Defining Federal and Institutional Methodologies

This topic provides an overview of calculating expected contributions from families using Federal Methodology (FM) and Institutional Methodology (IM) formulas and discusses how to:

-

Define global and federal options for the 2023-2024 and prior Aid Years.

-

Define federal global options for the 2024-2025 and future Aid Years.

-

Use EFC proration options. This setup won't be used after the 2023-2024 Aid year.

-

Define FM budget durations for 2023-2024 and prior Aid Years. This setup won't be used after the 2023-2024 Aid year.

-

Define IM budget durations.

-

Define IM tax and assessment parameters. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define EFM options. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define IM value parameters 1. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define IM value parameters 2. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define IM yes and no options. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define minimum student contribution. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define asset options. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define home and asset projections. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

Define minimum parental contribution. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

-

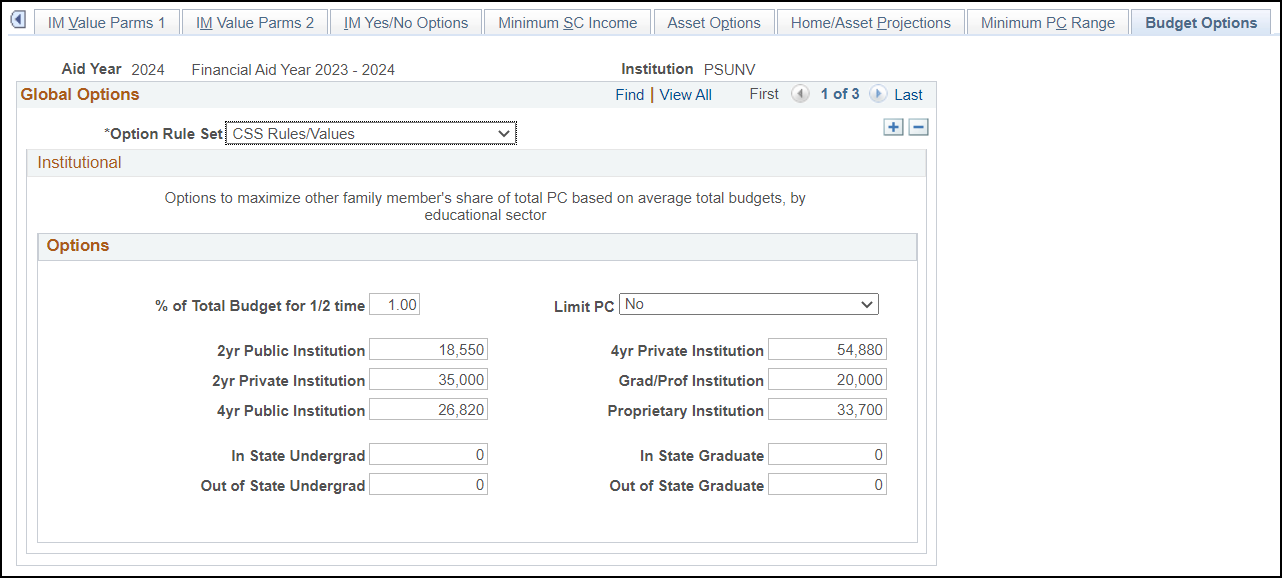

Define budget options. This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

For more information on Institutional Methodology (IM) and Estimated Federal Methodology (EFM), see the College Board's INAS Users Manual. For more information on Federal Methodology (FM), see the U. S. Department of Education's Expected Family Contribution (EFC) Formula Guide and Application Processing System Specifications for Software Developers (APS Specs).

Part of need analysis is determining what the student and their family can be expected to contribute to cover costs related to attending your school.

Federal Methodology is based on U.S. law to determine eligibility for Federal student financial aid funds. For Federal Methodology (FM),

-

For the 2023-2024 and prior Aid Years, refer to Expected Family Contribution (EFC) Formula Guide and Application Processing System Specifications for Software Developers (APS Specs) on ED's website.

-

For the 2024-2025 and future Aid Years, refer to the 2024-2025 Student Aid Index (SAI) and Pell Grant Eligibility Guide and Volume 5: Edits and Rejects of the FAFSA Specifications Guide on ED's website.

Institutional Methodology (IM) is based on The College Scholarship Service IM formula. Schools use IM to determine eligibility for their private student financial aid funds. College Board CSS Profile users should refer to the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for supporting documentation, including the IM tables and worksheets.

Note: For the 2023-2024 and prior Aid Years, all pages in this component are related to IM-specific processing with the exception of the Global and Federal Options page.

Note: Numeric values in screen shots used to document Global Processing Options are examples only. Refer to the College Board and ED websites for tables and worksheets related to IM and FM calculations, respectively.

Note: The navigation paths for the pages listed in the following table are for aid year 20nn-20nn. Oracle supports access for three active aid years.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Global and Federal Options |

INAS_LCL_PLCY1_nn |

OR

|

Define your global policy options for the majority of your student population. You can override these options on a student-by-student basis. The options affect your EFC calculations. You can enter values for additional Option rule sets developed by your institution. |

|

Global Options |

INAS_LCL_PLCY1_nn |

|

Define your global policy options for the majority of your student population. You can override these options on a student-by-student basis. The options affect your EFC calculations. You can enter values for additional Option rule sets developed by your institution. |

|

EFC Proration Options (expected family contribution proration option) |

INAS_FM_PRORTN_SEC |

Click the EFC Proration Options link on the Global and Federal Options page. |

Define your proration parameters. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

FM Budget Durations |

INAS_FM_DUR_SEC |

Click the FM Budget Durations link on the Global and Federal Options page. |

Define global options for federal academic and nonstandard budget durations. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

IM Budget Durations |

INAS_IM_DUR_SEC |

Click the IM Budget Durations link on the Global and Federal Options page. |

Define global options for institutional academic and nonstandard budget durations. Note: Total budget durations must match the budget durations defined in the College Board's Need Analysis Options (NAO) website. |

|

IM Tax/Assess Parms (institutional methodology tax assessment parameters) |

INAS_LCL_PLCY2_nn |

|

Define IM INAS calculation options for parents and students Note: This page is only used for 2023-2024 and prior Aid Years. |

|

EFM Options (estimated federal methodology options) |

INAS_LCL_PLCY3_nn |

|

Define EFM INAS calculation options for parents and students. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

IM Value Parms 1 (institutional methodology value parameters 1) |

INAS_LCL_PLCY4_nn |

|

Define IM INAS calculation options for parents and students. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

IM Value Parms 2 (institutional methodology value parameters 2) |

INAS_LCL_PLCY11_nn |

|

Define value parameters for multi-college enrollment to define treatment for more than one student in college. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

IM Yes/No Options (institutional methodology yes/no options) |

INAS_LCL_PLCY10_nn |

|

Define IM INAS calculation options for parents and students. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Minimum SC Income (minimum student contribution income) |

INAS_LCL_PLCY5_nn |

|

Define the minimum institutional student contribution values for dependent students and independent students. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Asset Options |

INAS_LCL_PLCY6_nn |

|

Define options and limitations for assessing parent and student assets other than the home. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Home/Asset Projections |

INAS_LCL_PLCY7_nn |

|

Define options and values for assessing home equity for parents and students. Define asset assessment rates. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Minimum PC Range (minimum parental contribution range) |

INAS_LCL_PLCY8_nn |

|

Define institutional minimum parental contribution values based on income ranges. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Budget Options |

INAS_LCL_PLCY9_nn |

|

Define allocation of total parental contribution to children on the basis of educational costs. Note: This page is only used for 2023-2024 and prior Aid Years. |

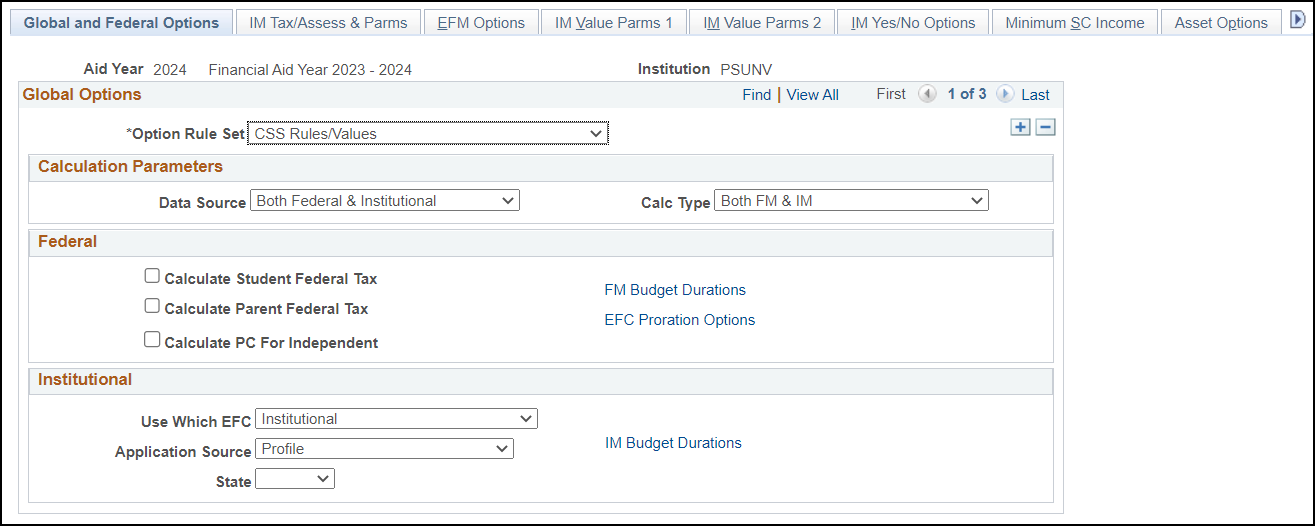

Use this page to define EFC calculation Global and Federal Options for ISIR records or Profile records by Aid Year and Institution.

Note: The system always makes available the three most recent Aid Year versions of the EFC Global Options component. For the 2021-2022 and 2022-2023 Aid Years, the page name remains "INAS 20nn-20nn Global Options". For the 2023-2024 and future Aid Years, the navigation is "NA 20nn-20nn Global Options".

Access the Global and Federal Options page ().

This example illustrates the fields and controls on the Global and Federal Options page. You can find definitions for the fields and controls later on this page.

Use this page to set the EFC calculation options for ISIR or Profile records.

|

Field or Control |

Description |

|---|---|

|

Option Rule Set |

Select the Option Rule Set. The Option Rule Set value enables full flexibility to determine how need analysis is processed for different academic careers or academic programs; it is linked to a specific academic career or program through the valid careers for aid year and valid programs for aid year tables. Your institution can create additional Option Rule Sets. The Option Rule Set refers to the Option Base Rules delivered with the Financial Aid system. Values are: CSS Rules/Values, Health Professional, and Undergraduate/Graduate. |

Global

Use the Global group box to define the parameters that control general processing options related to methodologies used.

|

Field or Control |

Description |

|---|---|

|

Data Source |

Select the Data Source that you want the EFC Calculation process to use to retrieve student information. Select: Both Federal & Institutional (both federal and institutional) to use both sets of data to calculate EFCs for either Profile or ISIR records. Federal Data to use only federal data to calculate a FM EFC for ISIR records only. Institutional to use only institutional data to calculate an IM EFC for PROFILE records only. |

|

Calc Type (calculation type) |

Select the calculation type: Federal Methodology to calculate a FM EFC for ISIR records only. Both FM & IM (both federal methodology and institutional methodology) to calculate EFCs for either PROFILE or ISIR records. Institutional Methodology to calculate an IM EFC for PROFILE records only. |

Federal

Use the Federal group box to define how the Federal Methodology Need Analysis Calculator (FM NAC) processes federal ISIR data.

|

Field or Control |

Description |

|---|---|

|

Calculate Student Federal Tax |

Select to calculate student federal tax as defined by the federal tax bracket and rate for the applicable tax year. |

|

Calculate Parent Federal Tax |

Select to calculate parent federal tax as defined by the federal tax bracket and rate for the applicable tax year. |

|

Calculate PC for Independent (calculate parent contribution for independent students) |

Select to calculate a parental contribution for independent students if parental data is available. The parental contribution is calculated, but not added to the EFC. |

|

FM Budget Durations |

Click this link to access the FM Budget Durations page, which shows academic and non-standard durations for both dependent and independent students. |

|

EFC Prorations Options |

Click this link to access the EFC Proration Options page. |

Institutional

Use the Institutional group box to define how INAS computes your IM.

|

Field or Control |

Description |

|---|---|

|

Use Which EFC |

Select a value to determine the institutional EFC displayed on the Need Summary page and used in the Award Entry component. Values are: Estimated Federal (estimated federal methodology): Select to display and use the EFM-EFC. Greatest: Select to compare base, IM with options, and estimated federal EFC, and then use the greatest EFC value of the three. Institutional W/Opt: Select to use the IM-EFC as a result of the calculation of IM with options. Institutional: Select to use the IM-EFC as a result of the base IM calculations. |

|

Application Source |

Select an application source. Values are: FT Canada Student Loan (full-time Canada Student Loan): Used in Canadian Need Analysis. Institutional Application. PT Canada Student Loan (part-time Canada Student Loan): Used in Canadian Need Analysis. Profile. |

|

State |

Select the state in which your institution is located. INAS uses this field to determine a student's budget requirements. |

|

IM Budget Durations |

Click this link to access the IM Budget Durations page, which shows academic and non-standard durations for both dependent and independent students. |

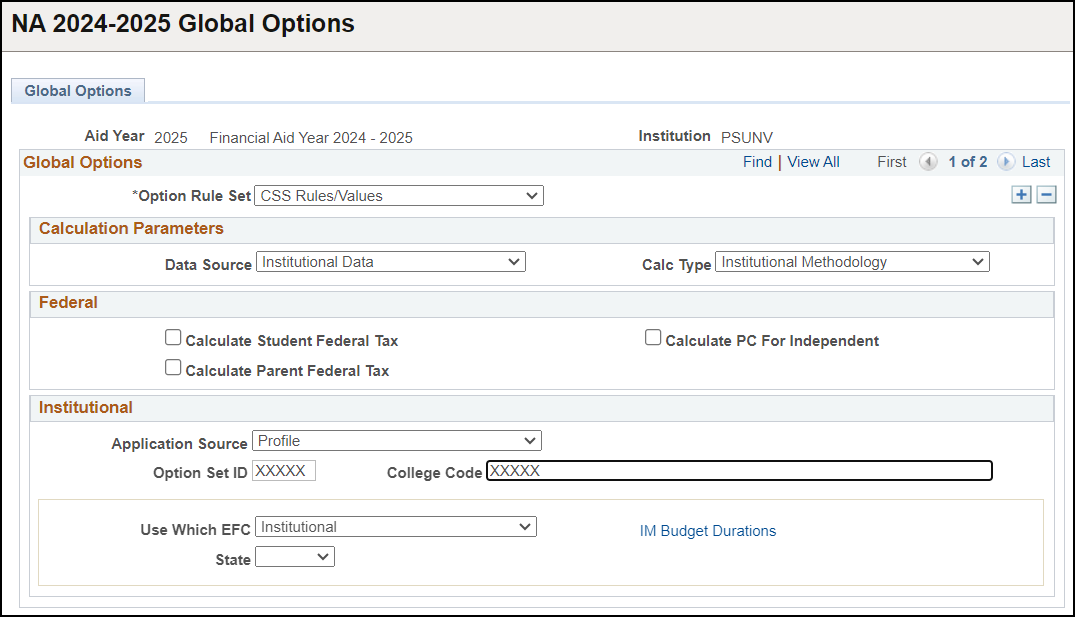

Use this page to define FM Student Aid Index (SAI) IM Expected Family Contribution (EFC) calculation Global Options for ISIR records or Profile records by Aid Year and Institution for the 2024-2025 and future Aid Years.

Access the Global Options page ().

This example illustrates the fields and controls on the Global Options page. You can find definitions for the fields and controls later on this page.

Use this page to set the FM SAI and IM EFC calculation options for ISIR or Profile records, respectively.

|

Field or Control |

Description |

|---|---|

|

Option Rule Set |

Select the Option Rule Set. The Option Rule Set value enables full flexibility to determine how need analysis is processed for different academic careers or academic programs; it is linked to a specific academic career or program through the valid careers for aid year and valid programs for aid year tables. Your institution can create additional Option Rule Sets. The Option Rule Set refers to the Option Base Rules delivered with the Financial Aid system. Values are: CSS Rules/Values, Health Professional, and Undergraduate/Graduate. |

Calculation Parameters

Use the Calculation Parameters group box to define the parameters that control general processing options related to methodologies used.

|

Field or Control |

Description |

|---|---|

|

Data Source |

Select the Data Source that you want the FM SAI/IM EFC Calculation process to use to retrieve student information. Select: Both Federal & Institutional (both Federal and institutional) to use both sets of data to calculate FM SAIs/IM EFCs for either ISIR or Profile records. Federal Data to use only federal data to calculate a FM SAI for ISIR records only. Institutional to use only institutional data to calculate an IM EFC for Profile records only. |

|

Calc Type (calculation type) |

Select the calculation type: Federal Methodology to calculate a FM SAI for ISIR records only. Both FM & IM (both federal methodology and institutional methodology) to calculate FA SAIs/IM EFCs for either ISIR or Profile records. Institutional Methodology to calculate an IM EFC for Profile records only. |

Federal

Use the Federal group box to define how the Federal Methodology Need Analysis Calculator (FM NAC) processes federal ISIR data to calculate an SAI.

|

Field or Control |

Description |

|---|---|

|

Calculate Student Federal Tax |

Select to calculate student federal tax as defined by the federal tax bracket and rate for the applicable tax year. |

|

Calculate Parent Federal Tax |

Select to calculate parent federal tax as defined by the federal tax bracket and rate for the applicable tax year. |

|

Calculate PC for Independent (calculate parent contribution for independent students) |

Select to calculate a parental contribution for independent students if parental data is available. The parental contribution is calculated, but not added to the EFC. |

Institutional

Use the Institutional group box to define how INAS computes your IM EFC.

|

Field or Control |

Description |

|---|---|

|

Application Source |

The Application Source is Profile. |

|

Option Set ID |

Enter the token ID provided by the College Board for each Global Option that is created within the College Board’s Need Analysis Options (NAO) website. You are required to setup an Option Rule Set for each Global Option created in the NAO website. |

|

College Code |

Enter the College Code provided by the College Board for your institution. |

|

Use Which EFC |

Select a value to determine the institutional EFC displayed on the Need Summary page and used in the Award Entry component. Values are: Estimated Federal (estimated federal methodology): Select to display and use the EFM-EFC. Greatest: Select to compare base, IM with options, and estimated federal EFC, and then use the greatest EFC value of the three. Institutional W/Opt: Select to use the IM-EFC as a result of the calculation of IM with options. Institutional: Select to use the IM-EFC as a result of the base IM calculations. |

|

State |

Select the state in which your institution is located. INAS uses this field to determine a student's budget requirements. |

|

IM Budget Durations |

Click this link to access the IM Budget Durations page, which shows academic and non-standard durations for both dependent and independent students. Note: This setup is also completed in the College Board NAO website. You are required to ensure that the summed value of your IM Budget Durations match the total Budget Duration value set in the NAO website for the corresponding Global Option. |

Use this page to select IM EFC Proration Options.

Note: This page is only used for FM EFC Proration setup for the 2023-2024 and prior Aid Years.

Access the EFC Proration Options page (click the EFC Proration Options link on the Global and Federal Options page).

|

Field or Control |

Description |

|---|---|

|

EFC Proration Method (expected family contribution proration method) |

Select one of the following:

Note: Using this method might cause your total EFC to exceed the 12-month EFC. |

|

Non-Standard Months |

The system uses this field in conjunction with the EFC Proration Method of Adjust Based on Total EFC. Select from:

|

Use this page to define FM Budget Durations for both Dependent and Independent students.

Note: This page is only used for FM Budget Duration setup for the 2023-2024 and prior Aid Years.

Access the FM Budget Durations page (click the FM Budget Durations link on the Global and Federal Options page).

Dependent Students

|

Field or Control |

Description |

|---|---|

|

Academic |

Enter the number of months for the academic term to be considered during need analysis for dependent students. |

|

Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for dependent students. |

Independent Students

|

Field or Control |

Description |

|---|---|

|

Academic |

Enter the number of months for the academic term to be considered during need analysis for independent students. |

|

Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for independent students. |

Use this page to define IM Budget Durations for both Dependent and Independent students.

Note: Total budget duration number of months must match the budget durations defined in the College Board's Need Analysis Options (NAO) website.

Access the IM Budget Durations page (click the IM Budget Durations link on the Global and Federal Options page).

Dependent Students

|

Field or Control |

Description |

|---|---|

|

Academic |

Enter the number of months for the academic term to be considered during need analysis for dependent students. |

|

Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for dependent students. |

Independent Students

|

Field or Control |

Description |

|---|---|

|

Academic |

Enter the number of months for the academic term to be considered during need analysis for independent students. |

|

Non-Standard |

Enter the number of months for the nonstandard term to be considered during need analysis for independent students. |

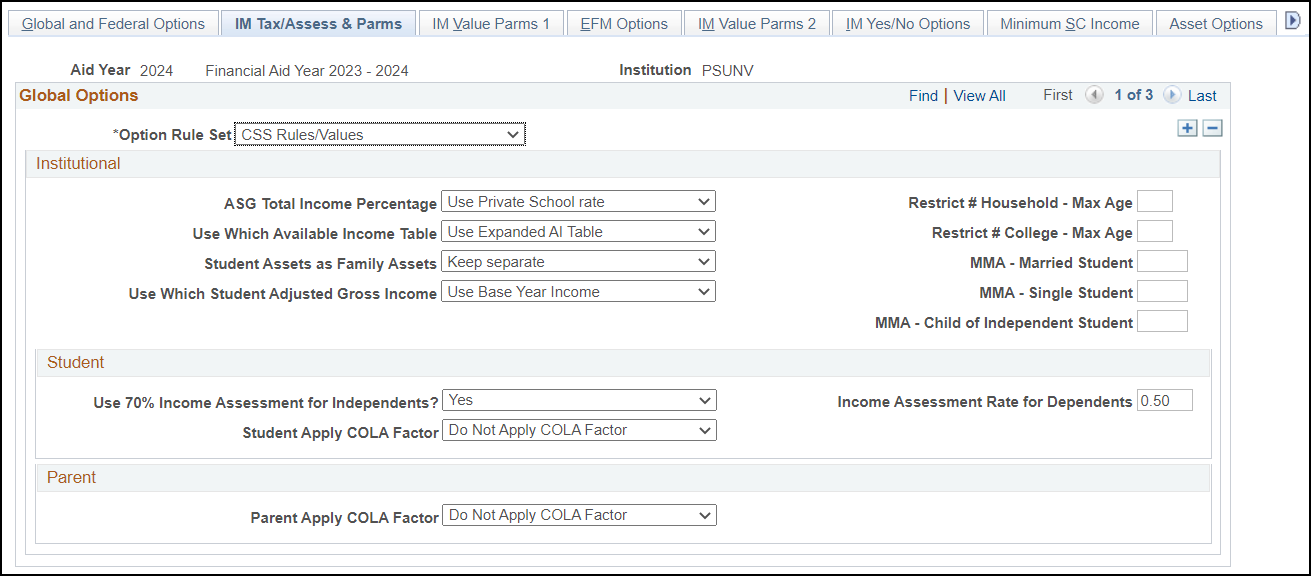

Use this page to define IM Tax and Assessment parameters for both Dependent and Independent students.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the IM Tax/Assess & Parms page ().

This example illustrates the fields and controls on the IM Tax/Assess & Parms page. You can find definitions for the fields and controls later on this page.

Institutional

|

Field or Control |

Description |

|---|---|

|

ASG Total Income Percentage (annual savings goal total income percentage) |

Select a value to determine an appropriate ASG total income percentage. This percentage is used as an allowance against income. Values are:

Note: College Board CSS Profile users should refer to the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for supporting documentation. |

|

Use Which Available Income Table |

Select a value to determine which Available Income Assessment Rate table to use. Values are:

|

|

Studnt Assets as Family Assets (student assets as family assets) |

Select All Student Assets to have all of the student's assets count as parent assets. Student assets are summed in the parent column. These calculation adjustments occur:

Select All but Trusts to have all of the student's assets except for the value of trust funds count as parent assets. The only student assets summed in the student column are trust funds. These calculation adjustments occur:

Select Keep separate to use the default calculation. Parent assets are summed in the parent column and student assets are summed in the student column. If you leave this field blank, the system automatically enters Separate and uses the default calculation. Select Stu Assets 5% and Trusts 25% to have the EFC calculation process assess student assets at 5 percent and the student's trust funds at 25 percent when calculating the student contribution portion of the EFC. |

|

Use Which Student AGI (use which student adjusted gross income) |

Select how the student adjusted gross income is represented:

|

|

Field or Control |

Description |

|---|---|

|

Rstrct # Household - Max Age (restrict number in household - maximum age) |

Enter the value. You can restrict the family size used in the calculation by establishing an age threshold for siblings or dependents. For example, the calculation would not include an allowance for a member in the household over the maximum age set by the institution. |

|

Rstrct # in College - Max Age (restrict number in college - maximum age) |

Enter the value. You can restrict the number in college used in the calculation by establishing an age threshold for family members in college. For example, the calculation would not include an allowance for a member of the household in college over the maximum age set by the institution. |

|

MMA-Married Student (monthly maintenance allowance for married student) |

Enter a value to override the default MMA rate for a married student. |

|

MMA-Single Student (monthly maintenance allowance for single student) |

Enter a value to override the default MMA rate for a single independent student. |

|

MMA Child of Indep Student (monthly maintenance allowance for child of an independent student) |

Enter a value to override the default MMA rate for a child of an independent student. |

STUDENT

|

Field or Control |

Description |

|---|---|

|

Use 70% Income Assmnt for Ind (use 70 percent income assessment for independent) |

This field refers to the available income assessment rate for independent students. Select from these values:

|

|

Alt Income Assessment Rate (alternate income assessment rate) |

When you select No for the Use 70% Income Assmnt for Ind option, enter the Alt Income Assessment Rate. Available options: Blank = No alternate rate provided; INAS will use the standard income assessment rate for independent students nnn = User defined number value; activate an alternate user-defined rate between 0% and 100%. For example, to specify 50%, enter "050"’. Entering "000" sets the rate to 0%. |

|

Income Assmnt Rate for Dep (income assessment rate for dependent) |

Enter an income assessment rate for dependent students. The default is 50 percent. |

|

Student Apply COLA Factor (student apply cost of living adjustment factor) |

Select from these values:

|

PARENT

|

Field or Control |

Description |

|---|---|

|

Parent Apply COLA Factor (student apply cost of living adjustment factor) |

Select from these values:

|

Use this page to define Estimated Federal Methodology (EFM) options.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the EFM Options page ().

Select an Option Rule Set and the EFM-Profile options for Student and Parent.

STUDENT

|

Field or Control |

Description |

|---|---|

|

Use Which IM Income (use which institutional methodology income) |

Select which student income field to use:

|

PARENT

|

Field or Control |

Description |

|---|---|

|

Use Which IM Income (use which institutional methodology income) |

Select which parent income field to use:

|

Use this page to define IM Value parameters.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the IM Value Parms 1 page ().

Select an Option Rule Set, then, use the default values or enter the percentages and values set by your institution for students and parents.

Use this page to define additional IM Value parameters.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the IM Value Parms 2 page ().

Select an Option Rule Set and the IM values for multiple dependents in college.

Use this page to select Yes/No options.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the IM Yes/No Options page ().

Select an Option Rule Set and the Yes/No options for Student and Parent.

STUDENT

|

Field or Control |

Description |

|---|---|

|

Calc PC For Independent (calculate parental contribution for independent) |

Select to use the parents' information in the calculation for an independent student. |

|

Use FM Tx (use federal methodology tax) |

Select to use the FM state and local income tax computation table in the calculation. When this check box is selected in conjunction with the Ind Use Par St Tax Alwnc check box, Use FM Tx takes priority for independent students. |

|

Add Non Cust PC to PC (add noncustodial parent contribution to parent contribution) |

Select to combine the non-custodial parent's contribution to the parent contribution. |

|

Ind Use Par St Tax Alwnc (independent use parent state tax allowance) |

Select if the student is independent with dependents but you want to use the parent's state tax allowance table in the calculation. When this check box is selected in conjunction with the Use FM Tx check box, Use FM Tx takes priority for independent students. |

|

Add Hope/LTL (add Hope/Lifetime Learning Credit) |

Select to let the system determine whether to add this value to taxes, based on federal tax allowance against income and tax filing status, as shown in the following table. The column headings represent the value of the Fed Tax Allwnc Against Income field from the IM Tax/Assess Parameters page. |

|

For this Tax Filing Status: |

CSS Rules will: |

Calc Tax will: |

Rptd Tax will: |

|---|---|---|---|

|

Completed Return |

Add Hope to taxes. |

Not add Hope to calculate taxes. |

Add Hope to taxes. |

|

Will File Return |

Not add Hope to calculate taxes. |

Not add Hope to calculate taxes. |

Add Hope to taxes. |

When the INAS calculates taxes, it compares the values for reported taxes and calculated taxes and uses the lower value in subsequent calculations. This table demonstrates how the system processes the Hope value when reported taxes are lower than calculated taxes:

|

For this Tax Filing Status: |

CSS Rules will: |

Calc Tax will: |

Rptd Tax will: |

|---|---|---|---|

|

Completed Return |

Add Hope to taxes. |

Add Hope to taxes only if reported is lower than calculated. |

Add Hope to taxes. |

|

Will File Return |

Add Hope to taxes only if reported is lower than calculated. |

Add Hope to taxes only if reported is lower than calculated. |

Add Hope to taxes. |

Note: Reported tax amounts are generally higher than calculated tax amounts.

|

Field or Control |

Description |

|---|---|

|

Alt Min SCI (alternate minimum student contribution from income) |

Clear to indicate No (default); select to indicate Yes for this Yes/No option. If the check box is not selected, the application performs the Alternate Minimum Student Contribution from Income calculation using the following calculations

|

|

|

|

|

Calculate Intl Student Contrib (calculate international student contribution) |

Select to calculate an international student contribution if there is enough information available. |

|

IM < FM (institutional methodology is less than federal methodology) |

Select to allow the calculated IM EFC to be below the calculated FM. |

PARENT

|

Field or Control |

Description |

|---|---|

|

Use Parent Reported PC (use reported parent contribution) |

Select to enforce the amount that the parents volunteered to contribute, if that amount is higher than the amount calculated by the system. |

|

Use FM Tx (use federal methodology tax) |

Select to use the FM state and local income tax computation table in the calculation. |

|

Allow Parent Other Loss |

Select to allow losses taken on a parent's income tax. This results in a lower EFC. |

|

Allow Parent Bus/Farm Loss |

Select to allow losses taken on a parent's income tax, such as depreciation in a business. This results in a lower EFC. |

Note: By default, the system disallows losses on business, farm, or other. By selecting Allow Parent Other Loss or Allow Parent Bus/Farm Loss, you allow the loss to be included in the calculation.

|

Field or Control |

Description |

|---|---|

|

Add Hope/LTL (add Hope/Lifetime Learning Credit) |

Select to have the system determine whether to add this value to taxes based on federal tax allowance against income and tax filing status, as shown in the previous table. The column headings in the table represent the value of the Fed Tax Allwnc Against Income field from the IM Tax/Assess Parameters page. |

|

Exclude Low Income Asset Alwnc (exclude low income asset allowance) |

Select to calculate without using the low income asset allowance. |

|

Exclude FSA for Health Care |

Select to exclude Flexible Spending Account for Health Care funds from total untaxed income. Default is selected. |

|

Exclude FSA for Dependent Care |

Select to exclude Flexible Spending Account for Dependent Care funds from total untaxed income. Default is selected. |

|

Exclude HSA for Pre-Tax Contrib |

Select to exclude Health Saving Account funds from total untaxed income. If not selected, Health Saving Account funds are excluded from total untaxed income. |

|

Limit International IPA/MMA (limit international student’s parental income protection allowance) |

Select to limit an international student's Parental Income Protection Allowance (IPA) to an amount greater than or equal to 25% of the parental income.

|

|

IM < FM |

Select to allow the calculated IM EFC to be less than the calculated FM. |

Use this page to define minimum student contributions.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the Minimum SC Income page ().

Select an Option Rule Set and enter the minimum institutional student contribution values set by your institution for dependent and independent students. IM uses a minimum student contribution from income, which you can adjust. The system uses these values to determine whether the calculated or minimum contribution is used.

Institutional

|

Field or Control |

Description |

|---|---|

|

Use Default Minimum Student Contribution Amounts |

Select from these values: Yes: Use the defaults. No: Make manual changes to the minimum student contribution amounts. |

Use this page to define IM Asset Options for Dependent and Independent students.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the Asset Options page ().

Institutional

|

Field or Control |

Description |

|---|---|

|

Asset Options |

Select asset options. Values are: Do not project assets: INAS does not impute a value for assets, reported amounts are used. Project assets: INAS uses the Yield % field to project assets. |

|

Yield % |

Enter the asset yield percentage. Values are 1% to 9%. Blank is treated as 0%. |

|

Tolerance |

Set up the appropriate and tolerance to compare the reported value to the imputed value. |

Note: The Asset Option of Individual Projection is not available for students.

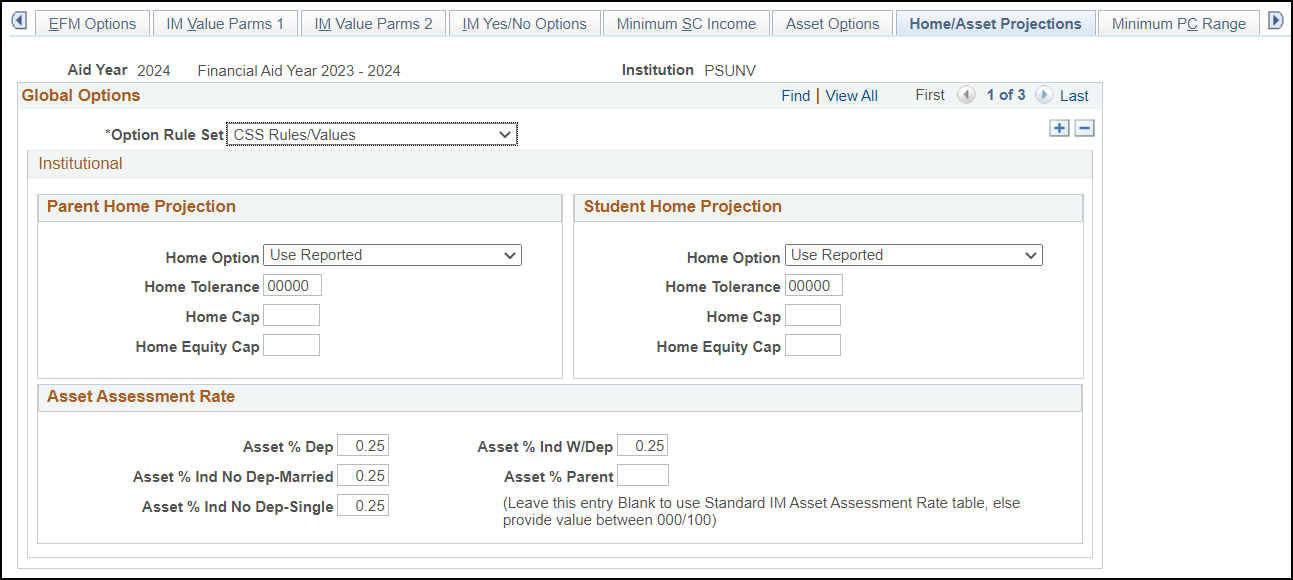

Use this page to define Home and Asset Projections.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the Home/Asset Projections page ().

This example illustrates the fields and controls on the Home/Asset Projections page. You can find definitions for the fields and controls later on this page.

Institutional

|

Field or Control |

Description |

|---|---|

|

Home Option |

Select the home option for parents and independent students. Values are: Use Highest of Projctd/Reptd: INAS compares the calculated and reported home value. The system uses the higher value to determine equity. Use Reported: INAS uses the value of the home reported on the application, to calculate equity. This is the default value. Use Projected: If the home projected value is outside of the Home Tolerance setting, the system calculates the value of the home based on the purchase price of the home and the date on which it was purchased, using the Federal Housing Multiplier table. |

|

Home Tolerance |

Enter a home tolerance value. INAS uses the reported value of the home, unless it exceeds the tolerance when the difference is compared to the calculated home value. If it exceeds the tolerance, the value is adjusted accordingly. |

|

Home Cap |

Enter a multiplier if you do not want the reported value or the computed value to exceed a certain multiple of the family's income. The system multiplies this value with total income to adjust the value of the home. |

|

Home Equity Cap |

Enter a cap factor from 0.0 to 9.9. Home equity is then capped using the factor times the computed income. |

Asset Assessment Rate

|

Field or Control |

Description |

|---|---|

|

Asset % Dep (asset percentage dependent) |

Enter a value to use as an allowance against assets. |

|

Asset % Ind No Dep-Married (asset percentage independent no dependents married) |

Enter a value to use as an allowance against assets. |

|

Asset % Ind No Dep-Single (asset percentage independent no dependents single) |

Enter a value to use as an allowance against assets. |

|

Asset % Parent (asset percentage parent) |

Enter a value to use as an allowance against assets. Leave this field and the Asset % Ind W/Dep field blank to invoke standard IM rules. |

|

Asset % Ind W/Dep (asset percentage independent with dependents) |

Enter a value to use as an allowance against assets. |

Use this page to define minimum parent contribution.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the Minimum PC Range page ().

Select an Option Rule Set and enter the minimum institutional parent contribution values set by your institution. The system uses these values to determine whether the calculated or minimum contribution is used.

|

Field or Control |

Description |

|---|---|

|

MINIMUM PC BASED ON INCOME RANGE (minimum parental contribution based on income range) |

Enter the values set by your institution's policy. |

Use this page to define budget (cost of attendance) options.

Note: This setup is only used for 2023-2024 and prior Aid Years. For 2024-2025 and future Aid Years, this setup is done on the College Board’s Need Analysis Options (NAO) website.

Access the Budget Options page ().

This example illustrates the fields and controls on the Budget Options page. You can find definitions for the fields and controls later on this page.

Institutional

|

Field or Control |

Description |

|---|---|

|

% of Total Budget for 1/2 time (percentage of total budget for half-time) |

Enter a percentage of the total budget that you want to use for a student attending an institution half-time. Note: The value 1.00 is equal to 100 percent. |

|

Limit PC (limit parental contribution) |

Select a parental contribution limit. Values are: No: Select for no parental contribution limit. Yes; % Total Budget (yes; percentage of total budget): Select to have the parental contribution limited to the student’s cost of attendance budget divided by the total of the cost of attendance budgets of all children in the family attending college. Yes; Highest PC from Sum and % (yes; highest parental contribution from sum and percentage) Select to compare the parental contribution limits set by Yes; % Total Budget (yes; percentage of total budget) and Yes; Sum of Budget: and set the limit to the higher value. Yes; Sum of Budget: Limit the parental contribution to the sum of the cost of attendance budgets for all other children in the family; not including the student. Enter the values that your institution set for each type of institution. |