete or Reject the unauthorized actions.

10.1.3.1 Processing Accept of Reversals

On authorization of Accept action, following is the processing:

l Sanction screening

l FX Rate Fetch

l ECA check

Reversal accounting is passed with reference as reversal transaction reference:

|

Event |

Dr/Cr |

Account |

Account Type |

Amount Tag |

|---|---|---|---|---|

|

ZWDR |

Dr |

Network Clearing GL |

GL |

Reversal Amount |

|

ZWDR |

Cr |

Intermediary GL |

GL |

Reversal Amount |

|

ZWCR |

Dr |

Intermediary GL |

GL |

Reversal Amount |

|

ZWCR |

Cr |

Customer Account |

Account |

Reversal Amount |

Accounting occurs with Reversal Reference Number.

IR/Notification generation is done on reversal acceptance processing completion.

Processing Return of Reversals

On authorization of Return action the following processing is done:

l Sanction screening: Sanctions screening based on retry days is done for the reversal transaction.

l Pacs.004 message is generated. Dispatch accounting is posted if it is configured in PMDINPRF Reversal preferences 'Return Dispatch accounting Code.

l The original transaction details in pacs.004 are populated from Reversal of ACH DD Receipts original transaction tables (the original data before any enrichment)

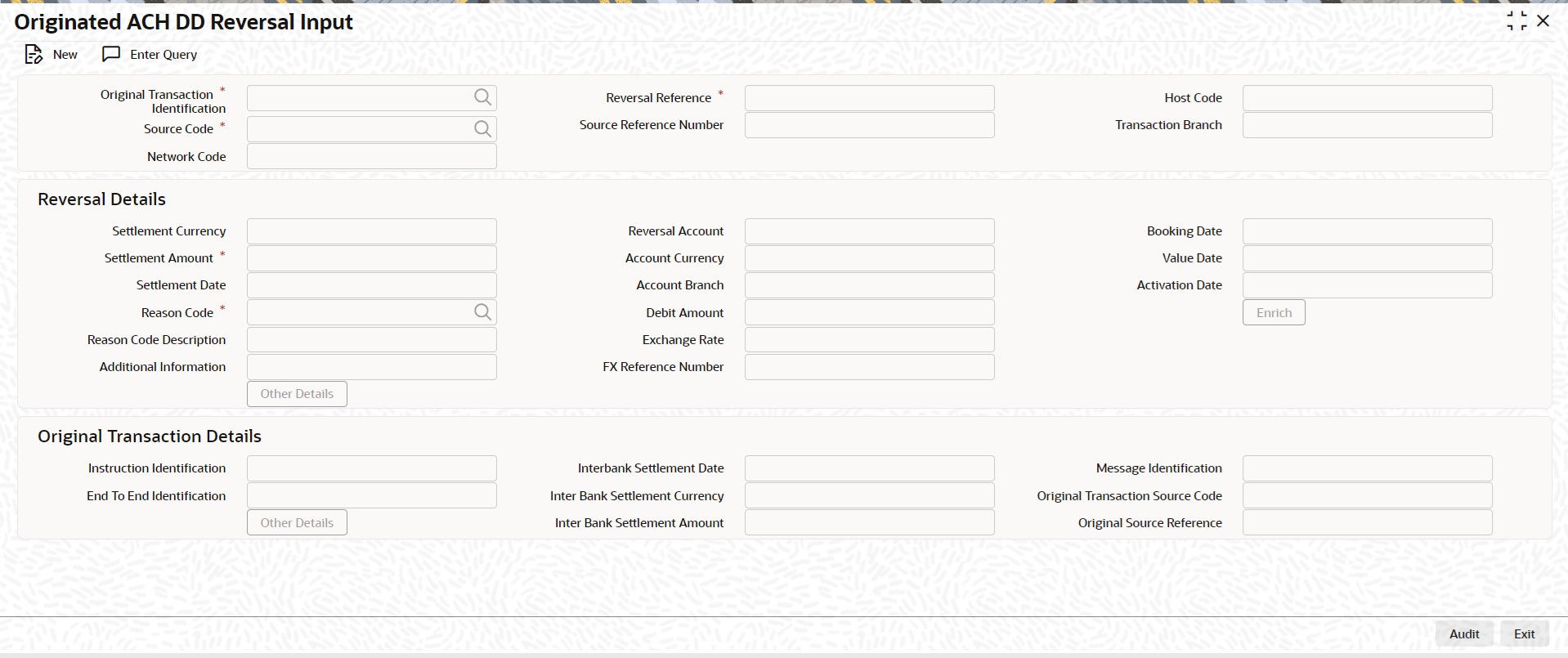

10.1.4 ACH Debit Receipts - Reversal Input

You can invoke ‘ACH Debit Receipts - Reversal’ screen by typing ‘PZDRVITN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

The system defaults the Host Code of transaction branch on clicking ‘New’.

Source Code

Specify the Source Code from the List of Values. All valid source codes maintained for the Host are listed.

Reversal Reference

Reversal Reference Number is system generated.

Source Reference Number

You can specify Source Reference Number.

Original Transaction Identification

Specify the Original Transaction Identification form the list of values.

All transactions of payment type 'ACH DD' are listed which are in 'Processed', 'In Progress', 'Exception' and 'Future Valued' status, if the Reversal screen is initiated as a standalone screen. If the Reversal screen is launched from the summary screen PZSIVIEW, the selected transaction identification is defaulted.

Transaction Branch

Transaction Branch is system generated.

Network Code

The system defaults the Network Code based on the Original Transaction Identification selected.

Reversal Details

Settlement Currency & Settlement Amount

These fields are defaulted as original transaction transfer currency and amount. However the amount can be modified by the user to a lesser amount, if required.

Settlement Date

Current Date is populated. You can modify the date.

Reversal Account

This field is Debit account of the original transaction. Account currency, Account branch are populated based on the Debit account.

Account Currency

Specify the Return Account Currency.

Account Branch

Specify the Account Branch.

Debit Amount

All the return codes maintained for the Network in the static table are listed.

Exchange Rate

The system defaults the Return Code Description based on the Primary Return Code selected.

FX Reference Number

The system defaults the Return Code Description based on the Primary Return Code selected.

Reason Code

Specify the Secondary Return Code from the list of values. All valid reason codes maintained for ACH DD in ACH Reason code maintenance (Function ID: PMDRSNCD) for the Network and Payment type 'Reversal' are listed.

Reason Code Description

The system defaults the Reason Code Description based on the Reason Code selected.

Additional Information

Specify any additional Information.

Booking Date

This field is populated as current date.

Value Date

If Original Transaction Settlement Date is not yet reached, the Reversal value date is Original Transaction Settlement Date. If the Original Transaction Settlement date is already over, the Reversal Value Date is populated as current date if it is Network working day. If the current date is not Network working day, the Value date is moved to next network working day.

Activation Date

This field is populated as current date.

Note

This date is rolled over only if the processing is delayed in any Exception Queue and the Return transaction is released from the queue on a later date. No holiday check is done on Return Activation Date.

Enrich

Enrich button performs date derivation. On saving a Reversal request system validates that no previous reversal request exists for the transaction in authorized or unauthorized status.

Origination Transaction Details:

The following fields are populated from ACH Debit Receipts transaction:

l Instruction Identification

l End To End Identification

l Other Details

l Interbank Settlement Date

l Inter Bank Settlement Currency

l Inter Bank Settlement Amount

l Message Identification

l Original Transaction Source Code

l Original Source Reference

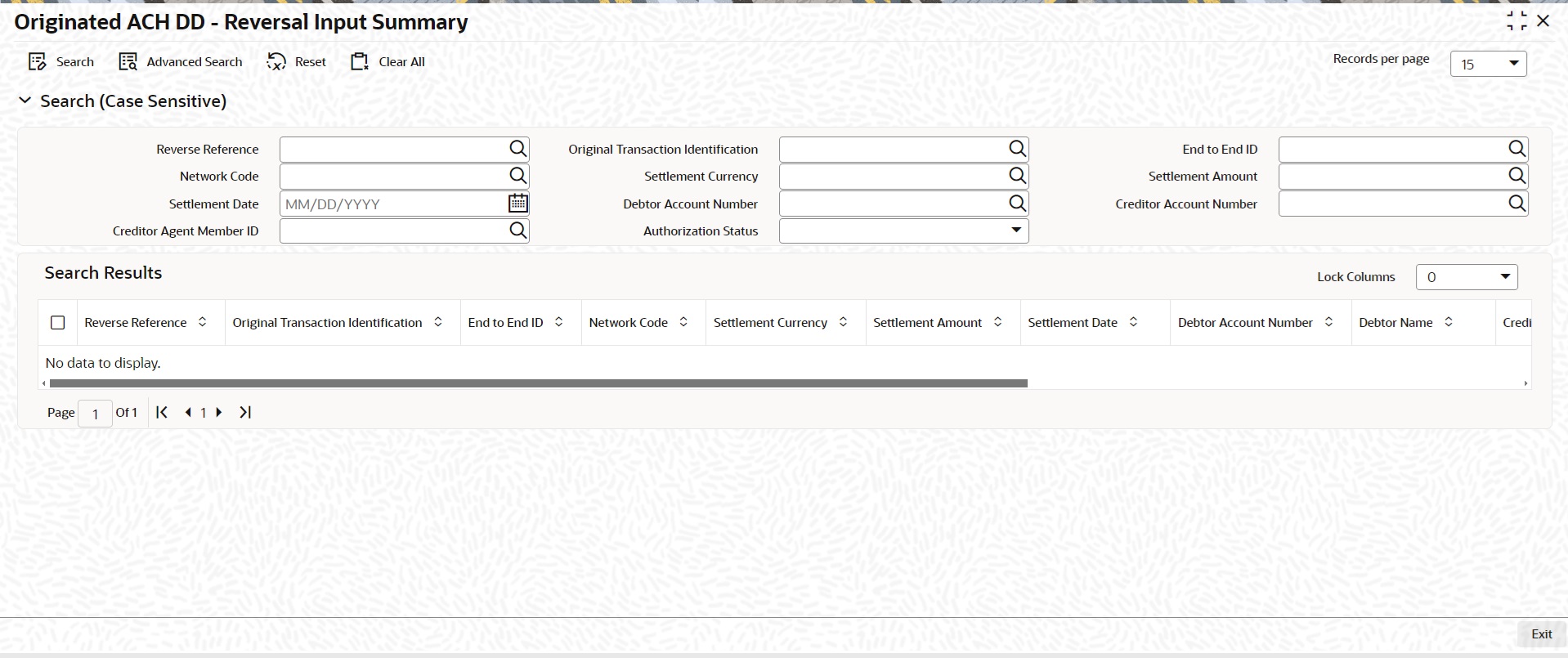

10.1.4.1 ACH Debit Receipts - Reversal Summary

You can invoke ‘ACH Debit Receipts - Reversal Summary’ screen by typing ‘PZSRVITN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

l Reverse Reference

l End to End ID

l Settlement Currency

l Settlement Date

l Creditor Account Number

l Authorization Status

l Original Transaction Identification

l Network Code

l Settlement Amount

l Debtor Account Number

l Creditor Agent Member ID

Once you have specified the search parameters, click the ‘Enter Query’ button. The system displays the records that match the search criteria.

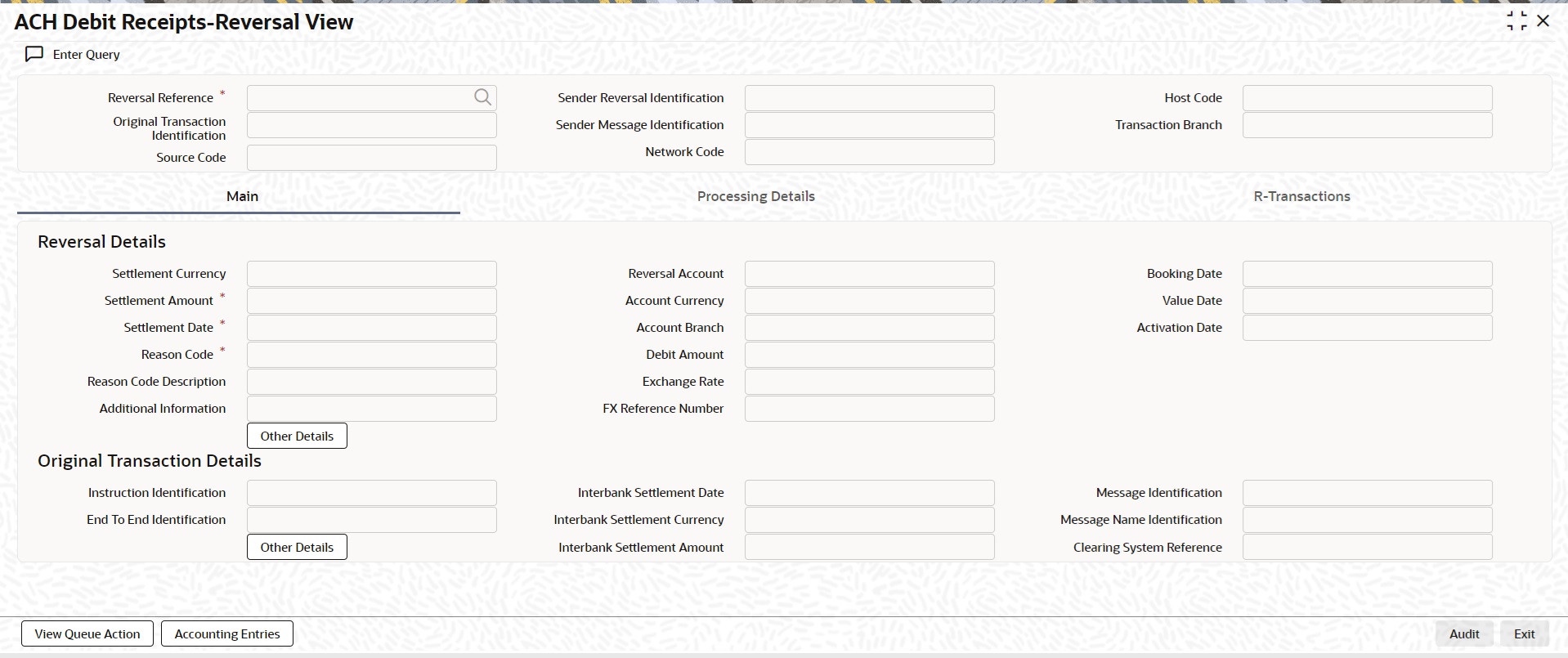

10.1.5 ACH Debit Receipts - Reversal View

You can invoke ‘ACH Debit Receipts - Reversal View’ screen by typing ‘PZDIRVVW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

l Reversal Reference

l Original Transaction Identification

l Network Code

l Host Code

l Transaction Branch

l Source Code

l Sender Message Identification

l Sender Reversal Identification

Once you have specified the search parameters, click the ‘Enter Query’ button. The system displays the records that match the search criteria.

The details are shown in following tab details:

l Main

l Processing Details

l R-Transactions

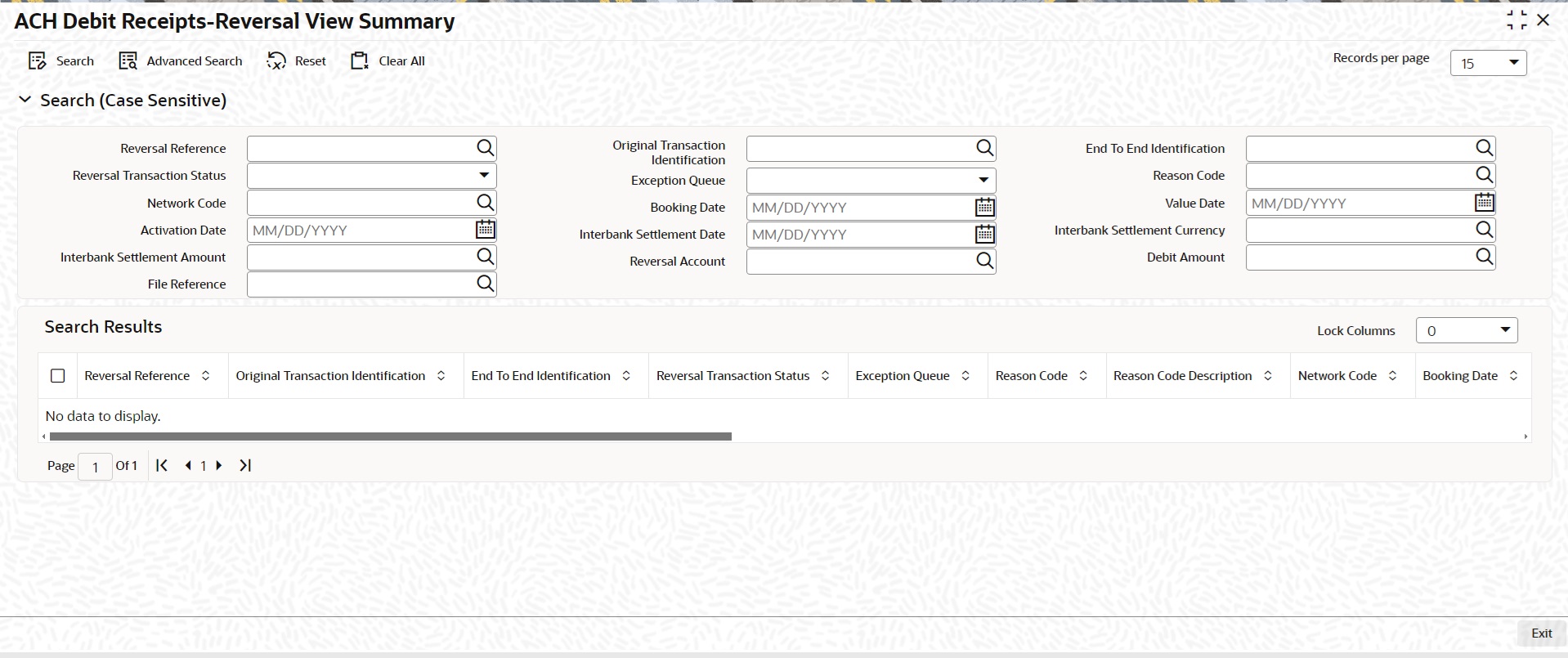

10.1.5.1 ACH Debit Receipts - Reversal View Summary

You can invoke ‘ACH Debit Receipts - Reversal View Summary’ screen by typing ‘PZSIRVVW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

l Reversal Reference

l Reversal Transaction Status

l Network Code

l Activation Date

l Interbank Settlement Amount

l File Reference

l Original Transaction Identification

l Exception Queue

l Booking Date

l Interbank Settlement Date

l Reversal Account

l End To End Identification

l Reason Code

l Value Date

l Interbank Settlement Currency

l Debit Amount

Once you have specified the search parameters, click the ‘Enter Query’ button. The system displays the records that match the search criteria.