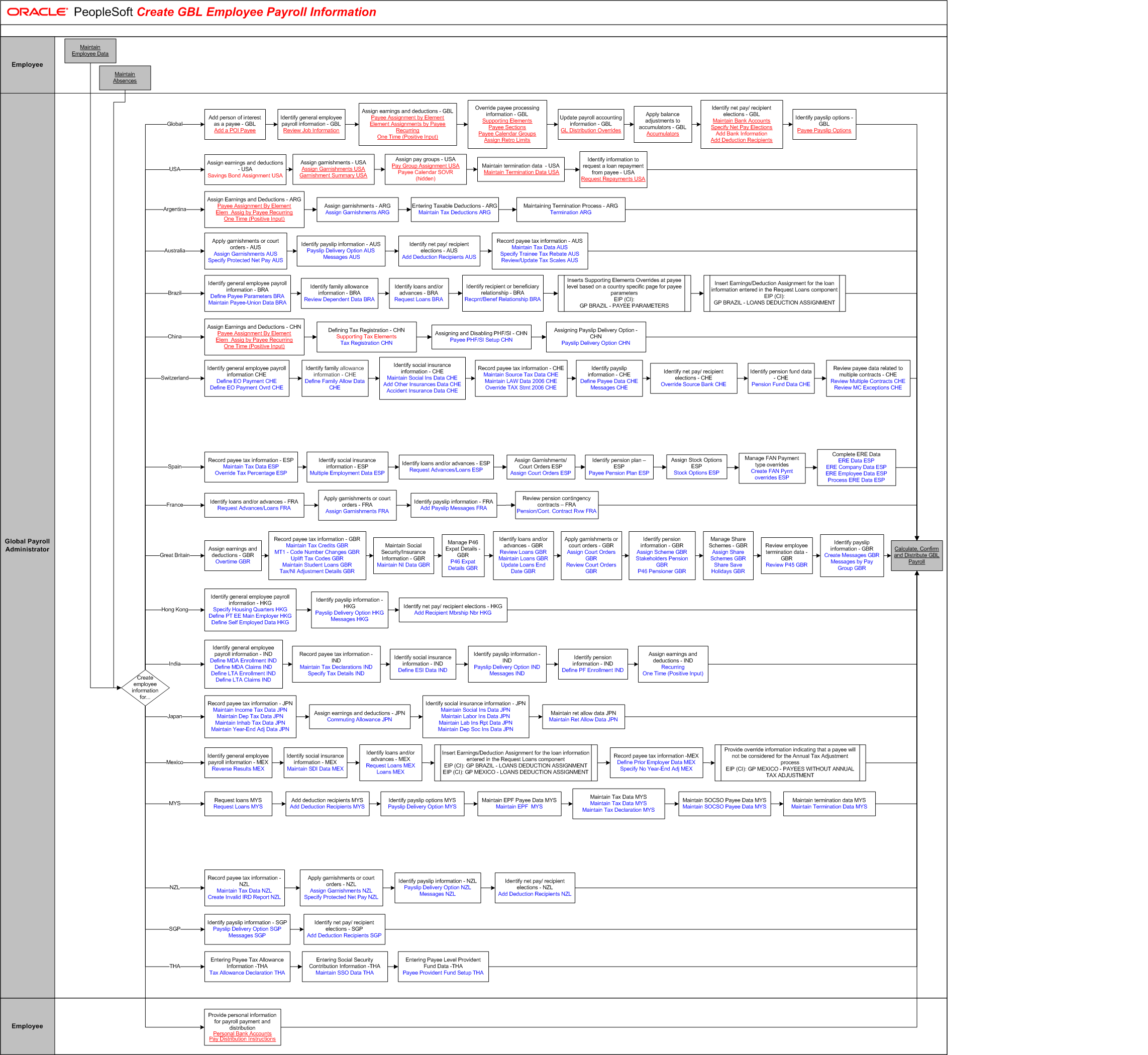

Create GBL Employee Payroll Information

The tables on this page list the tasks for this business process, grouped by role. Some roles may be listed more than once if their tasks are performed at different points in the process. Follow the task numbers in order, unless the Task Description column provides instructions to go to a different task number. Click links in the Task Description column to view detailed diagrams for those tasks or to go to the online help for those pages.

Employee

Task Number | Task Description |

|---|---|

1 |

Go to task number 3. |

2 | Maintain Absences. |

Global Payroll Administrator

Task Number | Task Description |

|---|---|

3 | Create employee information for. In parallel: Go to task number 4, Go to task number 12, Go to task number 17, Go to task number 21, Go to task number 25, Go to task number 31, Go to task number 35, Go to task number 43, Go to task number 52, Go to task number 60, Go to task number 64, Go to task number 74, Go to task number 77, Go to task number 83, Go to task number 87, Go to task number 93, Go to task number 100, Go to task number 105, Go to task number 109, Go to task number 111, Go to task number 114. |

4 | Add person of interest as a payee - GBL. |

5 | Identify general employee payroll information - GBL. |

6 | Assign earnings and deductions - GBL. |

7 | Override payee processing information - GBL. |

8 | Update payroll accounting information - GBL. |

9 | Apply balance adjustments to accumulators - GBL. |

10 | Identify net pay/ recipient elections - GBL. Add Bank Information |

11 | Identify payslip options - GBL. Go to task number 115. |

12 | Assign earnings and deductions - USA. Savings Bond Assignment USA |

13 | Assign garnishments - USA. |

14 | Assign pay groups - USA. Payee Calendar SOVR (hidden) |

15 | Maintain termination data - USA. |

16 | Identify information to request a loan repayment from payee - USA. Go to task number 115. |

17 | Assign Earnings and Deductions - ARG. |

18 | Assign garnishments - ARG. Assign Garnishments ARG |

19 | Entering Taxable Deductions - ARG. Maintain Tax Deductions ARG |

20 | Maintaining Termination Process - ARG. Termination ARG Go to task number 115. |

21 | Apply garnishments or court orders - AUS. Assign Garnishments AUS Specify Protected Net Pay AUS |

22 | Identify payslip information - AUS. Payslip Delivery Option AUS Messages AUS |

23 | Identify net pay/ recipient elections - AUS. Add Deduction Recipients AUS |

24 | Record payee tax information - AUS. Maintain Tax Data AUS Specify Trainee Tax Rebate AUS Review/Update Tax Scales AUS Go to task number 115. |

25 | Identify general employee payroll information - BRA. Define Payee Parameters BRA Maintain Payee-Union Data BRA |

26 | Identify family allowance information - BRA. Review Dependent Data BRA |

27 | Identify loans and/or advances - BRA. Request Loans BRA |

28 | Identify recipient or beneficiary relationship - BRA. Recpnt/Benef Relationship BRA |

29 | Inserts Supporting Elements Overrides at payee level based on a country specific page for payee parameters EIP (CI): GP BRAZIL - PAYEE PARAMETERS. |

30 | Insert Earnings/Deduction Assignment for the loan information entered in the Request Loans component EIP (CI): GP BRAZIL - LOANS DEDUCTION ASSIGNMENT. Go to task number 115. |

31 | Assign Earnings and Deductions - CHN. |

32 | Defining Tax Registration - CHN. Supporting Tax Elements Tax Registration CHN |

33 | Assigning and Disabling PHF/SI - CHN. Payee PHF/SI Setup CHN |

34 | Assigning Payslip Delivery Option - CHN. Payslip Delivery Option CHN Go to task number 115. |

35 | Identify general employee payroll information CHE. Define EO Payment CHE Define EO Payment Ovrd CHE |

36 | Identify family allowance information - CHE. Define Family Allow Data CHE |

37 | Identify social insurance information - CHE. Maintain Social Ins Data CHE Add Other Insurances Data CHE Accident Insurance Data CHE |

38 | Record payee tax information - CHE. Maintain Source Tax Data CHE Maintain LAW Data 2006 CHE Override TAX Stmt 2006 CHE |

39 | Identify payslip information - CHE. Define Payee Data CHE Messages CHE |

40 | Identify net pay/ recipient elections - CHE. Override Source Bank CHE |

41 | Identify pension fund data - CHE. Pension Fund Data CHE |

42 | Review payee data related to multiple contracts - CHE. Review Multiple Contracts CHE Review MC Exceptions CHE Go to task number 115. |

43 | Note: Tasks 43-51 have been removed. Go to task number 115. |

52 | Record payee tax information - ESP. Maintain Tax Data ESP Override Tax Percentage ESP |

53 | Identify social insurance information - ESP. Multiple Employment Data ESP |

54 | Identify loans and/or advances - ESP. Request Advances/Loans ESP |

55 | Assign Garnishments/ Court Orders ESP. Assign Court Orders ESP |

56 | Identify pension plan – ESP. Payee Pension Plan ESP |

57 | Assign Stock Options ESP. Stock Options ESP |

58 | Manage FAN Payment type overrides. Create FAN Pymt overrides ESP |

59 | Complete ERE Data. ERE Data ESP ERE Company Data ESP ERE Employee Data ESP Process ERE Data ESP Go to task number 115. |

60 | Identify loans and/or advances - FRA. Request Advances/Loans FRA |

61 | Apply garnishments or court orders - FRA. Assign Garnishments FRA |

62 | Identify payslip information - FRA. Add Payslip Messages FRA |

63 | Review pension contingency contracts – FRA. Pension/Cont. Contract Rvw FRA Go to task number 115. |

64 | Assign earnings and deductions - GBR. Overtime GBR |

65 | Record payee tax information - GBR. Maintain Tax Credits GBR MT1 - Code Number Changes GBR Uplift Tax Codes GBR Maintain Student Loans GBR Tax/NI Adjustment Details GBR |

66 | Maintain Social Security/Insurance Information - GBR. Maintain NI Data GBR |

67 | Manage P46 Expat Details - GBR. P46 Expat Details GBR |

68 | Identify loans and/or advances - GBR. Review Loans GBR Maintain Loans GBR Update Loans End Date GBR |

69 | Apply garnishments or court orders - GBR. Assign Court Orders GBR Review Court Orders GBR |

70 | Identify pension information - GBR. Assign Scheme GBR |

Stakeholders Pension GBR@

P46 Pensioner GBR

Task Number | Task Description |

|---|---|

71 | Manage Share Schemes - GBR. Assign Share Schemes GBR Share Save Holidays GBR |

72 | Review employee termination data - GBR Review P45 GBR. |

73 | Identify payslip information - GBR. Create Messages GBR Messages by Pay Group GBR Go to task number 115. |

74 | Identify general employee payroll information - HKG. Specify Housing Quarters HKG Define PT EE Main Employer HKG Define Self Employed Data HKG |

75 | Identify payslip information - HKG. Payslip Delivery Option HKG Messages HKG |

76 | Identify net pay/ recipient elections - HKG. Add Recipient Mbrship Nbr HKG Go to task number 115. |

77 | Identify general employee payroll information - IND. Define MDA Enrollment IND Define MDA Claims IND Define LTA Enrollment IND Define LTA Claims IND |

78 | Record payee tax information - IND. Maintain Tax Declarations IND Specify Tax Details IND |

79 | Identify social insurance information - IND. Define ESI Data IND |

80 | Identify payslip information - IND. Payslip Delivery Option IND Messages IND |

81 | Identify pension information - IND. Define PF Enrollment IND |

82 | Assign earnings and deductions - IND. Recurring One Time (Positive Input) Go to task number 115. |

83 | Record payee tax information - JPN. Maintain Income Tax Data JPN Maintain Dep Tax Data JPN Maintain Inhab Tax Data JPN Maintain Year-End Adj Data JPN |

84 | Assign earnings and deductions - JPN. Commuting Allowance JPN |

85 | Identify social insurance information - JPN. Maintain Social Ins Data JPN Maintain Labor Ins Data JPN Maintain Lab Ins Rpt Data JPN Maintain Dep Soc Ins Data JPN |

86 | Maintain ret allow data JPN@. Maintain Ret Allow Data JPN Go to task number 115. |

87 | Identify general employee payroll information - MEX. Reverse Results MEX |

88 | Identify social insurance information - MEX. Maintain SDI Data MEX |

89 | Identify loans and/or advances - MEX. Request Loans MEX Loans MEX |

90 | Insert Earnings/Deduction Assignment for the loan information entered in the Request Loans component EIP (CI): GP BRAZIL - LOANS DEDUCTION ASSIGNMENT EIP (CI): GP MEXICO - LOANS DEDUCTION ASSIGNMENT. |

91 | Record payee tax information -MEX@. Define Prior Employer Data MEX Specify No Year-End Adj MEX |

92 | Provide override information indicating that a payee will not be considered for the Annual Tax Adjustment process EIP (CI): GP MEXICO - PAYEES WITHOUT ANNUAL TAX ADJUSTMENT. Go to task number 115. |

93 | Request loans MYS. Request Loans MYS |

94 | Add deduction recipients MYS@. Add Deduction Recipients MYS |

95 | Identify payslip options MYS. Payslip Delivery Option MYS |

96 | Maintain EPF Payee Data MYS. Maintain EPF MYS |

97 | Maintain Tax Data MYS. Maintain Tax Data MYS Maintain Tax Declaration MYS |

98 | Maintain SOCSO Payee Data MYS@. Maintain SOCSO Payee Data MYS |

99 | Maintain termination data MYS. Maintain Termination Data MYS Go to task number 115. |

100 | Note: Tasks 100-104 have been removed. Go to task number 115. |

105 | Record payee tax information - NZL. Maintain Tax Data NZL Create Invalid IRD Report NZL |

106 | Apply garnishments or court orders - NZL. Assign Garnishments NZL Specify Protected Net Pay NZL |

107 | Identify payslip information - NZL. Payslip Delivery Option NZL Messages NZL |

108 | Identify net pay/ recipient elections - NZL. Add Deduction Recipients NZL Go to task number 115. |

109 | Identify payslip information - SGP. Payslip Delivery Option SGP Messages SGP |

110 | Identify net pay/ recipient elections - SGP. Add Deduction Recipients SGP Go to task number 115. |

111 | Entering Payee Tax Allowance Information -THA. Tax Allowance Declaration THA |

112 | Entering Social Security Contribution Information -THA. Maintain SSO Data THA |

113 | Entering Payee Level Provident Fund Data -THA. Payee Provident Fund Setup THA Go to task number 115. |

Employee

Task Number | Task Description |

|---|---|

114 | Provide personal information for payroll payment and distribution. |

Global Payroll Administrator

Task Number | Task Description |

|---|---|

115 | Calculate, Confirm and Distribute GBL Payroll. End of activity. |