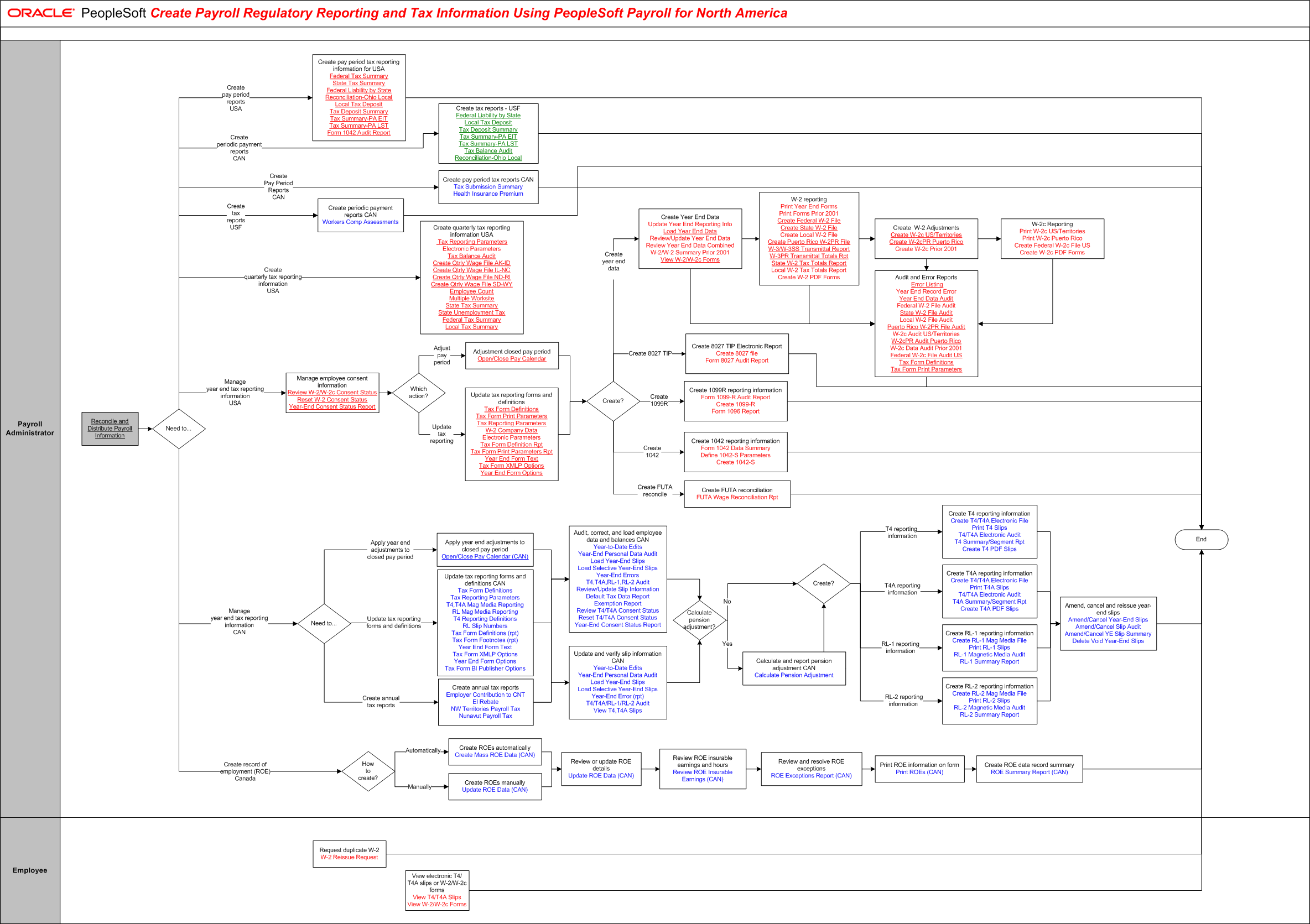

Create Payroll Regulatory Reporting and Tax Information Using PeopleSoft Payroll for North America

The tables on this page list the tasks for this business process, grouped by role. Some roles may be listed more than once if their tasks are performed at different points in the process. Follow the task numbers in order, unless the Task Description column provides instructions to go to a different task number. Click links in the Task Description column to view detailed diagrams for those tasks or to go to the online help for those pages.

Payroll Administrator

Task Number | Task Description |

|---|---|

1 | Reconcile and Distribute Payroll Information. |

2 | Need to. In parallel: Go to task number 3, Go to task number 4, Go to task number 5, Go to task number 6, Go to task number 7, Go to task number 8, Go to task number 22, Go to task number 36. |

3 | Create pay period tax reporting information for USA. End of activity. |

4 | Create tax reports - USF. End of activity. |

5 | Create pay period tax reports CAN. Health Insurance Premium End of activity. |

6 | Create periodic payment reports CAN. Workers Comp Assessments End of activity. |

7 | Create quarterly tax reporting information USA. Electronic Parameters End of activity. |

8 | Manage employee consent information. |

9 | Which action?. In parallel: Go to task number 10, Go to task number 11. |

10 | Adjustment closed pay period. Go to task number 12. |

11 | Update tax reporting forms and definitions. Electronic Parameters |

12 | Create?. In parallel: Go to task number 13, Go to task number 18, Go to task number 19, Go to task number 20, Go to task number 21. |

13 | Create Year End Data. Update Year End Reporting Info Review/Update Year End Data Review Year End Data Combined W-2/W-2 Summary Prior 2001 View W-2/W-2c Forms In parallel: Go to task number 14, Go to task number 17. |

14 | W-2 reporting. Print Year End Forms Print Forms Prior 2001 Create Local W-2 File Local W-2 Tax Totals Report Create W-2 PDF Forms In parallel: Go to task number 15, Go to task number 17. |

15 | Create W-2 Adjustments. Create W-2c Prior 2001 In parallel: Go to task number 16, Go to task number 17. |

16 | W-2c Reporting. Create Federal W-2c File US Create W-2c PDF Forms |

17 | Audit and Error Reports. Year End Record Error Federal W-2 File Audit Local W-2 File Audit W-2c Audit US/Territories W-2c Data Audit Prior 2001 End of activity. |

18 | Create 8027 TIP Electronic Report. Create 8027 file Form 8027 Audit Report End of activity. |

19 | Create 1099R reporting information. Form 1099-R Audit Report Create 1099-R Form 1096 Report End of activity. |

20 | Create 1042 reporting information. Form 1042 Data Summary Define 1042-S Parameters Create 1042-S End of activity. |

21 | Create FUTA reconciliation. End of activity. |

22 | Need to. In parallel: Go to task number 23, Go to task number 24, Go to task number 25. |

23 | Apply year end adjustments to closed pay period. Go to task number 26. |

24 | Update tax reporting forms and definitions CAN. Tax Form Definitions Tax Reporting Parameters T4,T4A Mag Media Reporting RL Mag Media Reporting T4 Reporting Definitions RL Slip Numbers Tax Form Definitions (rpt) Tax Form Footnotes (rpt) Year End Form Text Tax Form XMLP Options Year End Form Options Tax Form BI Publisher Options In parallel: Go to task number 26, Go to task number 27. |

25 | Create annual tax reports. $Employer Contribution to CNT $El Rebate $NW Territories Payroll Tax $Nunavut Payroll Tax In parallel: Go to task number 26, Go to task number 27. |

26 | Audit, correct, and load employee data and balances CAN. Year-to-Date Edits Year-End Personal Data Audit Load Year-End Slips Load Selective Year-End Slips Year-End Errors T4,T4A,RL-1,RL-2 Audit Review/Update Slip Information Default Tax Data Report Exemption Report Review T4/T4A Consent Status Reset T4/T4A Consent Status Year-End Consent Status Report Go to task number 28. |

27 | Update and verify slip information CAN. Year-to-Date Edits Year-End Personal Data Audit Load Year-End Slips Load Selective Year-End Slips Year-End Error (rpt) T4/T4A/RL-1/RL-2 Audit View T4,T4A Slips |

28 | Calculate pension adjustment?. In parallel: Go to task number 30, Go to task number 29. |

29 | Calculate and report pension adjustment CAN. Calculate Pension Adjustment |

30 | Create?. In parallel: Go to task number 31, Go to task number 32, Go to task number 33, Go to task number 34. |

31 | Create T4 reporting information. Create T4/T4A Electronic File Print T4 Slips T4/T4A Electronic Audit T4 Summary/Segment Rpt Create T4 PDF Slips Go to task number 35. |

32 | Create T4A reporting information. Create T4/T4A Electronic File Print T4A Slips T4/T4A Electronic Audit T4A Summary/Segment Rpt Create T4A PDF Slips Go to task number 35. |

33 | Create RL-1 reporting information. Create RL-1 Mag Media File Print RL-1 Slips RL-1 Magnetic Media Audit RL-1 Summary Report Go to task number 35. |

34 | Create RL-2 reporting information. Create RL-2 Mag Media File Print RL-2 Slips RL-2 Magnetic Media Audit RL-2 Summary Report |

35 | Amend, cancel and reissue year-end slips. Amend/Cancel Year-End Slips Amend/Cancel Slip Audit Amend/Cancel YE Slip Summary Delete Void Year-End Slips End of activity. |

36 | How to create?. In parallel: Go to task number 37, Go to task number 38. |

37 | Create ROEs automatically. Create Mass ROE Data (CAN) Go to task number 39. |

38 | Create ROEs manually. Update ROE Data (CAN) |

39 | Review or update ROE details. Update ROE Data (CAN) |

40 | Review ROE insurable earnings and hours. Review ROE Insurable Earnings (CAN) |

41 | Review and resolve ROE exceptions. ROE Exceptions Report (CAN) |

42 | Print ROE information on form. Print ROEs (CAN) |

43 | Create ROE data record summary. ROE Summary Report (CAN) End of activity. |

Employee

Task Number | Task Description |

|---|---|

44 | Request duplicate W-2. End of activity. |

45 | View electronic T4/T4A slips or W-2/W-2c forms. End of activity. |