11. India NACH Credit

The National Payments Corporation of India (NPCI) has implemented an electronic payment service termed as “National Automated Clearing House (NACH)” for banks, financial institutions, Corporates and Government Departments. NACH has both Debit and Credit variants. NACH (Debit) & NACH (Credit) aims at facilitating interbank, high volume, debit/credit transactions, which are bulk and repetitive in nature.

Sponsor Bank receives ACH Credit Input files in NPCI format (pacs.008.001.02) from customers. It should be possible in OBPM to upload and process these files, debit the customer account and forward the ACH Input files generated on dispatch to NPCI.

ACH Inward file received from NPCI is uploaded and processed by the Destination Bank. It should be possible to process the transactions received in the Inward file.

To support India NACH Credit, ACH CT payment type is used with the related processing.

11.1 India NACH Credit Maintenances

11.1.1 NACH User Number Maintenance

Every corporate which submits a NACH file is provided a User Number at the time of Registration with ACH.This maintenance is provided for maintaining the customer user number details:

You can invoke ‘Originated ACH Credit Transfer Preferences Summary’ screen by typing ‘PMDNCHUR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

The system defaults the Host Code of transaction branch on clicking ‘New’.

User Number

Specify the User Number.

User Name

Specify the User Name.

User Ledger Folio

Specify the User Ledger Folio.

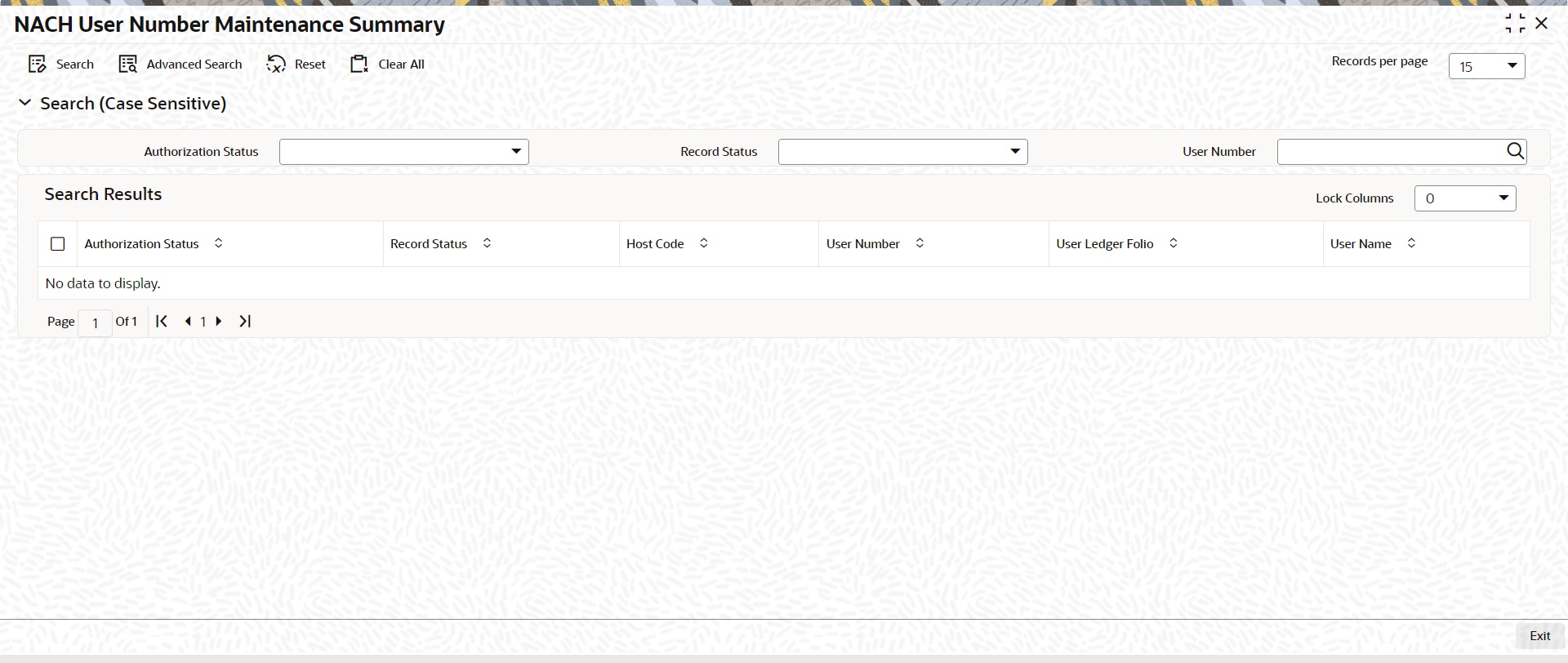

11.1.1.1 NACH User Number Maintenance Summary

You can invoke ‘NACH User Number Maintenance Summary’ screen by typing ‘PMSNCHUR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

l Authorization Status

l Record Status

l User Number

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

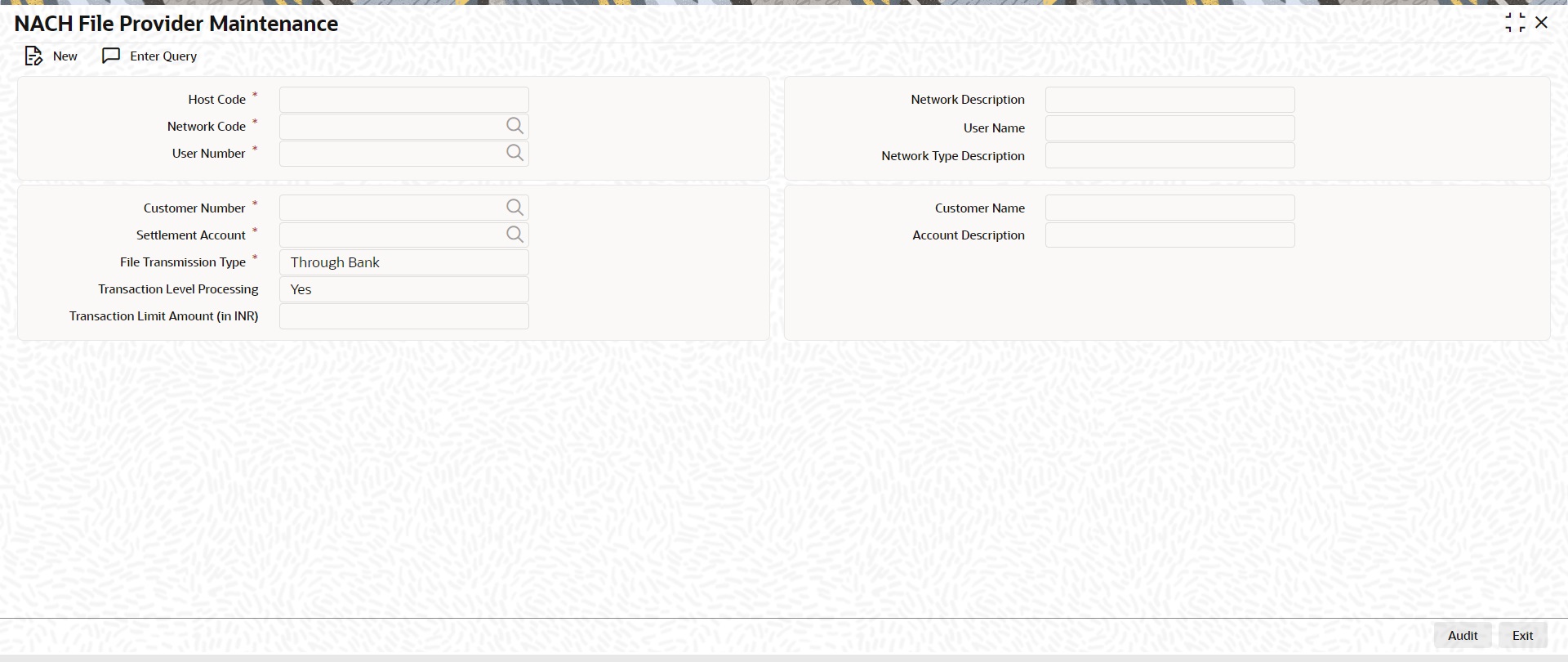

11.1.2 NACH File Provider Maintenance

Using this maintenance, you can capture File Provider details with the related settlement account and file processing preferences

You can invoke ‘NACH File Provider Maintenance’ screen by typing ‘PMDNCHFP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Host Code

The system defaults the Host Code of transaction branch on clicking ‘New’.

Network Code

Specify the Network Code from the list of values. All ACH CT Networks of Network Payment Type NACH CR are listed for this field.

Network Description

Network Description is defaulted based on the Network Code selected.

Network Type Description

Network Type Description is defaulted based on the Network Code selected.

User Number

Specify the User Number from the list of values. All valid User Numbers maintained in NACH User Number maintenance are listed.

User Name

User Name is defaulted based on the User Number selected.

Customer Number

Specify the Customer Number from the list of values. The customer number of the File provider can be selected.

Customer Name

Customer Name is defaulted based on the Customer Number selected.

Settlement Account

Specify the Settlement Account from the list of values. All valid accounts of the customer defined for the Host are listed.

Account Description

Account Description is defaulted based on the Settlement Account selected.

File Transmission Type

File transmission Type can be 'Through Bank' or 'Direct'. By default, 'Through Bank' file is selected.

Transaction Level Processing

This field is applicable if the File Transmission Type is 'Through Bank'. If Transaction level Processing is 'Yes' , then system processes the ACH Input file received from the corporate and perform validation of the individual transactions received. Dispatch file is generated by the system on successful processing of the transactions.

If the transaction level processing is set as 'No' the Sponsor Bank forwards the file received from the corporate to NPCI after file format validations and debit settlement.

Note

File transmission type “Through Bank” with “Transaction Level Processing” as ‘YES ‘is the only processing mode supported currently.

Transaction Limit Amount (in INR)

Specify the Transaction Limit Amount in INR. This is an optional field.

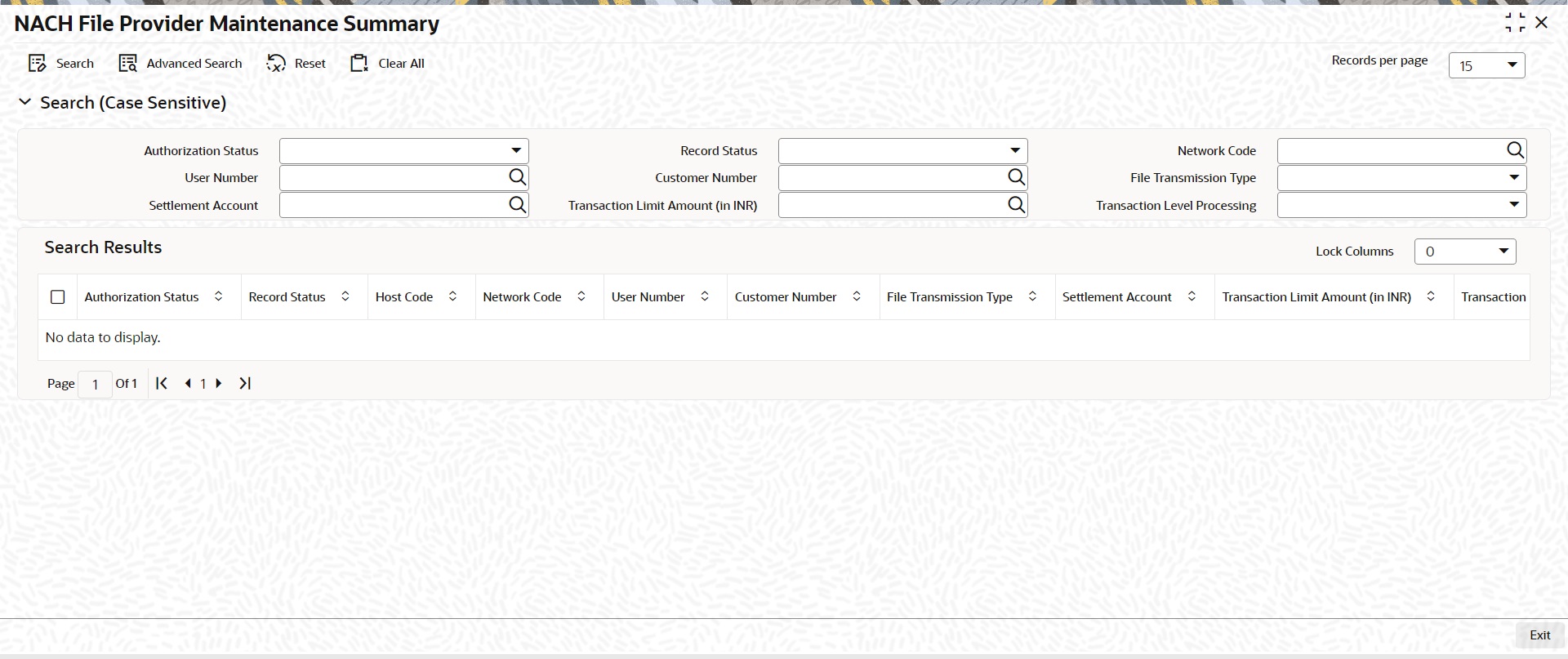

11.1.2.1 NACH File Provider Maintenance Summary

You can invoke ‘NACH File Provider Maintenance Summary’ screen by typing ‘PMSNCHFP’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can search using one or more of the following parameters:

l Authorization Status

l Record Status

l Network Code

l User Number

l Customer Number

l Payment Type

l File Transmission Type

l Settlement Account

l Transaction Limit Amount (in INR)

l Transaction Level Processing

Once you have specified the search parameters, click ‘Search’ button. The system displays the records that match the search criteria.

11.2 India NACH Credit Processing

From corporate customers, NACH Credit bulk file can be received in NACH CR input file format (pacs.008.001.02) of NPCI. The bulk file processing is done similar to the processing of ACH CT bulk files.

Dispatch file can be generated in NPCI format with NPCI specified file naming convention.

Please refer to Section 4., "Originated Credit Transfer Processing" for more details.

Inward files received from other banks can be uploaded and processed.

11.2.1 NPCI Acknowledgement in pacs.002

On receipt of NACH Credit Input file, NPCI sends a pacs.002 message indicating whether the file is accepted or rejected.

It is possible to upload the acknowledgement file in OBPM. The system updates the Network status of the Input file sent on upload of pacs.002.