Setting Up Default Special Tax Withholding Status and Override Reasons

This topic provides an overview of setting up default values for the special tax withholding status for each state and corresponding reason codes,

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Default Special Withholding Tax Status |

GPUS_SPWH_STAT |

To set the value of the Special Tax Withholding Status based on the current State rules, regarding taxability of earnings, at the employee level. |

Use the Default Special Withholding Tax Status page to set the value of the Special Tax Withholding Status based on the current State rules, regarding taxability of earnings, at the employee level.

Navigation:

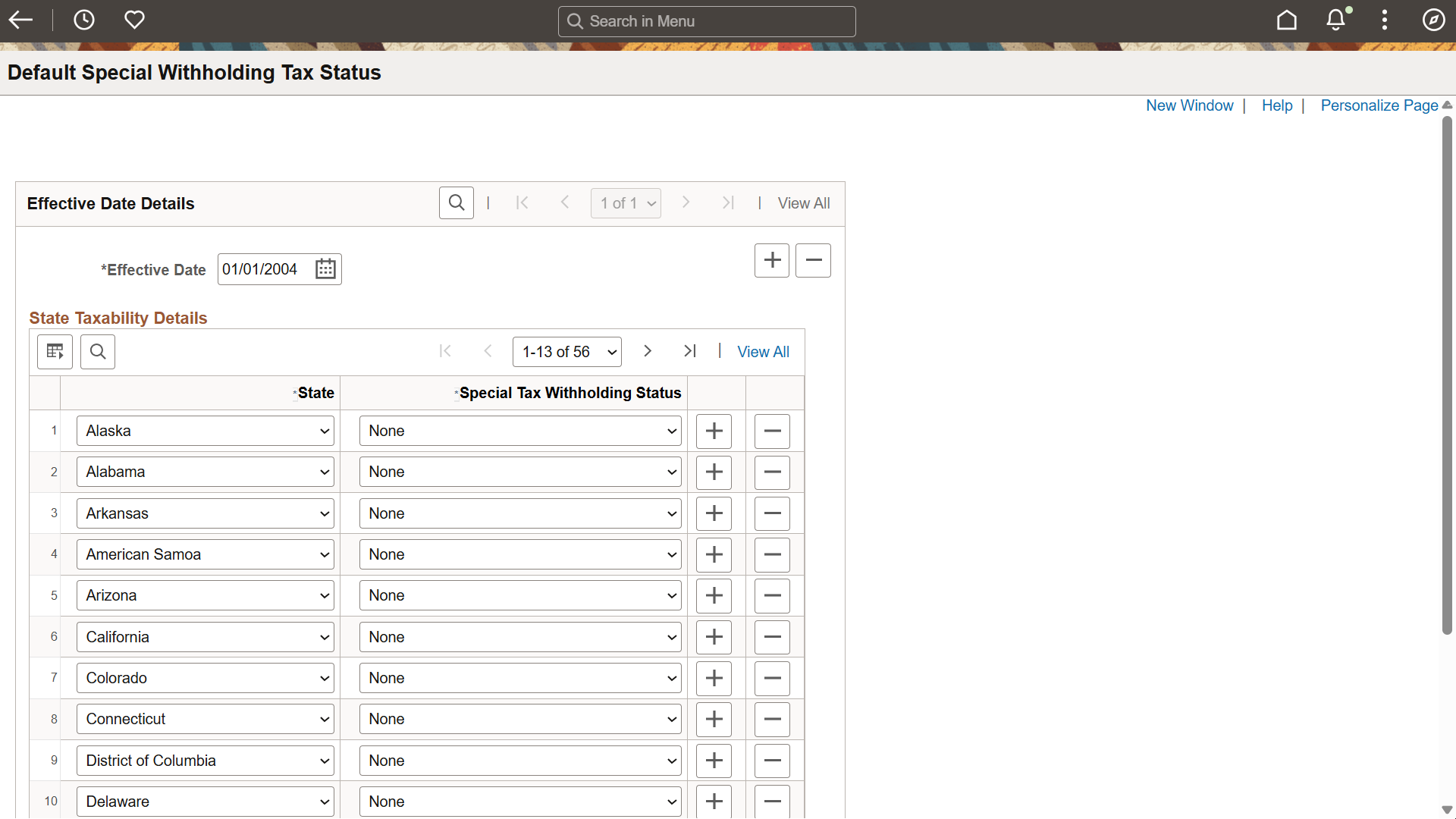

This example illustrates the fields and controls on the Default Special Withholding Tax Status Page.

|

Field or Control |

Description |

|---|---|

|

Effective Date |

Select the date on which the special tax withholding status is applicable for each state. |

|

State |

Select the required state for which the default special tax withholding status to be set. |

|

Special Tax Withholding Status |

Select the required special tax withhodling status from the drop-down list. Available options are:

The value selected in this field is set as the default value for special tax withholding status in the Maintain Tax Data USA page. This value can be modified at the employee level within the Maintain Tax Data page. For details on overriding default tax status, see Maintaining Payee Tax Information. |

Use Special Withholding Tax Status Override Reasons page (GPUS_SP_ST_OVD_RSN) to define the override reasons for the Special Withholding Tax Status.

Navigation:

TaxesDefault Tax Status USA

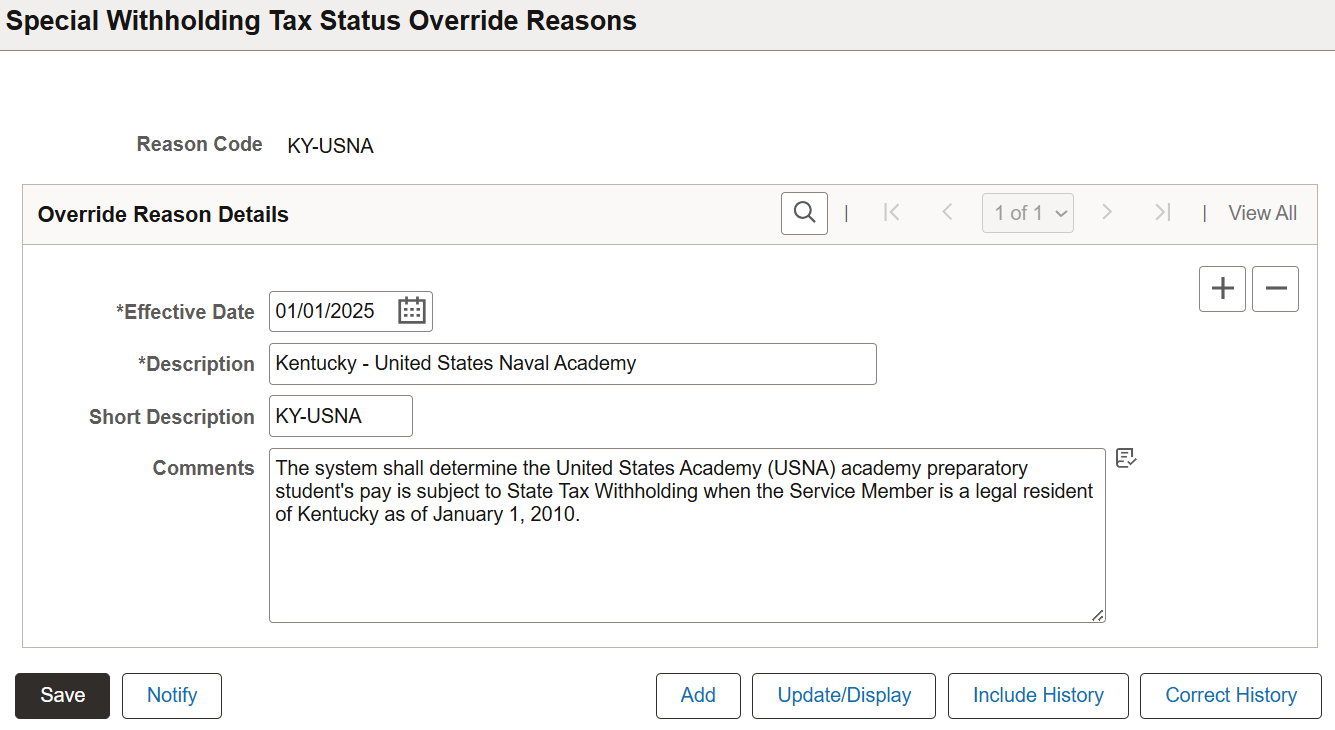

This example illustrates the Special Withholding Tax Status Override Reasons page.

|

Field or Control |

Description |

|---|---|

|

Reason Code |

Displays the code for tax status override. |

|

Effective Date |

Select the date on which the reason becomes effective. |

|

Description |

Enter a meaningful description for the override reason. |

|

Short Description |

Enter a short description for the override reason. |

|

Comments |

Enter additional remarks, if any. |