Using FM and IM Extensions to Override Options

This topic reviews overriding global policy options. Federal Methodology (FM) and Institutional Methodology (IM) extensions can be accessed from ISIR corrections, simulation, or the Maintain Institutional Application component. This section discusses how to:

-

Override federal extension options.

-

Override INAS institutional extension options 1.

-

Override INAS institutional extension options 2.

-

Override INAS institutional extension options 3.

-

Override INAS institutional extension options 4.

-

Override INAS institutional extension options 5.

See Making ISIR Corrections for 2022-2023 and 2023-2024.

Important! You must first establish an Option Rule Set before selecting override options.

Note: The navigation paths for the pages listed in the following page introduction table are for aid year 20nn-20nn. Oracle supports access for three active aid years.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

FAFSA Student Information |

ISIR_PIA_CS1_nn |

|

Correct information on the FAFSA Student Information page. |

|

FAFSA Parent Information |

ISIR_PIA_CS4_nn |

|

Correct information on the FAFSA Parent Information page. |

|

Federal Extension |

INAS_FED_EXTnn_SEC |

Click the FM link on any tab in the Correct 20nn-20nn ISIR records component. |

Override global policy options. |

|

Federal Extension Budget Durations |

INAS_FEDEX_DUR_SEC |

Click the Budget Durations link on the Federal Extension page. |

Override global policy options for federal academic and non-standard budget duration. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Federal Extension EFC Proration Options |

INAS_FEDEX_PRO_SEC |

Click the EFC Proration Options link on the Federal Extension page. |

Override EFC proration options for academic and non-standard months. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Federal Extension EFC Override |

INAS_FEDEX_EFC_SEC |

Click the Override Federal EFC link on the Federal Extension page. |

Override EFC

components for academic and non-standard award

periods.

Note: This page is only used for 2023-2024 and prior Aid Years. |

|

INAS Institutional Extension 1 |

INAS_PROF_EXT1_Snn |

Click the IM link on any tab in the Correct 20nn-20nn ISIR records component. |

Override global policy options. |

|

Institutional Budget Durations |

INAS_PRFEX_DUR_SEC |

Click the Budget Durations link or the Override Institutional EFC link on the INAS Institutional Extension 1 page. |

Override global policy options for institutional academic and non-standard budget duration. |

|

Institutional EFC Override |

INAS_PROF_EFC_SEC |

Click the Override Institutional EFC link on the INAS Institutional Extension 1 page. |

Override EFC components for academic and non-standard award periods. |

|

INAS Institutional Extension 2 |

INAS_PROF_EXT2_Snn |

Click the IM Extension 2 link on the INAS Institutional Extension 1 page. |

Override global policy options. |

|

INAS Institutional Extension 3 |

INAS_PROF_EXT3_SEC |

Click the Extension 3 link on the INAS Institutional Extension 1 page. |

Override global policy options. |

|

INAS Institutional Extension 4 |

INAS_PROF_EXT4_Snn |

Click the Extension 4 link on the INAS Institutional Extension 1 page. |

Override global policy options. |

|

INAS Institutional Extension 5 |

INAS_PROF_EXT5_SEC |

Click the Extension 5 link on the INAS Institutional Extension 1 page. |

Override global policy options. |

|

Monthly EFC |

NEED_SMRY_EFC_SEC |

Click the Monthly EFC link on the ISIR Corrections EFC/DB Matches page. |

View the monthly breakdown of the expected family contributions for months 1–8 and 10–12. The 9–month EFC displays on the EFC\DB Matches\Corr page. Note: This page is only used for 2023-2024 and prior Aid Years. |

Access the Federal Extension page (click the FM link on any tab of the Correct 20nn-20nn ISIR records component).

Federal Extension

|

Field or Control |

Description |

|---|---|

|

Option Rule Set |

Select a rule set. |

|

Calc Type (INAS calculation type) |

Select a calculation type:

|

|

Data Source |

Select a data source:

|

|

Dependency Override |

Select a data source:

|

|

Budget Durations |

Click this link to access the Federal Extension Budget Durations page. You can enter any value for FM academic and/or non-standard budget duration. Federal rules allow whole numbers only for budget duration. If the total allocation for the budget duration is greater than 12 months, a 9–month EFC is calculated and used in the academic award period, and no EFC is calculated for the non-standard award period. This field can be populated using Population Update as long as the records being updated are aid year activated for the intended aid year. Note: This page is only used for 2023-2024 and prior Aid Years. |

|

Override Federal EFC |

Note: This page is only used for 2023-2024 and prior Aid Years. |

Professional Judgment

|

Field or Control |

Description |

|---|---|

|

Calculate Federal Tax |

Select to calculate federal tax as defined by the Federal Methodology Need Analysis Calculator (NAC) for the student and/or parent. |

|

Calc PC for Independent (calculate parent contribution for independent) |

Select to calculate a parental contribution for independent students if parental data is available. The parental contribution is calculated but not added to the EFC. |

Assumption Overrides

Note: This is applicable for the 2023-2024 and prior Aid Years only.

|

Field or Control |

Description |

|---|---|

|

Number in College |

Select one of the following: Override Asmptns - Use ISIR NIC (override assumptions — use ISIR number in college) to override the number in college assumption when calculating the parent contribution. Don't Override Asmptns (don't override assumptions) to accept the number in college assumption when calculating the parent contribution. Note: Number in College override is only applicable to the 2023-2024 and prior Aid Years. |

Access the INAS Institutional Extension 1 page (click the IM link on any tab of the Correct 20nn-20nn ISIR records component).

Use the INAS Institutional Extension 1 page to set your basic overrides. From this page, access other extension pages, budget duration or EFC overrides.

|

Field or Control |

Description |

|---|---|

|

Option Rule Set |

Select an Option Rule Set to determine which global policy option rule to use as a base. |

|

Application Source |

The Application Source is Profile. |

|

Budget Durations |

Click this link to access the Institutional Budget Durations page. You can enter any value for IM academic and/or non-standard budget duration. Institutional rules allow whole numbers with one decimal place. This field can be populated using Population Update as long as the records being updated are aid year activated for the intended aid year. |

|

Override Institutional EFC |

Click this link to access the Override Institutional EFC page, where you can override the institutional EFC amount. |

|

Alt Min SC from Income Calc (alternate minimum student contribution from income calculation) |

Select this check box to override the Alt Min SCI option set for the student on the IM Yes/No Options page. |

|

Calc PC For Independent (calculate parental contribution for independent) |

Select this check box to override the Calc PC For Independent option set for the student on the IM Yes/No Options page. |

|

Skip Family Member Exclusion |

Select to override the Rstrct # Household - Max Age and Rstrct # in College - Max Age options set on the IM Tax/Assess & Parms options page. |

|

Allow Business/Farm Losses |

Select to override the Allow Parent Bus/Farm Loss option set on the IM Yes/No Options page. |

|

Allow Other Losses |

Select to override the Allow Parent Other Loss option set on the IM Yes/No Options page. |

|

Country Coefficient TCA (country coefficient total contribution from assets) |

Note: This is applicable for the 2023-2024 and prior Aid Years only. Select to calculate an optional contribution from assets by applying the country coefficient to the percentage used to calculate the step increment

Note: This is a local-only option applicable to international (non-domestic) students only. |

|

Limit International IPA/MMA (limit international student's parental income protection allowance) |

Select to limit an international student's Parental Income Protection Allowance (IPA)/MMA to an amount greater than or equal to 25% of the parental income.

|

|

Apply Intl Asset Prot Allowance (apply international asset protection allowance) |

Select to apply an international asset protection allowance based on the country coefficient value. |

|

Select Expanded Available Income Table |

Select:

|

|

Use Anticipated Year Income |

Select to override the Use Anticipated Year Income option set on the IM Yes/No Options page. |

|

Can Student IM Be Less Than FM |

Select to override the IM < FM option set on the IM Yes/No Options page. Note: This option doesn't use the FM SAI/EFC value. It only uses EFM value calculated by the College Board. |

|

Add Stu Hope/LTL to Rptd Taxes (add student hope/life time learning to reported taxes) |

Select to override the Add Hope/LTL option set on the IM Yes/No Options page. |

|

Allow All Income Exclusions |

Select to allow all income inclusions. |

|

Use Par Tax Table For Indeps (use parent tax table for independent students) |

Select to override the Ind Use Par St Tax Alwnc (independent use parent state tax allowance) option set on the IM Yes/No Options page. |

|

Student Disable Global Home Value Cap |

Select to turn off the global home value cap. |

|

Student Disable Global Home Equity Cap |

Select to turn off the global home equity cap. |

|

Use Which Student AGI/Income |

Select:

|

|

Exclude FSA for Health Care (exclude Flexible Spending Account for Health Care) |

Note: This is applicable for the 2023-2024 and prior Aid Years only. Select to exclude Flexible Spending Account for Health Care funds from total untaxed income. |

|

Exclude FSA for Dependent Care (exclude Flexible Spending Account for dependent Care) |

Note: This is applicable for the 2023-2024 and prior Aid Years only. Select to exclude Flexible Spending Account for Dependent Care funds from total untaxed income. |

|

Exclude HSA for PreTax Contrib (exclude Health Savings Account for pre-taxed contributions) |

Note: This is applicable for the 2023-2024 and prior Aid Years only. Select to exclude Health Saving Account funds from total untaxed income. |

|

Include HSA for Pre-Tax Contrib (include Health Savings Account for pre-taxed contributions) |

Note: This is applicable for the 2024-2025 and futue Aid Years only. Select to include Health Saving Account funds from total untaxed income. |

|

Parent Disable Global Home Value Cap |

Select to turn off the global home value cap. |

|

Parent Disable Global Home Equity Cap |

Select to turn off the global home equity cap. |

|

Use Which Parent AGI/Income |

Select:

|

See Maintaining Institutional Financial Aid Applications.

See the College Board's Financial Aid Services Information Center (https://groups.collegeboard.org/fas) for supporting documentation, including the IM tables and worksheets..

Access the INAS Institutional Extension 2 page (click the IM Extension 2 link on the INAS Institutional Extension 1 page).

Use the INAS Institutional Extension 2 page to override options used to determine the student's total budget.

|

Field or Control |

Description |

|---|---|

|

Use Which EFC (use which estimated family contribution) |

Select a value to determine the institutional EFC displayed on the Need Summary page and used in the Award Entry component. Your selection overrides the value selected on the Global and Federal Options page. |

|

Dependency Override |

Select either Ind Prof J ( individual professional judgement) or No (no override). INAS calculates a dependent student as independent when Ind Prof J is selected. |

|

Limit Share of PC (limit share of parental contribution) |

Select a parental contribution limit. Values are: Highest: Select to compare the parental contribution limits set by Ratio Bdgt(ratio budget) and Sum Bdgt(sum budget) and set the limit to the higher value. No: Select for no parental contribution limit. Ratio Bdgt (ratio budget): Select to have the parental contribution limited to the student’s cost of attendance budget divided by the total of the cost of attendance budgets of all children in the family attending college. Sum Bdgt (sum budget): Limit the parental contribution to the sum of the cost of attendance budgets for all other children in the family; not including the student. Your selection overrides the value selected on the Minimum PC Range page and the Budget Options page. |

|

Federal Tax Used |

Select to override the value selected for the Fed Tax Allwnc Against Income field on the IM Tax/Assess & Parms page. |

|

Project Home Value |

Select: Use Highest of Projctd/Reprtd if above tolerance. Use Projected if outside tolerance Use Reported. to override the value on the Home/Asset Projections page. |

|

Project Assets |

Select: Do not use projected. Use projected to override the value on the Asset Options page. |

|

Student Assets as Family Assets (student assets as family assets) |

Select a value to override the value selected for the Studnt Assets as Family Assets field on the IM Tax/Assess & Parms page. |

Access the INAS Institutional Extension 3 page (click the Extension 3 link on the INAS Institutional Extension 1 page).

Use the INAS Institutional Extension 3 page to override EFC global policy options for the given income, tax, and allowances.

|

Field or Control |

Description |

|---|---|

|

Student/Parent AGI (student/parent adjusted gross income) |

Enter an amount to override the student or parent adjusted gross income. |

|

Student/Parent Untaxed Income |

Enter an amount to override the student or parent untaxed income. |

|

Student/Parent Tax Paid |

Enter an amount to override the value used in the Fed Tax Allwnc Against Income (federal tax allowance against income) on the IM Tax/Assess & Parms page. |

|

Student/Parent Anticipated Tax |

Enter an amount to override the anticipated tax calculated by the IM method. |

Allowances

|

Field or Control |

Description |

|---|---|

|

Student/Parent Med/Dental Allowance (student/parent medical/dental allowance) |

Enter an amount to override the % Unreimbursed Med/Dent Expense (percent unreimbursed medical/dental expense) on the IM Value Parms 1 page. |

|

Student/Parent FICA/Payroll Tax (student/parent Federal Insurance Contributions Act/Payroll Tax) |

Enter an amount to override the allowance calculated by IM. |

|

Student/Parent Income Allowance |

Enter an amount to override allowance against income calculated by IM. |

|

Parent Tuition Allowance |

Enter an amount to override the Max Tuition Allowance (maximum tuition allowance) per child on the IM Value Parms 1 page. |

|

Parent IPA (parent income protection allowance) |

Enter an amount to override the Adjust IPA/MMA Regional COL calculated based on options set on the IM Tax/Assess & Parms page. |

|

Student/Parent COLA Index (student /parent cost of living allowance index ) |

Enter an amount to override the Adjust IPA/MMA Regional COL (Income Protection Allowance/Monthly Maintenance Allowance Regional Cost of Living) value based on options set on the IM Tax/Assess & Parms page. |

|

Parent Tuition Allowance |

Enter an amount to override the Maximum Tuition Allowance Per Child value based on the options set on the IM Values Parms 1 page. |

Access the INAS Institutional Extension 4 page (click the Extension 4 link on the INAS Institutional Extension 1 page).

Use the INAS Institutional Extension 4 page to override global policy options.

|

Field or Control |

Description |

|---|---|

|

Local Tax — Percent |

Enter an amount to override the amount calculated by IM. |

|

Cap Housing Value |

Enter an amount to override the value selected for the Home Cap field on the Home/Asset Projections page. |

|

Home Equity Cap Factor |

Enter an amount to override the value selected for the Home Equity Cap Factor field on the Home/Asset Projections page. |

|

Housing Multiplier |

Enter an amount to override the delivered housing multiplier table value that projects home equity. |

|

Asset Assessment Percent |

Enter an amount to override the value selected for the Asset Assessment Rate field on the Home/Asset Projections page |

|

Local Tax |

Enter an amount to override amount calculated by IM. |

|

Other Asset |

Enter an amount to add to calculated assets. |

|

Minimum Asset |

Enter an amount to override Minimum Contribution from Asset on the IM Value Parms 1 page. |

|

Asset Allowance |

Enter an amount to offset discretionary net worth calculated by IM. |

|

Minimum Income |

Enter an amount to override the Minimum SC or PC values from the Minimum SC Income and Minimum PC Range pages. |

|

Number in College |

Enter a number to override the number of students in college. |

|

Parent Number in College |

Enter an amount to allow parents in college. |

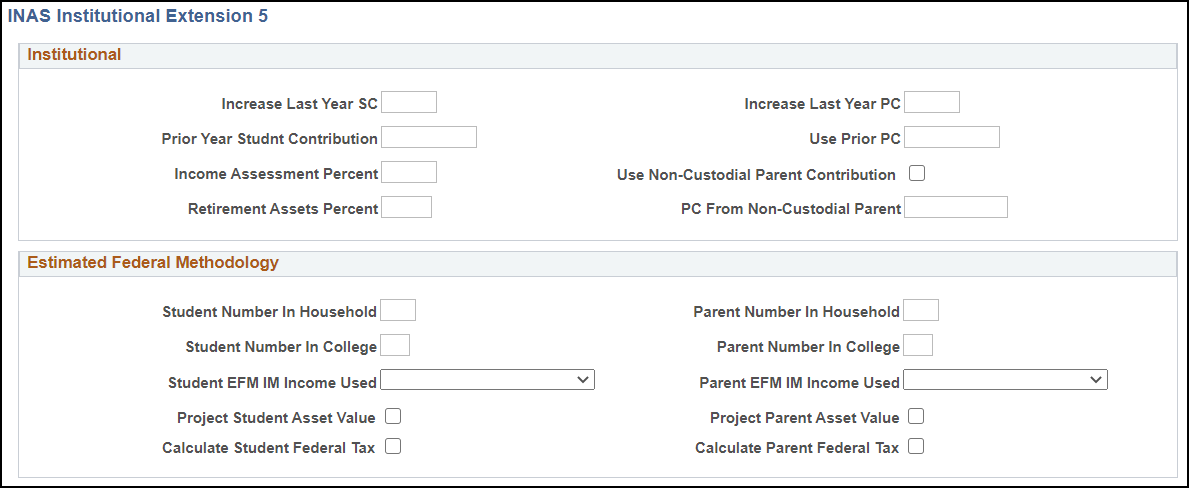

Access the INAS Institutional Extension 5 page (click the Extension 5 link on the INAS Institutional Extension 1 page).

This example illustrates the fields and controls on the INAS Institutional Extension 5 page. You can find definitions for the fields and controls later on this page.

Use the INAS Institutional Extension 5 page to override EFC global policy options for family factors such as past contributions.

Institutional

|

Field or Control |

Description |

|---|---|

|

Increase Last Year SC/PC (increase last year student contribution/parent contribution) |

Enter an amount to override increase last year SC or PC on the IM Value Parms 1 page. |

|

Prior Year Studnt Contribution (prior year student contribution) and Use Prior PC (use prior parent contribution) |

Enter the prior year's contribution for use with the Increase Last Year SC/PC option. |

|

Income Assessment Percent |

Enter an amount to override Use 70% Income Assmnt for Ind or Income Assmnt Rate for Dep from the IM Tax/Assess & Parms page. |

|

Retirement Assets Percent |

Enter an amount to override the value in the % Of Stdnt IRA Include In NW field from the IM Value Parms 1 page. |

|

Use Non-Custodial Parent Contribution |

Select to override the value entered on Add Non Cust PC to PC on the IM Yes/No Options page. Enter a value in the accompanying field PC from Non-custodial Parent if you want to override and use an amount other than the self reported value. |

Estimated Federal Methodology

|

Field or Control |

Description |

|---|---|

|

Student/Parent Number In Household |

Enter an amount to override amount calculated by EFM. |

|

Student/Parent Number In College |

Enter an amount to override amount calculated by EFM. |

|

Student/Parent EFM IM Income Used |

Select:

|

|

Project Student/Parent Asset Value |

Note: This applicable only to the 2023-2024 and prior Aid Years. Select to project asset values (cash using interest, investments using dividends) in EFM. Note: Selecting this option requires that the parameters are set on the global Asset Options page. |

|

Calculate Student/Parent Federal Tax |

Select to force the calculation of US taxes in EFM when using IM income. |